ADAS and Autonomous Driving Industry Chain Report 2018 (I) - Computing Platform and System Architecture

ADAS and Autonomous Driving Industry Chain Report 2018 (I) - Computing Platform and System Architecture underscores the followings:

Introduction to ADAS and autonomous driving;

Introduction to ADAS and autonomous driving;

ADAS and autonomous driving market forecast;

ADAS and autonomous driving market forecast;

ADAS and autonomous driving strategy of carmakers including Geely, GM, SAIC, Dongfeng, Great Wall, GAC, Chang’an, NIO, Xpeng and BYTON;

ADAS and autonomous driving strategy of carmakers including Geely, GM, SAIC, Dongfeng, Great Wall, GAC, Chang’an, NIO, Xpeng and BYTON;

Software architecture of ADAS and autonomous driving, including AUTOSAR Classic and Adaptive, ROS 2.0 and QNX;

Software architecture of ADAS and autonomous driving, including AUTOSAR Classic and Adaptive, ROS 2.0 and QNX;

Hardware architecture of ADAS and autonomous driving, including automotive Ethernet, TSN, Ethernet switch and gateway, and domain controller;

Hardware architecture of ADAS and autonomous driving, including automotive Ethernet, TSN, Ethernet switch and gateway, and domain controller;

Safety certification of ADAS and autonomous driving, including ISO26262 and AEC-Q100;

Safety certification of ADAS and autonomous driving, including ISO26262 and AEC-Q100;

Study into processor firms, including NXP, Renesas, Texas Instruments, Mobileye, Nvidia, Ambarella, Infineon and ARM.

Study into processor firms, including NXP, Renesas, Texas Instruments, Mobileye, Nvidia, Ambarella, Infineon and ARM.

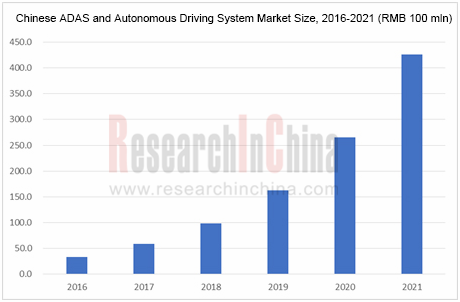

According to ResearchInChina, the Chinese ADAS and autonomous driving market was worth about RMB5.9 billion in 2017 and is expected to reach RMB42.6 billion in 2021 at an AAGR of 67% or so.

Automotive vision, MMW radar and ADAS are the market segments that develop first with the MMW radar market enjoying an impressive growth rate, closely followed by low-speed autonomous driving. While LiDAR, commercial-vehicle autonomous driving and passenger-car autonomous driving markets lag behind.

As the automobile enters an era of ADAS and autonomous driving, product iteration races up and lifecycle of products is shortened. The automotive market is far smaller than consumer electronics market but sees bigger difficulty in design and higher design and production costs than that in consumer electronics market. Thus automotive ADAS and autonomous driving processor is confronted with higher risks. Hence adequate financial and human resources are required to support the development of automotive ADAS and autonomous driving processors. Globally, only very a few enterprises like NXP and Renesas are capable of developing whole series of ADAS and autonomous driving processors.

With regard to safety certification, autonomous driving chips must attain ASIL B at least, a level only Renesas R-CAR H3 has reached for now. As GPU is a universal design and not car-dedicated design, it is hard to reach the certified safety level of ISO26262 from the point of design. The certification cycle of ASIL is up to two to four years.

Reliability, precision and functionality of stereo camera are well above that of mono camera, but as the stereo camera must use FPGA, it costs much. High costs restraint the application of the stereo camera only on luxury cars. However, with emergence of Renesas and NXP hardcore stereo processors, the stereo camera will be vastly used in ADAS and autonomous driving field, expanding from luxury models to mid-range ones.

With an explosive growth in data transmission, automotive Ethernet will become a standard configuration of the automobile, and Ethernet gateway or Ethernet switch is indispensable to autonomous driving.

Autosar will act as a standard configuration in ADAS and autonomous driving field.

CNN/DNN graphics machine leaning: GPU is most suitable when data is irrelevant to sequence. Nvidia GPU can be used in multiple fields except for automobile and finds shipments far higher than that of automotive ASIC, enjoying superiority in cost performance. TPU lifts speed and reduces power consumption (only 10% of that of GPU) at the expense of the precision of computation.

RNN/LSTM/reinforcement learning sequence-related machine learning: FPGA has distinct advantages, particularly in power consumption, consuming less than one-fifth of GPU under same performance. However, high-performance FPGA is incredibly costly. FPGA can also process graphics machine leaning and improve performance by reducing precision.

ASIC stands out by performance-to-power consumption ratio but has shortcomings of long development cycle, the highest development cost and the poorest flexibility. The unit price will be very high or firms will make losses if the shipments are small (at least annual shipments of 120 million units if 7-nanometer process is employed). Most ASICs for deep-learning graphics machine learning are similar to TPU.

Power consumption and cost performance are crucial in in-vehicle field. GPU is no doubt a winner in graphic machine learning. However, as algorithms are constantly improved, the ever low requirements on the precision of computation, and low power consumption will ensure a place of FPGA in graphics machine learning. FPGA has overwhelming advantages in sequence machine learning.

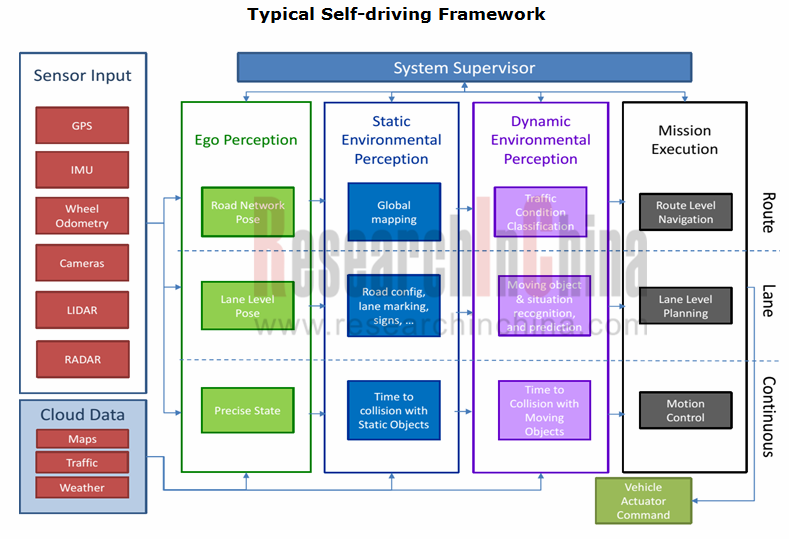

Autonomous driving can be divided into two types, one represented by Waymo, which has solved most of the problems concerning environmental perception and concentrates on behavior decision-making with computing architecture of CPU+FPGA (usually Intel Xeon 12-core and above CPU plus Altera or Xilinx’s FPGA; the other represented by Mobileye which has not solved all problems involving environmental perception and concentrates on it with computing architecture of CPU+GPU/ASIC.

CPU+GPU will be the mainstream in the short run, but CPU+FPGA/ASIC may dominate in the long term, largely due to continuous decline in the precision of computation of graphics because of improvement in algorithms and performance of sensors (LiDAR in particular), which is conducive to FPGA, while it is hardly for the power consumption of GPU to fall. It is easier for FPGA to meet car-grade requirements.

In chip contract manufacturing field, TSMC has won all 7-nanometer chip orders, including A12 exclusively provided for Apple, marking for the first time TSMC overtook Intel to become the vendor with the most advanced semiconductor manufacturing process, a must in the production of digital logic chip whose computing capability is underlined in AI autonomous driving.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...