Automotive Voice Market: Installation in New Passenger Cars in China Hit 28.7%

As software and hardware technologies advance, voice has been a key way for people to communicate with machines, particularly in automotive field where big auto brands are racing to launch the capability.

In 2019H1, 28.7% of new passenger cars on offer in China carried voice capability, with installation soaring by 57.8% from the same period of last year; brands that largely equipped their vehicles with the function included Geely, Nissan, Buick and Changan.

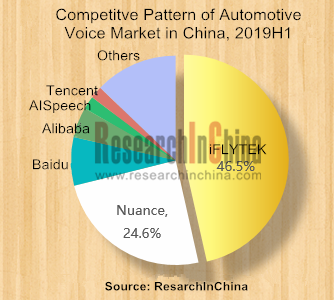

In 2018, China’s automotive voice market size ballooned by 73.5% year on year. Market competition is characterized by the following:

iFLYTEK as a bellwether in the market, swept 46.5% shares, and developed joint-venture brand customers beyond homegrown automakers.

Cerance (Nuance) is a voice provider for joint-venture brands, with a market share of 24.6% in the first half of 2019. Its voice convergence solutions have been an option for several companies.

Vehicle models packing voice technology of Baidu, Alibaba and Tencent (BAT), have begun to be spawned since 2018. Among BAT, Baidu is the most aggressive; Alibaba slows down in installation; Tencent will step forward by developing voice-enabled WeChat vehicle version and applets.

As the biggest speech provider in China, iFLYTEK has established a foothold in automotive field for 16 years, with rich experience in the area. By the end of 2018, iFLYTEK had forged close partnerships with a number of OEMs, with total installations of OEM automotive voice outnumbering 15 million.

iFLYTEK is working on IVI system by virtue of superiority in speech technologies. Its Feiyu IVI system has iterated to version 2.0 adding capabilities like voiceprint and face recognition beyond multi-dimensional voice interaction functions from integrated voice recognition, natural language understanding and speech synthesis to voice wake-up, voice enhancement, intelligent search and full duplex voice. Moreover, Feiyu 2.0 provides custom-made services, for example, IVI interface can display OEM’s unique label. The system has already been mounted on Changan CS95, Haval H7, Chery Arrizo GX/EX and Dongdeng Xiaokang 580.

Nuance as the world’s largest voice provider is about to complete spin-off of its automotive business in October 2019. The separate company named as Cerence, has 70 speech models (e.g., mandarin, Cantonese and Shanghainese), 1,250 patents, and a workforce of 1,300 including 240 staffs in China.

Cerence sees a rising share in the Chinese market as it broke the barriers on localization. ECARX GKUI 19 begins to use Cerence voice enhancement technology; Cerence local voice solution also becomes available to Banma Zhixing 3.0.

Tencent lags behind Baidu and Alibaba a bit in automotive voice. In August 2019, the launch of WeChat vehicle version invigorated new vitality into Tencent. WeChat vehicle version features voice-enabled message receiving and sending and a deep integration with navigation. The availability of smartphone Bluetooth perception allows automatic login when users get in car and automatic logout when they get off. Changan CS75 Plus is currently the first model carrying vehicular WeChat. For what to do next, Tencent Auto Intelligence will roll out an applet framework designed for voice and vehicle HMI, which enables voice wake-up driven by scenario engine, with lighter cloud load.

Global and China Automotive Voice Industry Report, 2019 highlights the following:

Intelligent speech industry and market (industry chain, application scenarios, development history, market size, competitive pattern, etc.);

Intelligent speech industry and market (industry chain, application scenarios, development history, market size, competitive pattern, etc.);

Global and China automotive voice markets (size, competitive pattern, development trends, major players’ layout, their development characteristics, etc.);

Global and China automotive voice markets (size, competitive pattern, development trends, major players’ layout, their development characteristics, etc.);

Chinese automotive voice suppliers (profile, operation, product system, R&D system, major clients, development plan, etc.).

Chinese automotive voice suppliers (profile, operation, product system, R&D system, major clients, development plan, etc.).

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...