China Automotive Finance Industry Report, 2018-2023

-

Jan.2019

- Hard Copy

- USD

$3,000

-

- Pages:163

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

ZLC072

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

Auto finance sees a rising penetration rate in China over the recent years, to about 40% in 2017, a gap with 70% in the developed countries, but China is chasing faster. It is anticipated in the upcoming several years that the auto finance penetration in China will be climbing progressively and will rise to 58% in 2023 under the impetus of favorable policies and a change in consumer spending habits.

The Chinese auto finance market is booming with the participation of professional car rental companies, automakers, dealerships, banks and so forth, with the estimated market size posting RMB1.2 trillion with a year-on-year increase of 2.6% in 2018, and projected to grow at a rapid rate in the next five years and to reach RMB1.6 trillion in 2023.

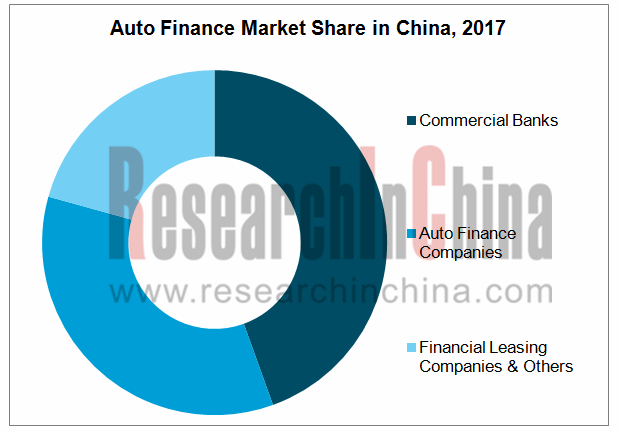

In Chinese auto finance market, there co-exist auto finance companies, commercial banks, auto financial leasing companies, internet auto finance firms, etc., among which commercial banks takes a lion’s share of the market but get increasingly squeezed, while auto finance companies seize a growing market share and held 34.8% in 2017.

The dealership-grown auto finance companies and internet platforms will enjoy more and more market shares in the wake of the marketing channels closer to consumer demand, the friendlier product design, the loosening of financing channels and the perfection of personal credit system, to break the monopoly of commercial banks.

Used Car Finance: The used car trade has grown steadily in China with the enforcement of policies like the Several Opinions on Facilitating Easy Trade of Used Cars over the past two years. From January to September of 2018, a total of 10.14 million used cars were traded in China, an upsurge of 12.9% year on year and being far higher than the growth rate of new car sales. The huge used car market provides opportunities for used car finance.

Used car finance had a penetration rate of just 8% in China in 2016, and it rose to 10% in 2017 under the drive of the increasingly perfect used car evaluation system, the changing consumer attitudes as well as the policies such as the Guidance for Strengthening Financial Support for New Consumer Fields. As estimated, the penetration of used car finance will be 13% in 2018 and up to 25% in 2023.

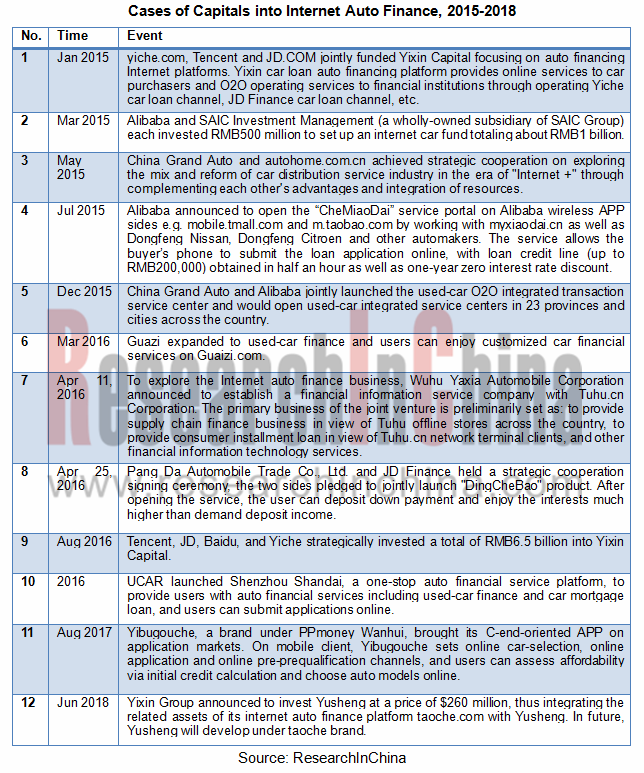

Automobile internet finance: Being incentivized by policies like the Guidance for Facilitating the Healthy Development of Internet Finance, the traditional automakers and dealerships have begun to optimize the original auto finance procedures and experience, whilst internet giants like Baidu, Alibaba, Tencent and JD (BATJ) as well as internet finance portals are aggressively attempting at auto internet finance. In future, the conventional auto finance services will be changed to be offered online stead of offline, and the automobile internet finance grows a trend.

China Automotive Finance Industry Report, 2018-2023 highlights the following:

Global automotive finance industry (overview, development environment, status quo, auto finance development in countries, competitive landscape, etc.);

Global automotive finance industry (overview, development environment, status quo, auto finance development in countries, competitive landscape, etc.);

China automotive finance industry (overview, development environment, development course, status quo, market size, competitive pattern, auto finance companies’ operation, development tendencies, etc.);

China automotive finance industry (overview, development environment, development course, status quo, market size, competitive pattern, auto finance companies’ operation, development tendencies, etc.);

Auto finance market segments in China (automobile financial leasing, used car finance, automobile internet finance);

Auto finance market segments in China (automobile financial leasing, used car finance, automobile internet finance);

14 OEM-related auto finance companies, 5 dealership-grown auto finance companies, and 10 other auto finance related firms.

14 OEM-related auto finance companies, 5 dealership-grown auto finance companies, and 10 other auto finance related firms.

1. Overview

1.1 Definition

1.2 Classification

1.3 Market Players

2. Global Automotive Finance Industry

2.1 Development Environment

2.2 Status Quo

2.3 Overview of Auto Finance in Major Countries

2.3.1 United States

2.3.2 Germany

2.3.3 Japan

2.4 Competitive Landscape

2.5 Global Expansion

3. Automotive Finance Industry in China

3.1 Development Environment

3.1.1 Policy

3.1.2 Economy

3.1.3 Automobile Production and Sales

3.1.4 Car Ownership

3.2 Development Course

3.3 Status Quo

3.4 Market Size

3.5 Competitive Landscape

3.6 Operation of Auto Finance Companies

3.7 Development Trends

3.7.1 Market Share of Auto Finance Companies Grows Further

3.7.2 Used Car Financial Business Grows Rapidly

3.7.3 Cyberization of Used Car Trade

3.7.4 Auto Financial Products Becomes More Diversified

3.7.5 Improved Credit System Pushes the Development of Auto Finance Market

3.7.6 Internet Auto Finance Has Developed into a Trend

3.7.7 Cooperation between Banks and Enterprises Drives Auto Finance

3.7.8 Competition in Auto Finance Industry Intensifies

4. Chinese Auto Finance Market Segments

4.1 Auto Financial Leasing

4.1.1 Profile

4.1.2 Development Course

4.1.3 Business Model

4.1.4 Status Quo

4.1.5 Policy Support

4.1.6 Competitive Landscape

4.1.7 Problems

4.2 Used Car Finance

4.2.1 Profile

4.2.2 Market Size

4.2.3 Price Trend

4.2.4 Market Structure

4.2.5 Huge Potential

4.2.6 Status Quo

4.2.7 Competitive Landscape

4.3 Internet Auto Finance

4.3.1 Profile

4.3.2 Policies

4.3.3 Status Quo

5. OEM-related Auto Finance Companies

5.1 SAIC-GMAC Automotive Finance Co., Ltd. (SAIC-GMAC)

5.1.1 Profile

5.1.2 Operation

5.1.3 New Car Finance Business

5.1.4 Used Car Finance Business

5.1.5 Developments

5.2 Volkswagen Finance (China)

5.2.1 Profile

5.2.2 Operation

5.2.3 New Car Finance Business

5.2.4 Used Car Finance Business

5.2.5 Developments

5.3 Chery Huiyin Motor Finance Service Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Auto Finance Business

5.3.5 Sales Network

5.3.6 Developments

5.4 BYD Auto Finance Company Limited

5.4.1 Profile

5.4.2 Operation

5.4.3 Auto Finance Business

5.4.4 Developments

5.5 Ford Automotive Finance (China) Limited

5.5.1 Profile

5.5.2 Operation

5.5.3 Auto Finance Business

5.5.4 Sales Network

5.5.5 Developments

5.6 Dongfeng Nissan Auto Finance Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 New Car Finance Business

5.6.4 Used Car Finance Business

5.6.5 Developments

5.7 Herald International Financial Leasing

5.7.1 Profile

5.7.2 Auto Finance Business

5.7.3 Developments

5.8 Toyota Motor Finance (China) Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Auto Finance Business

5.9 BMW Automotive Finance (China) Co., Ltd.

5.9.1 Profile

5.9.2 Operation

5.9.3 Auto Finance Business

5.9.4 Developments

5.10 Yulon Motor Finance (China) Co., Ltd.

5.10.1 Profile

5.10.2 Auto Finance Business

5.10.3 Developments

5.11 Changan Auto Finance Co., Ltd.

5.11.1 Profile

5.11.2 Auto Finance Business

5.11.3 Developments

5.12 GAC-SOFINCO Automobile Finance Co., Ltd.

5.12.1 Profile

5.12.2 Operation

5.12.3 Auto Finance Business

5.13 Genius Auto Finance Co., Ltd

5.13.1 Profile

5.13.2 Developments

5.14 Beijing Hyundai Auto Finance Co., Ltd.

5.14.1 Profile

5.14.2 Operation

5.14.3 Auto Finance Business

5.14.4 Developments

6. Auto Finance-related Dealers

6.1 Yongda Automobiles

6.1.1 Profile

6.1.2 Operation

6.1.3 Auto Finance Business

6.1.4 Shanghai Yongda Finance Leasing Co., Ltd.

6.1.5 Yongda Financial Group Holdings Limited

6.1.6 Developments

6.2 China Grand Automotive Services Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 All Trust Leasing Co., Ltd.

6.2.6 Auto Finance Business

6.2.7 Developments

6.3 Pang Da Automobile Trade

6.3.1 Profile

6.3.2 Operation

6.3.3 Pang Da ORIX Auto Leasing

6.3.4 Pang Da Leye Leasing Co., Ltd.

6.3.5 Developments

6.4 Yaxia Automobile

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Auto Finance Business

6.4.5 Developments

6.5 Shanghai Dongzheng Automotive Finance Co., Ltd

6.5.1 Profile

6.5.2 Operation

6.5.3 Layout

7. Other Auto Finance Companies

7.1 Cango Inc.

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Auto Finance Business

7.1.5 Developments

7.2 Great China Finance Leasing Co., Ltd.

7.2.1 Profile

7.2.2 Auto Finance Business

7.2.3 Developments

7.3 Zhejiang Jingu Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Auto Finance Business

7.4 Yixin Group

7.4.1 Profile

7.4.2 Operation

7.4.3 Auto Finance Business

7.4.4 Developments

7.5 eCapital

7.5.1 Profile

7.5.2 Auto Finance Business

7.5.3 Developments

7.6 Ucar Inc.

7.6.1 Profile

7.6.2 Operation

7.6.3 Auto Finance Business

7.7 Dafang Car Rental

7.7.1 Profile

7.7.2 Auto Finance Business

7.8 Jiayin Financial Leasing

7.8.1 Profile

7.8.2 Auto Finance Business

7.9 Souche

7.9.1 Profile

7.9.2 Financing

7.9.3 Auto Finance Business

7.10 Weidai Ltd.

7.10.1 Profile

7.10.2 Operation

7.10.3 Auto Finance Business

Advantages and Disadvantages of Major Auto Finance Practitioners in China

Global Automobile Output, 2010-2017

Global Top 20 Countries by Automobile Output, 2017

Global Automobile Sales, 2010-2017

Profit Structure of Mature Automotive Industry Chain

Global Automobile Purchase Structure by Mode

Global Auto Finance Penetration by Country, 2018

Features of Auto Finance Service in the US

Features of Auto Finance Service in Germany

Features of Auto Finance Service in Japan

Structure of Overseas Auto Finance Market by Capital Source, 2018

Global Layout of General Motors Financial Company, Inc.

Operating Results of General Motors Financial Company, Inc., 2015-2017

China’s Policies on Auto Finance Industry, 2004-2018

China’s GDP, 2012-2018

China’s Automobile Output and YoY Growth, 2011-2018

China’s Automobile Sales and YoY Growth, 2011-2018

Output and Sales Volume of China NEV, 2011-2018

China Motor Vehicle Ownership Structure by Type, 2017

China’s Automobile Ownership, 2010-2017

China’s Automobile Ownership by Region, 2017

China Automobile Ownership Structure by Type, 2017

Developmental Stages of Auto Finance in China

Penetration of Auto Finance in China, 2015-2023E

Auto Finance Market Size in China, 2014-2023E

The Auto Finance Related Enterprises Invested by BATJ

Advantages and Disadvantages of the Competitors in Auto Finance Market

Competition Pattern of Auto Finance Market in China, 2017

Major Auto Finance Companies in China, 2018

Operating Results of Major Auto Finance Companies in China, 2017

Total Assets of Auto Finance Companies in China, 2013-2017

Loans of Auto Finance Companies in China (by Type), 2013-2017

Main Business Structure of Auto Finance Companies in China, 2013-2017

Number of Automobiles (by Type) that Received Loans from Auto Finance Companies in China, 2013-2017

Asset Backed Securities (ABS) of Chinese Auto Finance Companies, 2017

Market Shares of Auto Finance Companies in China, 2016-2023E

Channels for Chinese to Buy and Sell Used Cars, 2018

Key Factors for Chinese Netizens to Buy and Sell Used Cars Online, 2018

Key Features of Used Car Netizens in China, 2018

Cases of Chinese Internet Firms that Make Layout in Internet Auto Finance

Cases of Banks and Enterprises that Work Together to Make Layout in Auto Finance

Financial Leasing Procedures

Main Features of Auto Financial Leasing

Comparison between Financial Leasing and Financial Loans

Development Stage of Auto Financial Leasing in China

Auto Financial Leasing -- Direct Leasing Model

Auto Financial Leasing -- Sale-leaseback Model

Comparison of Business Models of Auto Financial Leasing

Penetration of Auto Financial Leasing in Major Countries

Penetration of Auto Financial Leasing in China, 2016-2023E

Policies on Auto Financial Leasing in China, 2008-2017

Major Participants in China’s Auto Financial Leasing Market

Cases of Automakers in Financial Leasing

Main Advantages of TANGECHE

Trade Volume of Used Cars and YoY Growth in China, 2011-2018

Comparison between Growth Rates of New Car Trade and Used Car Trade in China, 2017

Top 10 Regions by Used Car Trade Volume in China, 2017

Average Price Trend of Used Car in China, 2010-2018

Trade Volume Structure of Used Cars in China by Price Range, 2017-2018

Trade Volume Structure of Used Cars in China by Type, 2014-2018

Trade Volume Structure of Used Cars in China by Service Life, 2010-2018

Ratio of Trade Volume of Used Cars to That of New Vehicles in Major Countries

Ratio of Trade Volume of Used Cars to That of New Vehicles in China, 2012-2018

Penetration of Used Car Finance in China, 2016-2023E

Advantages and Disadvantages of Used Car Finance Participants

Businesses of Major Suppliers of Used Car Financial Services

Procedures of Internet Auto Finance and Traditional Auto Mortgage Loan

Local Authorities’ Policy Support for Internet Finance

Cases of Capitals into Internet Auto Finance, 2015-2018

Equity Structure of SAIC-GMAC

Net Interest Income and Net Income of SAIC-GMAC, 2013-2017

Main Business Types of SAIC-GMAC

Car Loan Process of SAIC-GMAC

Development History of chengxin.saic-gm.com

Used Car Loan Service Flow of SAIC-GMAC

Net Interest Income and Net Income of Volkswagen Finance (China), 2013-2017

Main Types of New Car Loans of Volkswagen Finance (China)

Development Course of Chery Huiyin Motor Finance Service

Revenue and Net Income of Chery Huiyin Motor Finance Service, 2014-2017

Revenue Breakdown of Chery Huiyin Motor Finance Service by Business, 2014-2016

Number and Total Amount of Retail Car Loans of Chery Huiyin Motor Finance Service, 2014-2016

Number of Retail Car Loans of Chery Huiyin Motor Finance Service by Type, 2014-2016

Amount of Retail Car Loans of Chery Huiyin Motor Finance Service by Type, 2014-2016

Number of Retail Car Loans of Chery Huiyin Motor Finance Service by Region, 2014-2016

Amount of Retail Car Loans of Chery Huiyin Motor Finance Service by Region, 2014-2016

Main Auto Finance Products of Chery Huiyin Motor Finance Service

Number of Retail Car Loans of Chery Huiyin Motor Finance Service by Product, 2014-2016

Number of Partners of Chery Huiyin Motor Finance Service at Retail Car Loan Closing, 2014-2016

Number of Partners of Chery Huiyin Motor Finance Service at Retail Car Loan Closing by Region, 2014-2016

Number of Partners of Chery Huiyin Motor Finance Service at Retail Car Loan Closing by Type, 2014-2016

Equity Structure of BYD Auto Finance

Operating Results of BYD Auto Finance, 2015

Main Auto Finance Products of BYD Auto Finance

Business Flow of BYD Auto Finance

Equity Structure of Ford Automotive Finance (China)

Net Interest Income and Net Income of Ford Automotive Finance (China), 2014-2017

Main Auto Finance Products of Ford Automotive Finance (China)

Loan Process of Ford Automotive Finance (China)

Number of Dealers of Ford Automotive Finance (China), 2014-2017

Number of Cities with Retail Loan Business of Ford Automotive Finance (China), 2014-2017

Equity Structure of Dongfeng Nissan Auto Finance

Net Interest Income and Net Income of Dongfeng Nissan Auto Finance, 2015-2018

New Car Loan Products of Dongfeng Nissan Auto Finance

Featured Auto Finance Products of Dongfeng Nissan Auto Finance

Car Loan Process of Dongfeng Nissan Auto Finance

Used Car Loan Products of Dongfeng Nissan Auto Finance

Brands Supported by Herald International Financial Leasing

Main Auto Finance Products of Herald International Financial Leasing

Net Interest Income and Net Income of Toyota Motor Finance (China), 2013-2017

Auto Finance Products of Toyota Motor Finance (China)

Loan Process of Toyota Motor Finance (China)

Equity Structure of BMW Automotive Finance (China)

Net Interest Income and Net Income of BMW Automotive Finance (China), 2013-2017

Main Car Loan Products of BMW Automotive Finance (China)

Main Operations of Yulon Motor Finance (China)

Equity Structure of Changan Auto Finance

Personal Car Consumer Loan Products of Changan Auto Finance

Loan Application Procedures of Changan Auto Finance

Net Interest Income and Net Income of GAC-SOFINCO Automobile Finance, 2015-2017

Auto Finance Products of GAC-SOFINCO Automobile Finance

Approval Process of GAC-SOFINCO Automobile Finance

“360 Plan” of GAC-SOFINCO Automobile Finance -- After-sales Funds Quota

“360 Plan” of GAC-SOFINCO Automobile Finance -- VIP Roadside Assistance Services

Quanxiangdai Product Portfolios of GAC-SOFINCO Automobile Finance

Equity Structure of Genius Auto Finance

Financing Means of Beijing Hyundai Auto Finance, 2012-2017

Net Interest Income and Net Income of Beijing Hyundai Auto Finance, 2015-2017

Key Retail Finance Business of Beijing Hyundai Auto Finance

Loan Issuance of Beijing Hyundai Auto Finance, 2013-2017

Loan Amount of Beijing Hyundai Auto Finance, 2013-2017

Revenue and Net Income of Yongda Automobiles, 2013-2018

Financial Businesses of Yongda Automobiles

Financial Leasing Revenue of Yongda Automobiles, 2013-2018

Six Advantages of Financial Leasing of Yongda Automobiles

Revenue and Net Income of China Grand Auto, 2014-2018

Revenue Breakdown of China Grand Auto by Business, 2015-2017

Gross Margin of China Grand Auto by Business, 2015-2017

Development Course of All Trust Leasing

Financial Data of All Trust Leasing, 2015-2018

Major Financial Leasing Schemes of All Trust Leasing

Financial Leasing Procedures of All Trust Leasing

Equity Structure of Shaanxi Changyin Consumer Finance

Planned Fundraising Projects of China Grand Auto by Non-public Offering of Shares, 2016

Revenue and Net Income of Pang Da Automobile Trade, 2013-2018

Operating Leasing and Financial Leasing of Pang Da ORIX Auto Leasing

Auto Financial Leasing Procedures of Pang Da ORIX Auto Leasing

Financial Data of Pang Da Leye Leasing, 2014-2018

Revenue and Net Income of Yaxia Automobile, 2013-2018

Revenue Breakdown of Yaxia Automobile by Business, 2013-2018

Revenue Structure of Yaxia Automobile by Business, 2013-2018

Auto Finance Revenue and YoY Growth of Yaxia Automobile, 2013-2018

Revenue of Dongzheng Auto Finance, 2015-2018

Number of Loans Issued by Dongzheng Auto Finance (by Type), 2015-2018

Value of Loans Issued by Dongzheng Auto Finance (by Type), 2015-2018

Layout of Dongzheng Auto Finance in China

Development Course of CANGO

Business Network of CANGO in China

Revenue and Net Income of CANGO, 2016-2018

Revenue of CANGO by Business, 2016-2017

Service Range of CANGO

Service Objects and Contents of CANGO

Presence of Great China Finance Leasing in China

Major Partners of Great China Finance Leasing

Development Course of Great China Finance Leasing

Features of Great China Finance Leasing

Online Car Purchase Application Procedures of Great China Finance Leasing

Revenue and Net Income of Zhejiang Jingu, 2013-2018

Development Course of Yixin Capital

Revenue and Net Income of Yixin Group, 2016-2018

Revenue of Yixin Group by Business, 2016-2018

Financing Transactions of Yixin Group, 2016-2018

Major Partners of eCapital

Development Course of eCapital

Financial Leasing Schemes of eCapital

Tesla-dedicated Financial Leasing Products of eCapital

Revenue and Net Income of Ucar Inc., 2015-2018

Partners of Ucar's Carbank.cn

Dafang Car Rental’s Platform (usedcar.dafang24.com) -- Six Advantages

Dafang Car Rental’s Platform (usedcar.dafang24.com) -- Procedures

Equity Structure of Jiayin Financial Leasing

New Car Financing Schemes of Jiayin Financial Leasing

Used Car Financing Schemes of Jiayin Financial Leasing

Main Features of Tangeche

Total Expense Structure of Tangeche

Main Advantages of Tangeche

Development Course of Weidai

Operating Results of Weidai, 2018

Major Auto Finance Products of Weidai

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...