Global Autonomous Driving Simulation and Virtual Test Industry Chain Report, 2018-2019

It is in this report that the autonomous driving simulation industry is analytically expounded, ranging from simulation platform, vehicle dynamics simulation, sensor simulation, scenario simulation to scenario library.

Simulation technologies seem afar to people’s lives and are hard to understand for them, but it is a key domain in which breakthroughs are to be made for automotive sector, even intelligent manufacturing in China and it deserves heavy investments.

Simulation technology is the simulation model technology that reveals the system behaviors and process by way of simulation experiments and numerical computing with simulation hardware and software. Simulation technology found initial application in the early 20th century, taking example for the building of water conservancy model in laboratories for research of hydraulics. In 1940s-1950s, the burgeoning aviation & aerospace and atomic energy technologies conduced to advances in simulation technology. In 1960s, the computer technology flourished and the advanced simulation tools became available, which expedited evolution of simulation technology.

From 1990s on, simulation and digital virtualization technologies has been an integral crucial to the R&D of automobiles. The advanced idea to develop cars based on mathematical model and digital simulation has prevailed among the automakers worldwide.

The vehicle R&D becomes ever sophisticated as cars are going smarter and smarter, causing higher costs of vehicle development and a prolonged development cycle. Lots of new technologies about vehicle security are subject to external environment and test security restraints and are hard to be carried out effectively. Yet, the traditional means for R&D, tests and validation are out of date.

For adequate security validation, autonomous driving requires a great deal of scalable simulation testing service (billions of km and even to tens of billions of km). Actually, the real road test is featured with low efficiency, and many automakers favor selecting autonomous driving simulation tests.

It is pointed out by a guest speaker on an automobile forum that, 90 percent of autonomous driving tests will be done by simulation, 9 percent done in test fields, and 1 percent on real roads.

The so-called autonomous driving simulation tests are to test autonomous cars with technologies such as sensor simulation, vehicle dynamics simulation, advanced graphics processing, traffic flow simulation, numerical simulation and road modeling, and with algorithms to build the comparatively real driving scenarios.

Such processes must be undergone to develop an autonomous driving system, as software simulation, hardware in the loop (HiL), vehicle in the loop (VIL), indoors lab tests, outdoor test field, and to ultimately the massive tests on public roads.

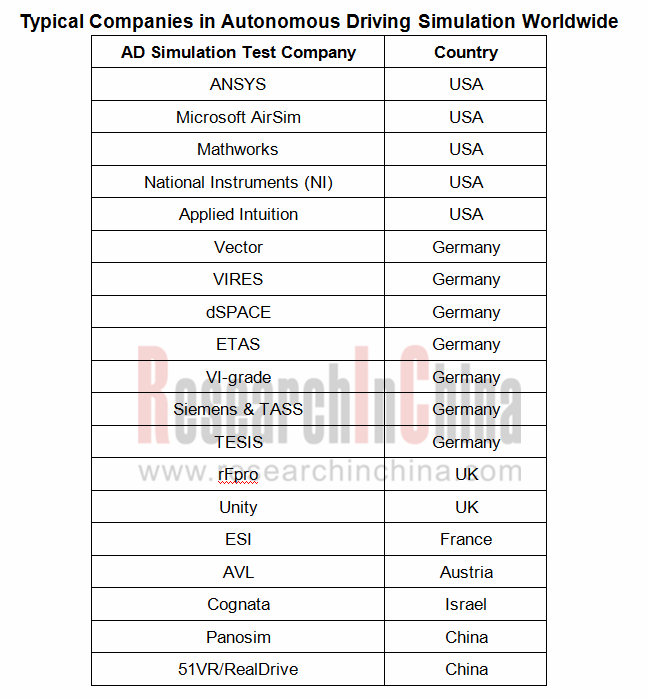

The Vehicle Simulation Industry Dominated by German and American Companies

There are dozens of simulation test companies around the globe, among which America ranks first by the number of companies but Germany boast most simulation firms in the automotive sector.

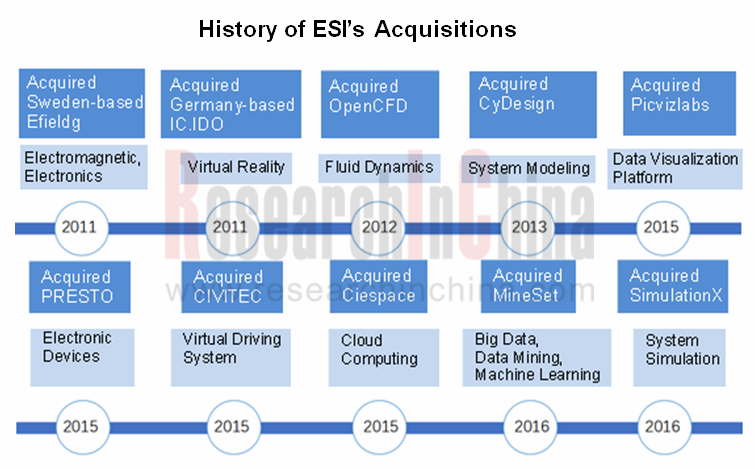

It can be seen from the development course of simulation industry that new opportunities emerge all the time and the emerging companies have sprung up incessantly. Simulation tycoons have grown ever competitive through mergers and acquisitions and have developed dozens of and even hundreds of product categories which are applied in tens of industries.

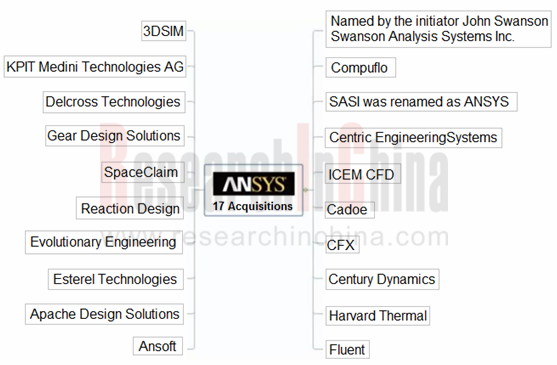

Through over ten acquisitions on companies inside and outside the industry, ANSYS dominates the CFD market, develops the embedded codes, beefs up chip encapsulation design, and enriches internal combustion engine simulation products. ANSYS purchased OPTIS in 2018 and improved the simulation technologies about sensors like LiDAR, camera and radar.

The potentiality of the autonomous driving simulation market has allured the inrush of many enterprises outside the automotive sector.

Autonomous driving tests call for various traffic scenarios simulation tool and massive scenario library. This is a totally new market, bringing traditional simulation companies, startups and new entrants on a par, and attracting the inroads of game firms, VR/AR firms and internet firms.

In October 2018, Cognata -- the Israel-based autonomous driving simulation startup -- completed the B-round funding of $18.5 million. Cognata reproduces the cities on its 3D simulation platform by fusing artificial intelligence, deep learning and computer vision, and provides the customers with a variety of the driving test scenarios simulating the real world. AID (Autonomous Intelligent Driving GmbH) under Audi reached cooperation with Cognata.

Founded in 2015, 51VR was grown from real property market and then made its foray in automobile, education, games and other fields, and is now primarily focused on 3D simulation reconstruction. In December 2017, 51VR conducted its B-round funding of RMB210 million. For now, 51VR boasts nearly 100 talents in the automotive business covering three modules, i.e., simulated driving experience (VR car), vehicle visualization, and autonomous driving simulation platform, of which simulation platform team accounts for more than a half of its workforce.

Baidu Apollo simulation platform is in-built with simulation scenarios with HD maps in favor of multi-algorithm (sensing, planning and control) module verification, making the autonomous driving algorithm verification more rigorous. Apollo 1.5 version began to open its simulation platform, empowering autonomous driving companies like Idriverplus to significantly improve their efficiency in R&D via Apollo cloud simulation capabilities. Baidu Apollo could sell HD map, simulation platform, computing hardware ACU in future, said by Li Yanhong, the chairman of Baidu. So, simulation platform will be one of the profit points of Baidu self-driving platform.

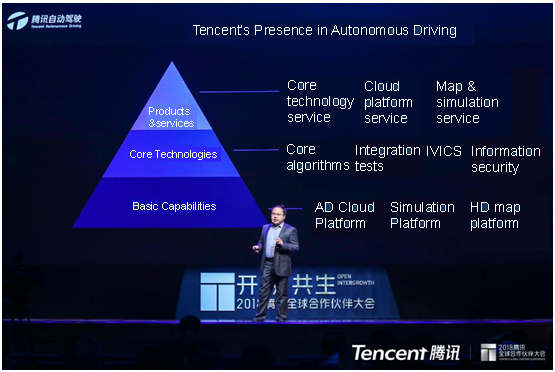

In line with Tencent’s layout in autonomous driving, simulation platform is one of the three basic competencies; maps and simulation services will be one of three profit engines of Tencent in future. Thanks to its superiorities in game engine, virtual reality, cloud games technologies, etc., Tencent has successfully built the simulation system TAD Sim (virtual + real combination) that is capable of verifying the closed-loop simulation of all modules (like sensing, decision, control algorithm) of a real car. Tencent wishes its simulation platform can help the automakers shorten development cycle, improve development efficiency, and reduce the costs of tests.

Since simulation software involves with hundreds of product categories, into which there are many ways to go. In comparison with difficulties in chassis and vehicle chip, the (automotive) industrial software represented by autonomous driving simulation is possibly the best field where IT/AI/VR firms can make investments.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...