Global and China Telematics-Box(T-Box) Industry Report, 2019

-

July 2019

- Hard Copy

- USD

$3,200

-

- Pages:124

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

YSJ106

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

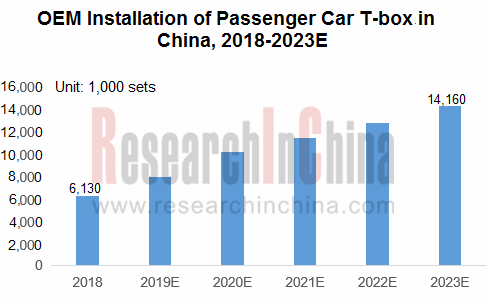

More than 14 Million Passenger Cars will be Equipped with T-Box in China in 2023

In China, passenger car T-Box installation in OEM market reached 6.13 million sets in 2018, before 2.25 million ones were installed in the first four months of 2019, a spurt of 28.9% from the same period of last year; it is predicted that the figure will hit 14.16 million in 2023, according to our Global and China T-BOX Industry Report, 2019.

T-Box (Telematics-Box), also called telematics control unit (TCU), refers to an automotive embedded system installed to control and track vehicles, including GPS unit, external interface electronic processing unit for mobile communications, microcontroller, mobile communication unit and memory. T-Box is able to acquire core vehicle data through communicating with CAN bus to send instructions and information, enabling online applied features from remote monitoring and remote control to safety monitoring & warning and remote diagnosis so that vehicles and telematics service providers (TSP) can be connected.

T-Box will deliver more powerful capabilities. The new-generation T-BOX products are mainly composed of mobile communication unit (4G/5G), C-V2X communication unit, GNSS-based high accuracy positioning module, microprocessor, in-vehicle bus controller and memory. Besides satisfying general needs, T-Box tends to be a connected controller for vehicle-to-cloud platform, vehicle-to-vehicle and vehicle-to-infrastructure communications in real time among all traffic participants. It plays a key role in intelligent connected vehicles and government’s ambition of intelligent transportation system.

In the Chinese passenger car T-Box market, vendors like LG, Continental, Shanghai Changxing Software, Huawei and Flaircomm Microelectronics, are the leading forces.

Continental ships at least 2 million sets of T-Box annually, and over 30 million connected vehicles having used its devices.

The 5G T-BOX being developed by Continental is integrated with not only 4G/5G network access technology but also DSRC and C-V2X communication technologies.

Wuhan Intest Electronic Technology Co., Ltd. (Intest for short), a conventional T-BOX vendor that has supplied passenger car T-BOX for BAIC BJEV, also expanded into the commercial vehicle market in recent years, with more than 40 OEM clients such as Zhongtong Bus, Nanjing Golden Dragon Bus, Beiqi Foton Motor, Geely New Energy Commercial Vehicle Group, Brilliance Renault New Energy Commercial Vehicle and BYD Commercial Vehicle.

Intest projected to develop fifth-generation terminal inBOX5.0 in 2018 as a preparation for the introduction of 5G communication in 2019. The new product will feature inertial navigation based on C-V2X communications, and improved and upgraded technologies like automotive Ethernet, CAN FD and Beidou high accuracy positioning. In response to the intelligent connected vehicle (ICV) development tendency, Intest also has planned development of “smart antenna” products using its inBOX5.0 technology platform, and will launch them on market in the form of usual TCU and smart antenna once they are developed.

Another T-BOX bellwether Flaircomm Microelectronics rolled out Ethernet architecture-based T-BOX 4.0 in March 2019, being featured as follows: computing power of MCU and MPU gets improved significantly; 4G wireless communications are subject to LTE CAT6 and vehicle body wireless communications support 802.11ac & BT 5.0, with ever higher bit rates; capabilities like TMPS and Bluetooth key are added; the latest 100base T1 automotive Ethernet bus becomes available and speed of CAN-FD bus is 16 times faster than the previous ones; AUTOSAR standard of latest version is supported.

1 Overview of T-Box

1.1 Definition

1.2 Main Functions

1.3 Composition and Working Principle

2 Global T-Box Market

2.1 Overview

2.1.1 Market Size

2.1.2 Characteristics

2.1.3 Competitive Pattern and Supply Relationships

2.2 China T-Box Market

2.2.1 Market Size (Installation)

2.2.2 Main Passenger Car OEM T-BOX Suppliers in China and Their Market Shares

2.2.3 Characteristics (by Price)

2.2.4 Characteristics (by Country)

2.2.5 Automakers Using T-Box and Their Models Equipped with the Device

2.2.6 Main T-Box Vendors

2.2.7 Policies

2.3 T-Box Market Trends

2.3.1 Global T-Box Market Forecast

2.3.2 China T-Box Market Forecast

2.3.3 Long-lasting Challenges in T-Box Development

2.3.4 Next-generation T-Box Products

3 Foreign T-Box Suppliers

3.1 LG Electronics

3.1.1 Profile

3.1.2 Main Products (Vehicle Components)

3.1.3 T-Box Products

3.2 Continental

3.2.1 Profile

3.2.2 T-Box Solutions

3.2.3 Development Directions

3.3 Harman

3.3.1 Profile

3.3.2 T-Box Business

3.3.3 Development Plan

4 Chinese T-Box Suppliers

4.1 Huawei

4.1.1 Profile

4.1.2 Deployments in Automotive Field

4.1.3 Development History of T-Box

4.1.4 T-Box Solutions

4.1.5 IoT Platform

4.2 Shenzhen Thread Technology Co., Ltd.

4.2.1 Profile

4.2.2 Main Products

4.2.3 Application of Thread T-Box in Time-sharing Field

4.2.4 Thread T-Box Application Cases in Time-sharing Field

4.2.5 Application of Thread T-Box in Logistics Field

4.2.6 Main Clients of Thread T-Box

4.3 Flaircomm Microelectronics, Inc.

4.3.1 Profile

4.3.2 Main Products

4.3.3 Partners

4.4 Wuhan Intest Electronic Technology Co., Ltd.

4.4.1 Profile

4.4.2 T-Box Products

4.4.3 T-Box Solutions

4.4.4 Partners

4.5 Shenzhen Soling Industrial Co., Ltd.

4.5.1 Profile

4.5.2 Operation

4.5.3 Product Lines

4.5.4 Partners

4.6 Pateo Inc.

4.6.1 Profile

4.6.2 Business Layout

4.6.3 T-Box Products

4.6.4 Main Clients

4.6.5 Ecosystem Partners

4.7 Neusoft Corporation

4.7.1 Profile

4.7.2 T-Box Product Lines

4.7.3 T-Box Business

4.8 Jiangsu TIANAN Smart Science & Technology Co., Ltd.

4.8.1 Profile

4.8.2 Business

4.8.3 T-Box Solutions

4.9 Beijing Yuantel Technology Co., Ltd.

4.10 Shanghai Changxing Software Co., Ltd.

4.11 Steelmate Co., Ltd.

5 Remote Control Functions of OEMs

5.1 Remote Control Functions of Skoda Models

5.2 Remote Control Functions of Buick Models, 2019Q1

5.3 Remote Control Functions of BMW New Models, 2019Q1

5.3.1 BMW RSU Technology

5.4 Remote Control Functions of KIA New Models, 2019Q1

5.5 Remote Control Functions of Ford New Models, 2019Q1

5.6 Remote Control Functions of BYD New Models, 2019Q1

5.6.1 Remote Driving Function of BYD New Models

5.7 Remote Control Functions of Geely New Models, 2019Q1

5.8 Remote Control Functions of SAIC Passenger Car New Models, 2019Q1

5.9 Remote Control Functions of Changan New Models, 2019Q1

5.10 Comparison of Remote Control Functions between New Models, 2019Q1

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...