Why is the installation rate of automated parking not high?

Automated parking was found in 7.7 percent of passenger cars in China in 2019, according to the data from ResearchInChina.

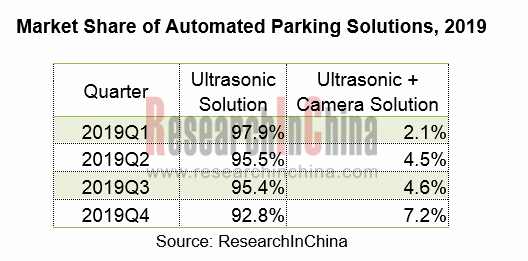

As shown in the table above, most Chinese new passenger cars were pre-installed with ultrasonic solutions for automated parking in 2019; while ultrasonic + vision fusion solution only held tiny shares but saw an uptrend from the fourth quarter.

The moderate assembly rate of automated parking results from the limited scenarios of traditional ultrasonic parking solutions where the driver has to stay in the car. To tackle this problem, there are two ways: better performance of ultrasonic radars and more sensors (such as cameras and millimeter-wave radars).

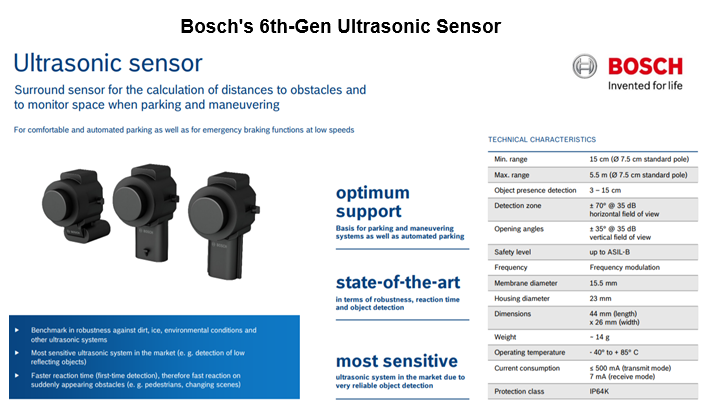

For instance, the AionS Automated Parking System, which was launched by GAC in the first half of 2019, uses 12 Bosch sixth-generation ultrasonic radars to detect a longer range than the previous generation and probe objects as close as 3cm instead of the original 6cm with faster refresh and agility.

More emerging models such as Changan CS75 PLUS, Geely Xingyue, SAIC Roewe MARVEL X, Chery EXEED, etc. have embarked on ultrasonic + vision fusion parking solutions.

Rare application of ultrasonic + visual fusion solution in the past lies in lack of algorithms and powerful compute. Tesla, the pioneer going intelligent, has long resorted to ultrasonic solutions, and its automated parking capability has not performed well. Even Smart Summon launched in the second half of 2019 is not so successful, either.

Tesla’s all models equipped with Autopilot 2.0 carry NVIDIA’s Drive PX2 chip which supports the access to up to 6 cameras. Autopilot 2.0 cannot bolster full work of 8 cameras in the car whatever the compute or video ports. Thus, Autopilot 2.0 does not attend to the fusion of ultrasonic + vision automated parking assistant sufficiently.

According to the study by Chris Zheng, Tesla annotates the mid-range camera in the front trifocal camera at 36 frames per second, records the front fisheye camera and four side-view cameras at 9 frames per second, while it temporarily abandons the remaining front long-range camera and rear-view camera. That is to say, when Autopilot is enabled, only 6 cameras in the car are involved in labeling and perception, of which only the front mid-range camera keeps a high perception frequency while the remaining 5 cameras run strenuously with the limited computing power.

Tesla began to develop chips for strong compute. In 2019, Elon Musk unveiled the Autopilot HW 3.0 hardware upgrade powered by Tesla’s self-developed FSD chip. The previous version HW2.5 uses Nvidia’s Drive PX2 chip. In terms of computing power, the new chip can process about 21 times more images per second than the old one (110 frames per second), at 2,300 frames per second. If all 8 cameras are running at 36 frames per second, the whole vehicle output will be 288 frames per second, which is equivalent to 12.5% of the processing capacity of the FSD chip and is quite sufficient for automated parking.

After solving the computing power, Tesla launched "Smart Summon" at the end of 2019, which is designed to allow the car to drive to the user or an appointed place by the user, maneuvering around objects and parking as necessary. The actual tests prove that Smart Summon still does not work in many cases, indicating that the algorithm needs improvement.

In March 2020, Musk said Tesla would finish work on Autopilot core foundation codes and 3D labelling to provide better algorithms and features for its cars, and then it would unveil "Reverse Summon" soon. Reverse Summon will likely be a mirror feature to Tesla’s existing “Smart Summon”. Whereas Smart Summon allows the user’s car to navigate from its parking space to the user, Reverse Summon likely reverses this. As such, it would conceivably entail that the user’s car can drop the user off, and then navigate to a parking space on its own. To ensure safety, Smart Summon works with the Tesla mobile app when the user’s phone is located within approximately 65 meters of the car with a projected top speed of 8 km/h.

Taking Tesla as a reference, OEMs and Tier1 suppliers are upgrading automated parking systems.

Desay SV told investors that its automated parking system using the vision + ultrasonic fusion solution (algorithms backed by MOMENTA) has been spawned for Chery EXEED, Geely Xing Yue and other models.

Tesla's new deep neural network will integrate all sub-neural networks including perception, path planning, and target recognition. The cooperation between Desay SV, which is adept at hardware, and MOMENTA, a veteran offer of neural network algorithms, inspires traditional Tier1 suppliers.

Valeo has long led the pack in the APA field, and its vision + ultrasonic fusion solution -- Park4U Remote has been applied to Mercedes-Benz's new S-Class sedans and Changan's new CS75 PLUS. With the powerful remote parking, Changan CS75 PLUS has been a best-seller nowadays.

To cater to the complicated parking scenarios in China, Valeo has prepared different sensor combinations for automated parking: Vision + Ultrasonic Radar Fusion Solution, and Millimeter Wave Radar + Ultrasonic Radar Fusion Solution. In 2020, a number of models using Valeo's automated parking solutions will be launched.

By launching Valeo.ai based in Paris, Valeo aims to host an open community network dedicated to the development of automotive applications in artificial intelligence and deep learning.

Souped-up compute and algorithms are not only necessary for automated parking and AVP systems, but also crucial to cockpit system, connected system, ADAS, etc. This involves changes in the vehicle's E/E architecture, super processors, domain controllers, vehicle OTA, information security, to name a few.

In the next few years, decentralized ECUs will be replaced by domain controllers whose development is often dominated by OEMs and Tier1 suppliers. The space for independent parking controllers is narrowing. For APA / AVP startups, it is of vital importance to improve algorithmic competences and have closer collaborations with Tier1 suppliers.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...