China Automotive Distribution and Aftermarket Industry Report, 2019-2025

-

Mar.2019

- Hard Copy

- USD

$3,200

-

- Pages:195

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZLC075

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

Spurred by downstream demand, China’s automobile production and sales sustained solid growth during 2011-2017, making a new high record in 2017. As the car sharing market is expanding apace, China just produced 27.81 million automobiles and sold 28.08 million units in 2018, both declining from the year before, by 4.2% and 2.8%, respectively.

In the meantime, the trading volume of used cars in the Chinese market has been rising over the years, reaching 13.82 million units in 2018, 11.5% more than in the previous year.

China’s automotive distribution and aftermarket industry features intense competition and a scattered pattern. In 2017, the top 100 auto dealers in China sold a total of 8.48 million units, occupying a mere 20.5% of the total automobile sales (including the used cars). By the end of 2017, they had run 6,267 4S outlets, or 27.8% of the country’s total.

Flocks of Chinese auto dealers turn to the aftermarket to reap benefits in recent years, arising from vehicle distribution gross margin of less than 5% and after-sale services’ whopping 40%.

China’s distribution and aftermarket industry shows the trends as follows:

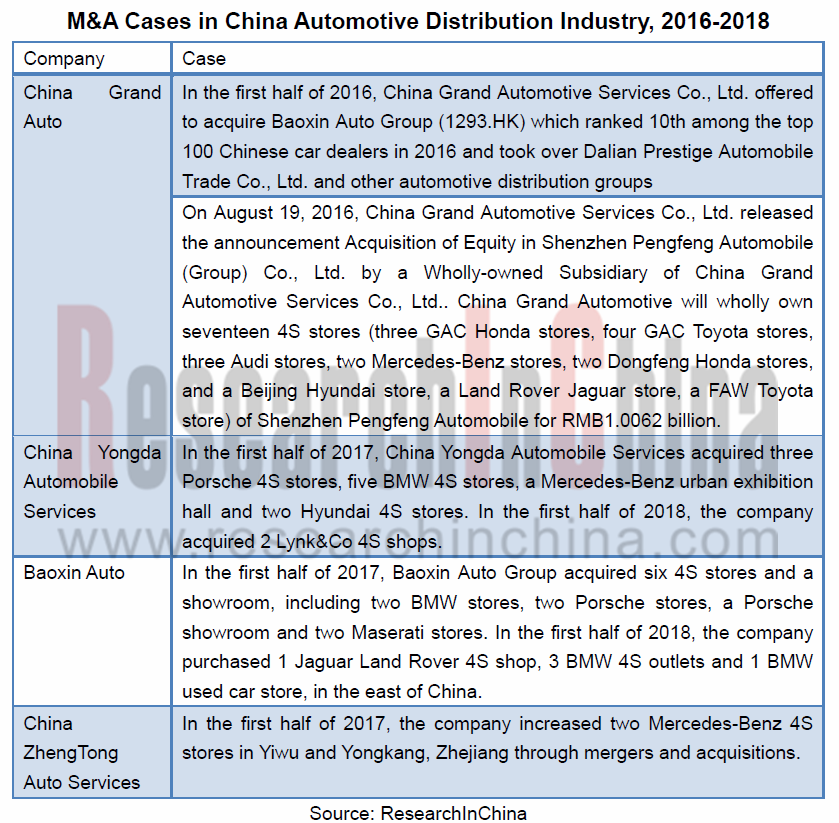

1.Frequent mergers and acquisitions: while building some of their own outlets, large auto dealers also expand their distribution network by way of mergers and acquisitions, as they did in the first half of 2018 when China Yongda Automobile Services Holdings Limited bought 2 Lynk&Co 4S shops and Grand Baoxin Auto Group Limited acquired 1 Jaguar Land Rover 4S shop, 3 BMW 4S outlets and 1 BMW used car store.

2. Online distribution: the prospering internet is disrupting the way people live and consume, and automotive ecommerce then springs up. Currently, traditional auto dealers are not the only one setting about deploying internet +; some other players are also launching their own internet + automotive distribution modes for a slice of the market. Take examples for SOUCHE, Guazi.com, Uxin and Gome, all of which have online offerings for buyers.

3. Stimulus of Auto finance: the booming auto finance makes cars more affordable. New financial modes such as “zero deposit or 10% deposit” by SOUCHE and Guazi.com among others, have aroused desire in buyers by virtue of simpler purchase process, giving automotive distribution a boost.

4. Increase in used car sales: more new cars in the market favors higher ownership of automobile, which leaves room for used cars. As all local policies that restrict sales of non-local second-hand vehicles are rescinded and the used car ecommerce mode grows mature, China is expected to see a steady growth in number of used cars traded in the market, up to estimated 32.46 million units in 2025.

China Automotive Distribution and Aftermarket Industry Report, 2019-2025 highlights the following:

China automotive distribution industry (distribution modes, profit models, competitive pattern and development trends);

China automotive distribution industry (distribution modes, profit models, competitive pattern and development trends);

China new car sales, used car sales, automotive finance, car maintenance & beauty and automotive insurance markets (status quo, market size, competitive landscape, development trends, etc.);

China new car sales, used car sales, automotive finance, car maintenance & beauty and automotive insurance markets (status quo, market size, competitive landscape, development trends, etc.);

14 auto dealers (operation, revenue structure, gross margin, and automotive distribution and aftermarket business).

14 auto dealers (operation, revenue structure, gross margin, and automotive distribution and aftermarket business).

1. Overview

1.1 Development History

1.2 Distribution Pattern

1.2.1 Main Marketing Models

1.2.2 Characteristics of Marketing Models

1.2.3 Imported Car Distribution Pattern

1.3 Automotive Aftermarket

1.3.1 Market Situation

1.3.2 Main Channels

1.3.3 Status Quo

2. Overview of Automotive Distribution Industry in China

2.1 Distribution Model

2.1.1 Passenger Car Distribution Model

2.1.2 Commercial Vehicle Distribution Model

2.2 Profit Model

2.3 Competitive Landscape

2.3.1 Revenue of Top 100 Companies

2.3.2 Comparison by Enterprises’ Operation

2.3.3 Comparison by Distribution Channels

2.4 Development Trends

2.4.1 Continuous Industrial M&As Further Raise Market Concentration

2.4.2 More Efforts to Expand Automotive Aftermarket

2.4.3 Automotive Distribution Heads towards "Internet +"

2.4.4 Second Child Policy Promotes the Development of the Industry

2.4.5 Used Car Sales Volume Grows

2.4.6 The Rapid Development of Automotive Finance Boosts the Development of Automotive Distribution Industry

2.4.7 4S Stores Decline Gradually

3 Sales Market of New Vehicle in China

3.1 Automobile Market

3.1.1 Output

3.1.2 Sales Structure

3.2 Passenger Car Market

3.2.1 Output & Sales Volume

3.2.2 Sales Structure

3.3 Commercial Vehicle Market

3.3.1 Output & Sales Volume

3.3.2 Sales Structure

3.4 New Energy Vehicles

3.4.1 Output and Sales Volume

3.4.2 Prospects

4 Chinese Used Car Sales Market

4.1 Market Situation

4.2 Distribution Model

4.3 Transaction

4.3.1 Overall Market

4.3.2 Market Structure

4.3.3 Regional Market

4.4 Competitive Landscape

4.5 Prospects

5 Chinese Automotive Finance Market

5.1 Status Quo

5.2 Market Size

5.3 Competitive Landscape

5.4 Operation of Auto Finance Companies

5.5 Development Trends

5.5.1 Market Share of Auto Finance Companies Grows Further

5.5.2 Used Car Financial Business Grows Rapidly

5.5.3 Cyberization of Used Car Trade

5.5.4 Auto Financial Products Becomes More Diversified

5.5.5 Improved Credit System Pushes the Development of Auto Finance Market

5.5.6 Internet Auto Finance Has Developed into a Trend

5.5.7 Cooperation between Banks and Enterprises Drives Auto Finance

5.5.8 Competition in Auto Finance Industry Intensifies

6 Chinese Auto Repair & Beauty Market

6.1 Market Size

6.2 Investment and Financing

6.3 Competitive Landscape

6.4 Analysis of Channels

6.5 Regional Analysis

6.6 Development Trend

6.6.1 Overall

6.6.2 Channels

6.7 Internet + Auto Repair & Beauty

6.7.1 Status Quo

6.7.2 Business Model

6.7.3 Competitive Landscape

7 Chinese Auto Insurance Market

7.1 Development Background

7.2 Status Quo

7.3 Market Size

7.4 Competitive Landscape

8 Majors Car Dealers in China

8.1 PANGDA Automobile Trade Group Co., Ltd.

8.1.1 Profile

8.1.2 Business Model and Profit Model

8.1.3 Operation

8.1.4 Revenue Structure

8.1.5 Gross Margin

8.1.6 Layout

8.1.7 Sales Volume

8.1.8 Customers

8.1.9 New Energy Vehicle Business

8.1.10 Auto Finance Business

8.1.11 Other Automotive Aftermarket Business

8.2 Sinomach Automobile Co., Ltd.

8.2.1 Profile

8.2.2 Operation

8.2.3 Revenue Structure

8.2.4 Gross Margin

8.2.5 Sales Volume

8.2.6 Imported Car Business

8.2.7 Auto Retail Business

8.2.8 Auto Aftermarket Business

8.3 Zhongsheng Group Holdings Limited

8.3.1 Profile

8.3.2 Operation

8.3.3 Revenue Structure

8.3.4 Gross Margin

8.3.5 Sales Volume

8.3.6 Layout

8.3.7 Automotive Aftermarket

8.3.8 Development Strategy

8.4 Dah Chong Hong Holdings Limited

8.4.1 Profile

8.4.2 Operation

8.4.3 Revenue Structure

8.4.4 Gross Margin

8.4.5 Automotive Distribution Business

8.4.6 Layout

8.4.7 Automotive Aftermarket

8.4.8 Development Strategy

8.5 China Grand Automotive Services Co., Ltd.

8.5.1 Profile

8.5.2 Operation

8.5.3 Revenue Structure

8.5.4 Gross Margin

8.5.5 Layout

8.5.6 Automotive Distribution Business

8.5.7 Used Car Business

8.5.8 Other Auto Aftermarket Business

8.5.9 Development Strategy

8.6 China ZhengTong Auto Services Holdings Limited

8.6.1 Profile

8.6.2 Operation

8.6.3 Revenue Structure

8.6.4 Gross Margin

8.6.5 Layout

8.6.6 Automotive Distribution Business

8.6.7 Auto Aftermarket Business

8.6.8 Development Strategy

8.7 China Yongda Automobile Services Holdings Limited

8.7.1 Profile

8.7.2 Operation

8.7.3 Revenue Structure

8.7.4 Gross Margin

8.7.5 Layout

8.7.6 Automotive Distribution Business

8.7.7 Auto Aftermarket Business

8.7.8 Development Strategy

8.8 Wuxi Commercial Mansion Grand Orient Co., Ltd.

8.8.1 Profile

8.8.2 Operation

8.8.3 Revenue Structure

8.8.4 Gross Margin

8.8.5 Automotive Distribution Business

8.8.6 Auto Aftermarket Business

8.8.7 Development Strategy

8.9 Baoxin Auto Group

8.9.1 Profile

8.9.2 Operation

8.9.3 Revenue Structure

8.9.4 Gross Margin

8.9.5 Layout

8.9.6 Automotive Distribution Business

8.9.7 Auto Aftermarket Business

8.9.8 Development Strategy

8.10 Harmony Auto

8.10.1 Profile

8.10.2 Operation

8.10.3 Revenue Structure

8.10.4 Gross Margin

8.10.5 Layout

8.10.6 Automotive Distribution Business

8.10.7 Auto Aftermarket Business

8.10.8 Development Strategy

8.11 Yaxia Automobile

8.11.1 Profile

8.11.2 Operation

8.11.3 Revenue Structure

8.11.4 Gross Margin

8.11.5 Automotive Distribution Business

8.11.6 Auto Finance Business

8.11.7 Other Auto Aftermarket Business

8.12 Materials Industry Zhongda Group Co., Ltd.

8.12.1 Profile

8.12.2 Operation

8.12.3 Automotive Distribution Business

8.13 Lei Shing Hong Limited (LSH)

8.13.1 Profile

8.13.2 Automotive Distribution Business

8.14 Hengxin Automotive

8.14.1 Profile

8.14.2 Automotive Distribution Business

Development History of Automotive Distribution in China

Major Means of Automotive Distribution in China

Comparison: Characteristics of Different Automotive Distribution Modes

Comparison: Business Model of Imported Cars and China-made Cars

Automotive Aftermarket Segments

China’s Automotive Aftermarket Size, 2015-2025E

Procedures for Constructing Passenger Car 4S Shop in China

Cost Structure for Constructing 4S Shop

Service Scope of Automotive Distribution in China

Profit Model of New Car Sales of Dealers in China

Dealers’ Profitability from Different Car Models

4S Outlet Numbers of Top 100 Auto Dealers in China, 2010-2017

Total Revenue of Top 100 Dealers in China, 2010-2018

Number of Car Dealers with the Revenue of over RMB10 billion in China, 2010-2017

Revenue of the Ranking No.1 among Top 100 Car Dealers in China, 2010-2017

Vehicle Sales Volume of Top 100 Car Dealers in China, 2010-2017

Top 20 Car Dealers by Revenue in China, 2018

New Car Sales Volume Comparison between Chinese Car Dealers, 2015-2018

Revenue Comparison between Major Chinese Car Dealers, 2013-2018

Net Income Comparison between Major Chinese Car Dealers, 2013-2018

Automobile Sales Gross Margin of Major Chinese Car Dealers, 2013-2018

After-sales Service Gross Margin of Major Chinese Car Dealers, 2013-2018

Comparison between Major Chinese Car Dealers by Number of 4S Shops, 2015-2018

M&A Cases in China Automotive Distribution Industry, 2016-2018

Layout of Major Chinese Car Dealers in each Field of Automotive Aftermarket

Cases of Automotive Distribution Industry's Layout on Internet + in China

China’s Used Car Trading Volume, 2016-2025E

China’s Automobile Output, 2011-2019

China’s Automobile Sales Volume, 2011-2019

China’s Automobile Output and Sales Volume, 2018-2025E

Sales Volume of Top 10 Automotive Brands in China by Type, 2018

China’s Automobile Sales Volume Structure (by Type), 2011-2019

China’s Automobile Sales Volume Structure (by Type), 2018-2025E

China’s Passenger Car Output, 2011-2019

China’s Passenger Car Sales Volume, 2011-2019

China’s Passenger Car Output and Sales Volume, 2018-2025E

China’s Passenger Car Sales Volume (by Type), 2011-2018

China’s Passenger Car Sales Volume Structure (by Type), 2011-2018

Sales Volume of Top 10 Passenger Car Brands in China by Type, 2018

China’s Commercial Vehicle Output, 2011-2019

China’s Commercial Vehicle Sales Volume, 2011-2019

China’s Commercial Vehicle Output & Sales Volume, 2018-2025E

China’s Commercial Vehicle Sales Volume (by Type), 2011-2018

China’s Commercial Vehicle Sales Volume Structure (by Type), 2011-2018

China’s New Energy Vehicle (EV&PHEV) Output and Sales Volume, 2011-2019

China’s New Energy Vehicle (EV&PHEV) Sales Volume (by Type), 2016-2019

China’s New Energy Vehicle (EV&PHEV) Output (by Type), 2016-2019

Policies on China’s New Energy Vehicle Industry, 2009-2018

Ratio of Used Cars to New Cars in China, 2012-2019

Main Trade Modes for Used Cars in China

Trade Modes for Used Cars in Major Countries

Trading Volume and YoY Growth Rate of Used Cars in China, 2011-2019

Proportion of Used Car Trading Volume in China (by Type), 2014-2018

Proportion of Used Car Trading Volume in China (by Service Life), 2010-2018

Proportion of Used Car Trading Volume in China (by Price Range), 2017

Proportion of Used Car Trading Volume in China (by Price Range), 2018

Top 10 Regions by Used Car Trading Volume in China, 2017

Top 10 Regions by Used Car Trading Volume in China, 2018

Layout of Major Chinese Car Dealers in Used Car Market

Penetration of Auto Finance in China, 2015-2023E

Auto Finance Market Size in China, 2014-2023E

Auto Finance Related Enterprises Invested by BATJ

Advantages and Disadvantages of Major Auto Finance Practitioners in China

Competition Pattern of Auto Finance Market in China, 2017

Major Auto Finance Companies in China, 2018

Operating Results of Major Auto Finance Companies in China, 2017

Total Assets of Auto Finance Companies in China, 2013-2017

Loans of Auto Finance Companies in China (by Type), 2013-2017

Main Business Structure of Auto Finance Companies in China, 2013-2017

Number of Automobiles (by Type) that Received Loans from Auto Finance Companies in China, 2013-2017

Asset Backed Securities (ABS) of Chinese Auto Finance Companies, 2017

Market Shares of Auto Finance Companies in China, 2016-2023E

Channels for Chinese to Buy and Sell Used Cars, 2018

Key Factors for Chinese Netizens to Buy and Sell Used Cars Online, 2018

Key Features of Used Car Netizens in China, 2018

Cases of Chinese Internet Firms that Make Layout in Internet Auto Finance

Cases of Banks and Enterprises that Work Together to Make Layout in Auto Finance

Market Size of China’s Auto Repair & Beauty Industry, 2012-2025E

Main Financing Cases of Auto Repair & Beauty Industry, 2016-2018

Major Competitors in China’s Auto Repair & Beauty Industry

Comparison between Auto Repair & Beauty Channels in China

Distribution of Auto Repair & Beauty Chain Brands in China’s Key Areas

Relative Advantages of Network Auto Repair & Beauty

Main Business Models of Internet Platforms for Repair and Maintenance

Some Auto Repair & Beauty Network Platform Projects in China

Regional Distribution of Auto Repair & Beauty Network Platform Projects in China

The Reform of the Administration System for Commercial Motor Vehicle Insurance Clauses and Premium Rates

China’s Automotive Insurance Premium Income, 2010-2018

China’s Premium Income from Compulsory Insurance for Vehicle Traffic Accident Liability and YoY Growth, 2010-2018

China’s Automotive Insurance Premium Income, 2018-2025E

Top 20 Auto Insurance Companies by Revenue, 2018

Procurement Model of Pangda Automobile’s 4S Shops

Sales Model of Pangda Automobile’s 4S Shops

Profit Model of Pangda Automobile’s 4S Shops

Revenue and Net Income of Pangda Automobile, 2013-2018

Revenue of Pangda Automobile (by Business), 2014-2016

Revenue Structure of Pangda Automobile (by Business), 2014-2018

Gross Margin of Pangda Automobile, 2014-2018

Number of Pangda Automobile’s Business Outlets (by Type), 2012-2017

Regional Distribution of Opened Outlets of Pangda Automobile by End 2017

Vehicle Sales Volume and Inventory of Pangda Automobile, 2015-2017

Revenue and % of total Revenue from Top Five Customers of Pangda Automobile, 2013-2017

Core Competitiveness of Pangda Automobile

Revenue and Net Income of Sinomach Automobile, 2013-2018

Purpose of Raised Fund through Private Offering of Sinomach Automobile, 2016

Revenue of Sinomach Automobile (by Business), 2013-2017

Revenue Structure of Sinomach Automobile (by Business), 2013-2017

Revenue of Sinomach Automobile (by Region), 2013-2017

Revenue Structure of Sinomach Automobile (by Region), 2013-2017

Gross Margin of Sinomach Automobile (by Business), 2013-2017

Sales Volume and Inventory of Sinomach Automobile, 2015-2017

Major Cooperative Manufacturers of Zhongsheng Group

Revenue and Net Income of Zhongsheng Group, 2013-2018

Revenue of Zhongsheng Group (by Business), 2013-2018

Revenue Structure of Zhongsheng Group (by Business), 2013-2018

Gross Margin of Zhongsheng Group, 2013-2018

Gross Margin of Zhongsheng Group (by Business), 2013-2017

New Car Sales Volume of Zhongsheng Group, 2011-2018

Luxury Brand New Car Sales Volume and % of Total Sales Volume of Zhongsheng Group, 2011-2018

Number of Zhongsheng Group’s Outlets (by Region), 2014-2018

Number of Zhongsheng Group’s Outlets (by Grade), 2011-2018

Number of Zhongsheng Group’s Outlets by Brand, as of 2018H1

National Layout of Zhongsheng Group, by end of 2018H1

Revenue and Net Income of DCH, 2013-2018

Revenue Breakdown of DCH (by Business), 2016-2018

Gross Margin of DCH, 2013-2018

Automobile & Automobile-related Business Customers of DCH

Revenue of DCH's Automobile and Automobile-related Business (by Region), 2013-2018

Revenue Structure of DCH's Automobile and Automobile-related Business (by Region), 2013-2018

Automobile Sales Volume of DCH (by Region), 2011-2018

Number of DCH’s 4S Shops and Showrooms, 2011-2018

Number of DCH’s Showrooms by Brand, 2015-2018

Revenue and Net Income of China Grand Auto, 2014-2018

Revenue Breakdown of China Grand Auto (by Business), 2015-2017

Gross Margin of China Grand Auto (by Business), 2015-2017

Number of Outlets of China Grand Auto by Region, by Jun 30, 2018

Number of China Grand Auto’s 4S Shops (by Type), as of Jun.30, 2018

New Car Sales Volume of China Grand Auto, 2014-2018

Number of Vehicles through Used Car Agent Transaction of China Grand Auto, 2015-2018

Number of Times with After-sales Maintenance of China Grand Auto, 2015-2018

Number of Vehicles with Financial Leasing Business of China Grand Auto, 2015-2018

Revenue and Net Income of ZhengTong Auto, 2013-2018

Revenue of ZhengTong Auto (by Business), 2013-2018

Revenue Structure of ZhengTong Auto (by Business), 2013-2018

Gross Margin of ZhengTong Auto (by Business), 2013-2018

National Layout of ZhengTong Auto, as of Jun.30, 2018

Number of ZhengTong Auto’s Business Outlets (by Type), as of Jun.30, 2018

New Car Sales Volume of ZhengTong Auto (by Brand), 2013-2018

New Car Revenue of ZhengTong Auto (by Brand), 2013-2018

Revenue of Shanghai Dongzheng Automotive Finance, 2015-2018

Industry Chain of Yongda Auto Business

Revenue and Net Income of Yongda Auto, 2013-2018

Revenue of Yongda Auto (by Business), 2013-2018

Revenue Structure of Yongda Auto (by Business), 2013-2018

Gross Margin of Yongda Auto, 2013-2018

Gross Margin of Yongda Auto (by Business), 2013-2018

Number of Outlets of Yongda Auto (by Type), as of June 30, 2018

Outlet Distribution of Yongda Auto in China, as of June 30, 2017

Brand Coverage of Yongda Auto, As of June 30, 2018

New Passenger Car Sales Volume of Yongda Auto (by Type), 2013-2018

New Sales Structure of Yongda Auto (by Brand), 2013-2018

Revenue from Self-operated Financial Business of Yongda Auto, 2013-2018

Revenue and Net Income of Grand Orient, 2013-2018

Revenue of Grand Orient (by Business), 2013-2018

Revenue Structure of Grand Orient (by Business), 2013-2018

Gross Margin of Grand Orient by Business, 2013-2018

Automobile Sales & Services and Business Model of Grand Orient

Revenue and % of Automobile Sales & Services of Grand Orient, 2013-2018

Revenue and Net Income of Baoxin Auto Group, 2013-2018

Revenue of Baoxin Auto Group (by Business), 2013-2018

Revenue Structure of Baoxin Auto Group (by Business), 2013-2018

Gross Margin of Baoxin Auto Group (by Business), 2013-2018

Sales Volume of Baoxin Auto Group (by Type), 2014-2018

Revenue of Automobile Sales of Baoxin Auto Group (by Type), 2013-2018

Revenue and Net Income of Harmony Auto, 2013-2018

Revenue of Harmony Auto (by Business), 2013-2018

Revenue Structure of Harmony Auto (by Business), 2013-2018

Gross Margin of Harmony Auto (by Business), 2013-2018

Number of Dealers Outlets of Harmony Auto, as of June 30, 2018

New Car Sales Volume of Harmony Auto, 2013-2018

Revenue and Net Income of Yaxia Automobile, 2013-2018

Revenue Breakdown of Yaxia Automobile by Business, 2013-2018

Revenue Structure of Yaxia Automobile by Business, 2013-2018

Gross Margin of Yaxia Automobile by Business, 2013-2018

Automobile Sales Volume of Yaxia Automobile, 2012-2017

Revenue from Auto Finance Business of Yaxia Automobile, 2013-2018

Revenue and Net Income of Materials Industry Zhongda Group Co., Ltd., 2014-2018

Revenue and Net Income of Yuantong Automobile, 2014-2018

Major Partners of LSH

Global Presence of LSH

Operation Network of Hengxin Automotive

Cooperated Brands of Hengxin Automotive

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...