In the automotive sector, MLCC is generally used in power system, safety system, comfort system, entertainment system and so forth. That intelligent driving functions prevail in cars brings strong demand for MLCC. As the intelligentization, networking and electrification of vehicles is galloping, it is expected by industry insiders that MLCC use in cars will soar by folds. In the era of intelligent connected battery electric vehicle (BEV), a single vehicle requires as 6 times MLCCs as that for a current common internal combustion engine.

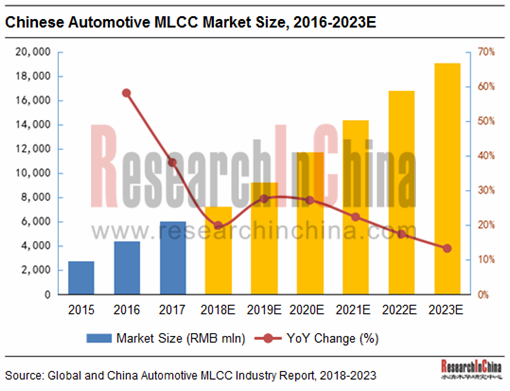

In recent years, electrification of cars is gathering momentum worldwide, and battery electric vehicle (BEV) output keeps soaring year after year, coupled with a steady rise in output of hybrids/PHEVs and smart fuel-efficient models as well as common internal combustion engines going intelligent, all of which serve as a spur to the demand for MLCC. As estimated, the Chinese market size of automotive MLCC will report RMB19.053 billion in 2023 (as compared with RMB6.044 billion in 2017), showing a CAGR of 21.1% between 2017 and 2023.

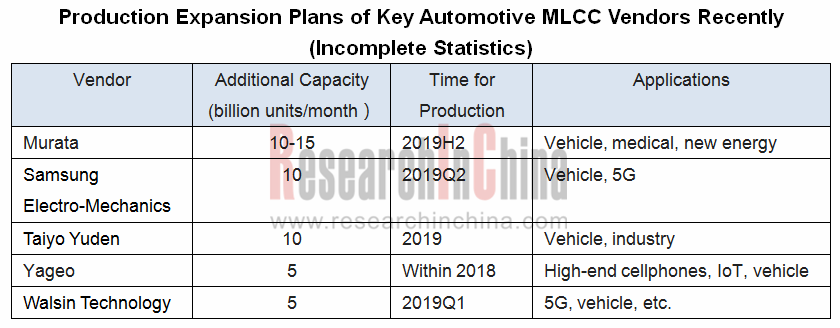

The well-known automotive MLCC vendors are mainly from Japan, South Korea, Europe & America, and Taiwan (China), of which Japanese companies consist of Murata, TDK, Taiyo Yuden, Kyocera, etc.; South Korean peer refers to Samsung Electro-Mechanics; and Taiwanese counterparts are Yageo and Walsin Technology.

Currently, Murata is the vendor boasting the most market shares worldwide (29%; about 40% in the automotive MLCC market), with the production capacity of 960 billion units/year for the moment. Murata has slashed production of low-end MLCC and related delivery has drawn to an end over the past two years. In 2018, Murata invested $660 million for expanding production of MLCC for medical and automotive use and mass-production is anticipated in 2019.

Samsung Electro-Mechanics has sprung up and has been in the second place worldwide since it outperformed Japan-based TDK in 2009. Impacted by the explosion of Samsung NOTE7, Samsung Electro-Mechanics has tightened control on the quality of products and cut shipments over the recent years, while it planned to invest the additional 10 billion units/month MLCC for cars and 5G products.

TDK canceled product orders involving 700 million MLCCs in 360 models in 2017, and has transferred to focus on medium- and high-end products.

Chinese MLCC vendors has been developing apace over the recent years but are still engaged in supply for consumer electronics. Few companies like Fenghua Advanced Technology have rolled out the products in line with AEC-Q200 criterion. Due to weak strength, Chinese players are still hard to pose a threat to the MLCC giants from Japan, South Korea and Taiwan (China).

The report highlights the following:

MLCC industry overview (definition, classification, policies, etc.);

MLCC industry overview (definition, classification, policies, etc.);

Global and China MLCC markets (market size, production capacity, industrial chains, competitive landscape, etc.);

Global and China MLCC markets (market size, production capacity, industrial chains, competitive landscape, etc.);

Global and China automotive MLCC markets (market size, production capacity, competitive pattern, etc.);

Global and China automotive MLCC markets (market size, production capacity, competitive pattern, etc.);

Eleven automotive MLCC vendors including Murata, Samsung Electro-Mechanics, Kyocera, Taiyo Yuden, TDK, KEMET, Fenghua Advanced Technology, Walsin Technology, Yageo, HolyStone and Chemi-Con (profile, financials, hit products, R&D, manufacturing bases, technical features, etc.);

Eleven automotive MLCC vendors including Murata, Samsung Electro-Mechanics, Kyocera, Taiyo Yuden, TDK, KEMET, Fenghua Advanced Technology, Walsin Technology, Yageo, HolyStone and Chemi-Con (profile, financials, hit products, R&D, manufacturing bases, technical features, etc.);

Eight manufacturers in the upstream of MLCC, including Sakai Chemical Industry, Ferro, Prosperities Dielectrics, Shandong Sinocera Functional Material, Nippon Chemical Industrial, SHOEI, Sumitomo Metal Industries, and ESL.

Eight manufacturers in the upstream of MLCC, including Sakai Chemical Industry, Ferro, Prosperities Dielectrics, Shandong Sinocera Functional Material, Nippon Chemical Industrial, SHOEI, Sumitomo Metal Industries, and ESL.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...