Domain control unit shipments will boom in 2021.

When the one-to-one correspondence between the growing number of sensors and electronic control units (ECU) leads to underperforming vehicles and adds circuit complexity, more powerful centralized architectures like domain control unit (DCU) and multi-domain controller (MDC) come as an alternative to the distributed ones.

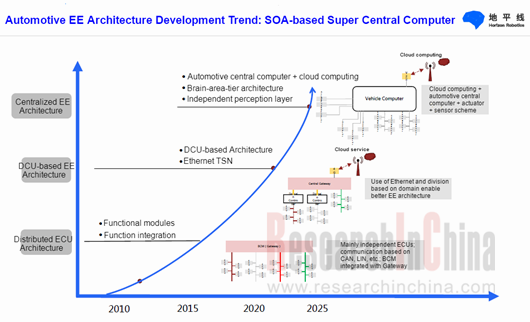

As concerns the tendency of domain controller, Vector conceives three stages of E/E architecture development: controller-centric, DCU, and central computer. Intelligent vehicle will ultimately be a mobile super computer and data center, and a new Wintel will come into being. In future, computing platform, operating system and application software will matter the most to the highly automated vehicles; multimedia multi-domain controllers and central domain controllers are likely to be combined into one.

In response to the disruption, Volkswagen plans adoption of a unified automotive E/E architecture; BMW will introduce central communication services and service-oriented architecture (SOA) in its next-generation E/E architecture; the smart vehicle architecture (SVA) launched by Aptiv breaks the bottleneck of conventional architectures, providing frame scalability for next-generation intelligent vehicles. The new E/E architectures will be built on the concept of central computer-layer-area, embodying the philosophy of SOA.

As to DCU, next-generation smart cockpit system based on cockpit DCU enables functionality of cockpit electronic system on a unified software and hardware platform. Cockpit electronic system offering intelligent interaction and scenarios as well as personalized services, will be a foundation for human-vehicle interaction and vehicle-to-everything (V2X) communication. Visteon argues that by 2023, intelligent cockpit integrated with LCD dashboard, center console and co-pilot infotainment system will be based entirely on single-ECU domain control platform.

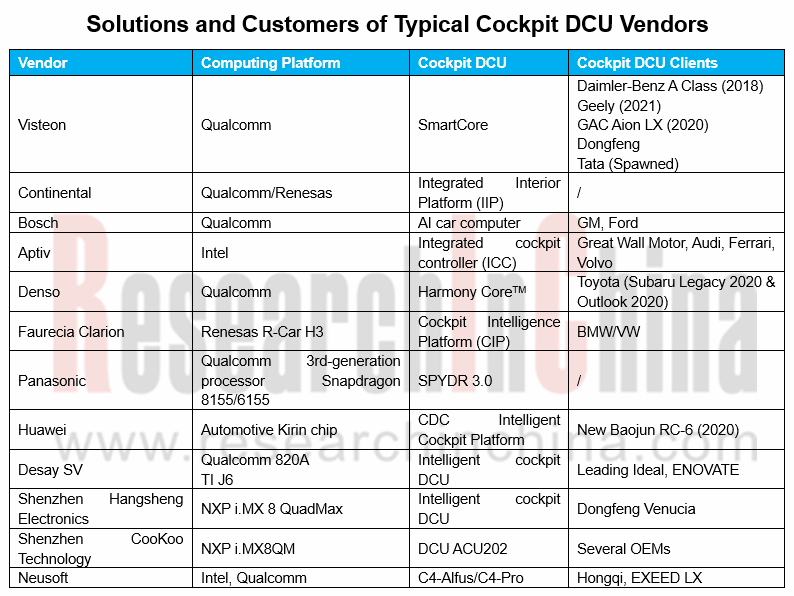

Globally, Visteon, Continental, Bosch and Aptiv dominate the cockpit DCU market; Chinese players like Huawei, Desay SV, Shenzhen Hangsheng Electronics and Neusoft race to unveil their cockpit DCU solutions.

As for cockpit chip, typical products are comprised of Qualcomm 820A, Intel Atom, NXP i.MX8, Renesas R-CAR H3 and TI Jacinto family. Notably, the prevailing Qualcomm 820A processor platform has been ordered by 18 out of the 25 world-renowned OEMs, with the order intake recording $5.5 billion or so.

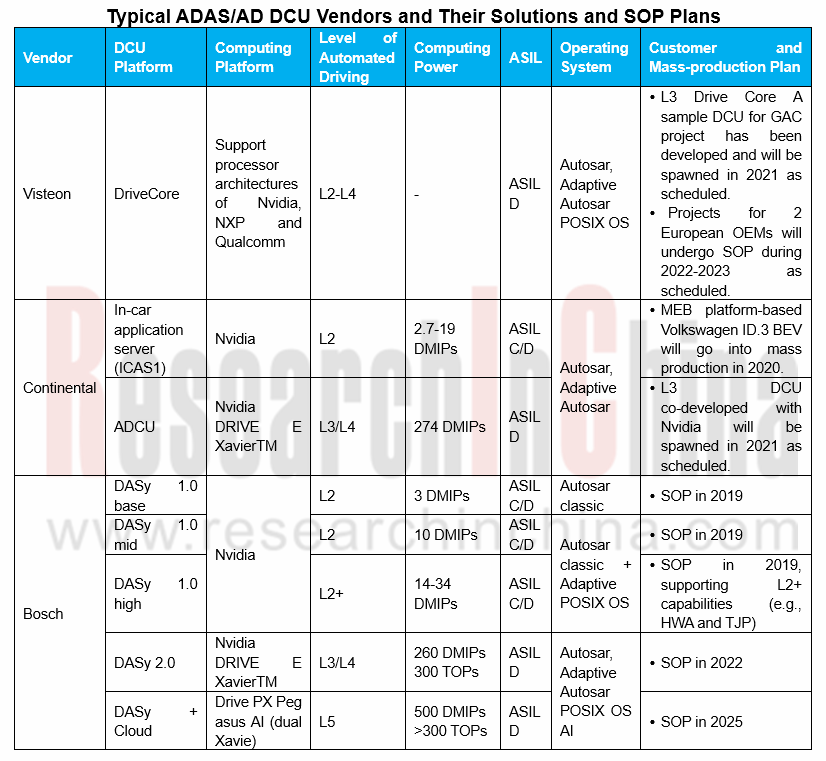

In the ADAS/AD DCU market, most of those in use for Level 1 driving assistance employ separate ECU to control. ADAS ECU which is developed mainly for Level 2 driving assistance is utilized to combine LDW/LKA and AEB. It is in the era of Level 2+, Level 3 and Level 4 automated driving that the demand for autonomous driving domain control unit (AD DCU) will be soaring.

Tier-1 suppliers worldwide already deploy ADAS/AD DCU such as Visteon DriveCore, Bosch DASy, Continental ADCU, ZF ProAI, Veoneer Zeus and Magna MAX4. In China, such typical products include iECU (co-developed by SAIC and TTTech), Huawei MDC (MobileData Center) intelligent driving DCU, IN-DRIVING TITAN, and Neusoft Reach CPDC-II DCU/CPDC-III central computer.

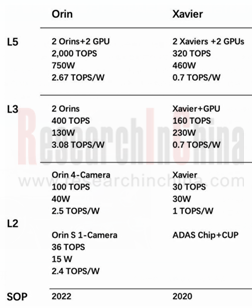

When it comes to autonomous driving chip, Nvidia is absolutely the leader with Nvidia Drive PX2 and Nvidia Drive Xavier being widely deployed by vendors. In December 2019, Nvidia introduced DRIVE AGX Orin, a software-defined platform for Level 5 automated driving, with nearly 7x the performance of the previous generation SoC Xaiver. The Orin SoC integrates NVIDIA’s next-generation GPU architecture and Arm Hercules CPU cores, as well as new deep learning and computer vision accelerators that, in aggregate, deliver 2,000 TOPS.

Other autonomous driving chips include TI TDA4, Qualcomm? Snapdragon Ride?, NXP S32 family, and Mobileye EyeQ family.

In the next three to five years, among DCU market segments, cockpit DCU will see a faster growth rate and a larger market than autonomous driving DCU because it is easier to spawn cockpit DCUs at lower cost; the surging demand for intelligent cockpits, which is fueled by the availability of 5G in vehicles, will drive up cockpit DCU shipments to explode in 2021 on the basis of OEM’s and Tier1’s progress in mass production.

In the ADAS/AD DCU field, inadequate regulations and immature technologies will expectedly make it hard to apply Level 3/Level 4 automated driving technologies on large scale in the upcoming three to five years. OEMs, tier-1 suppliers and chip vendors are working to mass produce L2+ autonomous vehicles. It is predicted that production of Level 3/Level 4 autonomous vehicles will peak around 2025, but business-oriented vehicles will play the key role, with roughly 5 million units of ADAD/AD DCUs for passenger cars to be shipped worldwide in 2025.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...