Automotive Head-up Display (HUD) Industry Report: Installation of OEM HUD for Passenger Cars Soared by 94.1% Year on Year in China in 2018

In 2018, 308,900 units of OEM HUDs were installed in passenger cars in China, a 94.1% upsurge from a year earlier, according to our recent report -- Automotive HUD Industry Report, 2018-2019.

We worked out 2019Q1 lists of passenger car HUD supplier ranking by competitiveness with efforts from secondary research, data processing, and investigation & integration to evaluation & analysis. Denso came to the top spot among all suppliers and CarRobot ranked first among Chinese suppliers.

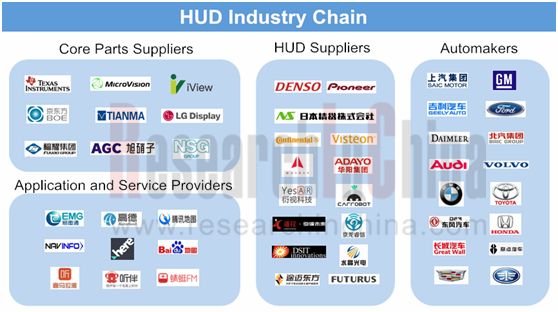

HUD was in vogue from 2014 to 2015. NAVDY that was a typical supplier then, however, doesn’t appear on our latest HUD industry chain.

NAVDY followed a digital light processing (DLP) technology roadmap, but DLP HUD had some drawbacks like complicated design and high cost. In TI’s case, its first-generation DLP chip only worked at temperatures of -40-85℃, short of automotive standards. Navdy raised USD42 million from Qualcomm and several other venture capital firms. Navdy HUD which should have been launched in the first quarter of 2015 came out just in recent two years. In October 2016, the product was put on sale, but its price surged to USD799 from the pre-sale price of USD299. In 2018, NAVDY had to go into liquidation after its failure in aftermarket.

Many a HUD start-up applied Navdy’s technology between 2016 and 2017. Using DLP as display system only left them a range of technology bottlenecks and often deferred launch of products. Most of them then turned to thin film transistor (TFT) display technology. Examples include CarRobot who designed its first-generation HUD with DLP technology but changed to TFT for its second-generation products.

In 2018, TI officially rolled out the 2nd-generation automotive chips DLP3030-Q1 and DLP5530-Q1 featuring smaller size and wider field of view and sufficing for AR head-up display (HUD). DLP3030-Q1 sees the digital micromirror device (DMD) footprint reduction by 65%, enabling smaller picture generation unit (PGU) design. It can operate between -40°C and +105°C

Technically, DLP is the best and most mature display technology by far. Therefore, Sunny Optical and other giants are still optimistic about HUD based on DLP technology, and they even spend tens of millions of yuan on introducing free-form surface mirror production lines.

The second HUD craze since 2018 arises from the emergence of AR HUD.

AR HUD, the augmented reality head-up display technology, superimposes some driving information in the driver's field of vision reasonably and combines it with real traffic conditions. Compared with HUD, AR HUD displays a wider range from a farther distance, and it is more complex. HUD is just a device that projects and displays information, while AR HUD needs to be deeply integrated with ADAS to achieve more advanced effects and functions.

Given the deep integration of AR HUD with ADAS, the burgeoning development of ADAS as a must for automotive intelligence has driven the demand for AR HUD.

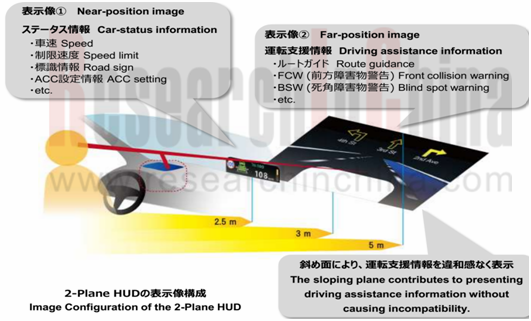

The image display of AR HUD is generally distributed in two or three layers. For instance, the AR-HUD of Nippon Seiki boasts three layers: the near field display layer, the far field display layer, and the side layer. The near field display layer is mainly a presentation of vehicle status, the far field display layer displays ADAS information, and the stereo side layer offers lane or navigation information.

Amid the intelligent connected trend of cars, any automotive electronic product is difficult to be independent. As an automotive electronic product, HUD has been an integral of the cockpit electronics solution and the overall ADAS solution.

Panasonic Automotive showcased its latest SPYDR 2.0 at CES 2019, which is a single-chip cockpit domain controller solution integrating Driver Monitoring System (DMS) with Head-Up Display (HUD). Besides, SPYDR 2.0 can integrate In-Vehicle Infotainment (IVI), dashboard, surround view system, Active Noise Control (ANC), HUD and four IVI displays on a platform

For this integration trend, traditional Tier1 giants enjoy first-mover advantages, whereas independent HUD suppliers have to establish close cooperation with other product suppliers. The collaboration modes -- Jiang Cheng + Baidu, Carrobot + China Unicom, Carrobot + AI Speech, etc. just follow the integration trend.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...