Global and China Automotive Seating Industry Report, 2018-2023

-

Dec.2018

- Hard Copy

- USD

$3,000

-

- Pages:133

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

CYH080

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

In 2018, global automotive seating market size remained at around USD77.9 billion, of which the Chinese market was worth RMB113.2 billion (approximately USD16.45 billion by USD to RMB 1:6.8779). As automotive market is saturated, global and Chinese automotive seating markets will level out, with market size expectedly growing at a respective annual average of 3.6% and 1.9% between 2018 and 2023. Safe intelligent seating will be a major driver for the market growth.

In global market, the top10 automotive seating giants like Adient, Lear, Toyota Boshoku and Faurecia currently grab a combined share of over 90%. Among them, Adient, the biggest player, forges long-term partnerships with automakers by establishing joint ventures with them, with a large client base almost covering all OEMs; Lear has four major clients, i.e., Ford, GM, BMW and FCA for targeting North American and European markets.

In China, Adient and Lear are the two suppliers of seating systems for American and German automobiles; for Japanese auto brands, TS is the only supplier of Honda and Toyota Boshoku supplies most seating products for Toyota while Nissan has more suppliers. Most Chinese auto brands also use products of joint venture manufacturers, for example, Great Wall Motor, BYD, Chery and Geely produce some themselves but also purchase from suppliers. Co-funded auto brands have their upsides in price and performance, boasting scale effects and complete supply chain; homegrown automakers set up their own seating divisions just for a say in market and a more flexible supply chain.

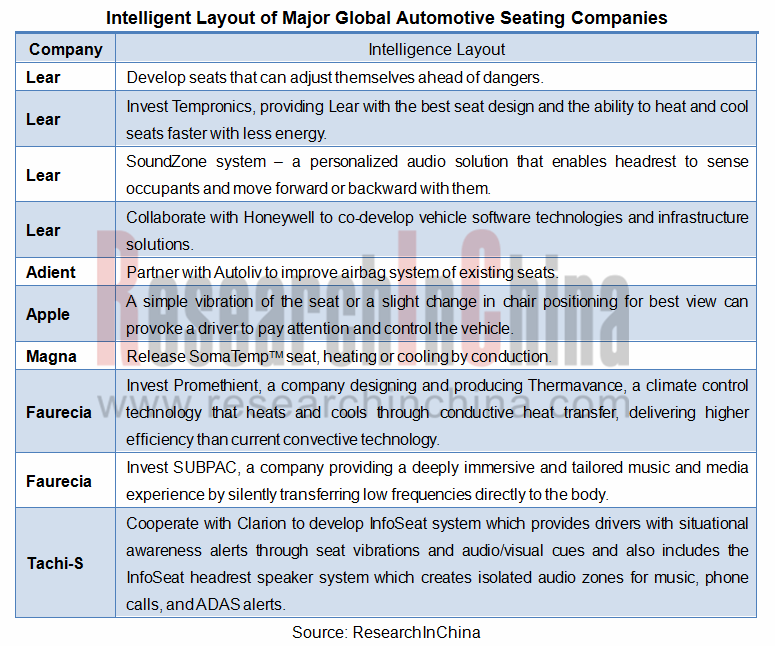

Automotive seats trend to be safe, intelligent, personalized, lightweight, green and comfortable in the era of “intelligent, electrified, connected and shared” vehicles. Many a seating manufacturer like Lear, Adient and Faurecia already makes layout of intelligent seating which will be deeply integrated into connected vehicles, providing passengers with intelligent, safe and comfortable driving experience.

In addition to technological upgrades, seating companies’ complete seating solutions will be the megatrend of the industry, leading to frequent M&As among seating vendors.

Global and China Automotive Seating Industry Report, 2018-2023 highlights the following:

Automotive seating (overview, composition, functions, classification, industry chain, etc.);

Automotive seating (overview, composition, functions, classification, industry chain, etc.);

Global automotive seating industry (market size, competitive pattern, supply pattern of major automakers, development trends, etc.);

Global automotive seating industry (market size, competitive pattern, supply pattern of major automakers, development trends, etc.);

China automotive seating industry (market size, competitive pattern, supply pattern of major automakers, development trends, etc.);

China automotive seating industry (market size, competitive pattern, supply pattern of major automakers, development trends, etc.);

Major global and Chinese automotive seating companies (operation, seating business, development tendencies, etc.).

Major global and Chinese automotive seating companies (operation, seating business, development tendencies, etc.).

1 Brief Introduction to Automotive Seating

1.1 Structure

1.2 Classification

1.3 Industry Chain

2 Global Automotive Seating Market

2.1 Market Size

2.2 Top10 Automotive Seating Companies

2.3 Regional Structure

2.4 Automotive Seating Suppliers for OEMs

2.5 Development Trend

3 China Automotive Seating Market

3.1 Market Size

3.2 Competitive Landscape

3.3 Automotive Seating Suppliers for OEMs

4. Global and China Automotive Market

4.1 Global

4.1.1 Output

4.1.2 Sales

4.2 China

4.2.1 Market Size

4.2.2 Structure

5. Automotive Seating Companies

5.1 Adient

5.1.1 Profile

5.1.2 Operation

5.1.3 Seating Business

5.1.4 Development in China

5.1.5 Yanfeng Adient

5.1.6 Changchun Faway Adient Automotive System Co., Ltd. (CFAA)

5.2 Lear

5.2.1 Profile

5.2.2 Operation

5.2.3 Seating Business

5.2.4 Development in China

5.2.5 Development Trend

5.3 TOYOTA BOSHKOU

5.3.1 Profile

5.3.2 Operation

5.3.3 Development in China

5.3.4 Tianjin Intex Auto Parts Co., Ltd.

5.3.5 Development Planning

5.4 Faurecia

5.4.1 Profile

5.4.2 Operation

5.4.3 Seating Business

5.4.4 Development in China

5.5 TS Tech

5.5.1 Profile

5.5.2 Operation

5.5.3 Development in China

5.5.4 Guangzhou TS Automotive Interior Systems Co., Ltd.

5.5.5 Wuhan TS-GSK Auto Parts Co., Ltd.

5.5.6 Development Planning

5.6 TACHI-S

5.6.1 Profile

5.6.2 Operation

5.6.3 Development in China

5.7 Magna

5.7.1 Profile

5.7.2 Operation

5.7.3 Seating Business

5.7.4 Development in China

5.8 Brose

5.8.1 Profile

5.8.2 Operation

5.8.3 Seating Business

5.8.4 Development in China

5.9 NHK Spring

5.9.1 Profile

5.9.2 Operation

5.9.3 Seating Business

5.9.4 Development in China

5.10 SITECH

5.11 Wuhan Xinyunhe Automotive Seating Co., Ltd.

5.12 GSK

5.13 DAS

5.13.1 Profile

5.13.2 Operation

5.13.3 Development in China

5.14 DAEWON

5.14.1 Profile

5.14.2 Operation

5.14.3 Seating Business

5.14.4 Development in China

5.15 DYMOS

5.15.1 Profile

5.15.2 Operation

5.15.3 Seating Business

5.15.4 Development in China

5.15.5 Beijing Lear Dymos Automotive Systems Co., Ltd.

Composition of Automotive Seating

Cushion Frame

Back Frame

Head Restraint

Lever Control

Slide

Covering ASSY

Pad Foam ASSY

Recliner ASSY

Lumbar Support ASSY

Automotive Seat Regulating System and Motors Utilized

Classification of Automotive Seating

Major Players in Automotive Seating Industry Chain

Automotive Seating Industry Chain

Global Automotive Seating Market Size, 2013-2023E

Ranking of Global Top 10 Automotive Seating Manufacturers by Revenue 2014-2018

Market Share of Major Seating Manufacturers for Passenger Car in North America, 2017

Market Share of Major Seating Manufacturers for Passenger Car in Europe, 2017

Market Share of Major Seating Manufacturers for Passenger Car in Japan, 2018

Share of Automotive Seating Suppliers for TOYOTA, 2018

Share of Automotive Seating Suppliers for HONDA, 2018

Share of Automotive Seating Suppliers for NISSAN, 2018

Share of Automotive Seating Suppliers for VW, 2018

Share of Automotive Seating Suppliers for BMW, 2018

Share of Automotive Seating Suppliers for BENZ, 2018

Share of Automotive Seating Suppliers for GM, 2018

Share of Automotive Seating Suppliers for FORD, 2018

Share of Automotive Seating Suppliers for HYUNDAI, 2018

Development Direction of Automotive Seating

Intelligent Layout of Global Major Seating Companies

Intelligent Seating Layout of Lear

China Automotive Seating Market Size, 2015-2023E

Market Share of Major Manufacturers in Chinese Passenger Car Seating Market, 2018

Share of Automotive Seating Suppliers for SAIC, 2018

Share of Automotive Seating Suppliers for FAW, 2018

Share of Automotive Seating Suppliers for CHANGAN, 2018

Share of Automotive Seating Suppliers for Dongfeng, 2018

Share of Automotive Seating Suppliers for BAIC, 2018

Global Automobile Output, 2013-2023E

Global Automobile Output Structure, 2010-2017

Global Automobile Output by Region, 2012-2017

Top 20 Countries by Automotive Output, 2017

Global Automobile Sales Volume, 2013-2023E

Global Automobile Sales Volume by Region, 2012-2017

Top 10 Countries by Automobile Sales, 2012-2017

China Automobile Sales Volume, 2013-2023E

China Passenger Car Sales Volume, 2010-2018

China Commercial Vehicle Sales Volume, 2010-2018

Sales Volume Structure of SUVs in China (by Price), 2016-2017

Sales Volume Structure of Sedans in China (by Price), 2016-2017

Top10 Passenger Car Makers by Sales Volume, 2017

Sales Volume of Top10 Passenger Car Brands by Model in China, 2017

Sales Volume of Top10 Passenger Car Brands by Model in China, 2018(Jan.-Oct.)

Sales Structure of Passenger Car (by Country) in China, 2017

Global Footprint of Adient

Global Presence of ADIENT Production Bases, FY2018

Operation of Adient, FY2017-FY2018

Revenue Structure of Adient by Region/Customer, FY2017

Revenue Structure of Adient by Region, FY2017

Market Share of Adient

Seating Business Orders of Adient, FY2018-FY2020

Market Share of Adient Seating Business among Each OEM Group

Market Share of Adient Seating by Automotive Brand, FY2017& FY2021

Adient's Purchase of Futuris in 2017

Footprint of Adient in China, 2018

Operation of Adient in China, 2013-2017

Adient Seating China

Adient Joint Venture Structure

Adient China’s Current Seating Market Share

Company Overview of Yanfeng Automotive Interiors

Distribution of Production Bases and Subsidiaries of Yanfeng Adient

Operation of Yanfeng Adient, 2017

Major Clients of Yanfeng Adient

Major Subsidiaries of Adient

Global Footprints of Lear, 2018

Net Sales and Gross Margin of Lear, 2012-2018

Key Financials of Lear, 2018Q3

Net Sales of Lear by Customer, 2017

Net Sales of Lear by Business, 2014-2017

Operation of Lear by Segment, 2018Q3

Revenue of Lear by Business, 2012-2022E

Sales Backlog of Lear, 2018-2020E

Seating Component Capabilities of Lear, 2018

Key Seating Launches of Lear, 2018-2019

Automotive Seating Operations of Lear Worldwide, 2018

Revenue Structure of Lear Seating Business by Region, 2017

Revenue Structure of Lear Seating Business by Product, 2017

Revenue Structure of Lear Seating Business by Customer, 2017

Market Share of Lear Seating Business by Region, 2018

Seating Business Quarter Sales and Margin Drivers, 201Q3

Global Engineering Development of Lear Seating Business

Development Trend of Lear Seating Products

Sales and Operating Margins of Lear, 2023E

Net Sales and Operating Margin of TOYOTA BOSHKOU, FY2010-FY2019

Net Sales of TOYOTA BOSHKOU by Region, FY2010-FY2019

Shipment of TOYOTA BOSHKOU by Region, FY2011-FY2019

Shipment of TOYOTA BOSHKOU Seat Assembly by Region, FY2019H1

Operating Profit of TOYOTA BOSHKOU by Region, FY2011-FY2019

Seat Shipment of TOYOTA BOSHKOU, FY2011-FY2019

Subsidiaries of TOYOTA BOSHKOU in China

Development Layout of TOYOTA BOSHKOU in China, 2020E

New Technologies and New Products of TOYOTA BOSHKOU, 2030E

Integration of Seating Industry Chain of TOYOTA BOSHKOU, 2020E

Seating Business Capacity Expansion Plan of TOYOTA BOSHKOU, 2019-2022E

Revenue and Operating Margin of Faurecia, 2008-2017

Revenue of Faurecia by Business, 2015-2018

Revenue Structure of Faurecia by Business, 2017

Revenue Breakdown of Faurecia by Country/Region, 2015-2017

Revenue Structure of Faurecia by Customer, 2017

Revenue Structure of Faurecia by Customer, 2015-2017

Seating Supporting of Faurecia, 2018-2021E

Sales Offices Newly Established by TS Tech in 2018

Net Sales and Operating Margin of TS Tech, FY2009-FY2019

Revenue Breakdown of TS Tech by Business, FY2016-FY2018

Revenue Breakdown of TS Tech by Region, FY2010-FY2019

Operating Profit of TS Tech by Region, FY2010-FY2019

Automotive Seating Sales Volume of TS Tech, FY2017-FY2018

Motorcycle Seat Production of TS Tech, FY2017-FY2018

Key Models Supported by TS Tech Seat, 2018-2019

Development of TS Tech in China, FY2019H1

Sales of TS Tech in China, FY2017-FY2019Q2

Development Planning of TS Tech

Seating Development Orientation of TS Tech

Global Footprint of TACHI-S

R&D Centers of TACHI-S Worldwide, 2020

Net Sales and Operating Margin of TACHI-S, FY2009-FY2019

Net Sales of TACHI-S by Country/Region, FY2016-FY2019

Operating Profit of TACHI-S by Country/Region, FY2016-FY2019

Revenue of TACHI-S by Customer, FY2016-FY2019

Seat Sales Volume of TACHI-S, FY2014-FY2018

Vehicle Models Supported by Seats of TACHI-S, 2018

TACHI-S Strengthens Competitiveness of Components/Monozukuri (Frame), 2020

TACHI-S Strengthens Competitiveness of Components/Monozukuri (Sewing), 2020

TACHI-S as a Provider of Seats for Geely EV450

Honda Motor N-VAN

Vehicle Models Supports by Seats of TACHI-S, 2018-2019

Presence of TACHI-S’ Subsidiaries in China, 2018

Presence of TACHI-S in China, 2020

Global Footprint of Magna

Sales and Operating Margin of Magna, 2015-2018E

Sales of Magna by Region, 2016-2017

Sales of Magna by Customer, 2015-2017

Seating Systems of Magna

Magna Development of Seating Systems, 2017-2020E

Seating Business (by Vehicle Model) Market Share of Magna, 2017

Seating Development History of Magna

New Clients for Magna’s Seating Business

Continued Vertical Integration of Magna Seating Segment

Revenue and Investment of Brose, 2009-2018E

Revenue of Brose by Business, 2014-2017

Major Customers of Brose

Seat Supply of Brose, 2018

Presence of Brose’s Subsidiaries in China

Business Distribution of NHK Spring

Net Sales and Operating Margin of NHK Spring, FY2009-FY2019

Sales of NHK Spring by Business, FY2009-FY2019

Operating Profit of NHK Spring by Business, FY2009-FY2019

Sales of NHK Spring by Region, FY2009-FY2019

Sales Structure of NHK Spring by Customer, FY2016-FY2018

Automotive Seating Sales of NHK Spring, FY2015-FY2019

Seating Investment Projects of NHK Spring, 2018

Subsidiaries of NHK Spring in China

Major Customers of GSK

Major Clients of DAS

Revenue of DAS, 2013-2016

Vehicle Models Supported by Seating-related Products of DAS, 2018

Profile of DAEWON

Operations of DAEWON

Key Auto Parts of DAEWON

DAEWON’s Components for High-speed Trains

Major Clients of DAEWON

Presence of DAEWON in China

Global Network of DYMOS

DYMOS Fact Figure

Profile of DYMOS

Revenue of DYMOS, 2013-2017

Net Income of DYMOS, 2013-2017

Seat Sales of DYMOS, 2012-2020

Seating Operations of DYMOS Worldwide

Major Customers of DYMOS

Presence of DYMOS in China

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...