China EV (Electric Vehicle) Motor Controller Industry Report, 2018-2022

-

Aug.2018

- Hard Copy

- USD

$3,600

-

- Pages:253

- Single User License

(PDF Unprintable)

- USD

$3,400

-

- Code:

LT043

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,000

-

- Hard Copy + Single User License

- USD

$3,800

-

Motor drive control system (including drive motor and motor controller) is an important execution mechanism when an EV runs, and its control & drive properties decide main diving performance indicators. Each battery electric vehicle or hybrid vehicle needs a set of motor drive control system.

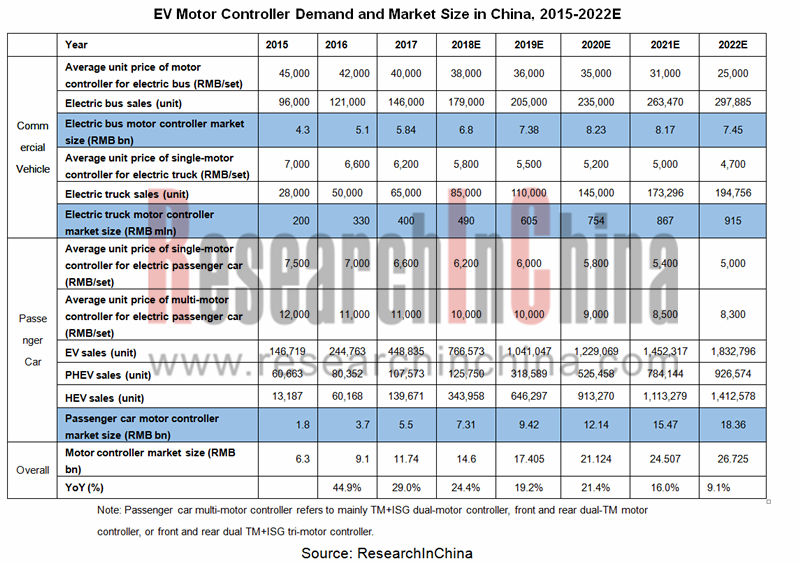

Motor controller prices vary greatly depending on specifications and performance requirements. The market price of motor controller for electric bus is usually RMB30,000-50,000/set (around RMB45,000/set on average), of single-motor controller for electric truck RMB6,000-7,000/set or so, of single-motor controller for passenger car RMB7,000/set, and of multi-motor controller for passenger car RMB10,000-12,000/set. As the dual-motor design can simplify plug-in hybrid system and improve driving performance (like BMW 2 Series PHEV, Toyota Prius, BYD Tang, and BYD Yuan), the proportion of EVs (PHEV in particular) carrying dual-motor system will be on a steady rise.

China’s demand for EV motor controllers was around 870,000 sets or worth RMB11.7 billion or so in 2017, up 34.6% and 29% year on year, respectively. It is expected that EV motor controller market size will climb to RMB26.7 billion in 2022 with passenger car holding a dominant position, propelled by NEVs and conventional hybrids.

The Chinese EV motor controller market is dominated China-made brands, while foreign brands hold fractional share at the stage of market fostering and early development due to higher prices. Chinese companies fall into two parts: EV makers that produce EV motor controllers generally for its own vehicles; EV parts companies that produce EV motor controllers for specific or non-specific carmakers.

Some automakers may ramp up efforts for R&D of motor electronic control and produce products by themselves after mastering the know-how; however, a great many carmakers without such capability still choose third parties to supply products. Hence, the companies with core technologies, experience in mature products, and good cost control will be main beneficiaries.

Prices will trend down throughout the industry, so does the gross margin of major producers, as the competition in the EV motor controller market is possible to prick up along with a quicker R&D progress & launching of mature products of Chinese EV motor controller producers as well as deep involvement of foreign-funded enterprises. In addition, as subsidies decline, the cost transfer of carmakers will also have a big impact on prices.

China EV (Electric Vehicle) Motor Controller Industry Report 2018-2022 highlights the followings:

Main technical routes and development trends of EV motor controller;

Main technical routes and development trends of EV motor controller;

Upstream IGBT & thin-film capacitor and downstream EV industry (market size, competitive landscape, main policies, etc.);

Upstream IGBT & thin-film capacitor and downstream EV industry (market size, competitive landscape, main policies, etc.);

EV motor controller (industrial policy, market size, supply chain, and competitive landscape), global mainstream EV motor electronic control systems;

EV motor controller (industrial policy, market size, supply chain, and competitive landscape), global mainstream EV motor electronic control systems;

19 Chinese EV motor controller producers (operation, motor controller business and technology, etc.);

19 Chinese EV motor controller producers (operation, motor controller business and technology, etc.);

6 global IGBT vendors (operation, business in EV field, etc.);

6 global IGBT vendors (operation, business in EV field, etc.);

8 global automotive inverter companies (operation, business in EV field, etc.).

8 global automotive inverter companies (operation, business in EV field, etc.).

1 Overview of Motor Controller

1.1 Definition

1.2 Operating Principle

1.3 Classification of Products

1.4 Development History of Main Technical Routes

1.4.1 Si IGBT Motor Controller

1.4.2 SiC IGBT Motor Controller

1.5 Technology Trend

1.5.1 Modularization

1.5.2 Intelligence

1.5.3 Integration

2 Industry Chain

2.1 Upstream IGBT Market

2.1.1 Development of IGBT

2.1.2 Market Size

2.1.3 Competitive Landscape

2.1.4 Supply Chain

2.1.5 EV IGBT

2.1.6 Development Direction of IGBT

2.2 Upstream Thin-film Capacitor Market

2.2.1 Market Size

2.2.2 Industrial Chain and Manufacturing Process

2.2.3 Competitive Landscape

2.2.4 EV Thin-film Capacitor

2.3 Downstream EV Market

2.3.1 Overall

2.3.2 Electric Passenger Car

2.3.3 Electric Commercial Vehicle

2.3.4 Main Policies

3 EV Motor Controller Market

3.1 Policy Environment

3.2 Market Size

3.3 Industry Profit

3.4 Mode of Supply

3.5 Competitive Landscape

3.6 Development of Major Enterprises

3.7 Global Mainstream NEV Motor Electronic Control Systems

3.7.1 Tesla Model S

3.7.2 Nissan Leaf

3.7.3 Mitsubishi Outlander PHEV

3.7.4 BMW i3

3.7.5 Chevrolet Volt

3.7.6 Volkswagen e-Golf

3.7.7 Audi A3 e-tron

3.7.8 Ford Fusion/C-Max

3.7.9 Toyota Prius (PHEV and HEV)

4 Chinese EV Motor Controller Manufacturers

4.1 Shanghai E-drive Co., Ltd.

4.1.1 Profile

4.1.2 Operation

4.1.3 EV Motor Controller Business

4.1.4 Technical Features

4.1.5 Supply Chain

4.1.6 Expansion in Lines of Business

4.2 Shenzhen Inovance Technology Co., Ltd.

4.2.1 Profile

4.2.2 Operation

4.2.3 EV Motor Controller Operation and Development Strategy

4.2.4 EV Motor Controllers and Technical Features

4.3 Shanghai Dajun Technologies, Inc.

4.3.1 Profile

4.3.2 Development History

4.3.3 Operation

4.3.4 Business Model

4.3.5 EV Motor Controllers and Technical Features

4.3.6 Business in EV Field

4.3.7 Development Strategy in EV Field

4.4 Tianjin Santroll Electric Automobile Technology Co., Ltd.

4.4.1 Profile

4.4.2 EV Business

4.4.3 EV Power Systems and Technical Features

4.4.4 Development Strategy in EV Field

4.5 Zhongshan Broad-Ocean Motor Co., Ltd.

4.5.1 Profile

4.5.2 Operation

4.5.3 EV Motor Controller Business

4.5.4 R&D

4.5.5 Development Strategy

4.6 United Automotive Electronic Systems Co., Ltd. (UAES)

4.6.1 Profile

4.6.2 Production and R&D

4.6.3 EV Motor Controller Business

4.7 Hunan CRRC Times Electric Vehicle Co., Ltd.

4.7.1 Profile

4.7.2 Operation

4.7.3 EV Controller Business

4.7.4 Dynamics of Drive System Business

4.8 BYD

4.8.1 Profile

4.8.2 Operation

4.8.3 EV Motor Controller Business

4.9 Zhuhai Enpower Electric Co., Ltd.

4.9.1 Profile

4.9.2 Revenue and Costs

4.9.3 Sales Model

4.9.4 Major Customers

4.9.5 EV Motor Controller Business

4.9.6 R&D

4.9.7 Development Strategy of Motor Controller Business

4.10 Shenzhen V&T Technologies Co., Ltd.

4.10.1 Profile

4.10.2 Revenue and Costs

4.10.3 Sales Model

4.10.4 Major Customers

4.10.5 EV Motor Controller Business

4.10.6 R&D

4.10.7 Development Strategy of Motor Controller Business

4.11 Fujian Fugong Power Technology Co., Ltd.

4.11.1 Profile

4.11.2 Cooperation with Overseas Partners

4.11.3 NEV Drive Assembly Business

4.11.4 Capacity Planning

4.12 Chroma ATE Inc.

4.12.1 Profile

4.12.2 Operation

4.12.3 EV Motor Controller Business

4.12.4 Development Strategy in EV Field

4.13 Delta Electronics

4.13.1 Profile

4.13.2 Operation

4.13.3 Business in EV Field

4.14 Jing-Jin Electric Technologies (Beijing) Co., Ltd.

4.14.1 Profile

4.14.2 EV Motor Controller Business

4.15 DEC Dongfeng Electric Machinery Co., Ltd.

4.15.1 Profile

4.15.2 EV Controller Business

4.16 Nidec (Beijing) Drive Technologies Co., Ltd.

4.16.1 Profile

4.16.2 Operation

4.16.3 EV Motor Controller Business

4.17 Time High-Tech Co., Ltd.

4.17.1 Profile

4.17.2 EV Motor Controller Business

4.18 JEE Automation Equipment Co., Ltd.

4.18.1 Profile

4.18.2 EV E-drive Business

4.19 Shandong Deyang Electronics Technology Co., Ltd.

4.19.1 Profile

4.19.2 EV E-drive Business

4.20 Beijing Siemens Automotive E-Drive System Co., Ltd.

4.21 Prestolite E-Propulsion Systems (Beijing) Limited

5 IGBT Suppliers

5.1 Fuji Electric

5.1.1 Profile

5.1.2 Operation

5.1.3 Business in EV Field

5.1.4 Development Strategy in EV Field

5.2 Infineon

5.2.1 Profile

5.2.2 Operation

5.2.3 Business in EV Field

5.2.4 Development Strategy in EV Field

5.3 Denso

5.3.1 Profile

5.3.2 Operation

5.3.3 Business in EV Field

5.4 ROHM

5.4.1 Profile

5.4.2 Operation

5.4.3 Business in EV Field

5.5 IR

5.5.1 Profile

5.5.2 Operation

5.5.3 Business in EV Field

5.6 Semikron

5.6.1 Profile

5.6.2 Operation

5.6.3 Business in EV Field

6 Inverter Manufacturers

6.1 Hitachi Automotive Systems

6.1.1 Profile

6.1.2 Operation

6.1.3 Business in EV Field

6.2 Mitsubishi Electric

6.2.1 Profile

6.2.2 Operation

6.2.3 Business in EV Field

6.3 Meidensha

6.3.1 Profile

6.3.2 Operation

6.3.3 Business in EV Field

6.4 Toshiba

6.4.1 Profile

6.4.2 Operation

6.4.3 Business in EV Field

6.5 Hyundai Mobis

6.5.1 Profile

6.5.2 Operation

6.5.3 Business in EV Field

6.6 Delphi

6.6.1 Profile

6.6.2 Operation

6.6.3 Business in EV Field

6.7 Robert Bosch

6.7.1 Profile

6.7.2 Operation

6.7.3 Business in EV Field

6.8 Continental

6.8.1 Profile

6.8.2 Operation

6.8.3 Business in EV Field

Principle of EV Motor Controller

Classification of EV Motor Controllers

IGBT Power Module and Motor Controller for 2nd-generation Prius

Structure of Hitachi’s 1st-generation Motor Controller

Structure of Hitachi’s 2nd-generation Motor Controller

Hitachi’s Double-sided Pin-Fin IGBT Module and 3rd-generation Motor Controller

Bosch’s 3rd-generation Automotive IGBT Power Module

Bosch’s Motor Controller - INV2CON

Bosch’s Motor Controller - INVCON2.3

Continental’s EPF2 Series Motor Controllers

Continental’s New-generation Motor Controllers

SiC (Left) and Si (Right) Motor Controllers Co-developed by Toyota and Denso

Meidensha’s SiC Motor Controller and Motor AIO (All-In-One)

Application of IGBT by Voltage

IGBT Technology Evolution and Players Involved

Development History of 1st-6th-generation IGBT Technologies

Technology Roadmaps of Global Major IGBT Vendors, 2017-2025

Global IGBT Market Size by Application, 2016-2022E

Selling Price, Shipments, and Market Size of IGBT, 2014-2020E

Chinese IGBT Market Size, 2014-2020E

Market Shares of Global Major IGBT Vendors, 2017

Ranking of Global IGBT Vendors by Power Range, 2017

Market Shares of Major IGBT Vendors in China, 2014

Global Major EV IGBT Vendors

Global IGBT Industry Supply Chain by Power Range

China’s IGBT Industry Supply Chain

Major Local Companies in China’s IGBT Industry Chain and Their Products

Global Downstream Markets of IGBT Module by Field, 2014

Global Downstream Markets of IGBT Module by Field, 2020E

Global EV IGBT Market Size, 2014-2020E

Max. Voltage and Current of Controllable Power Semiconductor on the Market

Levels of Power Module Integration

Comparison of Parameters between Major Materials and Silicon Material

Physical Parameters of Different Semiconductor Materials

SPT+ IGBT Structure

Diagrams of Trench-gate IGBT and CSTBT

Structure of an RC-IGBT from ABB

Global Capacitor Market Size, 2009-2019E

Chinese Capacitor Market Size, 2009-2019E

China’s Film Capacitor Output and Sales Volume, 2010-2014

Film Capacitor Industry Chain

Film Capacitor Manufacturing Process and Barriers

Major Film Capacitor Vendors at Home and Abroad

Sales Volume of Electric Passenger Vehicle in Major Countries/Regions, 2013-2017

Monthly Sales Volume of New Energy Vehicle (EV&PHEV) Worldwide, 2014-2017

Ranking of World’s NEV Makers by Sales Volume, 2017

Global Sales Volume of Electric Passenger Vehicle, 2012-2020E

Monthly Sales Volume of Electric Vehicle in the United States, 2014-2017

Monthly Sales Volume of Electric Vehicle in Europe, 2014-2016

Automobile Ownership, Output and Sales Volume in China, 2010-2018

China’s Output and Sales Volume of Electric Vehicles, 2011-2017

China’s Sales Volume of Electric Vehicles (EV&PHEV), 2014-2022E

China’s Sales Volume of Conventional Hybrid Electric Vehicles (HEV), 2012-2022E

China’s Sales Volume of Electric Vehicles (EV&PHEV), 2014-2022E

Sales of TOP10 Battery Electric Passenger Vehicle Makers in China, 2017

Electric Passenger Vehicle (EV&PHEV) Sales Volume in China, 2016-2017

Ranking of New Energy Passenger Vehicle Models by Sales Volume, 2017

Top 30 New Energy Passenger Car Models by Output in China, 2016-2017

Top 20 Energy-saving and New Energy Passenger Car Models by Monthly Sales, 2016-2017

China’s Output of Electric Commercial Vehicles, Jan-Dec 2015

China’s Monthly Output of New Energy Commercial Vehicles, 2016-2017

China’s Output of New Energy Commercial Vehicles by Model, 2016-2017

China’s Output of Electric Bus, Jan-Dec 2015

China’s Output of New Energy Buses by Model, 2016-2017

China’s Output of Battery Electric Trucks, Jan-Dec 2015

China’s Output of Battery Electric Trucks, 2016-2017

China’s Sales Volume of Electric Commercial Vehicles, 2014-2022E

Comparison of Subsidy Standards (Central Finance) for Electric Bus in China, 2018

Changes in Subsidy Standards (Central Finance) for Electric Vehicle in China, 2016-2018

Subsidy Standards for Full-cell Vehicle in China, 2018

List of Cities or Regions for New Energy Vehicle Promotion and Application (1st Batch)

List of Cities or Regions for New Energy Vehicle Promotion and Application (2nd Batch)

Comparison of Taxes on ICE and EV in China

Models among 4th-17th Batches of Purchase Duty-Free Catalog Approved by MIIT, 2015-2017

Policies on EV Motor Controller in China

EV Motor Controller Demand and Market Size in China, 2015-2022E

Gross Margins of Shenzhen Inovance Technology, Shenzhen V&T Technologies and Zhuhai Enpower Electric’s Motor Controller Business, 2012-2017

Supply Modes of EV Motor Controller in China

Market Shares of Major Manufacturers of Electric Passenger Car Motor Controller in China, 2015

Market Shares of Major Manufacturers of Electric Passenger Car Motor Controller in China, 2016

Market Shares of Major Manufacturers of Electric Passenger Car Motor Controller in China, 2017

Top10 Electric Passenger Car Motor Controller Manufacturers by Installment in China, 2017

TOP10 Electric Passenger Car Motor Manufacturers by Installment in China, 2017

Motor and Controller Suppliers of Major Electric Bus Manufacturers in China

Motor and Controller Suppliers of Major Passenger Car Manufacturers in China

Motor and Controller Suppliers of Major Electric Logistics Vehicle Manufacturers in China

Major EV Motor Controller Manufacturers in China

Tesla Front-drive Motor Controller

Tesla Rear-drive Motor Controller

Tesla Rear-drive Powertrain

Nissan Leaf E-drive System FF

Nissan Leaf E-drive Assembly

Nissan Leaf Supply System

Architecture of Mitsubishi Outlander PHEV

BMW i3 Drive Motor and Inverter Assembly

Voltec E-drive System

Volkswagen e-golf “Electric Engine Room” (Electric Motor (Middle), Motor Controller (Left))

Architecture of Audi A3 etron

Audi A3 etron Motor Controller (Integrating DCDC)

Ford C-Max Motor Controller

4th-generation Prius Electronic Control PCU

Equity Structure of Shanghai E-drive (Before/After Being Acquired)

Operation System of Shanghai E-drive (After Being Acquired)

Major Clients of Zhongshan Broad-Ocean Motor and Shanghai E-drive

Financial Indices of Shanghai E-drive, 2009-2017

Main Products of Shanghai E-drive

Production Base Construction of Shanghai E-drive

Installment of Shanghai E-drive’s EV Motor Controller Systems, 2013-2017

Core Patented Technologies of Shanghai E-drive

Top5 Clients of Shanghai E-drive, 2014-2015Q1

Top5 Suppliers of Shanghai E-drive, 2014-2015Q1

Revenue and Net Income of Shenzhen Inovance Technology, 2009-2018Q1

Gross Margin of Shenzhen Inovance Technology, 2009-2017

Revenue of Shenzhen Inovance Technology by Product, 2014-2017

Gross Margin of Shenzhen Inovance Technology by Product, 2012-2017

Partners of Shenzhen Inovance Technology’s Automotive Electronics Business

Shenzhen Inovance Technology’s System Solutions for Plug-in Hybrid Bus

Shenzhen Inovance Technology’s Main EV Motor Controllers and Their Applications

Business Performance of Shanghai Dajun Technologies, 2012-2017

Main Materials Purchased by Shanghai Dajun Technologies

Technical Parameters of Shanghai Dajun Technologies’ N110WSA Motor Controller

Technical Parameters of Shanghai Dajun Technologies’ A360140J Motor Controller

Output and Sales Volume of Shanghai Dajun Technologies’ Motor Drive System, 2012-2017

Subsidiaries of Shanghai Dajun Technologies

Equity Structure of Tianjin Santroll Electric Automobile Technology

Main Financial Indices of Tianjin Santroll Electric Automobile Technology, 2014-2016

Revenue of Tianjin Santroll Electric Automobile Technology by Product, 2015-2016

Structure of Santroll IV-generation Plug-in Hybrid System

Ratio of Battery Electric to CCBC in Typical Chinese Cities

Proportion of Actual Battery Electric Duration of Battery Electric Bus 803 in Tianjin

Santroll 5th-generation ECU

Equity Structure of Zhongshan Broad-Ocean Motor

New Energy Vehicle Powertrain Revenue and Sales Volume of Zhongshan Broad-Ocean Motor, 2012-2017

Zhongshan Broad-Ocean Motor’s 30KW Motor (YTD030W04) + Controller (KM6025W05) Drive Motor System

Zhongshan Broad-Ocean Motor’s New Energy Vehicle E-drive System Projects under Construction

Zhongshan Broad-Ocean Motor’s Presence in New Energy Vehicle Market

10-year Development Strategy of Zhongshan Broad-Ocean Motor

Production Bases and R&D Centers of UAES

UAES’ E-drive Product Line

Test Equipment for UAES’ E-drive Business

UAES’ Planning for Power Electronic Controllers

UAES’ R&D Capability for Power Electronic Controllers

Structure and Specifications of UAES’ Single-motor Control Products

Structure and Specifications of UAES’ Dual-motor Control Products

Financial Indices of Hunan CRRC Times Electric Vehicle, 2011-2015

Motor Controllers of Hunan CRRC Times Electric Vehicle

BYD’s Workforce, 2007-2017

Automobile Output and Sales of BYD, 2010-2017

Revenue, Net Income & Gross Margin of BYD, 2007-2018Q1

Revenue of BYD by Product, 2009-2017

Gross Margin of BYD by Product, 2009-2017

Bidirectional Inverter Charging/Discharging Drive Motor Controller

BYD’s Bidirectional Inverter Charging/Discharging Technology

BYD’s Competence in Motor Controller Process

Main Motor Controller Production Lines and Key Equipment of BYD

Revenue of Zhuhai Enpower Electric by Product, 2013-2017

Zhuhai Enpower Electric’s Purchases for Main Raw Materials, 2013-2016

Major Suppliers and Procurement of Zhuhai Enpower Electric, 2016

Motor Controller Partners of Zhuhai Enpower Electric

Major Customers and Sales of Zhuhai Enpower Electric, 2013-2016

Capacity, Output, and Sales Volume of Zhuhai Enpower Electric’s Main Products, 2013-2017

Average Prices of Zhuhai Enpower Electric’s Motor Controllers, 2013-2017

Zhuhai Enpower Electric’s R&D Programs

Zhuhai Enpower Electric’s Projects with Funds from IPO

Revenue and Net Income of Shenzhen V&T Technologies, 2012-2018Q1

Revenue of Shenzhen V&T Technologies by Product, 2014-2017

Procurement and Purchase Prices of Main Raw Materials for Motor Controller of Shenzhen V&T Technologies, 2012-Jan-Sept 2015

Product Sales Model of Shenzhen V&T Technologies, 2011-2014

Top5 Customers of Shenzhen V&T Technologies, 2011-2014

Major Customers for Shenzhen V&T Technologies’ EV Motor Controllers

Average Unit Price of Shenzhen V&T Technologies’ EV Motor Controllers, 2012-2017

EV Motor Controller Capacity and Capacity Utilization of Shenzhen V&T Technologies, 2012-2015

EV Motor Controller Sales of Shenzhen V&T Technologies, 2012-2017

Shenzhen V&T Technologies’ Core Technologies for Motor Controller

Shenzhen V&T Technologies’ Projects with Funds from IPO

Major Cooperative Enterprises of Fujian Fugong Power Technology

Main Financial Indices of Fujian Fugong Power Technology, 2014-Oct 2015

Architecture of CHS Dual-mode Hybrid System

Diagram of Internal CHS Hybrid Transmission Case

Auto Models with CHS Hybrid System

R&D Center Architecture of Fujian Fugong Power Technology

Global Presence of Chroma ATE Inc.

Financial Indices of Chroma ATE Inc. (Group’s Consolidation), 2010-2017

Revenue (by Division) of Chroma ATE Inc., 2016-2017

CR Series Motor Controller Product Line of Chroma ATE Inc.

Key Technical Parameters of CR Series Motor Controller of Chroma ATE Inc.

Financial Indices of Delta Electronics, 2011-2017

Capacity, Output and Output Value of Delta Electronics’ Power Supply and Components, 2015-2017

Sales Volume of Delta Electronics’ Power Supply and Components, 2016-2017

Jing-Jin Electric Technologies’ R&D of Key Equipment

Performance Parameters of PII Automotive Motor Controller of Jing-Jin Electric Technologies

Performance Parameters of Four-in-One Automotive Motor Controller of Jing-Jin Electric Technologies

EV Motor Controllers of DEC Dongfeng Electric Machinery Co., Ltd

New Energy Vehicle SRD Motor of China Tex MEE

Battery Electric Power & Control System Assemblies of Time High-Tech

EV Power Control System Composition Solution of Time High-Tech

Key Technical Parameters of EV Motor Controller of Time High-Tech

Financial Indices of Fuji Electric, FY2012-2018

Revenue and Operating Income of Fuji Electric (by Business), FY2013-2017

Revenue (by Region) of Fuji Electric, FY2013-2017

Revenue of Fuji Electric’s Power Device Division, FY2016-FY2020E

IGBT and SiC R&D Planning of Fuji Electric, 2015-2021

Power Device Expansion Plan of Fuji Electric

7th-generation IGBT Product Planning of Fuji Electric, 2016-2018

New IGBT Mass Production Plan of Fuji Electric

Industrial IGBT / SiC Loss Comparison, 2015-2017

Automotive Power Module Development Roadmap of Fuji Electric, 2005-2025E

Global Rankings of Infineon’s Three Major Businesses, 2017

Global Rankings of Infineon’s Automotive Electronics Businesses, 2017

Infineon’s Revenue (by Region), FY2017-FY2018

Infineon’s Revenue (by Division), FY2017-FY2018

Infineon HybridPACK? Family IGBT Modules

Denso’s Revenue and Profits, FY2017-FY2018

Denso’s Revenue and Operating Income (by Region), FY2017-FY2018

Denso’s Revenue (by Product), FY2017-FY2018

Denso’s Client Structure, FY2017-FY2018

Power Electronics Projects of Japanese NEDO

ROHM’s Financial Indices, FY2013-FY2018

ROHM’s Revenue (by Business), FY2014-FY2019

ROHM’s Revenue (by Region), FY2014-FY2019

ROHM’s Revenue (by Application), FY2018

Main Technical Parameters of ROHM’s Automotive IGBT Module

Structure of ROHM IGBT-IPM

Loss Comparison of Conventional IGBT-IPM and ROHM MOS-IPM

Development History of ROHM’s SiC Products

SiC-based Power Device Lineup of ROHM

IR’s Revenue (by Division), FY2012-FY2014

Operation of Semikron

Key IGBT Brands of Semikron

Product Portfolio of SEMIKRON’s SKiM modules

Key Features of SEMIKRON’s SKiM modules

Product Portfolio of SEMIKRON’s SKiiP IPM

Key Features of SEMIKRON’s SKiiP IPM

Structure of SEMIDRON’s SKAI Power Electronic Platform

Product Portfolio of SEMIKRON’s SKAI Power Electronic Platform

Key Features of SEMIKRON’s SKAI Power Electronic Platform

Revenue of Hitachi Automotive Systems, FY2012-FY2016

Workforce of Hitachi Automotive Systems, FY2012-FY2016

Revenue Planning of Hitachi Automotive Systems by Business, FY2015-FY2020E

Hitachi Automotive Systems’ Major Customers for Its EV Inverters

Financial Indices of Mitsubishi Electric, FY2013- FY2018

Revenue Percentage of Mitsubishi Electric by Business, FY2009-FY2018

EV J1-Series Power Modules EVPM of Mitsubishi Electric

Lineup and Packaging Structure of J1-Series Power Modules EVPM

Mitsubishi Electric’s Major Customers for Its EV Inverters

Meidensha’s Financial Indices, FY2014- FY2018

Meidensha’s Revenue (by Division), FY2016-FY2017

Meidensha’s Major Customers for Its EV Inverters

Toshiba’s Revenue and Net Income, FY2014- FY2018

Toshiba’s Revenue Structure (by Business), FY2017- FY2018

Toshiba’s Major Customers for Its EV Inverters

Global Distribution of Hyundai Mobis’ Customers

Revenue Plan of Hyundai Mobis (by Business), 2018-2025E

Revenue and Operating Margin of Hyundai Mobis, FY2006- FY2017

Hyundai Mobis’ Major Customers for Its EV Inverters

Delphi’s Financial Indices, 2014-2017

Delphi’s Major Customers and Regional Distribution

Delphi’s Major Customers and Revenue Contribution Rates, 2017

Delphi’s Products in EV Field

Technical Features of Delphi’s EV Inverters

Delphi’s Viperv Double-sided Heat Dissipation Structure

Major Customers for Delphi’s EV Inverters

Bosch’s Revenue and EBIT, 2011-2017

Bosch’s Revenue Structure (by Division), 2012-2017

Revenue and EBIT of Bosch Automotive Division, 2012-2017

Bosch’s Revenue Structure (by Region), 2012-2017

Bosch’s Sales in Major Countries, 2016-2017

Major Customers for Bosch’s EV Inverters

Continental’s Revenue and EBIT, 2011-2017

Major Customers for Continental’s EV Inverters

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...