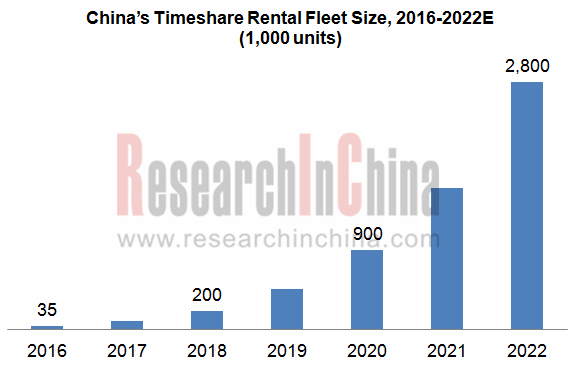

Car sharing exists in three forms: timeshare rental, ride-hailing, and P2P (peer-to-peer) car rental. In China, ride-hailing now prevails; P2P car rental firms almost have gone out of business; only timeshare rental gathers pace. China is expected to see its timeshare rental fleets have 200,000-250,000 cars by the end of 2018, according to the data of ResearchInChina.

It is predicted that China’s timeshare rental fleet size will outnumber 900,000 units by 2020 before hitting more than 2.8 million units in 2022.

Timeshare rental boom in 2018 is largely credited to the following:

Electric vehicles can travel a far longer distance, allowing customers to use more often;

Electric vehicles can travel a far longer distance, allowing customers to use more often;

The use of more customized car models for timeshare rental enables lower car cost;

The use of more customized car models for timeshare rental enables lower car cost;

The influx of funds helps to increase fleets and scale effect plays a part;

The influx of funds helps to increase fleets and scale effect plays a part;

The improving scheduling strategy and algorithms lower operating cost;

The improving scheduling strategy and algorithms lower operating cost;

Delivering cars to users’ door and allowing them to rent and return at any time among other services make it more convenient to use cars;

Delivering cars to users’ door and allowing them to rent and return at any time among other services make it more convenient to use cars;

Automakers put more resources into timeshare rental as their car sales drop

Automakers put more resources into timeshare rental as their car sales drop

On the whole, lower price and more convenience for renting a car conduce to timeshare rental sustaining over 100% growth in recent two years. The introduction of autonomous driving technology will be another reason to let customers find it cheaper and easier to use a car in the future. As a result, timeshare rental and ride-hailing services will roll into one, that is, autonomous taxi service.

Some start-ups also have their eye on the promising timeshare rental market. They can provide a host of solutions from fleet management and scheduling to autonomous valet parking.

Among Chinese firms, FutureMove Automotive positions itself as a provider of mobility services. Its solutions like “automotive software and cloud platform”, “digital operation service” and “intelligent vehicle hardware” have been available to multiple scenarios such as ride-hailing, timeshare rental, business purpose vehicle, industrial customer fleet management and test ride and drive.

Autonomous valet parking (AVP), a key link to timeshare rental service, saves users a lot of picking and returning time. Leading autonomous driving solution providers like Baidu, UISEE and ZongMu Technology, all have announced to put their AVP service into trial operation by cooperating with timeshare rental firms and automakers.

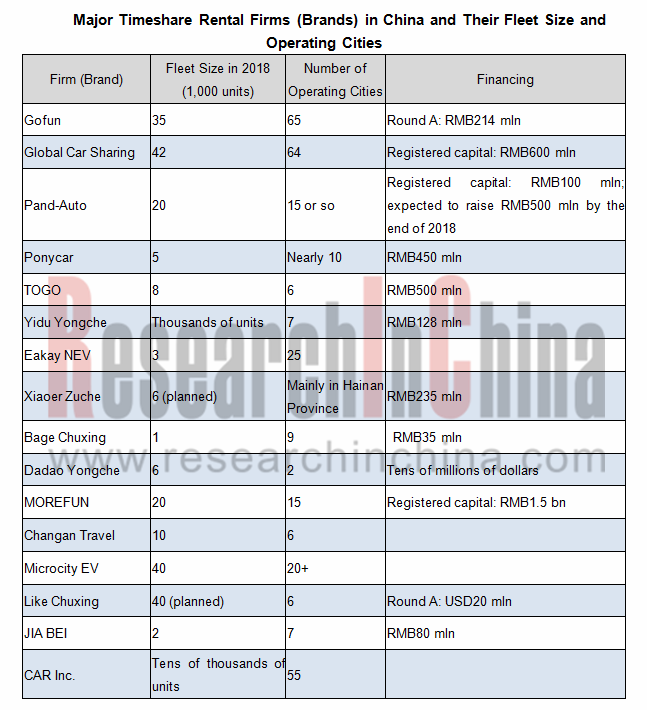

Timeshare rental already begins to shake traditional car rental industry in which the typical firm, CAR Inc. also has announced the launch of a timeshare rental service this year. In the first half of 2018, the car rental giant spent RMB3.42 billion buying new cars, most of which would be for expanding its timeshare rental fleets, a move sending its total fleet size to 123,879 units.

In 2020, China will boast the timeshare rental fleet size of more than 900,000 cars, equivalently replacing over 4.5 million private cars, and the figures to reach over 2.8 million and 14 million in 2022, respectively.

The report will explain the industry development trends and analyze 15 timeshare rental operators and 10 solution providers for their products and services, target market and operation strategy.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...