Report on Emerging Automakers in China in 2018 (Corporate Reach & Connectivity Functions)

There have emerged more than a hundred new automakers in the wake of the rapidly expanding electric vehicle market in China over the past few years, among which fifty ones or so have gained popularity. Amid the depressed economy and the waning vehicle sales, the majority of these players will suffer a setback in attempts to expand, and capital and industrial resources will thus flow to a few big ones.

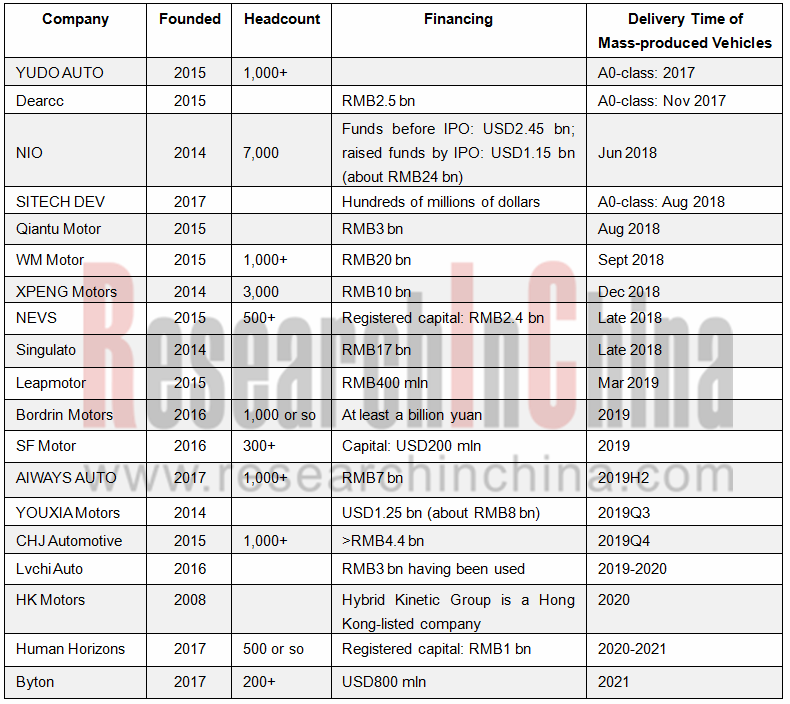

19 emerging automakers are analytically selected in the report focusing on their layout in production, research and development, manufacturing, marketing and mobility, as well as configurations of their typical connected vehicle models, technology roadmaps and development strategies.

Emerging automakers did not yet slow their pace of raising funds in the past two years. Bellwethers’ financing scale jumped from more than hundreds of millions of yuan to billions of yuan before hitting tens of billions of yuan in the near future.

Most of the 19 firms have launched cars on the market since 2018. The vehicles released by YUDO Auto and Dearcc in 2017 are A0-class models. In 2018 another 7 automakers have cars delivered or to be delivered; in 2019, 6 carmakers will have launches; between 2020 and 2021, four carmakers will do so.

Emerging automakers strive for a place in the huge Chinese automobile market where they compete in a differentiated way with the help of Tier1 suppliers. Thanks to more capital inflows, they can exert themselves to innovations in local Chinese market as automobile is going smart, connected, electrified and shared.

Most players use the cutting-edge automotive electrical/electronic architecture, coupling local featured services (e.g., allowing couriers to put a package directly into the receiver’s car trunk), to build intelligent connected cars. The report introduces 110 intelligent and connectivity capabilities as a points-based criterion system to evaluate how typical car models of the 19 firms are intelligent and connected.

Here is a briefing of connected car strategies and development directions of emerging automakers:

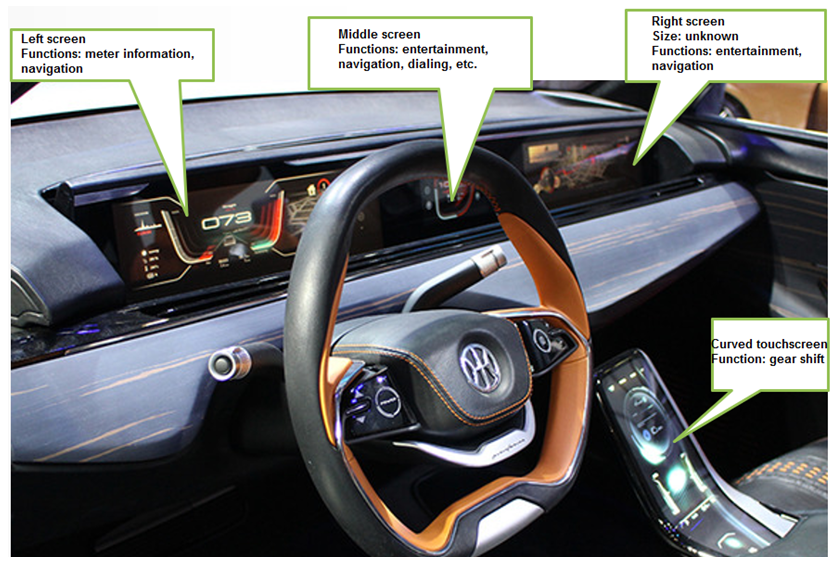

1. These firms prefer 4-to-6-inch LCD screens. Multi-screen is a highlight but also a challenge, because display and interaction of multiple screens cost a lot of computing resources, which undoubtedly leads to the rising costs of chip and software development.

2. More use of HUD, multiple interactive systems and biometric system provides front and rear seat occupants with independent space of entertainment and interaction.

3. More than 20 sensors are preset as hardware for upgrading ADAS and automated driving functions. Examples include NIO ES8 equipped with 21 sensors, Xpeng G3 with 25 and Singulato iS6 with 25. Some manufacturers even express that users can get an upgrade of hardware like sensors. OTA has been a standard configuration for software update.

4. For Chinese suppliers have no mature applicable automated driving solutions, the emerging automakers choose either Mobileye’s solutions or independent development and iterations, of which NIO, WM Motor and YOUXIA Motors partner with Mobileye. Those without cooperating with major suppliers are running out of time to develop telematics and automated driving systems by themselves (or teaming up with their partners), because their foreign counterparts like WAYMO and Tesla have left them far behind. Mobileye’s solutions, Banma Zhixing system and Baidu Apollo system are being utilized by more and more automakers.

5. These players set up special funds to back their own supply chain system. For example, NIO Capital, NIO’s fund management agency with fundraising target of RMB10 billion, has invested 15 companies in the areas of car sharing, autonomous driving and automotive new materials through its RMB funds; Dearcc’s automotive industry development funds managing more than RMB2.5 billion, will concentrate on investment in the industry chain of intelligent electric vehicle and integration of resources in new energy power technology, intelligent driving and shared services; Singulato and Suzhou Municipal Government have built a RMB10 billion joint investment fund for intelligent electric vehicle industry.

As a whole, the boom of emerging automakers lends vigor to innovation and transformation in China’s automobile industry. A great number of Chinese automakers offer opportunities for suppliers in the intelligent connected vehicle (ICV) industry chain covering sensors, software and algorithms, communication systems, controllers, chips, connectivity systems and system integration, mobility services, entertainment services, parking services and charging systems, making China the one boasting the most number of start-ups in the ICV field and innovating at the fastest speed.

Tesla achieved great success in the third quarter of 2018. It is believed that several out of dozens of Chinese emerging automakers will come to the fore.

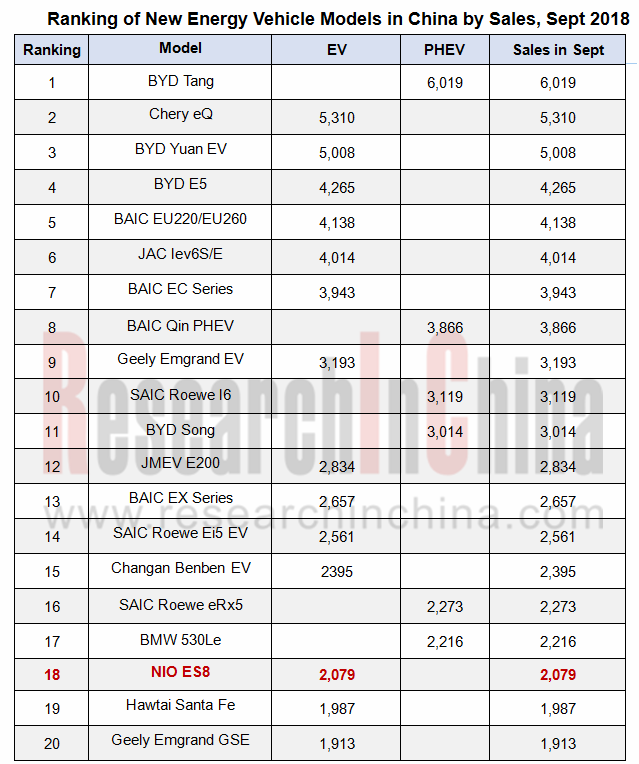

NIO ES8 has edged into the top20, according to the ranking list of new energy vehicle models in China by sales in September 2018. The emerging automakers will have more models on the list in the second half of 2019.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...