Autonomous Driving Simulation Industry Chain Report, 2019-2020 (II)

Autonomous Driving Simulation (II): It Turns Out to Be a Battlefield of Giants

Alibaba DAMO Academy unveiled in early 2019 the "Top Ten Technology Trends of 2019", most of which are still credible today, including two trends about autonomous driving:

Trend 1: Autonomous driving is in a cooling-off period

Only "single-car intelligence" cannot achieve absolute autonomous driving in the long run, but cooperative vehicle infrastructure system (CVIS) is gathering way to bring autonomous driving on roads in a reality. In the next two years or three, autonomous driving will be commercialized in limited scenarios such as logistics and transportation, for example, fixed-route buses, unmanned delivery, and micro-circulation in parks are just around the corner.

Trend 2: Real-time simulation of cities becomes possible, and smart cities emerge

The perceived data of urban infrastructure and the real-time data flow of cities will be pooled on a big computing platform. The advances in algorithms and computing power will facilitate the real-time fusion of unstructured information like video and other structured information. Real-time simulation of cities becomes a possibility, and local intelligence in cities will be upgraded to global intelligence. In the future, urban brain technology R&D and application will be in full swing with the involvement of more forces. Beyond the physical cities, there will be smart cities with full spatiotemporal perception, full-factor linkage and full-cycle iteration.

The development of autonomous driving industry has a direct bearing on autonomous driving simulation. The decelerating autonomous driving in the past two years is an unprecedented challenge to startups not only in autonomous driving but in autonomous driving simulation. RightHook, a sensor simulation company, has made no progress for two years; meanwhile, new autonomous driving simulation startups rarely ever came out in 2019.

On the contrary, the giants perform strikingly.

At the Shanghai Auto Show in April 2019, Huawei launched the autonomous driving cloud service Octopus (including training, simulation and testing).

In December 2019, Waymo acquired Latent Logic to strengthen its simulation technology.

In April 2020, Alibaba DAMO Academy released the "hybrid simulation test platform" for autonomous driving.

GAC believes that a virtual simulation platform was the supplement of the real vehicle test platform before, but it is indispensable to the R&D of L3 (or above) autonomous driving. At present, virtual simulation tests share more than 60% of GAC’s autonomous driving R&D, a figure projected to rise to 80% in the future.

Simulation is essential for both single-car intelligence and autonomous driving R&D in CVIS route.

As autonomous driving is heading from single-car intelligence to CVIS, autonomous driving simulation has evolved from dynamics simulation, sensor simulation and road simulation (static) to traffic flow simulation (dynamic) and smart city simulation.

51VR, which has raised hundreds of millions of yuan, changed its name to 51WORLD after experiencing the VR bubble, and set about digital twin cities and autonomous driving simulation. 51WORLD signed a contract to settle in the Liangjiang New Area of Chongqing in November 2019, and will focus on expanding innovative applications of digital twin cities in Chongqing as well as autonomous driving simulation.

In fact, the combination of VR and autonomous driving simulation is not the last resort of 51WORLD. VR/AR plays a growing role in autonomous driving simulation. The technologies for building virtual scenarios are generally based on modeling software, completed games, VR / AR, and HD maps.

In August 2019, rFpro launched an autonomous driving simulation training system based on VR scenarios, featured as follows:

(1) A multitude of autonomous driving simulation operations can be fulfilled in the software.

(2) rFpro also allows the import of models from 3rd party maps, including IPG ROAD5, .max, .fbx, OpenFlight, Open Scene Graph, .obj., featured with ultra-HIDEF graphical fidelity.

Given the importance of autonomous driving simulation, the formulation of simulation standards has kicked off.

Association for Standardization of Automation and Measuring Systems (ASAM) is a global leader in autonomous driving simulation test standards (mainly OpenX Standards). Since the launch by ASAM, OpenX Standards has attracted more than 100 companies worldwide (including major automakers in Europe, America and Japan, and Tier1 suppliers) to participate in the formulation of the standards.

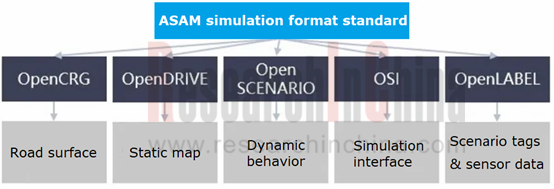

In ASAM simulation verification, OpenX Standards cover Open-DRIVE, OpenSCENARIO, Open Simulation Interface (OSI), Open-LABEL and OpenCRG.

OpenDRIVE and OpenSCENARIO unify different data formats for simulation scenarios.

OpenLABEL provides a unified calibration method for initial data and scenarios.

OSI is a generic interface that allows users to connect any sensor with a standardized interface to any automated driving function or driving simulator tool.

OpenCRG realizes the interaction between road physical information and static road scenarios.

In September 2019, China Automotive Technology & Research Center (CATARC) and ASAM jointly established the C-ASAM Working Group whose early members included Huawei, SAIC, CATARC Data Resource Center, Tencent, 51VR, Baidu, to name a few.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...