ADAS and Autonomous Driving Industry Chain Report 2018 (III)– Automotive Radar

-

July 2018

- Hard Copy

- USD

$3,800

-

- Pages:284

- Single User License

(PDF Unprintable)

- USD

$3,600

-

- Code:

HEJ008

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,400

-

- Hard Copy + Single User License

- USD

$4,000

-

ADAS and Autonomous Driving Industry Chain Report 2018 – Automotive Radar at 284 pages in length highlights the followings:

Introduction to automotive radar

Automotive radar market size and forecast

Application trends of automotive MMW radar

Application trends of automotive LiDAR

Global automotive radar companies

Chinese automotive radar companies

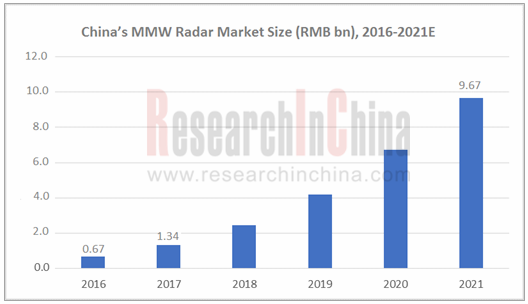

Automotive radars mainly fall into MMW radar, LiDAR and ultrasonic radar. According to the report, China’s MMW radar market size reached approximately RMB1.34 billion in 2017, a figure projected to hit RMB9.67 billion in 2021, with an AAGR of about 70.6% between 2016 and 2021.

LiDAR has been a favorite of capital market since 2017. But as things now stand, MMW radar is the fastest-growing market. The report suggests in the first five months of 2018, installment of OEM MMW radars for passenger cars in China reached as many as 1.406 million units, a year-on-year spurt of 112.7%.

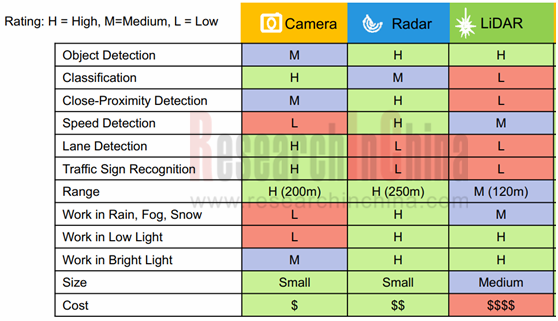

By comparing the three types of sensors in the chart below, MMW radar outperforms LiDAR synthetically at the present stage.

As concerns MMW radar market segments, 24GHz radar still prevails in shipment. In the early days, 24GHz radar was often used for short and mid-range detection, while 77GHz radar found its way into long-range detection. As the technology gets improved with lower cost and better performance, there is a tendency for 77GHz radar to replace 24GHz radar. The year 2017 saw shipments of 77GHz MMW radars for LCA/RCTA soar.

In terms of total volume, 24GHz side-looking short range radar (SRR) is now still the mainstream, for example, some OEMs like Mercedes-Benz and PSA which generally use forward-looking long range radars (LRR) also employ 24GHz radars, leaving such a type of radar with a rosy prospect in the short run; additionally, most new products of world-renowned suppliers including Bosch and Continental will have a frequency band of 76-77GHz. So it is expected that 77GHz radar will forereach 24GHz radar in market size around 2020.

Traditional tier1 suppliers such as Bosch, Continental and Hella still rule the roost in MMW radar market, taking the lion’s share of the market. Chinese MMW radar vendors foray into the OEM market in efforts to cooperate with home automakers though starting from the aftermarket.

Muniu Tech has received orders for tens of thousands of its radars from aftermarket. WHST Co., Ltd. has acquired OEM orders for its 24Ghz rear side radars from a Chinese auto brand -- Changfeng Leopaard. It is expected that at least ten new models in 2019 will utilize the MMW radars from WHST Co., Ltd.

LiDAR has been an innovation hotspot in autonomous driving area at home and abroad. Traditional auto giants and startups without exception invest more in LiDAR and stage mergers & acquisitions. As for technology, mechanical multi-beam LiDAR has been applied massively in self-driving prototype cars, but solid-state LiDAR is more applicable to mass production if used in automobiles, being a future development trend of radar.

In current stage, LiDAR still faces some challenges, for instance, uncertain technology roadmaps, high price and hard to meet automotive requirements. Meanwhile, the maturing technology, next-generation high precision MMW radar for imaging, will be a competitor of LiDAR.

LiDAR technology is and yet developing by leaps and bounds, increasingly incentivizing LiDAR suppliers. In 2018, Quanergy would produce LiDARs in its partner, Sensata’s plant in Changzhou City, Jiangsu Province, China, with capacity initially reaching estimated 10 million units and expectedly climbing to hundreds of millions of units to meet the rising market demand, said Louay Eldada, a co-founder and the CEO of Quanergy at the beginning of this year.

Apart from Quanergy, some Chinese LiDAR players like RoboSense, Surestar, Hesai and LeiShen Intelligent System also have constructed their own factories and are expanding capacity. LiDAR market is predicted to boom in 2021.

MMW radar and LiDAR each have merits and demerits in size, price, applied scene, imaging, ranging, positioning and object detection. Both of them fall short of requirements self-driving cars demand in perception of external environment. Fusion of radar and camera is a solution to acquisition of more accurate environment data and redundancy increase in a bid to secure ADAS and automated driving system’s stability and safety in full measure.

1 Introduction to Automotive Radar

1.1 Definition of Radar

1.2 Radar Frequency Division in China

1.3 Vehicular Radar Band

1.4 Development History of Automotive MMW Radar

1.5 Overview of LiDAR

1.6 Composition and Classification of LiDAR

1.7 Working Principal of LiDAR

1.8 LiDAR Ranging and Imaging Technologies

1.9 Four Key Technologies of LiDAR

2 Automotive Radar Market Size

2.1 The Four New Automotive Trends (Electrification, Connectivity, Intelligence and Sharing) Drive Automotive Radar Market

2.2 China’s Automotive Radar Market Will Grow Faster than Global Market

2.3 Application of ADAS Gives Impetus to Automotive Radar Market

2.4 China’s MMW Radar Market is Flourishing

2.5 77GHz MMW Radar for Short- and Mid-range Detection is Used More Widely

2.6 Applications of SRR/LRR and 24GHz/77GHz Radars for Passenger Cars in China

2.7 Suppliers’ Product Planning Will Spur the Growth of 77GHz MMW Radar

2.8 Automotive MMW Radar Shipments and Market Size in China, 2016-2021E

2.9 Global Automotive MMW Radar Market Size, 2016-2021E

2.10 Global Automotive MMW Radar Shipments, 2016-2021E

2.11 Applications of Ultrasonic Radars for Passenger Cars in China

2.12 Global Automotive Ultrasonic Radar Market Size and Shipments, 2016-2021E

2.13 Relationship between Japanese Automakers and ADAS Sensor Suppliers

2.14 Relationship between the US, Korean and Chinese Automakers and ADAS Sensor Suppliers

2.15 Relationship between European Automakers and ADAS Sensor Suppliers

2.16 Market Shares of Global Major Automotive MMW Radar Manufacturers, 2017

3 Application Trends of Automotive MMW Radar

3.1 Key Automotive MMW Radar Technologies and Application Trends

3.1.1 Comparison between MMW Radar and Other Sensors

3.1.2 Frequency Spectrum of Automotive MMW Radar

3.1.3 Working Principal of MMW Radar

3.1.4 MMW Radar Modulation Technology

3.1.5 Composition of 77GHz Automotive Radar System

3.1.6 Core Parts for MMW Radar - Monolithic Microwave Integrated Circuit (MMIC)

3.1.7 Core Parts for MMW Radar - Antenna PCB

3.1.8 Application Trends of Automotive MMW Radar

3.1.9 Technology Roadmaps of Automotive MMW Radar System in China

3.2 Technology Trends of MMW Radar

3.2.1 RF CMOS Technology

3.2.2 Solutions to Fusion of MMW Radar and Monocular Camera

3.2.3 Trends of MMW Radar Sensor

3.2.4 MMW Radar Develops Towards Integration and High Precision

3.3 Application Trends of MMW Radar

3.3.1 The Number of MMW Radars for a Single Automobile is Increasing

3.3.2 MMW Radar is Penetrating from High-class Models into Low/Middle-class Models

3.3.3 77GHz MMW Radar Will Be the Mainstream

3.3.4 Most New Products of Main Suppliers Will Have a Frequency Band of 77GHz

4 Application Trends of LiDAR

4.1 Application Areas of LiDAR

4.1.1 LiDAR is a Key Sensor for Automated Driving

4.1.2 LiDAR Coupled with Other Sensors Can Recognize Objects Accurately

4.1.3 What LiDAR is Used for in Automated Driving

4.1.4 LiDAR is Used for Centimeter-level Enhanced Positioning

4.2 Classification and Applications of LiDAR

4.2.1 Fixed-beam LiDAR is Being Marginalized

4.2.2 Some Models Using Continental SRL1

4.2.3 Representative Mechanical LiDAR Manufacturers

4.2.4 Analysis of Mechanical LiDAR Products (1)

4.2.4 Analysis of Mechanical LiDAR Products (2)

4.2.5 Mechanical LiDAR is Now Applied to Many a Self-driving Prototype Car (1)

4.2.5 Mechanical LiDAR is Now Applied to Many a Self-driving Prototype Car (2)

4.2.6 Mechanical LiDAR Has Found Application in Mass-produced Models

4.2.7 Representative Solid State LiDAR Manufacturers

4.2.8 Analysis of Solid State LiDAR (1) - MEMS Technology

4.2.9 Analysis of Solid State LiDAR (1) - 3D FLASH

4.2.10 Analysis of Solid State LiDAR (1) - Phased Array

4.3 Technology Trends of LiDAR

4.3.1 Technology Roadmaps of LiDAR

4.3.2 Comparison between Three Solid State LiDAR Technologies: MEMS is Expected to Be Used Firstly

4.3.3 Solid State LiDAR is a Development Trend of Future Automotive Radar

4.3.4 Product Planning of Main Chinese and Foreign LiDAR Manufacturers

4.3.5 Multi-LiDAR Coupling

4.3.6 VCSEL

4.3.7 Fusion of LiDAR and Camera

4.3.8 Scanning Methods for Laser Emission and Reception

4.4 Mass Production of LiDAR

4.4.1 Frequent Investments and Mergers & Acquisitions Accelerate the Process of Mass-producing LiDAR

4.4.2 Meeting Automotive Requirements Plays an Essential Part in the Future Development of LiDAR

4.4.3 Price Drop Will Give a Boost to Wide Application of Automotive LiDAR

4.4.4 Main Factors behind the Decline in LiDAR Price

4.4.5 Representative Companies Lead the Way in Production Increase and Price Reduction

5 Global Automotive Radar Companies

5.1 Continental Automotive

5.1.1 Overview of Continental

5.1.2 Continental’s ADAS Business is Included in its Chassis & Safety Division

5.1.3 List of Continental’s ADAS Products

5.1.4 Continental’s Fifth-generation 77GHz MMW Radar

5.1.5 Advantages of Continental’s Fifth-generation 77GHz MMW Radar

5.1.6 Continental’s LiDAR

5.1.7 Distribution of Continental’s Radar and LiDAR Clients

5.1.8 Main Applications of Continental’s MMW Radar in the Chinese Market

5.1.9 Continental’s Outlook for Automated Driving by 2025

5.2 Bosch

5.2.1 Overview of Bosch

5.2.2 Bosch is Developing Next-generation High Performance Sensors for Automated Driving

5.2.3 Bosch’s ADAS Products - 77GHz MMW Radar

5.2.4 Bosch’s Fourth-generation Long-range Radar Sensor (LRR4)

5.2.5 Bosch’s Fourth-generation Mid-range Radar Sensor (MRR4)

5.2.6 Bosch is Developing Fifth-generation 77GHz MMW Radar

5.2.7 Main Applications of Bosch’s MMW Radar (Chinese Brands)

5.2.8 Main Applications of Bosch’s MMW Radar (Foreign Brands)

5.2.9 Bosch’s Functional Planning of ADAS and Automated Driving for Commercial Vehicles

5.3 ZF

5.3.1 Active & Passive Safety Technology Division

5.3.2 ZF’s R&D Expenses

5.3.3 TRW AC1000 Long-range MMW Radar

5.3.4 TRW AC100 Mid- and Long-range MMW Radar

5.3.5 Main Applications of TRW MMW Radar in the Chinese Market

5.4 APTIV

5.4.1 Overview of APTIV

5.4.2 APTIV’s Structure - Brain and Nerve Divisions

5.4.3 Distribution of Clients and Regional Terminal Markets of APTIV

5.4.4 APTIV’s Active Safety Product Orders, 2016-2018

5.4.5 APTIV’s ESR MMW Radar

5.4.6 APTIV’s MMW Radar + Monocular Camera Integrated Systems

5.4.7 Main Applications of APTIV’s MMW Radar in the Chinese Market

5.4.8 APTIV’s Investment in LiDAR

5.5 Autoliv

5.5.1 Overview of Autoliv

5.5.2 Distribution of Automotive Safety Clients and Products

5.5.3 Active Safety Product Orders, 2012-2017

5.5.4 Autoliv’s Active Safety Technologies

5.5.5 Autoliv’s 77GHz MMW Radar

5.5.6 Autoliv’s 24GHz MMW Radar

5.5.7 Autoliv’s Investments and Acquisitions in ADAS and Automated Driving

5.5.8 Autoliv’s Research & Development Roadmap of Automated Driving Products

5.6 Denso

5.6.1 Overview of Denso

5.6.2 Distribution of Denso’s Clients Consolidated in its Revenue

5.6.3 Denso’s 77GHz MMW Radar

5.6.4 Denso’s New 24GHz Sub-MMW Radar

5.6.5 Main Applications of Denso’s MMW Radar in the Chinese Market

5.6.6 Denso’s Investments in Automated Driving

5.6.7 Denso’s Key Research & Development of ADAS and Automated Driving

5.7 Valeo

5.7.1 Overview of Valeo

5.7.2 Valeo’s Revenue from Comfort & Driving Assistance Systems Division, 2017

5.7.3 Valeo’s OEM Sales by Region

5.7.4 Valeo’s Order Intake, 2008-2017

5.7.5 Valeo’s SCALA LiDAR

5.7.6 Valeo’s 24GHz MMW Radar

5.7.7 Valeo’s Automated Driving Technology Roadmap

5.7.8 Applications of Valeo’s Automated Driving Sensors

5.8 Hella

5.8.1 Hella’s Operation

5.8.2 Hella’s 24GHz MMW Radar

5.8.3 Hella’s New 77GHz MMW Radar

5.8.4 Hella’s Automated Driving Technology Roadmap

5.8.5 Hella’s Partners and Key Concerns in Automated Driving

5.9 Denso Ten (Previously Known as Fujitsu Ten)

5.9.1 Denso’s Three Kinds of MMW Radars

5.9.2 Denso’s 76GHz Short-range MMW Radar

5.10 Metawave

5.10.1 Metawave’s WARLORD Radar

5.10.2 Technical Features of WARLORD

5.11 Oculii

5.11.1 Analysis of Oculii’s 4D Radar Technology

5.11.2 Product Application

5.11.3 Product Description

5.12 Velodyne

5.12.1 Velodyne’s Product Roadmap

5.12.2 Velodyne has Mass-produced LiDARs Which are Used Widely

5.12.3 Velodyne’s Latest Automotive LiDAR

5.13 Quanergy

5.13.1 Quanergy’s LiDAR Products

5.13.2 Quanergy’s M8 Mechanical LiDAR

5.13.3 Quanergy’s S3 Solid State LiDAR

5.13.4 Quanergy’s S3-Qi LiDAR and Comparison of Parameters

5.14 LeddarTech

5.14.1 LeddarTech’s Vu8 Solid State LiDAR Module

5.14.2 LeddarTech’s M16 Solid State LiDAR Module

5.14.3 LeddarTech Develops Solid State LiDAR Chips for Automated Driving

5.15 IBEO

5.15.1 IBEO Had Mass-Produced LiDAR Products

5.15.2 IBEO is Developing New Solid State LiDAR

5.16 Innoviz

5.16.1 Innoviz’s Product Line Planning

5.16.2 Innoviz’s Solid State LiDAR---InnovizPro

5.16.3 Innoviz’s Solid State LiDAR---InnovizOne

5.16.4 Innoviz’s Technology Roadmap

5.17 Luminar

5.17.1 Luminar’s Research and Development of LiDAR

5.17.2 Luminar’s Research and Development of LiDAR

5.18 TriLumina

5.18.1 TriLumina’s Business Models

5.18.2 TriLumina’s VCSEL Illumination Modules

5.18.3 TriLumina and LeddarTech Team up to Demonstrate the Applications of 3D Radar

Comparison between Foreign MMW Radar Manufacturers

Comparison between Foreign LiDAR Manufacturers

6 Chinese Automotive Radar Companies

6.1 Wuhu Sensortech Intelligent Technology Co., Ltd. (WHST)

6.1.1 List of Headquarter and Branches

6.1.2 Summary of Automotive MMW Radar Products

6.1.3 Representative Product (1) - STA24-4 Blind Spot Monitoring Radar

6.1.4 Representative Product (2) - STA77-5 Forward Anti-collision Radar

6.1.5 Representative Product (3) - STA79-3 Near-field Detection Radar Upgraded Version

6.1.6 The Company Stays Ahead of its Domestic Peers in Process of Commercialization

6.1.7 Recent Developments

6.2 Beijing Autoroad Tech Co., Ltd.

6.3 Hangzhou IntiBeam Technology Co., Ltd.

6.3.1 Product Description (1) - 24GHz Blind Spot Detection Radar

6.3.2 Product Description (2) -77GHz Automotive Anti-collision Radar

6.3.3 Layout of 24GHz and 77GHz Products

6.3.4 Zhejiang Asia-pacific Mechanical & Electronic Co., Ltd Bought in Hangzhou IntiBeam Technology Co., Ltd.

6.4 Beijing Muniu Pilot Technology Co., Ltd. (Muniu Technology)

6.4.1 Orientations of Automotive Radar Products

6.4.2 Recent Automotive Radar Planning

6.4.3 Product Analysis (1) - Kanza77 Automotive MMW Radar

6.4.4 Product Analysis (2) - Kanza79 Automotive MMW Radar

6.4.5 Product Analysis (2) - T-79 Automotive Corner Radar

6.5 Hunan Nanoradar Science & Technology Co., Ltd.

6.6 Shanghai Morgina Intelligent Information Technology Co., Ltd.

6.6.1 Development Course/Recent Planning

6.6.2 Technical Analysis: TI SoC Based Solutions

6.6.3 Strategic Layout

6.7 Suzhou Millimeter-wave Technology Co., Ltd.

6.7.1 R&D Progress

6.7.2 Development Plan

6.7.3 Product Analysis (1) - 24GHz Mid-range Radar

6.7.4 Product Analysis (1) - 24GHz Long-range Radar

6.7.5 The Company Has Finished the Research and Development of 79GHz Prototype

6.7.6 The Company and a Japanese Supplier Work Together on Mass Production of ADAS Products

6.8 HawkEye Technology Co., Ltd.

6.9 Xiamen Imsemi Technology Co., Ltd.

6.10 Hesai Photonics Technology Co., Ltd.

6.10.1 Development Course

6.10.2 Financing

6.10.3 Full Line of Products

6.10.4 Product Analysis (1) - Pandar 40

6.10.5 Product Analysis (2) - Pandar GT

6.10.6 Product Analysis (3) - Pandora

6.11 Beijing Surestar Technology Co., Ltd.

6.11.1 Development Course

6.11.2 Financing

6.11.3 Business Divisions

6.11.4 Product Analysis (1) - R-Fans-16

6.11.5 Product Analysis (2) - R-Fans-32

6.11.6 Product Analysis (3) - C-Fans 128-beam LiDAR

6.11.7 Recent Product Planning

6.12 Benewake (Beijing) Co., Ltd.

6.12.1 Development Course/Market Coverage

6.12.2 Financing

6.12.3 Development Plan

6.12.4 Business and Financing

6.12.5 Overview of Products

6.12.6 Analysis of Latest Product - CE30

6.13 Suteng Innovation Technology Co., Ltd. (RoboSense)

6.13.1 Development Course

6.13.2 Financing

6.13.3 Overview of Products/Production and Supply

6.13.4 Product Analysis (1) - RS-LiDAR-16

6.13.5 Product Analysis (2) - RS-LiDAR-32

6.13.6 Product Analysis (3) - RS-LiDAR-M1Pre

6.13.7 RoboSense’s P3 LiDAR Perception Solutions

6.13.8 RoboSense and Alibaba Launched Autonomous Logistics Vehicles Together

6.14 LeiShen Intelligent System Co., Ltd.

Comparison between Chinese MMW Radar Manufacturers

Comparison between Chinese LiDAR Manufacturers

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...