Global and China Automotive Turbocharger Industry Report, 2019-2025

-

Mar.2019

- Hard Copy

- USD

$3,000

-

- Pages:170

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

ZJF129

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

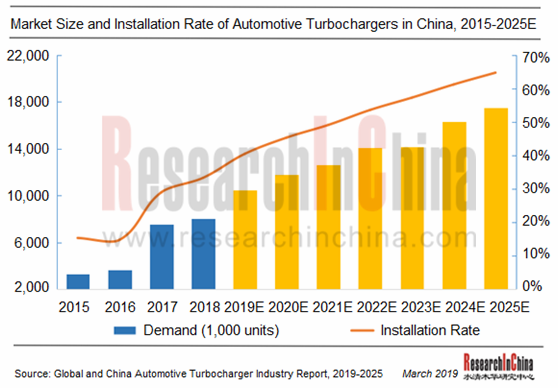

With the increasingly serious problems like atmospheric pollution and high dependence on crude oil, energy conservation and emission reduction need to be implemented urgently. The automobile industry undoubtedly becomes one of target industries, and energy-saving and new energy vehicles will be the future development trend. The market size of automotive turbocharger, one of the most important technologies for energy saving and emission reduction of automobiles thanks to its energy efficiency and technology maturity, has been ballooning accordingly. In 2018, the demand for automotive turbochargers in China rose 7.1% year on year to 8.045 million units, and the installation rate reached 33.29%. With the continuous upgrading and implementation of China's emission standards, automotive energy conservation and emission reduction will remain a major concern in the near future. Countries have set the timetable for phasing out internal combustion engines, but most of them are not legally effective. What’s more, the supportive projects for new energy vehicle will still take time. In short, the upgrade of traditional power technology will still be the mainstream in the next decade, and the turbocharged market will show enormous development potentials.

From the perspective of market segments, Chinese automotive turbochargers are mainly divided into gasoline turbochargers and diesel turbochargers. Due to different fuel combustion efficiency, the installation rate of diesel turbochargers has been much higher than that of gasoline turbochargers, for instance, the former hit 76.3% while the latter was only 27.7% in 2018. In future, gasoline turbocharger will see a fleetly growing installation rate, expectedly reaching 62.4% in 2023 given stricter environmental requirements.

In competition, international turbocharger giants Garrett Motion (a spin-off from Honeywell in 2018), BorgWarner, MHI and IHI have almost monopolized Chinese gasoline turbocharger market as the operating speed and temperature of gasoline turbochargers require high-quality materials and processing technology. It is difficult for Chinese players to break the foreign monopoly in the short run, because they lack high-end innovation in the design and development of core turbocharger components (such as compressors and turbines), the reliability of their products desires to be much improved, and they forayed into the field late. Only Ningbo Vofonturbo and Hunan Tyen Machinery can support low-end vehicle models of Chinese automakers. As for diesel turbochargers, the world-renowned suppliers of commercial vehicle turbocharger consist mainly of Garrett Motion and Cummins, both of which seize handsome shares in the Chinese market, especially for high-end vehicle models. Chinese competitors such as Hunan Tyen Machinery, Kangyue Technology, FuYuan Turbochargers and Weifu Tianli target the medium & low-end commercial vehicle market and the construction machinery market.

Global and China Automotive Turbocharger Industry Report, 2019-2025 by ResearchInChina highlights the following:

Overview of the automotive turbocharger industry (including definition and classification, technical characteristics, development trends, industrial policies, etc.);

Overview of the automotive turbocharger industry (including definition and classification, technical characteristics, development trends, industrial policies, etc.);

Overview of global and China automotive industry (automobile output, etc.);

Overview of global and China automotive industry (automobile output, etc.);

Market size, competitive landscape, etc. of global turbochargers;

Market size, competitive landscape, etc. of global turbochargers;

Market size, demand structure, automaker layout, etc. of Chinese turbochargers, especially automotive turbochargers;

Market size, demand structure, automaker layout, etc. of Chinese turbochargers, especially automotive turbochargers;

Demand for diesel and gasoline engine turbochargers in China;

Demand for diesel and gasoline engine turbochargers in China;

Operation, turbocharger business, development in China, etc. of eight global turbocharger manufacturers;

Operation, turbocharger business, development in China, etc. of eight global turbocharger manufacturers;

Operation, turbocharger business, R&D, development strategy, etc. of eight Chinese turbocharger manufacturers.

Operation, turbocharger business, R&D, development strategy, etc. of eight Chinese turbocharger manufacturers.

1 Overview

1.1 Definition

1.2 Classification

1.3 Product Technology Trends

2 Development of Global Automotive Industry

2.1 Global Market

2.2 Chinese Market

3. Global Automotive Turbocharger Market

3.1 Market Size

3.2 Competitive Landscape

4. China Automotive Turbocharger Market

4.1 Marketing Environment and Policy

4.1.1 Related Standards

4.1.2 Related Policies

4.2 Market Size

4.2.1 Demand

4.2.2 Layout of Automakers

5. China’s Automotive Turbocharger Market Segments

5.1 Turbocharger for Automotive Diesel Engine

5.2 Turbocharger for Automotive Gasoline Engine

5.2.1 Output of Turbo Passenger Car

5.2.2 Demand for Turbocharger for Automotive Gasoline Engine

5.2.3 Competitive Landscape

6 Major Global Turbocharger Manufacturers

6.1 Garrett Motion

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Turbocharger Business

6.1.5 Global Presence

6.1.6 Development in China

6.1.7 Development Plan

6.2 BorgWarner

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 R&D

6.2.5 Customers

6.2.6 Turbocharger Business

6.2.7 Development in China

6.2.8 Dynamics

6.3 Cummins

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 R&D and Acquisition

6.3.5 Turbocharger Business

6.3.6 Development in China

6.3.7 Wuxi Cummins Turbo Technologies Co. Ltd.

6.4 IHI

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Turbocharger Business

6.4.5 Turbocharger Revenue

6.4.6 Development in China

6.4.7 Wuxi IHI Turbo Co., Ltd. (WIT)

6.4.8 Changchun FAWER-IHI Turbo Co., Ltd. (FIT)

6.5 MHI

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 R&D

6.5.5 Turbocharger Business

6.5.6 Development in China

6.6 Continental

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Turbocharger Products

6.6.5 Development in China

6.6.6 Dynamics

6.7 BMTS Technology

6.7.1 Profile

6.7.2 Turbocharger Products

6.7.3 Business in China

6.8 Zage (GESON)

6.8.1 Profile

6.8.2 Turbocharger Products

7. Major Chinese Turbocharger Manufacturers

7.1 Hunan Tyen Machinery Co., Ltd (600698)

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 Output & Sales Volume

7.1.6 Turbocharger and Its Supportings

7.1.7 Development Prospects

7.2 Kangyue Technology Co., Ltd. (300391)

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Gross Margin

7.2.5 Output & Sales Volume

7.2.6 R&D

7.2.7 Customers

7.2.8 Development Prospects

7.3 Wuxi Weifu High-technology Co., Ltd. (000581)

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Gross Margin

7.3.5 R & D and Investment

7.3.6 Turbocharger Business

7.3.7 Performance Forecast

7.4 Ningbo Vofonturbo Systems Co., Ltd.

7.4.1 Profile

7.4.2 Major Products and Supportings

7.5 Weifang FuYuan Turbochargers Co., Ltd.

7.5.1 Profile

7.5.2 Turbocharger Products

7.6 Zhejiang Rongfa Motor Engine Co., Ltd.

7.6.1 Profile

7.6.2 Turbocharger Products

7.7 Hunan Rugidove Turbocharging Systems Co., Ltd.

7.7.1 Profile

7.7.2 Major Products

7.8 Shandong Xinde Mako Supercharger Co., Ltd.

7.8.1 Profile

7.8.2 Major Products

Principle of Turbocharger

Structure of Turbocharger

Turbocharger Industry Chain

Turbocharger Classification and Proportion by Fuel Type

Turbocharger Classification and Proportion by Compressor Impeller Diameter

Turbocharger Classification and Proportion by Application

Primary Technologies of Turbocharger Products

Global Automotive Output, 2012-2017

Global Passenger Car Output, 2012-2017

Global Commercial Vehicle Output, 2012-2017

Global Automotive Output, 2018-2023E

China Automotive Output, 2010-2023E

Market Size of Total Turbocharger Worldwide, 2000-2025E

Market Share and Turbocharger Revenue of Global Top 5 Turbocharger Manufacturers, 2018

Position of Global Major Turbocharger Manufacturers

China's Ongoing Environmental Standards for Engine Emissions

Implementation of Motor Vehicle Emission Standards in the 5th Phase in China

Emission Regulation Upgrading Process of Heavy Vehicle in China

Process of Chinese Emission Standards

Policies on Commercial Vehicle Exhaust Emission System Industry in China

Market Capacity and Assembly Rate of Automotive Turbochargers in China, 2015-2025E

Existing Models with Turbochargers of Some Major Car Brands and Output, 2018

Top 20 Passenger Car Models by Sales Volume, 2018

Ranking of Passenger Cars with Turbochargers by Output, 2018

Ranking of Chinese Brand Passenger Cars with Turbochargers by Output, 2018

Turbocharger Demand and Assembly Rate of Automotive Diesel Engines in China, 2014-2025E

Output of Passenger Cars with Turbochargers and Proportion in China, 2015-2018

Turbocharger Demand and Assembly Rate of Automotive Gasoline Engines in China, 2015-2025E

Capacity and Clients of Major Turbocharger Manufacturers in China, 2018

Net Sales and Net Income of Garrett Motion, 2013-2018

Revenue Structure of Garrett Motion by Business, 2017-2018

Revenue Structure of Garrett Motion by Region, 2017-2018

Main Turbo Product of Garrett Motion

Global Manufacturing Presence of Garrett Motion

Aftermarket Global Presence of Garrett Motion

Global Technology Presence of Garrett Motion

Profile of Honeywell Turbocharging Systems (Shanghai) Co. Ltd.

Supporting of Honeywell Turbocharging Systems (Shanghai) Co. Ltd. in Recent Years

Profile of Honeywell Turbo Technologies (Wuhan) Co., Ltd.

Supporting of Honeywell Turbo Technologies (Wuhan) Co., Ltd. in Recent Years

Main Technology Development Strategy of Garrett Motion

BorgWarner’s Net Sales and Net Income, 2012-2018

BorgWarner’s Net Sales Breakdown by Business, 2014-2018

BorgWarner’s Net Sales Breakdown by Country/Region, 2016-2018

BorgWarner’s R&D Costs and % of Total Revenue, 2012-2018

Net Sales Proportion of BorgWarner’s Top 2 Customers, 2009-2018

BorgWarner’s Net Sales Structure by Application, 2011-2018

BorgWarner’s Net Sales from Light-duty Automotive Turbocharger and % of Total Revenue, 2011-2018

BorgWarner’s Net Sales and Percentage in China, 2011-2018

Profile of BorgWarner Automotive Components (Ningbo) Co., Ltd.

Supportings of BorgWarner Automotive Components (Ningbo) Co., Ltd.

Profile of BorgWarner Automotive Components (Jiangsu) Co., Ltd.

Supportings of BorgWarner Automotive Components (Jiangsu) Co., Ltd.

Cummins’ Net Sales and Net Income, 2012-2018

Cummins’ Net Sales Breakdown by Business, 2017-2018

Cummins’ Net Sales Breakdown by Country/Region, 2016-2018

Cummins’ R&D and % of Total Revenue, 2011-2018

Cummins’ Sales from Turbocharger Products of Cummins

Cummins’ Sales from Turbocharger and % of Total Revenue, 2011-2018

Cummins’ Net Sales in China, 2011-2018

Development Course of Wuxi Cummins Turbo Technologies

IHI’s Major Business Segments and Main Products,

Global Presence of IHI

IHI’s Net Sales and Net Income, FY2011-FY2018

IHI’s Net Sales Breakdown by Business, FY2016-FY2018

IHI’s Net Sales Breakdown by Country/Region, FY2016-FY2017

IHI’s Turbocharger High-tech Products

IHI’s Turbocharger Business Breakdown by Main Customer

IHI’s Subsidiaries that Produce Turbochargers, 2018

IHI’s Net Sales from Turbocharger and YoY Growth, FY2010-FY2018

IHI's Net Sales from Automotive Turbocharger by Region, FY2012-FY2018

IHI's Net Sales from Automotive Turbocharger in China, FY2012-FY2018

Profile of Wuxi IHI Turbo Co., Ltd.(WIT)

VGT (Variable GeometryTurbocharger) of Wuxi IHI Turbo Co., Ltd.

TurboCharger Supportings of Wuxi IHI Turbo Co., Ltd.

Profile of FIT

FIT’s Revenue and Net Income, 2013-2018

Automotive Turbocharger Supportings of FIT

Global Footprint of MHI

MHI’s Net Sales and Net Income, FY2012-FY2018

MHI’s Net Sales by Business, FY2016-FY2018

MHI’s Net Sales by Country/Region, FY2016-FY2018

MHI’s R&D Costs and % of Total Revenue, FY2010-FY2018

MHI's Revenue from Automotive TurboCharger, 2015-2020E

Profile of Shanghai MHI Turbocharger Co., Ltd. (SMTC)

Revenue and Net Income of Shanghai MHI Turbocharger Co., Ltd., 2012-2018

Automotive Turbocharger Supportings of Shanghai MHI Turbocharger Co., Ltd.

Net Sales and Employees of Continental by Business, 2017

Revenue and EBIT of Continental, 2011-2018

Revenue, EBIT and Employees of Powertrain Segment of Continental, 2018H1

Main Products Related to Internal Combustion Engine Solutions of Continental

Aluminum Turbochargers of Continental

Bases of Continental in China

Profile of Continental Termec Automotive Systems (Shanghai) Co., Ltd.

Supporting by Turbochargers of Continental Termec Automotive Systems (Shanghai) Co., Ltd.

Business Restructuring of Continental

Overview of BMTS Technology

EXHAUST TURBOCHARGERS FOR Commercial vehicles of BMTS Technology

EXHAUST TURBOCHARGERS FOR CARs of BMTS Technology

Profile of BMTS Technology

Supporting by Turbochargers of BMTS Technology in Recent Years

Supporting by Diesel Turbochargers of ZAGE

Supporting of ZAGE Performance Turbo

Revenue and Net Income of Hunan Tyen Machinery, 2011-2018

Operating Revenue of Hunan Tyen Machinery by Product, 2015-2017

Gross Margin of Hunan Tyen Machinery by Product, 2012-2017

Hunan Tyen Machinery’s Turbocharger Output, Sales Volume, and Sales-output Ratio, 2012-2017

Diesel-engine-use fixed Section Turbochargers of Hunan Tyen Machinery

High-power-engine-use Turbochargers of Hunan Tyen Machinery

Hunan Tyen Machinery’s Gasoline Engine Turbochargers

OEMs Supported by Turbochargers of Hunan Tyen Machinery

Commercial-vehicle-use Turbochargers (Natural Gas) of Hunan Tyen Machinery

Revenue and Net Income of Hunan Tyen Machinery, 2017-2025E

Kangyue Technology’s Revenue and Net Income, 2011-2018

Operating Revenue Breakdown of Kangyue Technology by Product, 2016-2018

Operating Revenue Breakdown of Kangyue Technology by Region, 2016-2018

Kangyue Technology’s Gross Margin by Product, 2016-2018

Kangyue Technology’s Turbocharger Output and Sales Volume, 2016-2017

Kangyue Technology’s R&D Costs and % of Total Revenue, 2011-2018

Kangyue Technology’s Turbocharger-Supported Customers by Application

Kangyue Technology’s Revenue and Net Income, 2017-2025E

Development Course of Weifu High-technology

Revenue and YoY Change of Weifu High-technology, 2012-2018

Net Income and YoY Change of Weifu High-technology, 2012-2018

Revenue Breakdown of Weifu High-technology (by Business Unit), 2012-2018

Revenue Structure of Weifu High-technology (by Regions), 2012-2018

Gross Margin of Weifu High-technology, 2011-2018

R&D Costs and % of Total Revenue ofWeifu High-technology, 2012-2018

Wuxi Weifu High-technology’s Turbocharger Output, Sales Volume, and Sales-output Ratio, 2015-2017

Profile of Ningbo Weifu Tianli Turbocharging Technology Co., Ltd.

Turcharger Products of Ningbo Weifu Tianli Turbocharging Technology Co., Ltd.

Profile of Wuxi Weifu ITMA Turbo Technologies

Revenue and Net Income of Weifu High-technology, 2018-2025E

Profile of Ningbo Vofonturbo

Supporting by Turbochargers of Ningbo Vofonturbo in Recent Years

FuYuan’s Passenger Car Turbochargers

FuYuan’s Commercial Vehicle Turbochargers

Turbocharger Products of Zhejiang Rongfa Motor Engine

Turbocharger Marketing Network of Zhejiang Rongfa Motor Engine

Turbocharger Supportings of Hunan Rugidove Turbocharging Systems (with Dongfeng as example)

Some Commercial Vehicle Turbochargers of Xinde Mako

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...