Autonomous Commercial Vehicle Industry Report, 2019-2020

-

Mar.2020

- Hard Copy

- USD

$3,800

-

- Pages:280

- Single User License

(PDF Unprintable)

- USD

$3,600

-

- Code:

BJ002

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,400

-

- Hard Copy + Single User License

- USD

$4,000

-

Self-driving commercial vehicle study: billions of dollars swarm into the field where fifty players compete fiercely, according to our recent report the Autonomous Commercial Vehicle Industry Report, 2019-2020

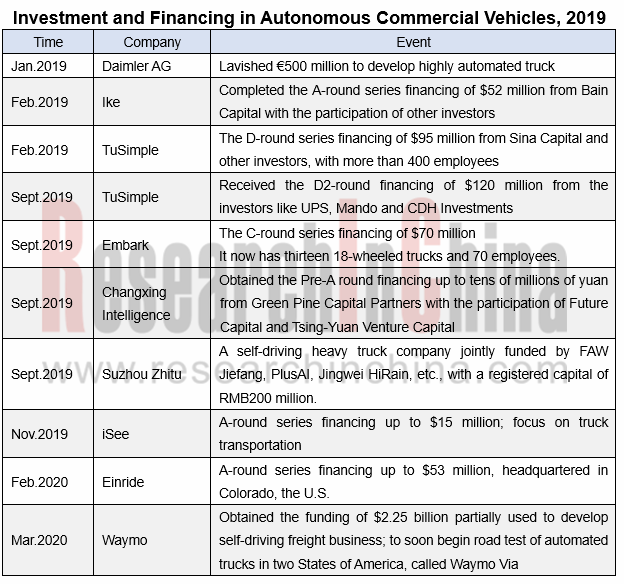

Automated commercial vehicle will be realized ahead of self-driving passenger car. The number of enterprises that forayed into commercial vehicle autonomy in 2019 doubled the prior-year figure. A case in point is TuSimple raised funds up to $215 million in 2019 and won 18 contract clients that devote themselves to transportation in the United States.

After over a year’s halt, Waymo restarted self-driving truck tests in May 2019. Pony.ai, a competitor in RoboTaxi operations and with the investment of $400 million from Toyota and other investors, was also pressing ahead with self-driving truck tests in 2019.

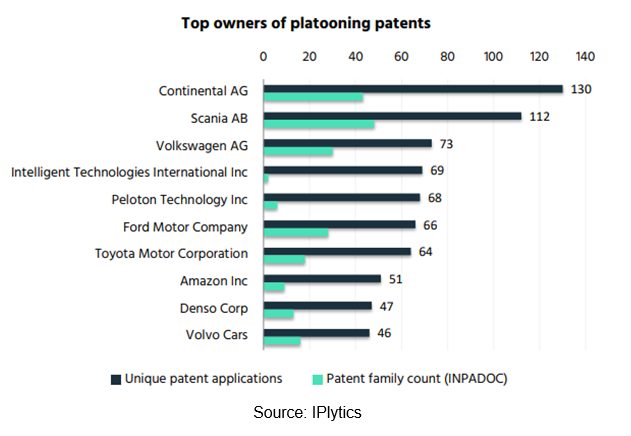

Truck platooning still remains the focus of automated truck test and gets increasingly combined with 5G technology in 2019, into which the companies have set foot including Daimler, CiDi, Scania, Iveco, Volvo, DAF, Peloton, SAIC, Foton, Huawei, TuSimple and Hyundai.

It can be seen from the top 10 holders of platooning patents that the competitive ones are Continental, Scania, Peloton, Ford, Toyota, among others. Chinese counterparts are rarely seen.

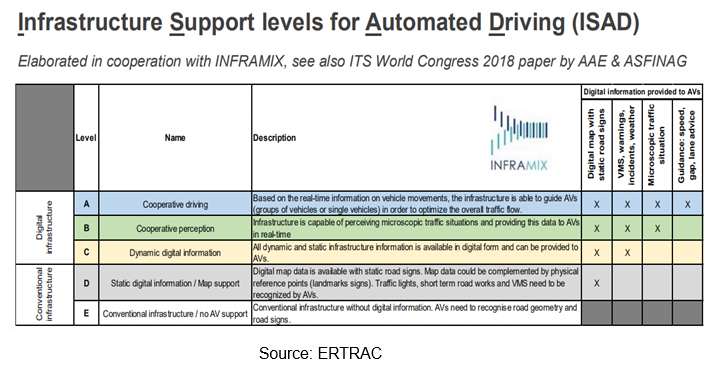

Commercial vehicle going smart coincides with road intelligence, about which the laws and regulations are getting perfect. Road infrastructure for automated driving is classified by ERTRAC (European Road Transport Research Advisory Council) into the five in the table below.

China Highway & Transportation Society (CHTS) Automated Driving Working Committee and Automated Driving Standardization Working Committee issued the Intelligent Connected Road System Levels and Interpretations (Exposure Draft) in September 2019, according to which traffic infrastructure system is divided into I0 level (zero information/intelligence/autonomy), I1 (preliminarily digital/intelligent/automated), I2 (partially connected/intelligent/automated), I3 (conditional autonomy and high connectivity based on traffic infrastructure), I4 (highly automated and based on traffic infrastructure), and I5 (fully automated driving based on traffic infrastructure).

The importance of road intelligence was shown in the platooning test on the Beijing-Chongli Expressway (Yanchong Expressway Beijing Section) in December 2019 that has complex road conditions for more than 94% of the sections are tunnels and viaducts. In most cases, autonomous driving in the tunnel became difficult because the GNSS signal was bad. Moreover, it was the middle of winter and the outdoor temperature remained as low as -20°C, challenging a multitude of supporting equipment. Huawei has installed the 5G vehicle terminal T-Box with 5G+C-V2X technology on Foton Commercial Vehicles, and also provides roadside sensing terminal cameras, radars, road side unit, edge computing, C-V2X Server, etc. Through the C-V2X services for the entire road sections, the deficiencies in positioning, communication and perception in the tunnel can be compensated. Foton commercial vehicles completed a 14-km L4 platooning demonstration, including a 9.8-km continuous extra-long tunnel.

Billions of dollars flocked to the maturing self-driving commercial vehicle market in 2019. Vehicle intelligence is prioritized in foreign countries, while CVIS (Cooperative Vehicle Infrastructure System) prevails in China. There will be greater development space from 2020 on.

The report details technologies about automated driving of commercial vehicle, organizations, the status quo of the market as well as progress in platooning; nearly 50 suppliers’ and automakers’ investments, deployments, technical routes, products & solutions, business models, plans and goals, tests, collaborations, applied scenarios, etc.

1. Overview of Autonomous Commercial Vehicle Industry

1.1 Overview of Autonomous Commercial Vehicle

1.1.1 Definition of Commercial Vehicle

1.1.2 Necessity of Autonomous Commercial Vehicle

1.1.3 Advantages of Commercial Vehicles Popularizing Autonomous Driving Technology

1.1.4 Development Stage of Autonomous Commercial Vehicle at Home and Abroad

1.1.5 Expected Development Path of Autonomous Commercial Vehicle

1.1.6 Development Stage of Autonomous Trucks

1.1.7 Features of Autonomous Trucks by Development Stage

1.2 Autonomous Commercial Vehicle Technology

1.2.1 Typical Applied Scenarios of Autonomous Commercial Vehicle and Technologies

1.2.2 Technology Solutions for Typical Applied Scenarios of Commercial Vehicles

1.2.3 Key Technologies for Autonomous Commercial Vehicle

1.2.4 Reference Architecture of Autonomous Commercial Vehicle

1.2.5 Evolution of Autonomous Commercial Vehicle

1.2.6 ADAS Features Required by L1-L2 Commercial Vehicle

1.3 Autonomous Commercial Vehicle and Regulations

1.3.1 Timeline of Regulations on Brake Control and ADAS (by Region) Worldwide

1.3.2 Active Safety and ADAS Are the Compulsory Requirements in Laws & Regulations of All Countries

1.3.3 China's Regulations on Active Safety and ADAS Are Rapidly Advancing

1.3.4 Latest Regulations and Policies in 2019

1.4 Challenges and Supporting Facilities for Autonomous Commercial Vehicle

1.4.1 Challenges to Autonomous Commercial Vehicle

1.4.2 Acceptance of Autonomous Commercial Vehicle

1.4.3 Challenges for and Impacts of Autonomous Trucks

1.4.4 Impact of Autonomous Driving on Stakeholders in the Truck Industry

1.4.5 Autonomous Commercial Vehicle Needs Related Infrastructure

1.4.6 Classification of Autonomous Driving-related Infrastructure (Road) (Europe)

1.4.7 Classification of Autonomous Driving-related Infrastructure (Road) (China)

1.5 Autonomous Truck Market Size Forecast

1.5.1 Global and China Autonomous Truck Market Size Forecast

1.5.2 Autonomous Truck Market Size Forecast by Type

1.6 Organizations Concerned and Important Projects

1.6.1 EATA

1.6.2 ENSEMBLE

1.6.3 Milestones of ENSEMBLE

2. Commercial Vehicle Platooning

2.1 Truck Platooning

2.1 Introduction to Truck Platooning

2.1.1 Key Truck Platooning Components and Functions

2.1.2 Evolution of Truck Platooning Technology

2.1.3 Value of Truck Platooning

2.1.4 Fuel Saving of Truck Platooning Tests

2.1.5 Status Quo of Truck Platooning in the World

2.1.6 Truck Platooning Projects Worldwide, 2018-2020

2.1.7 Comparison of Some Truck Platooning Projects

2.1.8 Development History of Truck Platooning

2.1.9 Truck Platooning Patent Analysis

2.2 Status Quo of Truck Platooning in Europe

2.3 Status Quo of Truck Platooning in US

2.3.1 Truck Platooning Overview in US

2.3.2 Truck Platooning Projects in US

2.3.3 Truck Platooning Test in US

2.3.4 Platooning Regulations in US by State

2.4 Status Quo of Truck Platooning in China

2.4.1 Representative Truck Platooning Projects in China, 2018

2.4.2 Cainiao’s Self-driving Truck Platooning Technology Solution

2.4.3 The First Large-scale Commercial Vehicle Platooning Trial in China

2.3.4 Platooning Is an Important Part of ICV Standard System Construction Guide

2.3.5 Truck Platooning Tests in China, 2019

2.4 Status Quo of Truck Platooning in Japan and South Korea

2.4.1 Platooning Projects in South Korea

2.4.2 Development Roadmap of Autonomous Trucks in South Korea

2.4.3 Platooning Participants in Japan

2.4.4 Platooning Development Roadmap in Japan

3. Foreign Providers of Autonomous Commercial Vehicle Solutions

3.1 Starsky Robotics

3.2 Embark

3.3 Peloton Technology

3.4 BestMile

3.5 Oxbotica

3.6 Einride

3.7 WABCO

3.8 Knorr-Bremse

3.9 Kodiak Robotics

3.10 Thor Trucks

3.11 WAYMO

3.12 Pronto

3.13 Ike

3.14 iSee

3.15 Outrider

Comparison of Foreign Autonomous Commercial Vehicle Solution Providers (including revenue, workforce, financing, major products, business models, major customers, partners, support for self-driving trucks, autonomous driving tests, truck platooning tests, etc.)

Conclusions

4. Chinese Providers of Autonomous Commercial Vehicle Solutions

4.1 Tsintel Technology

4.2 TuSimple

4.3 Westwell

4.4 FABU Technology

4.5 PlusAI

4.6 TRUNK

4.7 CiDi

4.8 Inceptio Technology

4.9 SuperG AI

4.10 Changxing Intelligence

4.11 Suzhou Zhitu

4.12 In-Driving

Comparison of Chinese Autonomous Commercial Vehicle Solution Providers (including location, registered capital, financing, headcount, main products, business models, major clients, partners, support for remote control, support for autonomous trucks/buses, autonomous driving tests, planning and goals, etc.)

Conclusions

5. Autonomous Driving Layout of Foreign Commercial Vehicle Makers

5.1 Volkswagen

5.2 PACCAR

5.3 Volvo

5.4 Daimler

5.5 SCANIA

5.6 Hino

5.7 Iveco

Comparison of Foreign Commercial Vehicle Companies (including revenue and growth rate, sales volume, profit, nationality, planned investment in autonomous driving, foreign investment, major products, ICV partners, investment in autonomous trucks / buses, autonomous driving tests, planning and goals, etc.)

Conclusions

6. Autonomous Driving Layout of Chinese Commercial Vehicle Makers

6.1 Beiqi Foton Motor

6.2 Dongfeng Motor

6.3 SINOTRUK Group

6.4 FAW Jiefang

6.5 China Shaanqi

6.6 SAIC Hongyan

6.7 Beiben Trucks

6.8 JMC

6.9 Zhengzhou Yutong Bus

6.10 King Long Bus

6.11 CRRC Electric Vehicle

6.12 Xiamen Golden Dragon Bus

6.13 Anhui Ankai Automobile

6.14 Skywell

Comparison of Chinese Commercial Vehicle Companies (including revenue and growth rate, sales volume, profit, registered capital, autonomous driving investment, main products, ICV partners, autonomous driving tests, launch time, planning and goals, etc.)

Conclusions

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...