Global and China Automotive Radiator Industry Report, 2019-2025

-

May 2019

- Hard Copy

- USD

$3,000

-

- Pages:142

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

ZJF132

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

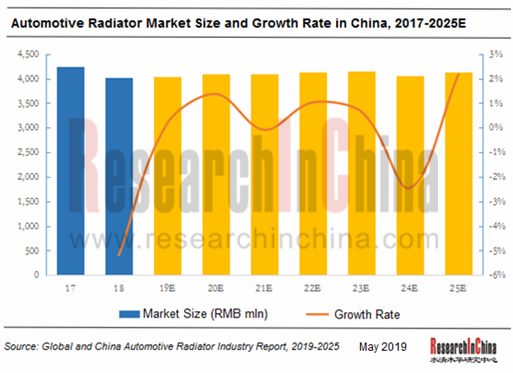

As an essential part of an automobile, the radiator’s demand hinges on growth of the automotive sector. In 2018, output and sales of automobiles in China declined by 4.2% and 2.8% from a year earlier to 27.809 million units and 28.081 million units, respectively, causing a year-on-year decrease of 4.2% in the demand for radiators to hit 27.809 million units with the market size of roughly RMB4,026 million, all of which arose from preferential purchase tax policy cancellation, macro-economy slowdown, China-US trade war and weaker consumer confidence, according to the data from China Association of Automobile Manufacturers (CAAM). It is expected that the sales drop of automobiles will be accompanied by less demand for radiators in China whilst the radiator prices are declining. Chinese radiator market will be worth RMB3,857 million and 30.21 million units will be demanded in 2025.

Automotive radiators are used in compact vehicles (including passenger cars and small/mini commercial vehicles), medium and large commercial vehicles and new energy vehicles. Market size of the three types of radiators reached RMB2,966 million, RMB753 million and RMB308 million in 2018, respectively, and are projected to be RMB2,510 million, RMB615 million and RM1,014 million in 2025, among which only those for new energy vehicles will rise.

The boom of new energy vehicles gives a boost to the radiator segment where the CAGR will range at 18.6% from 2018 to 2025. New energy vehicle radiator system is a new component designed to cool motor instead of engine that is the case in conventional fuel vehicle. Traditional thermal management system suppliers still remain superior in some technology areas, but some late entrants stand a chance of making breakthroughs in product, technology and brand.

In China, joint venture OEMs and local Chinese automakers have established own parts supply systems, or set up radiator branches or subsidiaries as their fixed suppliers. In contrast, only by superiorities in technology, quality and cost can external professional radiator vendors become the qualified suppliers. World-renowned automotive radiator companies have built factories independently or together with others in China. Examples include Behr, T.RAD, Denso, Modine, Valeo and Hanon. There are approximately 30 foreign-funded companies (including Sino-foreign joint ventures, cooperative businesses, and wholly foreign-owned enterprises) established in China, and they command much of the passenger car market because of fixed supply relationships with automakers; Chinese brands such as Zhejiang Yinlun Machinery Co., Ltd., Weifang Hengan Radiator Group Co., Ltd., Ningbo Lurun Cooler Manufacturing Co., Ltd. and Nanning Baling Technology Co., Ltd. are edging their way into OEM market with constant efforts, especially supply systems of homegrown automakers in the commercial vehicle field in which they have won a place.

The followings are highlighted in this report:

Automotive radiator (definition, classification, technical features, development trends, etc.);

Automotive radiator (definition, classification, technical features, development trends, etc.);

Global and China’s automobile production and sales as well as the output and sales volume of segmented products;

Global and China’s automobile production and sales as well as the output and sales volume of segmented products;

Global and China automotive radiator market (environment, size, competitive landscape);

Global and China automotive radiator market (environment, size, competitive landscape);

Automotive radiator market segments in China;

Automotive radiator market segments in China;

Technical features, market size and so forth of new energy vehicle radiators in China;

Technical features, market size and so forth of new energy vehicle radiators in China;

7 global automotive radiator manufacturers (operation, technical characteristics of their radiators, supply, development in China, among others);

7 global automotive radiator manufacturers (operation, technical characteristics of their radiators, supply, development in China, among others);

9 Chinese automotive radiator producers (operation, characteristics of their radiators, R&D, development strategy, etc.)

9 Chinese automotive radiator producers (operation, characteristics of their radiators, R&D, development strategy, etc.)

1 Overview

1.1 Definition

1.2 Classification

2 Global and China Automobile Market

2.1 Global Automotive Market

2.2 China’s Automotive Market

2.2.1 Market Overview

2.2.2 Recent Developments

3 Global and China Automotive Radiator Markets

3.1 Global Market

3.1.1 Market Size

3.1.2 Market Pattern

3.2 Chinese Market

3.2.1 Industrial Policy

3.2.2 Market Size

3.2.3 Competitive Landscape

4 Automotive Radiator Market Segments in China

4.1 Radiators for Passenger Cars

4.2 Radiators for Commercial Vehicle

5 New Energy Vehicle Cooling System

5.1 NEV Thermal Management System

5.2 Key Cooling Technologies for NEV

5.3 Market Size

6 World-renowned Manufacturers of Automotive Radiator

6.1 Calsonic Kansei

6.1.1 Profile

6.1.2 Operation

6.1.3 Automotive Radiator Business

6.1.4 Global Presence

6.1.5 Development in China

6.1.6 Development Planning

6.2 Mahle

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 R&D

6.2.5 Automotive Radiator Business

6.2.6 Development in China

6.3 Denso

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 R&D and Acquisitions

6.3.5 Automotive Radiator Business

6.3.6 Development in China

6.4 T.RAD

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Automotive Radiators

6.4.5 Development in China

6.5 Hanon Systems

6.5.1 Profile

6.5.2 Revenue

6.5.3 Revenue Analysis

6.5.4 Automotive Radiator Business

6.5.5 Development in China

6.6 Valeo SA

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Automotive Radiators

6.6.5 Business in China

6.7 Modine

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Radiators

6.7.5 Business in China

7 Leading Chinese Turbocharger Manufacturers

7.1 Zhejiang Yinlun Machinery Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 Radiators and Supply

7.1.6 Development Strategy

7.1.7 Latest Developments

7.2 Shanghai Aerospace Automobile Electromechanical Co., Ltd. (HT-SAAE)

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 SDAAC Automotive Air-Conditioning Systems Co., Ltd., Shanghai

7.2.5 erae Automotive

7.3 Weifang Hengan Radiator Group Co., Ltd.

7.3.1 Profile

7.3.2 Major Products

7.3.3 Marketing Network

7.4 Nanning Baling Technology Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 R & D and Investment

7.4.5 Radiator Business

7.5 Shandong Tongchuang Auto Cooling System Co., Ltd.

7.5.1 Profile

7.5.2 Operation

7.5.3 Revenue Structure

7.5.4 Major Products and Supply

7.6 South Air International

7.6.1 Profile

7.6.2 Major Products

7.6.3 Marketing Network

7.7 Ningbo Lurun Cooler Manufacturing Co., Ltd.

7.7.1 Profile

7.7.2 Major Products

7.7.3 Latest Developments

7.8 Nantong Jianghua Machinery Co., Ltd.

7.8.1 Profile

7.8.2 Major Products

7.9 Guangdong Faret Auto Radiator Co., Ltd.

7.9.1 Profile

7.9.2 Major Products

Diagram for Engine Heat Dissipation System

Automotive Radiators of Different Materials

Decomposition of Automotive Radiator

Automotive Radiators with Varied Core Structure

Classification of Automotive Radiators by Coolant Flow Direction

Global Automobile Output, 2013-2018

Top 25 Countries by Automobile Output, 2018

Global Output of Passenger Cars, 2012-2018

Global Output of Commercial Vehicle, 2012-2018

Global Automobile Output, 2018-2025E

China’s Automobile Output, 2010-2025E

Monthly Sales Volume of Passenger Cars, 2016-2018

Sales Volume of Passenger Cars by Type, 2017-2018

Monthly Sales Volume of New Energy Passenger Vehicle in China, 2016-2018

Sales Percentages of New Energy Vehicle by Type, 2018

Global Installations of Automotive Radiator, 2014-2025E

Demand Structure of Global Automotive Transmission Market (by Country), 2014-2025E

Competition among Foreign Suppliers of Automotive Cooling System

Related Policies on Automotive Radiator Industry in China

Installations of Automotive Radiator in China, 2015-2025E

Competitive Landscape of Chinese Automotive Radiator Market

Chinese Market Size of Passenger Car Radiators, 2017-2025E

Chinese Market Size of Commercial Vehicle Radiators, 2017-2025E

Core Parts of a Typical New Energy Vehicle

Comparison of Differences between New Energy Vehicle and Fuel Vehicle in Thermal Management System

Relationship of New Energy Vehicle Battery Temperature with Service Life

Relationship of New Energy Vehicle Battery Capacity with Temperature

Comparison of New Energy Vehicle Battery Cooling Technologies

Battery Cooling Solutions Applied by Some NEV Makers at Home and Abroad

China’s Output of EVs and the EV Radiator Market Size, 2017-2025E

Operation of CalsonicKansei, FY2018

Automotive Heat Exchange Products of CalsonicKansei

Automotive Radiators of CalsonicKansei

Global Presence of CalsonicKansei

Global Workforce Structure of CalsonicKansei

Production and Supply Layout of CalsonicKansei

Automotive Radiator Supply of CalsonicKansei in Recent Years

Layout of CalsonicKansei in China

Profile of CalsonicKansei Components (Wuxi) Co., Ltd.

Overview of CalsonicKansei’s "Compass 2021" Strategy

Key Implementation Fields of CalsonicKansei’s "Compass 2021" Strategy

Key Implementation Paths of CalsonicKansei’s "Compass 2021" Strategy

Business Structure of MAHLE GmbH

Major Investment Events of MAHLE GmbH, 2014-2018

Sales and Net Income of MAHLE GmbH, 2013-2018

Sales of MAHLE GmbH by Business, 2016-2018

Sales of MAHLE GmbH by Region, 2016-2018

Global R&D Footprints of MAHLE GmbH

R&D Costs and % of Total Revenue of MAHLE GmbH, 2012-2018

Major Automotive Thermal Management System Products of MAHLE GmbH

Engine Cooling Modules of MAHLE GmbH

Low-temperature Radiators of MAHLE GmbH

Radiators of MAHLE GmbH

Equity Structure of Shanghai MAHLE Thermal Systems Co., Ltd.

Profile of Chengdu MAHLE Automotive Thermal Systems Co., Ltd.

Cooling System Supply of Chengdu MAHLE Automotive Thermal Systems Co., Ltd. in Recent Years

Profile of Shenyang MAHLE Automotive Thermal Systems Co., Ltd.

Cooling System Supply of Shenyang MAHLE Automotive Thermal Systems Co., Ltd. in Recent Years

Profile of Dongfeng MAHLE Thermal Systems Co., Ltd.

Denso’s Global Presence

Denso’s Revenue and Net Income, FY2014-FY2019

Denso’s Revenue by Business, FY2018-FY2019

Denso’s Revenue by Country / Region, FY2014-FY2019

Denso’s Revenue by Customer, FY2018-FY2019

R&D Costs and % of Total Revenue of Denso, FY2014-FY2019

Denso’s Main Thermal Control Products

Denso’s Radiator Supply in Recent Years

Profile of Guangzhou Denso Co., Ltd.

Profile of DENSO (Tianjin) Thermal Products Co., Ltd.

Global Presence of T.RAD

Revenue and Net Income of T.RAD, FY2014-FY2019

Net Sales of T.RAD by Business, FY2017-FY2019

Net Sales of T.RAD by Country / Region, FY2017-FY2019

Sales of T.RAD by Product, FY2019

Sales of T.RAD by Customer, FY2019

Main Products of T.RAD

Radiator Supply of T.RAD in Recent Years

Future Development Trends of T.RAD's Automotive Radiators

Net Sales and Growth Rate of T.RAD in China, FY2016-FY2019

Profile of T.RAD (Zhongshan) Co., Ltd.

Automotive Cooling System Supply of T.RAD (Zhongshan) Co., Ltd. in Recent Years

Profile of Qingdao T.RAD

Automotive Cooling System Supply of Qingdao T.RAD in Recent Years

Global Presence of Hanon Systems

Operating Revenue and Net Income of Hanon Systems, 2012-2018

Revenue Structure of Hanon Systems by Region, 2018

Revenue Structure of Hanon Systems by Customer, 2018

Quarterly Orders of Hanon Systems, 2016-2018

Main Thermal Management System Products of Hanon Systems

Cooling Modules of Hanon Systems

Profile of Fawer Hanon Automotive Thermal System (Changchun) Co., Ltd.

Radiator Supply of Fawer Hanon Automotive Thermal System (Changchun) Co., Ltd. in Recent Years

Profile of Hanon Beijing

Radiator Supply of Hanon Beijing in Recent Years

Valeo’s Revenue and Net Income, 2012-2018

Valeo’s Revenue Structure by Division, 2013-2018

Valeo’s Revenue Structure by Region, 2013-2018

Valeo’s Revenue Structure by Market, 2013-2018

Overview of Valeo’s Thermal Management Segment

Valeo’s Main Thermal Management Products

Valeo’s Powertrain Cooling Modules

Valeo’s Powertrain Cooling Module Supply in Recent Years

Profile of Valeo Engine Cooling (Foshan) Co., Ltd.

Profile of Tianjin Valeo Xinyue Auto Parts Co., Ltd.

Modine’s Revenue and Net Income, FY2014-FY2019

Modine’s Modine Net Sales by Business, FY2017-FY2019

Modine’s Net Sales by Country / Region, FY2016-FY2019

Modine’s Main Automotive Cooling System Products

Modine’s Automotive Cooling System Supply in Recent Years

Profile of Modine Thermal Systems (Shanghai) Co., Ltd.

Global Layout of Zhejiang Yinlun Machinery

Development Course of Zhejiang Yinlun Machinery

Revenue and YoY Change of Zhejiang Yinlun Machinery, 2012-2018

Net Income and YoY Change of Zhejiang Yinlun Machinery, 2012-2018

Revenue Structure of Zhejiang Yinlun Machinery (by Products), 2014-2018

Revenue Structure of Zhejiang Yinlun Machinery (by Regions), 2012-2018

Gross Margin of Zhejiang Yinlun Machinery (by Products), 2014-2018

Commercial Vehicle Front-end Cooling Modules of Zhejiang Yinlun Machinery

Passenger Car Front-end Cooling Modules of Zhejiang Yinlun Machinery

Main Radiators of Zhejiang Yinlun Machinery

Development Strategy of Zhejiang Yinlun Machinery

Global Layout of HT-SAAE’s Automotive Thermal System Business

Revenue and Net Income of HT-SAAE, 2011-2018

Operating Revenue of HT-SAAE by Product, 2016-2018

Revenue Structure of HT-SAAE by Region, 2016-2018

SDAAC’s Main Products

Revenue and Total Profit of SDAAC, 2016-2018

Output, Sales Volume and Inventory of SDAAC’s Main Products, 2018

Capacity and Capacity Utilization of SDAAC’s Main Products, 2018

OEM and AM Sales of SDAAC’s Main Products, 2018

Major Automotive Thermal System Management Products of erae Automotive

Global Production and R&D Layout of erae Automotive

Global Customer Distribution of erae Automotive

Output, Sales Volume and Inventory of erae Automotive’s Main Products, 2018

Capacity and Capacity Utilization of erae Automotive’s Main Products, 2018

OEM and AM Sales of erae Automotive’s Main Products, 2018

Passenger Car Radiators of Weifang Hengan Radiator

Commercial Vehicle Radiators of Weifang Hengan Radiator

New Energy Vehicle Radiators of Weifang Hengan Radiator

Global Marketing Network of Weifang Hengan Radiator

Revenue and YoY Change of Baling, 2014-2018

Net Income and YoY Change of Baling, 2014-2018

Revenue Breakdown of Baling (by Business Unit), 2017-2018

Revenue Breakdown of Baling (by AREA), 2017-2018

R&D Costs and % of Total Revenue of Baling, 2014-2018

Main Radiators of Nanning Baling Technology

Main Cooling Modules of Nanning Baling Technology

Major Customers of Nanning Baling Technology

Revenue and Net Income of Shandong Tongchuang Auto Cooling System, 2011-2018

Operating Revenue of Shandong Tongchuang Auto Cooling System by Product, 2016-2018

Main Automotive Radiators of Shandong Tongchuang Auto Cooling System

Global Sales Layout of Shandong Tongchuang Auto Cooling System

Strategic Layout of South Air International

Radiator Series of South Air International

Market Distribution of South Air International

Main Radiators of Ningbo Lurun Cooler Manufacturing

Marketing Network of Ningbo Lurun Cooler Manufacturing

Aluminum Radiators of Nantong Jianghua Machinery

Copper Radiators of Nantong Jianghua Machinery

Aluminum Radiators of Guangdong Faret Auto Radiator

Expansion-type Tube Radiators of Guangdong Faret Auto Radiator

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...