ADAS and Autonomous Driving Industry Chain Report 2018-2019 -- Automotive Vision

Vision sensor, a key sensor for ADAS and autonomous driving was galloping ahead in the past year along with the relentless march of LiDAR and radar technologies.

Automotive camera is just tending to pack network clustering, night vision, inward-looking and 3D capabilities.

Network Clustering

In 2018 Continental AG launched MFC500, its fifth-generation automotive camera with image resolution of 1-to-8 megapixels. Continental projects to mass-produce it in 2020. The camera is interlinked with the environment: by connecting it to the electronic horizon (‘eHorizon’) and ‘Road Database’, road information and landmarks can be transmitted to and received from the cloud to locate the vehicle and enable proactive driving.

Bosch third-generation camera with a detection range of 150 meters will go into mass production in 2019. Bosch will also build an automotive camera perception network among its OEM customers worldwide through “Bosch Road Signature” (a crowd-sourced localization service that enables automated vehicles to determine their exact position).

What Bosch and Continental have done is identical with Mobileye’s autonomous driving roadmap.

But Mobileye has set about putting its technology into practical use when its peers are still working on development. Mobileye Aftermarket announced a raft of partnerships and collaborations with ride-hailing leaders, municipalities and governmental agencies that will enable the mapping of city streets around the world, including London and New York, through the deployment of Mobileye 8 Connect? in thousands of ride-hailing vehicles. From early 2019 on, the fleets equipped with Mobileye 8 Connect will harvest valuable information on city streets and infrastructure to create high-definition crowd-sourced maps through Mobileye’s Road Experience Management (REM) – a critical enabler of full autonomy.

Mobileye has partnered with BMW, Nissan and Volkswagen that collectively had two million cars with EyeQ4 system-on-chips collecting road data in 2018. In Japan, Mobileye collaborated with Zenrin and Nissan on using REM technology to collect data of all highways in the country. Mobileye and its Chinese partners like SAIC, Great Wall Motor and NIO work together to push on REM program.

There is reason to believe that Chinese IT giants will follow suit. Examples include Alibaba striving to develop cooperative vehicle infrastructure system (CVIS), Hikvision that enjoys superiorities in camera field and invests Wuhu Sensorthch Intelligent Technology Co., Ltd., a radar firm, and Tus-Holdings Co., Ltd which acquired Suzhou INVO Automotive Electronics Co., Ltd., a developer of ADAS. These players grab some first-mover advantage in vehicle-to-infrastructure (V2I) camera-based network clustering perception system.

Inward-looking: half of vision-based ADAS firms are developing DMS

Driver monitoring systems (DMS) is largely needed by commercial vehicle ADAS and will be a standard configuration for future L3 passenger cars. Half of vision-based ADAS companies are developing DMS, including EyeSight, Shenzhen Autocruis Technology Co., Ltd., Roadefend Vision Technology (Shanghai) Co., Ltd., Whetron Electronics Co., Ltd., Wuhan JIMU Intelligent Technology Co., Ltd., Minieye, Beijing Smarter Eye Technology Co., Ltd. and Black Sesame Technologies.

EyeSight, an Israeli start-up founded in 2005, provides driver monitoring, gesture recognition and user perception and analysis technologies. Its software-based automotive sensing solutions need support from infrared (IR) or time of flight (TOF) sensors.

Black Sesame Technologies has developed in-vehicle monitoring systems with capabilities of face recognition-based driver authority authentication, driver fatigue monitoring, bad driving behavior monitoring and occupant monitoring.

In February 2019 Shanghai Baolong Automotive Corporation released a range of automotive sensor products from dynamic vision sensor, 77G/24G radar, stereo forward-looking system, infrared thermal imager for night vision and diver warning system to face recognition system.

Night Vision

Continental AG rolled out MFC500, a fifth-generation automotive camera capable of night vision.

In 2018 Denso developed a new vision sensor which improves vehicle’s night vision by using a solid-state imaging device and unique lenses specifically designed for low-light conditions.

In 2018 Israel-based Foresight unveiled its QuadSight? quad-camera vision system. Using four-camera technology that combines two pairs of stereoscopic infrared and visible-light cameras, the system is designed to achieve near 100% obstacle detection with near zero false alerts in any weather or light conditions (including complete darkness, rain, haze, fog and glare).

3D Trend

3D sensing is now one of the key development orientations of camera technology.

AMS and Sunny Optical announced in November 2017 a joint plan to develop 3D sensing solutions for mobile devices and automotive application.

ZF is developing a kind of three-dimension interior observation system (3D IOS) that can detect occupants in a car and classify them to ascertain their sizes and positions as well as whether the occupant is manipulating the car willingly or monitoring the autonomous driving system.

Magna and Renesas collaborate in fusion of Magna’s eyeris? 3D surround-view camera system with the latter’s SoC (system-on-a-chip) to develop a more cost-effective 3D surround-view system especially for entry-level and mid-range cars.

Naturally, automotive 3D sensing not only relies on cameras but also takes advantage of either radar or LiDAR for 3D imaging. It is through using radar that Vayyar Imaging brings 3D imaging into a reality.

Vayyar Imaging announced in May 2018 to roll out millimeter wave 3D imaging system used chip. Vayyar’s 3D sensor can be utilized for obstacle detection, classification and simultaneous localization and mapping (SLAM). The embedded 3D sensor of Vayyar can scan the internal environment inside the car in real time and offer real-time imaging. Alerts will be sent to the drowsy driver through monitoring the vital signs of the occupant inside the car, or the guardian will be warned if the children and pets get off the car.

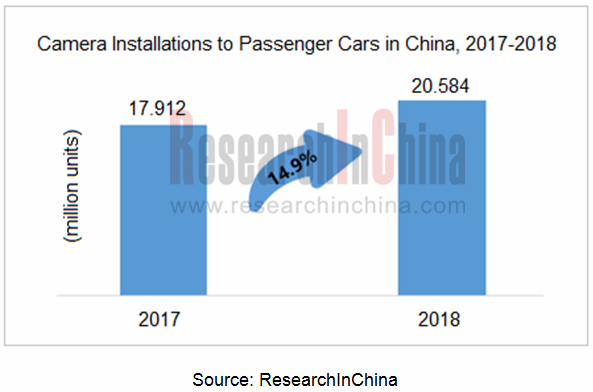

In 2018, the OEM installations of cameras (inclusive of front view, rear view, side view, interior view, surround view, driving recorder camera, among others.) to passenger car reached 20.584 million units with a year-on-year surge of 14.9%, of which front camera soared 28% YoY, surround-view camera shot up by 30.1% YoY, and stereo camera skyrocketed 170.3% YoY, according to ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Vision by ResearchInChina.

ADAS and Autonomous Driving Industry Chain Report, 2018-2019 of ResearchInChina covers following 17 reports:

1)Global Autonomous Driving Simulation and Virtual Test Industry Chain Report, 2018-2019

2)China Car Timeshare Rental and Autonomous Driving Report, 2018-2019

3)Report on Emerging Automakers in China, 2018-2019

4)Global and China HD Map Industry Report, 2018-2019

5)Global and China Automotive Domain Control Unit (DCU) Industry Report, 2018-2019

6)Global and China Automated Parking and Autonomous Parking Industry Report, 2018-2019

7)Cooperative Vehicle Infrastructure System (CVIS) and Vehicle to Everything (V2X) Industry Report, 2018-2019

8)Autonomous Driving High-precision Positioning Industry Report, 2018-2019

9)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Processor

10)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Lidar

11)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Radar

12)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Vision

13)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Passenger Car Makers

14)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– System Integrators

15)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Commercial Vehicle Automated Driving

16)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Low-speed Autonomous Vehicle

17)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– L4 Autonomous Driving

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...