OEM ADAS and Autonomous Driving Strategy Research: At least Billions of Dollars and Thousands of Software Engineers are Required.

The new trends “electrification, networking, intelligence and sharing” led by autonomous driving are disrupting the traditional automotive industry.

Yet, barriers to L4 and above autonomous driving are so high that no one can image. WAYMO that has spent over a decade and billions of dollars on the technology, has slowed its pace of commercialization even if being far ahead of its rivals, and has admitted that the fully automated driving will take time. As Waymo CEO John Krafcik said in late 2018, though driverless cars are “truly here”, they aren’t ubiquitous yet and autonomy always will have some constraints for decades to come.

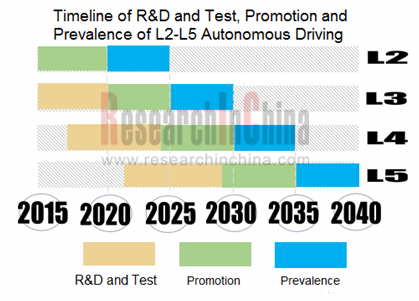

Source: ResearchInChina

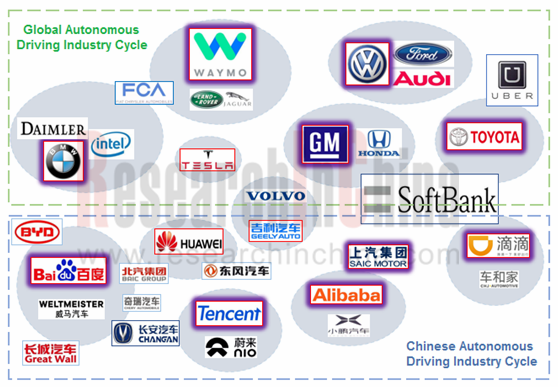

This means that autonomous driving costs too much and those who shell out for it will face long-term loss. To cope with the challenges posed by Waymo, traditional OEMs are forming alliances. Examples include the partnership among Daimler, BMW and Intel (Mobileye) and the collaborations between GM and Honda, VW and Ford.

Source: ResearchInChina

Typical leagues in China embrace Baidu + Weltmeister, Alibaba + Xpeng Motors and Didi + CHE Automotive. Traditional Chinese automakers prefer not to partner with only one or two of the four IT giants (Baidu, Alibaba, Tencnet and Huawei) but keep an open cooperative relationship with all of them. SAIC is striving to foster its own ecosystem by investing many start-ups.

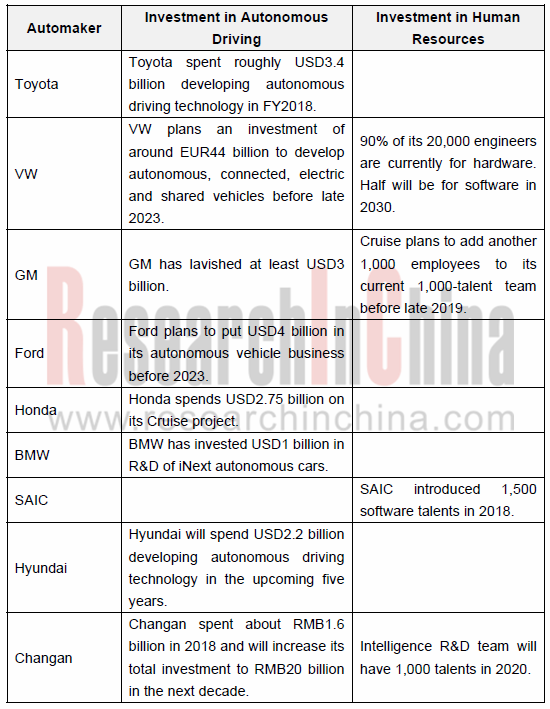

Besides the way of cooperation for complementing with each other and apportioning research and development and operation expenses, OEMs are also racing to invest more in recruiting software engineers.

“Software will account for 90 percent of future innovations in the car. Today, our 20,000 developers are 90 percent hardware-oriented. That will change radically by 2030. Software will account for half of our development costs”, says Herbert Diess, CEO of Volkswagen, which means VW’s software engineers will be 10,000 or so.

American tech firms make enormous investments in autonomous driving as well. Apple autonomous car team claims 5,000 people, and Uber possesses about 1,500.

Autonomous driving market has been an arena for big names, and other small and medium players have to take sides.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...