Report on Chinese Automakers’ Telematics Products in 2019

-

Jun.2019

- Hard Copy

- USD

$3,000

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

LY008

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

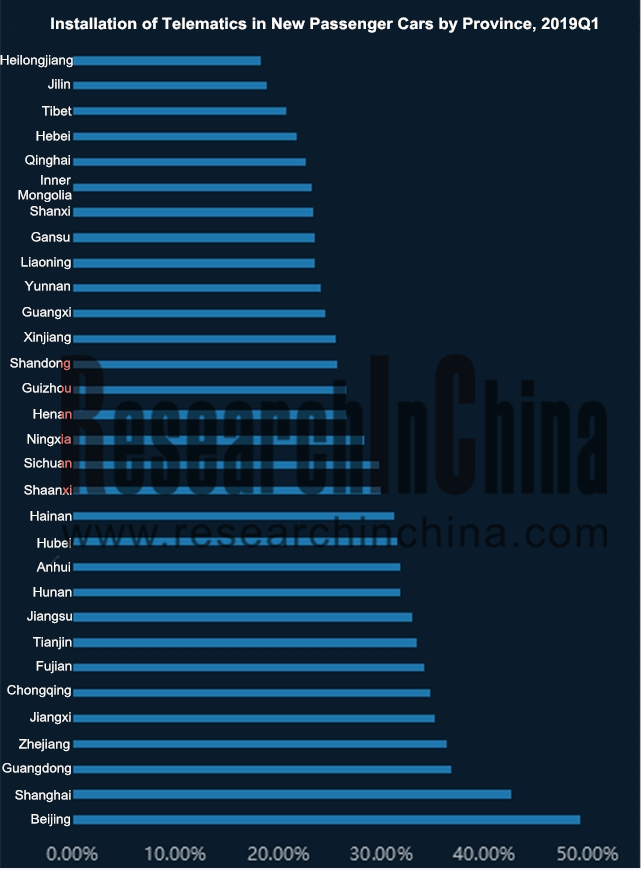

It is Shown from the Findings of Our Research on Chinese Automakers’ Telematics Products: Telematics is Available to 49% New Vehicles in Beijing, Compared with a Mere 18% in Heilongjiang.

In the first quarter of 2019, Beijing, Shanghai and Guangdong stay ahead of other provinces in availability of telematics in new passenger cars, with rates of 49.2%, 42.5% and 36.7%, respectively; Jilin and Heilongjiang were left behind with installation rates of 18.9% and 18.2%, respectively, far below the country’s average of 30.2%, according to Report on Chinese Automakers’ Telematics Products in 2019 we released recently.

Automotive telematics solution falls into built-in and external types. Built-in telematics system enables vehicles with direct connectivity; external telematics system offers connectivity for vehicles via a smartphone or other devices. Built-in telematics system has become the mainstream configuration for new vehicles as ever more of them used the system in recent two years, making the external type give its way to it. In 2018, telematics (built-in + external) installation rate in China just rose a bit.

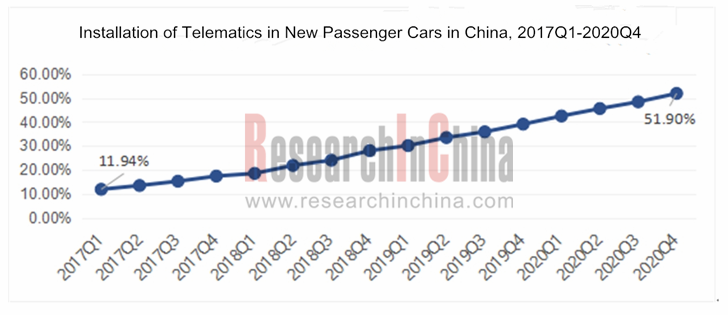

Only in terms of built-in telematics system, installation of telematics in new vehicles has soared, expectedly up to 51.9% in the fourth quarter of 2020 compared with a mere 11.94% in the first quarter of 2017.

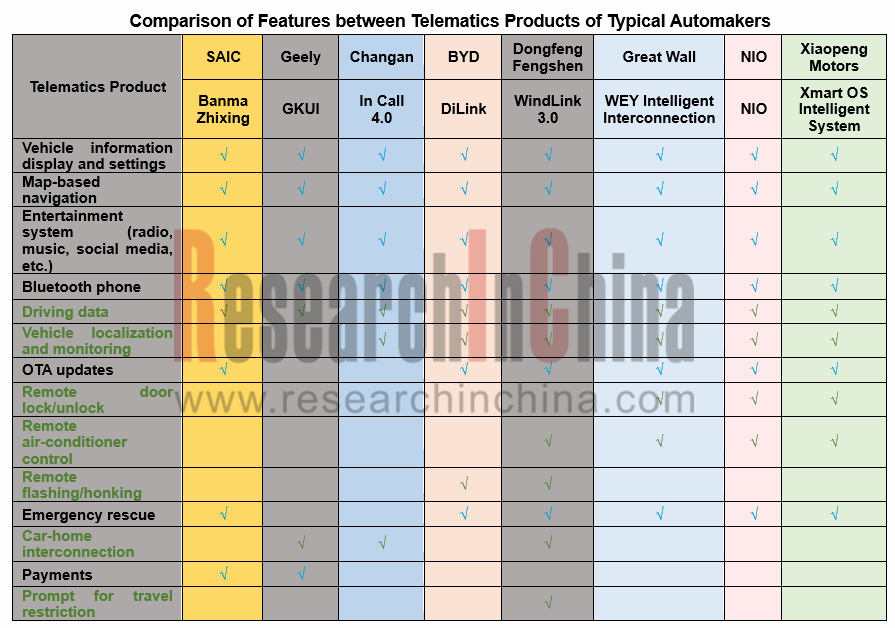

The report compares and analyzes telematics products of more than 10 Chinese automakers from the aspects as follows: features, technology providers, human-machine interaction, communications, map and navigation, voice, big data and service, dashboard and central console, car owner’s APP, remote control, cloud technology, in-vehicle infotainment, mobility services, life services, car-home interconnection deployment, pre- and after-sale services, charge mode, installation of telematics products, installation by province and municipality, etc.

1 China Telematics Industry

1.1 Overview of Telematics

1.1.1 Definition

1.1.2 System Architecture

1.1.3 Industry Chain

1.1.4 Telematics Based on Big Data Platform Extends to Service Ecosystem Market

1.1.5 Development Stage

1.2 Telematics Market

1.2.1 Installation of Telematics in New Passenger Cars in China, 2017Q1-2020Q4

1.2.2 Telematics Installation of Main Passenger Car Brands, 2017-2019

1.2.3 Installation of Telematics in New Vehicles by Province, 2017Q1-2019Q1

1.2.4 Installation and Market Shares of Main Telematics Products, 2018-2019

1.3 Telematics Development Trends

1.3.1 Telematics Terminal

1.3.2 Trend toward Integration between Service Ecosystem and Map-based Navigation

1.3.3 Related Laws, Regulations and Standards are Getting Improved

1.3.4 Multi-channel Interaction and Fusion

1.3.5 Heuristic Active Telematics Voice Service

1.3.6 Vehicle Entertainment Contents are Getting Enriched

2 Comparison of Features between Telematics Products of Typical Automakers

2.1 Comparison of Overall Telematics Layout

2.1.1 Overview of Telematics Products of Main Automakers

2.1.2 Telematics Products and Development Plans of Automakers

2.1.3 Telematics Technologies and Service Suppliers of Main Automakers

2.1.4 Comparison of Human-computer Interaction Functions between Main Automakers

2.1.5 4G is the First Choice for Telematics Communications and Manufacturers are Working to Deploy 5G

2.1.6 Automakers and Communication Firms Make Joint Efforts to Promote the Development of 5G Telematics

2.1.7 Map-based Navigation Service Suppliers of Typical Automakers

2.1.8 Voice Technology Suppliers of Typical Automakers

2.2 Comparison of Functions between Telematics Software and Hardware

2.2.1 Comparison of Highlights between Telematics Products of Typical Automakers

2.2.2 Comparison of Features between Telematics Products of Typical Automakers

2.2.3 Comparison of Telematics Big Data and Service between Typical Automakers

2.2.4 Comparison of Dashboard and Central Console between Typical Automakers

2.2.5 Comparison of Voice Control Functions between Typical Automakers

2.2.6 Comparison of Telematics APP Capabilities between Typical Automakers

2.2.7 Comparison of Remote Control Functions between Typical Automakers

2.2.8 Cloud Technology Suppliers and Functions Available of Typical Automakers

2.3 Telematics Services

2.3.1 Operating Value-added Service

2.3.2 Telematics Service Ecosystem is Expanding

2.3.3 Comparison of Vehicle Entertainment Capabilities between Typical Automakers

2.3.4 Comparison of Mobility Services between Typical Automakers

2.3.5 Comparison of Telematics-based Living Services between Typical Automakers

2.3.6 Car-home Interconnection Layout of Typical Automakers

2.3.7 Comparison of Telematics-based Pre- and After-sale Services between Typical Automakers

2.3.8 Comparison of Telematics Service Charge Mode between Typical Automakers

3 Telematics Products of Traditional Chinese Auto Brands

3.1 Passenger Car Telematics Products of SAIC

3.1.1 Overview of Passenger Car Telematics Products of SAIC

3.1.2 Telematics Suppliers and Partners of SAIC

3.1.3 Voice Control & Recognition

3.1.4 New Map-based Navigation Technology—AR-Driving

3.1.5 SAIC Telematics: IVI OS and APP

3.1.6 SAIC Telematics: Network Communications

3.1.7 SAIC Big Data Applications

3.1.8 SAIC Telematics: Dashboard & Central Console

3.1.9 MG HS Cockpit

3.1.10 MG HS Service Ecosystem

3.1.11 Installation of Passenger Car Telematics Products of SAIC, 2017Q1-2019Q1

3.1.12 Installation of SAIC AliOS by Province, 2017Q1-2019Q1

3.2 Geely GKUI

3.2.1 Overview of Geely GKUI

3.2.2 GKUI System Core

3.2.3 G-ID

3.2.4 GKUI Cloud Platform

3.2.5 Geely GKUI: User Interface (UI)

3.2.6 Geely GKUI: Map-based Navigation

3.2.7 Geely GKUI: Payment Platform

3.2.8 Geely GKUI: Network Communications

3.2.9 Geely GKUI: Intelligent Vehicle Voice Assistant

3.2.10 Geely GKUI: 5G NR Technology Co-developed with Others

3.2.11 Geely GKUI: Ecosystem Partners

3.2.12 Digital Operation Plan of Geely

3.2.13 Installation of Telematics Products of Geely, 2017Q1-2019Q1

3.2.14 Installation of Geely GKUI by Province, 2017Q1-2019Q1

3.3 Changan

3.3.1 Overview of Changan In-Call

3.3.2 Main Functions of In-Call

3.3.3 In-Call: Map-based Navigation

3.3.4 In-Call: Zhiyin Huoban APP

3.3.5 Intelligent Voice Assistant—“Xiaoan”

3.3.6 In-Call: Network Communications

3.3.7 Changan Embarks on Joint Development of LTE-V and 5G Telematics

3.3.8 Set up a Joint Venture with Tencent in Intelligent Connected Vehicle Field

3.3.9 InCall Partnered with JD Weilian

3.3.10 In-Call: Ecosystem Partners

3.3.11 Changan “Dubhe” Strategy

3.3.12 Changan Intelligent Connection Plan

3.3.13 Installation of Telematics Products of Changan, 2017Q1-2019Q1

3.3.14 Installation of Changan InCall by Province, 2017Q1-2019Q1

3.4 BYD

3.4.1 Overview of BYD DiLink

3.4.2 BYD DiPad

3.4.3 BYD Di Cloud

3.4.4 BYD Di Ecosystem

3.4.5 BYD Di Openness

3.4.6 Smart Bracelet Key--Di Band

3.4.7 DiLink: Natural Speech Recognition

3.4.8 DiLink: Map-based Navigation

3.4.9 DiLink: Network Communications

3.4.10 D++ Open Ecosystem

3.4.11 DiLink: Suppliers and Partners

3.4.12 Installation of Telematics Products of BYD, 2017Q1-2019Q1

3.4.13 Installation of DiLink by Province, 2017Q1-2019Q1

3.5 Dongfeng WindLink

3.5.1 Overview of Dongfeng Fengshen WindLink3.0

3.5.2 Highlights of Dongfeng Fengshen WindLink3.0

3.5.3 WindLink3.0 Human-machine Interaction

3.5.4 WindLink Map-based Navigation

3.5.5 WindLink App 3.0

3.5.6 WindLink3.0 Network Communications

3.5.7 Dongfeng Fengshen Application Ecosystem

3.5.8 Suppliers and Partners

3.5.9 WindLink3.0 Development Plan

3.5.10 Installation of Telematics Products of Dongfeng, 2017Q1-2019Q1

3.5.11 Installation of WindLink by Province, 2017Q1-2019Q1

3.5.12 Installation of Venucia Intelligent Connection by Province, 2017Q1-2019Q1

3.6 Great Wall Motor

3.6.1 Great Wall WEY Intelligent Interconnection

3.6.2 Great Wall WEY·Road APP

3.6.3 WEY Intelligent Interconnection: Human-Machine Interaction

3.6.4 WEY Intelligent Interconnection: Voice Control & Recognition

3.6.5 WEY Intelligent Interconnection: Map-based Navigation

3.6.6 WEY Intelligent Interconnection: Infotainment System

3.6.7 WEY Intelligent Interconnection: Connectivity

3.6.8 WEY Intelligent Interconnection: Suppliers and Partners

3.6.9 WEY Intelligent Interconnection: Business Model

3.6.10 5G Intelligent Connectivity Layout

3.6.11 Cooperated with Baidu on Telematics

3.6.12 Launched “C+ Intelligent Strategy”

3.6.13 Cooperated with JD on Smart Home and Car Delivery

3.6.14 Installation of Telematics Products of Great Wall, 2017Q1-2019Q1

3.6.15 Installation of Haval Interconnection by Province, 2017Q1-2019Q1

3.6.16 Installation of WEY Intelligent Interconnection by Province, 2017Q1-2019Q1

4 Telematics Products of Emerging Chinese Auto Brands

4.1 NIO

4.1.1 Profile

4.1.2 NOMI Vehicle Artificial Intelligence System

4.1.3 Map-based Navigation

4.1.4 Human-Machine Interaction

4.1.5 NIO APP

4.1.6 NIO Service

4.1.7 Suppliers and Partners

4.1.8 “Car Delivery” Layout

4.2 Xiaopeng Motors

4.2.1 Profile

4.2.2 X-mart OS Intelligent System

4.2.3 Xiao P AI-driven Voice Assistant

4.2.4 XPENG APP

4.2.5 XPENG: Map-based Navigation

4.2.6 Alibaba Cloud Bastion Host Information Security Technology

4.2.7 XPENG: Human-Machine Interaction

4.2.8 XPENG: G3 Network Communications

4.2.9 Business Model

4.2.10 “XPENG+” Plan

4.2.11 XPENG Vehicle Application Ecosystem

4.2.12 XPENG: Telematics Suppliers and Partners

4.3 Weltmeister (WM Motor)

4.3.1 Profile

4.3.2 Weltmeister Zhixing App

4.3.3 Weltmeister EX5: Human-Machine Interaction

4.3.4 Weltmeister EX5: Main Parameter & Intelligent Interaction

4.3.5 Weltmeister EX5: Cockpit

4.3.6 Partners

4.3.7 Car-home Interconnection Layout

4.3.8 Ride-hailing Mobility Layout

4.3.9 Pioneer Service Plan

4.4 Byton

4.4.1 Profile

4.4.2 Human-Machine Interaction

4.4.3 Byton APP

4.4.4 Byton Experience

4.4.5 BYTON Life

4.4.6 Business Model

4.5 CHJ Automotive

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...