ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Processor and Computing Chip

As automobiles are going smart, cockpit and intelligent driving require more efficient processors.

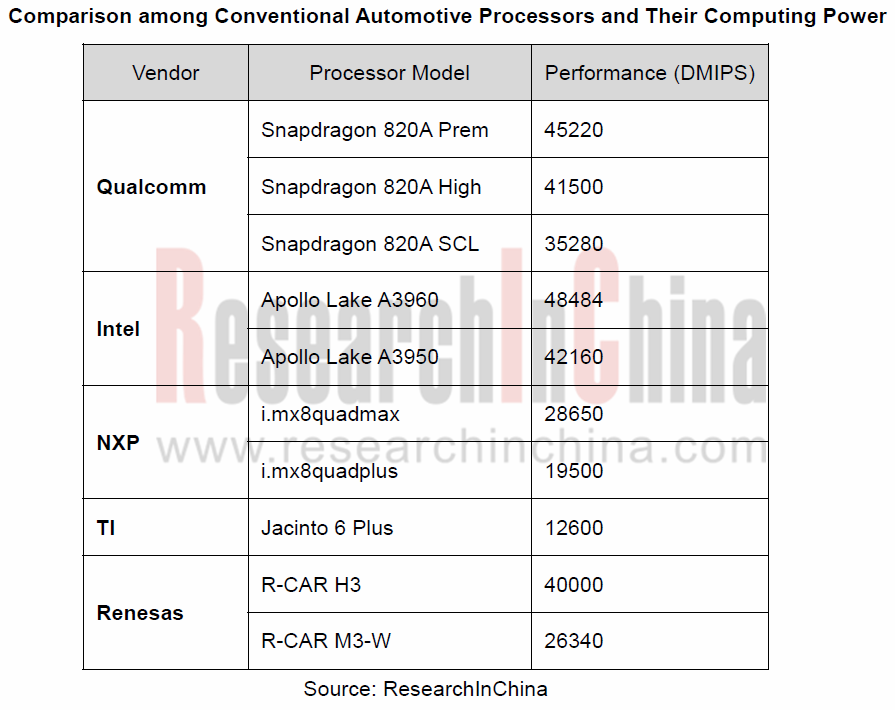

Full LCD instrument cluster with at least 3 or even 5 to 6 screens, will be an integral of a mainstream electronic cockpit solution which may be integrated with some local and cloud capabilities such as natural language processing (NLP), gesture control, fatigue detection, face recognition, AR HUD, HD map and V2X. So it can be said that cockpit has endless demand for computational resources, for instance, 50000DMIPS in 2020 and more after the year.

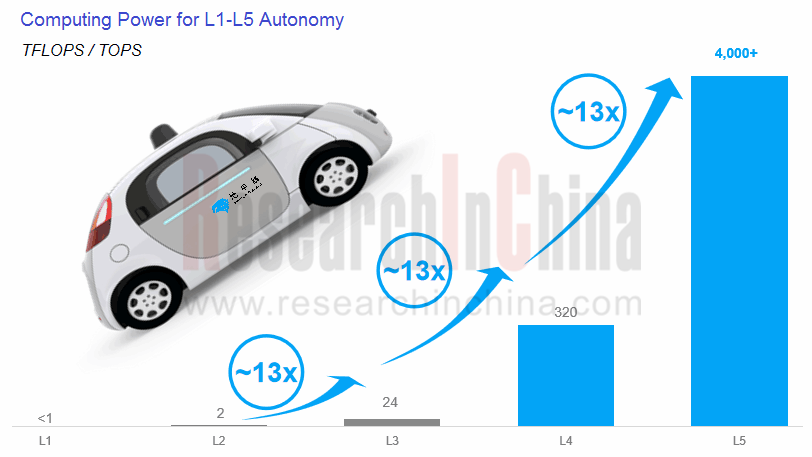

Autonomous driving needs processors that perform far better. According to Horizon Robotics’ summary of OEM demand, a higher level of automated driving means more orders of magnitude, namely, 2 TOPS for L2 autonomy, 24 TOPS for L3, 320 TOPS for L4 and 4,000+TOPS for L5.

Source: Horizon Robotics

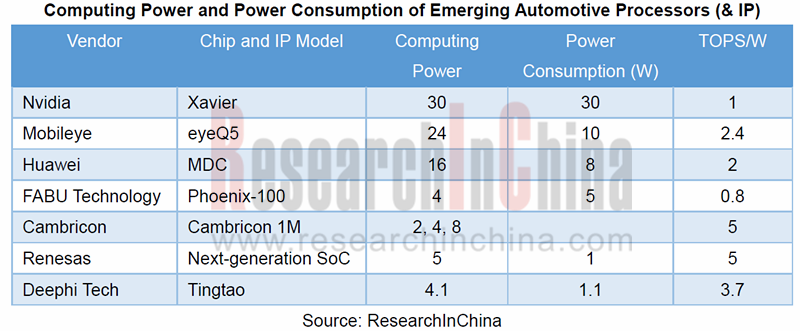

Only computing power is not enough. Complexity of automotive applications should be taken into account. That’s because an automotive processor also has to consider how much power is consumed, how much computing power is used or whether it is up to the automotive and safety standards or not.

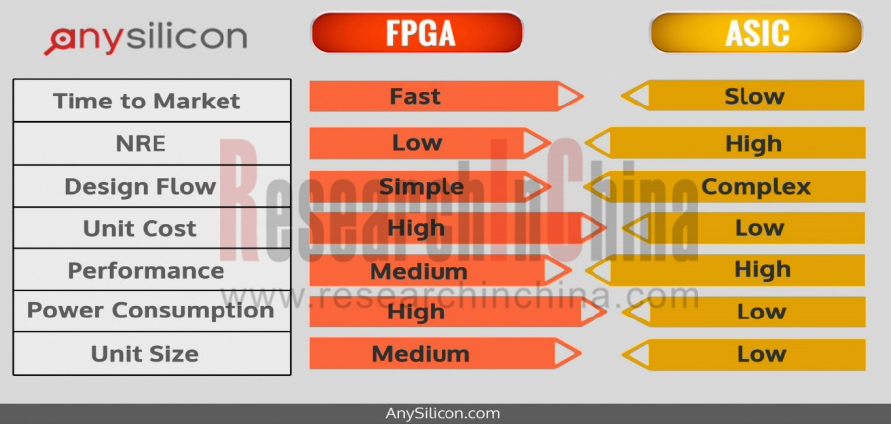

Automotive processor, also referred to as automotive computing chip, typically falls into three types: Application specific standard products (ASSP), like CPU and GPU; application specific integrated circuits (ASIC); field programmable gate arrays (FPGA). Conventional CPU and GPU have begun to find it hard to meet increasing new demand as AI computing is developing by leaps and bounds, and in terms of energy efficiency, underperform semi-custom FPGA and full-custom ASIC, both of which are booming.

By and large, FPGA and FPGA have their own merits and demerits, offering options for different areas

The huge demand from intelligent connected vehicle (ICV) for semiconductors (including processors) is an enticement for the inrush of consumer electronics processor vendors. Take example for Qualcomm, the fastest entrant whose 820E and 855E among other products have won great popularity in automotive sector. Of the top 25 OEMs worldwide, 18 have chosen the giant’s processors. Samsung, MediaTek, Huawei and even Apple follow suit to forge into the automotive semiconductor field.

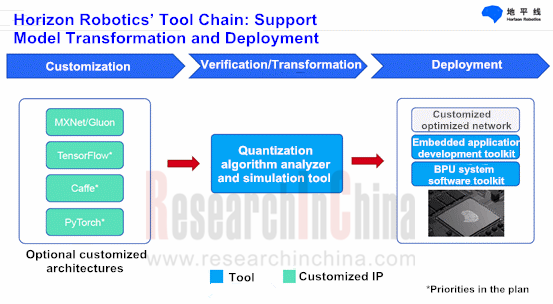

Processor vendors’ fight is more than in computing power area. Tool chain is also their battleground.

One competitive edge on processor lies in more tools for users’ easier and more efficient use of processors.

“No one will buy your GPU, if you don’t have software and applications”, said Greg Estes, the vice president of NVIDIA, at GTC CHINA 2018. With efforts, the inventor of the GPU has expanded its developer’s community with more than 1 million members and 600,000 GPU applications.

In 2017, NVIDIA unveiled new NVIDIA? TensorRT? 3 AI inference software that significantly boosts the performance and slashes the cost of inferencing from the cloud to edge devices, including self-driving cars and robots. With TensorRT, the user can get up to 40x faster inference performance comparing Tesla V100 to CPU. TensorRT inference with TensorFlow models running on a Volta GPU is up to 18x faster under a 7ms real-time latency requirement.

At CES 2019, NVIDIA didn’t release more efficient processors but enlarge its software tool kit. The company integrated its previous Drive Autopilot software, Drive AGX computing platform and DRIVE Works development tool into a platform, called Drive AP2X. DRIVE AutoPilot offers precise localization to the world’s HD maps for vehicle positioning on the road and creates a self-driving route. Drive Works provides developers with reference applications, tools and a complete module library.

Deephi Tech’s deep neural network development kit (DNNDK) is an equivalent of NVIDIA TensorRT. DNNDK offers a complete process from neural network inference to model compression, heterogeneous programming, compilation and operation deployment, which is a solution for deep learning algorithm engineers and software development engineers to accelerate AI computing load.

In July 2018, Xilinx acquired Deephi Tech in a USD300 million deal, helping the two-year-old firm promote FPGA.

Starting from EyeQ?5, Mobileye will support an automotive-grade standard operating system and provide a complete software development kit (SDK) to allow customers to differentiate their solutions by deploying their algorithms on EyeQ?5. The SDK may also be used for prototyping and deployment of Neural Networks, and for access to Mobileye pre-trained network layers.

In July 2018, Intel released OpenVINOTM Toolkit for accelerating development of high performance computer vision and deep learning vision application.

There are more than 70 AI start-ups globally, but few of them remain powerful enough to develop tool chain. And conforming to the active safety standards poses a bigger challenge to development of automotive computing chip tool chain.

In China, Horizon Robotics, an autonomous driving chip bellwether, provides full-stack perception software and full-stack tool chain. The way of coordinating algorithms, computing architecture and tool chain enables the firm’s BPU with a performance 30 times higher than GPU.

Automakers are deficient in deep learning capability of their processors as well, and they are going all out to improve weaknesses.

In early 2019, NXP joined forces with Kalray to co-develop an autonomous driving computing platform, with the aim of helping NXP gain muscle in deep learning. The partnership will combine NXP’s scalable portfolio of functional safety products for ADAS and Central Compute with Kalray’s high-performance intelligent MPPA (Massively Parallel Processor Array) processors. MPPA with an optimized tool and a library, enables the best performance of deep learning or vision algorithms.

Renesas plans to roll out next-generation R-CAR SoC for deep learning, which is expected to be mounted on L4 autonomous cars in 2020. The new SoC sample will be unveiled in 2019, and can compute 5 trillion times per second with power consumption of a mere 1W. Also, Renesas upgrades its processor tool chain and ecosystem via its Autonomy Platform.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...