China End-of-Life Vehicle (ELV) and Dismantling Industry Report,2018-2022

-

Dec.2018

- Hard Copy

- USD

$2,700

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZLC071

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,100

-

- Hard Copy + Single User License

- USD

$2,900

-

Automobile ownership has been climbing steadily in China over the recent years, at a CAGR of 15.2% between 2010 and 2017, and it will continue to rise in the upcoming five years, up to estimated 313.1 million units in 2022, despite a decline in both production and sales in 2018.

As automobile ownership increases in China, more vehicles are due to be scrapped. As estimated, there were a total of 7.3 million end-of-life vehicles (ELV) in China in 2017, with a scrap rate of 4%, but a mere 30% of them were recycled. In the first eleven months of 2018, 1.469 million ELVs were recycled in China, 15.1% more than in the same period of 2017, with the full-year recycling rate expectedly ranging at 20.0%.

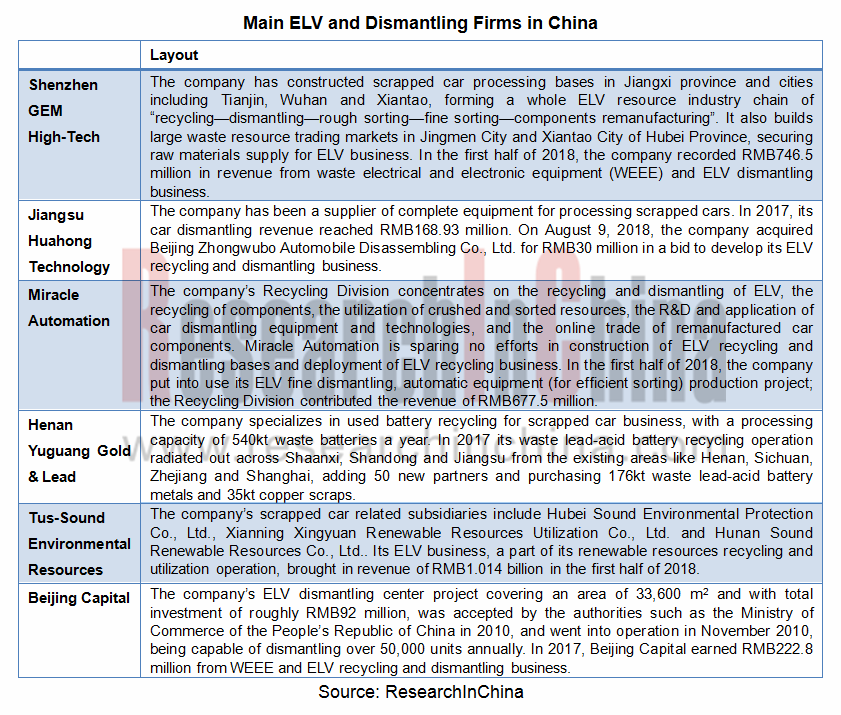

Among 650 to 700 Chinese car dismantling firms for the moment, most are small sized with low annual recycling rate of ELV and scattered resources, though their dismantling networks already take shape. As yet, big players are Shenzhen GEM High-Tech, Jiangsu Huahong Technology, Miracle Automation, Henan Yuguang Gold & Lead, Tus-Sound Environmental Resources and Beijing Capital.

Despite China boasts a huge number of ELVs, its scrap rate remains far lower than the level of 6% to 8% in the developed countries, and a mere 0.5%-1% vehicles out of automobile ownership are recycled compared with a staggering 5%-7% in developed nations. That’s largely because ELV subsidies are directly given to vehicle owners but in small amount, and professional dismantling firms buy their cars at a low price due to weak profitability, which leads to an influx of scrapped cars to the black market which offers a higher price.

The forthcoming new version of the Measures on Management of ELV Recycling, a policy allowing recycling and remanufacturing of “five automotive assemblies” (engine assembly, steering assembly, transmission assembly, front and rear axles, and frame), will promote market growth. With the subsequent issuance of related rules, the ELV and dismantling industry is hopefully to boom, with output value hitting RMB43.43 billion and recycling rate at 24.5% in 2022.

China End-of-Life Vehicle (ELV) and Dismantling Industry Report, 2018-2022 highlights the following:

Global ELV and dismantling industry (overview, development in main countries, and typical companies);

Global ELV and dismantling industry (overview, development in main countries, and typical companies);

China renewable resource industry (policy, status quo, import and export, market segments, and forecast);

China renewable resource industry (policy, status quo, import and export, market segments, and forecast);

China ELV and dismantling industry (policy, upstream sectors, overview, market size, competitive pattern, and summary and forecast);

China ELV and dismantling industry (policy, upstream sectors, overview, market size, competitive pattern, and summary and forecast);

14 Chinese ELV and dismantling firms (operation, gross margin, ELV business, and development strategy).

14 Chinese ELV and dismantling firms (operation, gross margin, ELV business, and development strategy).

1. Overview of ELV & Dismantling Industry

1.1 Definition

1.2 Industry Chain

1.3 Auto Dismantling Process

1.4 Industry Barrier

2. Global ELV& Dismantling Industry

2.1 Overview

2.2 Development in Major Countries

2.2.1 USA

2.2.2 EU

2.2.3 Japan

2.3 Typical Player -- LKQ

3. China Renewable Resource Industry

3.1 Related Policies

3.2 Status Quo

3.3 Import & Export

3.3.1 Import

3.3.2 Export

3.4 Industry Segments

3.4.1 Iron and Steel Scraps

3.4.2 Nonferrous Metal Scraps

3.4.3 Waste Plastics

3.4.4 Waste Paper

3.4.5 Waste Electrical and Electronic Products

3.4.6 End-of-Life Motor Vehicles

3.4.7 Waste Textiles

3.4.8 Scrap Tire

3.4.9 Waste Battery

3.4.10 Waste Glass

3.5 Development Forecast

3.5.1 Iron and Steel Scraps Recycling Trend

3.5.2 Nonferrous Metal Scraps Recycling Trend

3.5.3 Waste Plastics Recycling Trend

3.5.4 Waste Paper Recycling Trend

3.5.5 Waste Electrical and Electronic Products Recycling Trend

3.5.6 End-of-Life Motor Vehicles Recycling Trend

3.5.7 Waste Textiles Recycling Trend

3.5.8 Scrap Tire Recycling Trend

3.5.9 Waste Battery Recycling Trend

3.5.10 Waste Glass Recycling Trend

4. Development Status of China ELV & Dismantling Industry

4.1 Policy Environment

4.2 Downstream Industries

4.2.1 Output and Sales Volume of Automobile

4.2.2 Automobile Ownership

4.3 Development History

4.4 Industry Scale

4.5 Competitive Landscape

4.6 Summary and Forecast

5. Key Players

5.1 Shenzhen GEM High-Tech Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 ELV & Dismantling Business

5.1.6 Development Strategy

5.2 Jiangsu Huahong Technology Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 ELV & Dismantling Business

5.2.6 Development Strategy

5.3 Miracle Automation Engineering Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 ELV & Dismantling Business

5.3.6 Development Strategy

5.4 Henan Yuguang Gold & Lead Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 ELV & Dismantling Business

5.4.6 Development Strategy

5.5 Yechiu Metal Recycling (China) Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 ELV & Dismantling Business

5.5.6 Development Strategy

5.6 Tus-Sound Environmental Resources Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 ELV & Dismantling Business

5.6.6 Development Strategy

5.7 Beijing Capital Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.7.5 ELV & Dismantling Business

5.8 Others

5.8.1 Shanghai KIMKEY Environmental S&T Co., Ltd.

5.8.2 Shanghai Xinzhuang Auto Dismantling Co., Ltd.

5.8.3 Baosteel Resources Limited

5.8.4 Anhui Win-win Renewable Resources Group

5.8.5 Chongqing Auto Scrap (Group) Co., Ltd.

5.8.6 Shenzhen End-of-Life Vehicle Recycling Co., Ltd.

5.8.7 Shenyang Qiushi End-of-Life Vehicle Recycling Co., Ltd.

ELV & Dismantling Industry Chain

Auto Dismantling Process Flowchart

Average Annual Processing Capacity of Dismantling Enterprises in Major Countries

Average Annual Processing Capacity of Crushing Enterprises in Major Countries

Subsidies on Motor Vehicle Liquidation in Major Countries

Policies on Vehicle Dismantling in Major Countries

Development Course of USA Automobile Industry

Five Categories of Parts in Automobile Recycling Market in USA

Laws and Regulations on U.S. ELV & Dismantling Industry

Dismantling Industry Overview of U.S. ELV

Laws and Regulations on ELV Processing in EU and Major Countries

Number of ELVs in EU and Major Countries, 2013

Number of Auto Dismantling and Crushing Enterprises in Japan, 2010-2013

Development Course of LKQ

M&A Cases of LKQ

Revenue, Net Income and Growth of LKQ, 2007-2017

Revenue Structure of LKQ by Product, 2017

ELV Recovery Channels of LKQ

Related Policies on Recycling of Renewable Resources in China, 2010-2018

Recycling Quantity of Renewable Resources in China by Category, 2016-2017

Recycling Value of Renewable Resources in China, 2016-2017

Recycling Value Structure of Renewable Resources in China by Category, 2014-2017

Import of Major Renewable Resources in China, 2016-2017

Import Quantity Trend of Major Renewable Resources in China, 2013-2017

Export of Major Renewable Resources in China, 2016-2017

Recycling Amount of Iron and Steel Scraps in China, 2013-2017

Recycling Amount of Nonferrous Metal Scrap in China, 2013-2017

Recycling Amount of Waste Plastics in China, 2013-2017

Recycling Amount of Waste Paper in China, 2013-2017

Recycling Amount of Waste Electrical and Electronic Products in China, 2013-2017

Recycling Amount of End-of-Life Motor Vehicles in China, 2013-2017

Recycling Amount of Scrap Tire in China, 2013-2017

Recycling Amount of Waste Battery (Except Lead-acid Battery) in China, 2013-2017

Recycling Amount of Waste Glass in China, 2013-2017

Policies and Regulations on ELV & Dismantling Industry in China, 2001-2018

Output and Sales Volume of Automobile in China, 2011-2018

Output and Sales Volume of NEV in China, 2011-2018

Automobile Ownership Structure (by Category in China, 2017

Automobile Ownership in China, 2010-2017

Automobile Ownership in China by Region, 2017

Automobile Ownership Structure by Type in China, 2017

Automobile Ownership Structure by Fuel Type in China, 2017

Automobile Ownership Structure by Emission Standard in China, 2017

Development History of ELV & Dismantling Industry in China

Service Life of Main Vehicles in China

Implementation Schedule of China New Motor Vehicle Emission Standards, 1999-2020

Scrapping Quantity of ELV in China, 2007-2017

China’s Car Scrap Rate, 2007-2017

Car Recycling Market Comparison: China vs. USA, 2017

Recycling Number and Growth of ELV in China, 2011-2018

Recycling Number of ELV by Category in China, 2015-2018

Recycling Rate of ELV in China, 2011-2017

Unit Recycling Price of ELV in China, 2011-2018

China Automobile Recycling Value, 2011-2018

Related ELV& Dismantling Companies in China

Revenue Comparison of Major ELV& Dismantling Companies, 2013-2018

Net Income Comparison of Major ELV& Dismantling Companies, 2013-2018

Comparison of Subsidies on ELV in China and USA

Material Structure of Scrapped Sedan

Waste Materials Price of Scrapped Sedan in China, May 14, 2018

Single Car Dismantling Economic Calculation before Five Assemblies Remanufacturing was Allowed

Single Car Dismantling Economic Calculation after Five Assemblies Remanufacturing was Allowed

Output Value of Automobile Recycling Industry in China, 2017-2022E

Automobile Ownership in China, 2017-2022E

Scrapping Quantity of ELV in China, 2017-2022E

China’s Car Scrap Rate, 2017-2022E

Recycling Number of ELV in China, 2017-2022E

Recycling Rate of ELV in China, 2017-2022E

Revenue and Net Income of GEM, 2009-2018

Revenue Breakdown of GEM by Product, 2016-2018

Revenue Structure of GEM by Product, 2016-2018

Gross Margin of GEM, 2012-2018

Revenue from Waste Electronics and ELV& Dismantling Business of GEM, 2016-2018

Revenue and Net Income of Huahong Technology, 2009-2018

Revenue Breakdown of Huahong Technology by Business, 2014-2018

Revenue Structure of Huahong Technology by Business, 2014-2018

Gross Margin of Huahong Technology by Business, 2014-2018

Major Clients of Miracle Automation

Revenue and Net Income of Miracle Automation, 2009-2018

Revenue Breakdown of Miracle Automation by Product, 2014-2018

Revenue Structure of Miracle Automation by Product, 2014-2018

Gross Margin of Miracle Automation by Product, 2014-2018

Revenue from Circulation Segment of Miracle Automation, 2014-2018

Revenue and Net Income of Henan Yuguang Gold and Lead, 2009-2018

Revenue Breakdown of Henan Yuguang Gold and Lead by Product, 2014-2017

Revenue Structure of Henan Yuguang Gold and Lead by Product, 2014-2017

Gross Margin of Henan Yuguang Gold and Lead by Product, 2014-2017

Revenue and Net Income of Ye Chiu Metal Recycling (China) Ltd., 2009-2018

Revenue Breakdown of Ye Chiu Metal Recycling (China) Ltd. by Product, 2014-2017

Revenue Structure of Ye Chiu Metal Recycling (China) Ltd. by Product, 2014-2017

Gross Margin of Ye Chiu Metal Recycling (China) Ltd. by Product, 2014-2017

Revenue and Net Income of Tus-Sound Environmental Resources, 2009-2018

Revenue Breakdown of Tus-Sound Environmental Resources by Product, 2014-2018

Revenue Structure of Tus-Sound Environmental Resources by Product, 2014-2018

Gross Margin of Tus-Sound Environmental Resources by Product, 2014-2018

Tus-Sound Environmental Resources’ Scrapped Car Related Subsidiaries and Its Equity Ratio in Them

Tus-Sound Environmental Resources’ Revenue from Renewable Resource Recycling Business and % of Total Revenue, 2015-2018

Revenue and Net Income of Beijing Capital, 2009-2018

Revenue Breakdown of Beijing Capital by Product, 2014-2017

Revenue Structure of Beijing Capital by Product, 2014-2017

Revenue Breakdown of Beijing Capital by Region, 2014-2017

Revenue Structure of Beijing Capital by Region, 2014-2017

Gross Margin of Beijing Capital by Product, 2014-2017

Revenue, Proportion and Gross Margin of Waste Electronic Products and ELV & Dismantling of Beijing Capital, 2016-2017

Equity Structure of Shanghai Xinzhuang Auto Dismantling Co., Ltd.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...