Global and China Automotive Seat Motor Industry Report, 2018-2022

-

Jun.2018

- Hard Copy

- USD

$3,200

-

- Pages:105

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZHP072

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

The growing demand for automobiles has driven the steady growth of the automotive seat industry whose market size reached approximately USD75.9 billion worldwide in 2017 with a year-on-year increase of 3.1%. China, the world's largest car producer, saw the automotive seat market size of RMB123.1 billion (about USD18.2 billion as per the average exchange rate 1:6.7518) in 2017, accounting for 24.0% of the world's total and jumping by 14.6% from a year earlier; the average annual growth rate in 2018-2022 is expected at above 10.0%.

As the automotive seat market keeps ballooning and the trend of motorized seats becomes obvious, the market for automotive seat motors has grown remarkably. In 2017, the global shipments of automotive seat motors reached 130 million units, with the CAGR of 10.6% during 2012-2017, and the figure in 2022 outnumber 190 million units. China's automotive seat motor shipments ascended 11.3% year on year to roughly 29.5 million units in 2017, sweeping 21.6% of the world; thanks to the fast-growing Chinese passenger car market (whose growth rate is higher than the global average), China's automotive seat motor shipments will go beyond 50 million units in 2022.

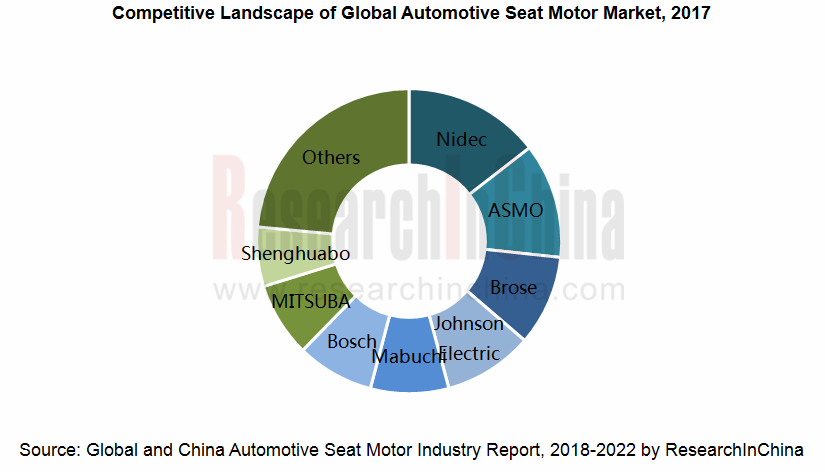

Amid the relatively stable competitive landscape in the global automotive seat motor market, leading manufacturers include Japan’s ASMO, Nidec, Mitsuba and Mabuchi, Germany’s Bosch and Brose, China’s Johnson Electric, Shenghuabo Group and Founder Motor. In 2017, the world's top three automotive seat motor manufacturers -- Nidec, ASMO and Brose enjoyed the combined market share of 36.3%. Hong Kong-based Johnson Electric, the largest producer of automotive seat motor in China, seized the market share of 9.5% or so in 2017.

Of the local manufacturers in Mainland China, only Shenghuabo Group and Founder Motor are quite competitive. Shenghuabo Group is the largest seat motor manufacturer in Mainland China, exports about 60% of its products, and is preparing for IPO now. Founder Motor has officially become a second-tier supplier of automotive seat motors for Tesla.

At present, the automakers are developing energy-saving technologies. Lightweight is one of the major development directions. In this sense, automotive seat motors tend to be compact and lightweight.

The report focuses on the following:

Definition, classification, technical standards and the like of automotive seat motors;

Definition, classification, technical standards and the like of automotive seat motors;

Status quo, market size, competitive landscape, etc. of the global seat motors;

Status quo, market size, competitive landscape, etc. of the global seat motors;

Development environment, market size, competitive landscape, development trend, etc. of Chinese seat motors;

Development environment, market size, competitive landscape, development trend, etc. of Chinese seat motors;

Market size, competitive landscape, etc. of downstream automobiles and automotive seats;

Market size, competitive landscape, etc. of downstream automobiles and automotive seats;

Operation, automotive seat motor business, etc. of 9 Chinese and 5 foreign automotive seat motor companies.

Operation, automotive seat motor business, etc. of 9 Chinese and 5 foreign automotive seat motor companies.

1. Overview of Automotive Seat Motor

1.1 Automotive Power Seat

1.2 Definition and Classification

1.3 Technical Standards

2. Global Automotive Seat Motor Industry

2.1 Status Quo

2.2 Market Situation

2.2.1 Market Size

2.2.2 Competitive Landscape

3. China Automotive Seat Motor Industry

3.1 Development Environment

3.2 Market Situation

3.2.1 Market Size

3.2.2 Competitive Landscape

3.3 Development Trend

4. Downstream Automotive Seat Industry

4.1 Automobile

4.1.1 Global

4.1.2 China

4.2 Automotive Seat

4.2.1 Market Size

4.2.2 Competitive Landscape

5. Foreign Automotive Seat Motor Manufacturers

5.1 Nidec

5.1.1 Profile

5.1.2 Operation

5.1.3 Automotive Seat Motor Business

5.2 Mabuchi

5.2.1 Profile

5.2.2 Operation

5.2.3 Automotive Seat Motor Business

5.3 Brose

5.3.1 Profile

5.3.2 Operation

5.3.3 Automotive Seat Motor Business

5.3.4 Shanghai Brose Electric Motors Co., Ltd.

5.4 ASMO

5.4.1 Profile

5.4.2 Operation

5.4.3 Automotive Seat Motor Business

5.4.4 Tianjin ASMO Automotive Small Motor Co., Ltd.

5.4.5 ASMO (Hangzhou Xiaoshan) Small Motor Co., Ltd.

5.5 Bosch

5.5.1 Profile

5.5.2 Operation

5.5.3 Automotive Seat Motor Business

5.5.4 Bosch Automotive Products (Changsha) Co., Ltd.

5.6 MITSUBA

5.6.1 Profile

5.6.2 Operation

5.6.3 Automotive Seat Motor Business

5.6.4 Guangzhou Mitsuba Electric (Wuhan) Co., Ltd.

6. Chinese Automotive Seat Motor Manufacturers

6.1 Johnson Electric

6.1.1 Profile

6.1.2 Operation

6.1.3 Automotive Seat Motor Business

6.2 Shenghuabo Group

6.2.1 Profile

6.2.2 Automotive Seat Motor Business

6.2.3 Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd.

6.2.4 Zhejiang SHB Automotive Appliance, Anhui Co., Ltd.

6.3 Founder Motor

6.3.1 Profile

6.3.2 Operation

6.3.3 Automotive Seat Motor Business

6.4 Others

6.4.1 Zhejiang Kefon Auto-Electric Co., Ltd.

6.4.2 Jiangsu Yidong Aviation Machinery Co., Ltd.

6.4.3 Zhangjiagang Heli Motor Co., Ltd.

6.4.4 Shenzhen Puda Motor Co., Ltd.

6.4.5 Shanghai Mansda Industrial Co., Ltd.

6.4.6 Ningbo Shuanglin Auto Parts Co., Ltd.

Composition of Automotive Seat

Typical 8-way Adjustable Power Seat Buttons

Typical 10-way Adjustable Power Seat

Schematic Diagram for Motor Distribution of Automotive Seating

Automotive Seat Regulating System and Motors Used

Growth Rate of Global Automotive Seat-use DC Brush Motor Market, 2012-2017

Global Automotive Power Seat Motor Shipment, 2011-2022E

Global Automotive Seat Motor Revenue, 2011-2022E

Competitive Landscape of Global Seat Motor Market, 2017

Supply Relationship between Global Major Seat Motor Manufacturers and Automakers

China’s Automotive Seat Motor Shipment, 2012-2022E

China’s Automotive Seat Motor Revenue, 2012-2022E

Global Share of China’s Automotive Seat Motor Sales Volume, 2012-2022E

Lightweight Trend of Automotive Seat Mechanical Parts

Lightweight Trend of Automotive Seat Adjustment Motors

Lightweight Trend of Automotive Seat Lumbar Support

Global Automobile Output, 2012-2022E

Global Automobile Output Structure, 2010-2017

Global Automobile Output (by Region), 2012-2017

Top 20 Countries by Automobile Output, 2017

Global Automobile Sales Volume, 2012-2022E

Global Automobile Sales Volume (by Region), 2010-2017

Top 10 Countries by Automobile Sales Volume, 2012-2017

China’s Automobile Sales Volume and Growth Rate, 2012-2022E

China’s Passenger Car Sales Volume, 2011-2018E

China’s Commercial Vehicle Sales Volume, 2010-2018E

China’s SUV Sales Volume Structure (by Price), 2016-2017

China’s Sedan Sales Volume Structure (by Price), 2016-2017

Top 10 Passenger Car Manufacturers in China by Sales Volume, 2017

Top 10 Passenger Car Brands (by Model) in China by Sales Volume, 2017

China’s Passenger Car Sales Volume Structure (by Country), 2017

Global Top 10 Power Seats for Midsize Cars by Sales Volume, 2017

Global Automotive Seat Market Size, 2013-2022E

China’s Automotive Seat Market Size, 2015-2022E

Competitive Landscape of Passenger Car Seating Market in North America, 2017

Competitive Landscape of Passenger Car Seating Market in Europe, 2017

Competitive Landscape of Passenger Car Seating Market in Japan, 2017

Distribution of Toyota’s Automotive Seat Suppliers, 2017

Distribution of Honda’s Automotive Seat Suppliers, 2017

Distribution of Nissan’s Automotive Seat Suppliers, 2017

Distribution of VW’s Automotive Seat Suppliers, 2017

Distribution of BMW’s Automotive Seat Suppliers, 2017

Distribution of BENZ’s Automotive Seat Suppliers, 2017

Distribution of GM’s Automotive Seat Suppliers, 2017

Distribution of Ford’s Automotive Seat Suppliers, 2017

Distribution of HYUNDAI’s Automotive Seat Suppliers, 2017

Competitive Landscape of Chinese Passenger Car Seating Market, 2017

Distribution of SAIC’s Automotive Seat Suppliers, 2017

Distribution of FAW’s Automotive Seat Suppliers, 2017

Distribution of Changan’s Automotive Seat Suppliers, 2017

Distribution of Dongfeng’s Automotive Seat Suppliers, 2017

Distribution of BAIC’s Automotive Seat Suppliers, 2017

Nidec’s Business Structure

Nidec’s Net Revenue, FY2011-FY2017

Nidec’s Net Revenue (by Product), FY2008-FY2017

Nidec’s Revenue and Structure (by Region), FY2013-FY2015

Nidec’s Revenue and Structure (by Region), FY2016-FY2017

Application of Nidec’s Motors in Automobiles

Nidec’s Major Automotive Motor R & D Bases

Revenue and Operating Income of Nidec’s Automobile and Industrial Application Division, FY2016-FY2017

Automotive Motor Shipments of Nidec by Product, FY2016-FY2020

Seat Motors Produced by Nidec

Seat Motors Produced by Nidec’s Dalian Factory

Mabuchi’s Major Motor Products

Mabuchi’s Global Footprint

Mabuchi’s Revenue and Operating Income, 2012-2018

Mabuchi’s Development Plan, 2018E

Mabuchi’s Revenue Structure (by Product), 2013-2017

Mabuchi’s Revenue Structure (by Region), 2013-2017

Application of Mabuchi’s Micro-motors in Automotive Electrical Equipment Field

Application of Mabuchi’s Micro-motors in Automotive AV Field

Revenue Structure of Mabuchi’s Automotive Micro-motors (by Product), 2016-2017

Revenue Structure of Mabuchi’s Automotive Medium Motors (by Product), 2016-2017

Revenue of Mabuchi’s Medium Automotive Motors, 2014-2018E

Output of Mabuchi’s Major Motor Production Bases in China, 2017

Mabuchi’s Seat Adjustment Motors

Parameters of Mabuchi’s Seat Adjustment Motors

Mabuchi’s Seat Motor Revenue, 2011-2018E

Brose’s Revenue, 2006-2017

Brose’s Revenue Structure (by Business), 2013-2017

Brose’s Revenue Structure (by Business), 2017

Brose’s Revenue in China, 2009-2017

ASMO’s Overseas Footprint

ASMO’s Net Sales, FY2012-FY2017

Seat Motors Displayed by ASMO on Tokyo Auto Show, 2013

Capacity of Main Products of Tianjin ASMO Automotive Small Motor Co., Ltd., 2017

Bosch’s Revenue and Growth Rate, 2009-2017

Bosch’s Revenue and Growth Rate in China, 2009-2017

Bosch’s Net Income, 2009-2017

Bosch’s Revenue (by Division), 2017

Bosch’s Revenue Structure (by Region), 2011-2017

MITSUBA’s Operation, FY2012-FY2017

MITSUBA’s Revenue Structure (by Business), FY2017

MITSUBA’s Revenue (by Region), FY2015-FY2017

MITSUBA’s Revenue in China and Global Share, FY2012-FY2017

Application of MITSUBA’s Automotive Motors

MITSUBA’s Main Automotive Motors

Global Distribution of Johnson Electric’s Production Bases

Development Course of Johnson Electric

Revenue and Gross Profit of Johnson Electric, FY2011-FY2018

Revenue of Johnson Electric (by Business), FY2011-FY2018

Revenue Structure of Johnson Electric (by Region), FY2018

Seat Adjustment Motors of Johnson Electric

Lightweight Seat Motors of Johnson Electric

Automotive Seat Motor Weight of Johnson Electric

Compact Seat Motors of Johnson Electric

Lumbar Support Adjustment Motors of Johnson Electric

Seat Belt Pretensioner Drive Motors of Johnson Electric

Key Business of Shenghuabo Group

Seating Motor Products of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd.

Output of Seating Motor of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd., 2008-2018E

Sales Volume Structure of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd. b Region, 2017

Major Clients of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd. by Region

Revenue and Net Income of Founder Motor, 2010-2018

Revenue of Founder Motor (by Product), 2010-2017

Revenue Structure of Founder Motor (by Region), 2010-2017

Revenue from Top 5 Customers of Founder Motor, 2017

Gross Margin of Founder Motor, 2011-2017

Plants of Global Major Seat Motor Enterprises in China

Output of Major Seat Motor Manufacturers in China, 2017

Passenger Car Fuel Consumption Standards in Major Countries

Power Seat Configuration for Global Passenger Car (by Displacement)

Revenue of Global Major Automotive Seat Manufacturers, 2014-2017

Relationship between Chinese Major Automotive Seat Manufacturers and Automakers

Parameters of Seat Motors Produced by Nidec

Brose’s Major Branches in China

Brose’s Seat Motors and Parameters

ASMO’s Subsidiaries in China

Application of ASMO’s Motors in Automobiles

MITSUBA’s Seat Motor Factories / Subsidiaries

Seat Motor Development Course of Shenghuabo Group

Main Vehicle Models Supported by Seat Motors of Shenghuabo Group

Parameters and Appearance of Seat Motors of Shenghuabo Group

Parameters and Appearance of Automotive Seat Motors of Kefon Auto-Electric

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...