Automotive Vision Industry Chain Report 2019-2020 (I): Monocular Vision

Automotive Vision Industry Chain Report 2019-2020 (I): The front-view monocular camera market soared 95.6% year-on-year in 2019

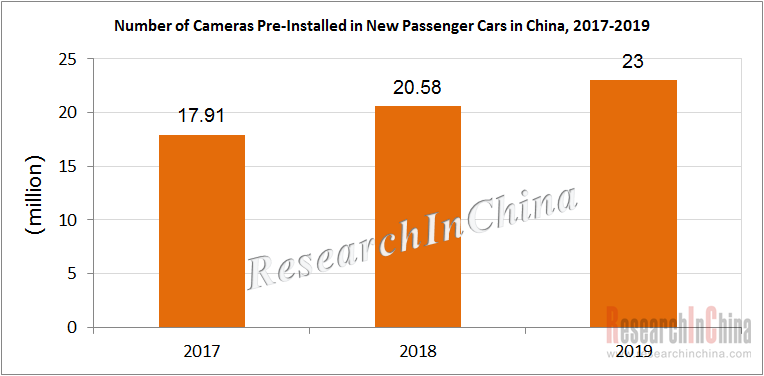

About 23 million cameras were pre-installed in new passenger cars in China in 2019, up 11.7% on an annualized basis, as is revealed by ResearchInChina.

Front-view monocular cameras and surround-view cameras grew by 95.6% and 23.9% year-on-year respectively, while both rear-view and side-view cameras dropped.

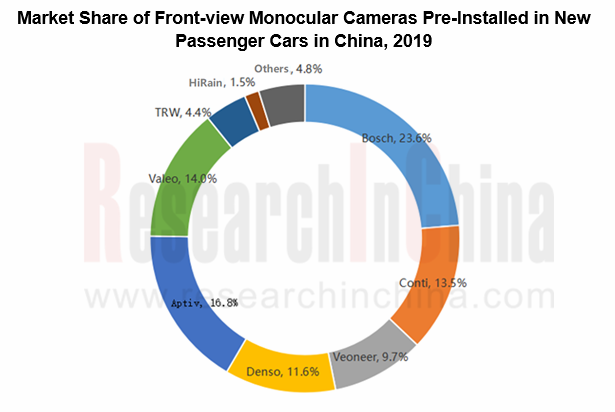

The Tier1 suppliers such as Bosch, Continental, Aptiv, Denso, Valeo, Veoneer, ZF, etc. occupy more than 90% share of the front-view monocular camera market, so that Chinese visual ADAS vendors that rarely ever break monopoly turn to focus on surround-view cameras, rear-view cameras, commercial vehicle vision ADAS and other markets.

Cameras find wider application in automobile, in forms of DMS, CMS, binocular stereo, tri-focal, night vision, etc., broadening the market space of automotive vision observably. In March 2020, Waymo unveiled its fifth-generation autonomous driving system with the synergy of 29 cameras in all around the body to see a road sign 500 meters away through the overlapped fields of view.

Driver Monitoring System (DMS)

For safer driving on roads, European Commission approved EU rules requiring life-saving technologies in vehicles. The advanced systems that will have to be fitted in all new vehicles are: intelligent speed assistance; alcohol interlock installation facilitation; driver drowsiness and attention warning; advanced driver distraction warning; emergency stop signal; reversing detection; and event data recorder (“black box”). Most of these technologies and systems are due to become mandatory as from May 2022 for new models and as from May 2024 for existing models.

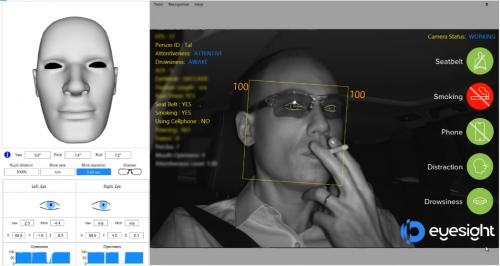

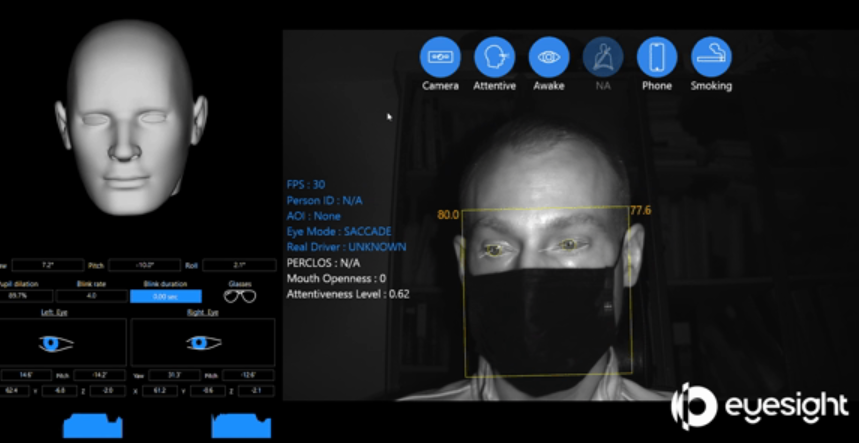

Over the past year, leading Tier1 suppliers and most visual ADAS startups have been developing DMS, especially the most active EyeSight, an Israeli start-up founded in 2005, provides driver monitoring, gesture recognition and user perception and analysis technologies.

On November 21, 2019, Eyesight announced new features for the company’s Driver Sense and Fleet Sense solutions to monitor the driver and detect driver distraction as a result of cell phone usage and smoking. The new features will be added to the company’s existing distraction and drowsiness detection capabilities to further mitigate driver distractions and prevent accidents.

In April 2020, Eyesight upgraded its platform for in-cabin sensing solutions to detect when drivers who wear face masks get distracted or feel fatigued behind the wheel. It has developed a set of AI algorithms that can keep track of drivers’ behavior behind the wheel when wearing masks, protection goggles or sunglasses. The company’s Driver Sense and Fleet Sense leverage IR sensors to analyze head position, eye openness, pupil dilation, blink rate, and gaze direction, in any lighting condition.

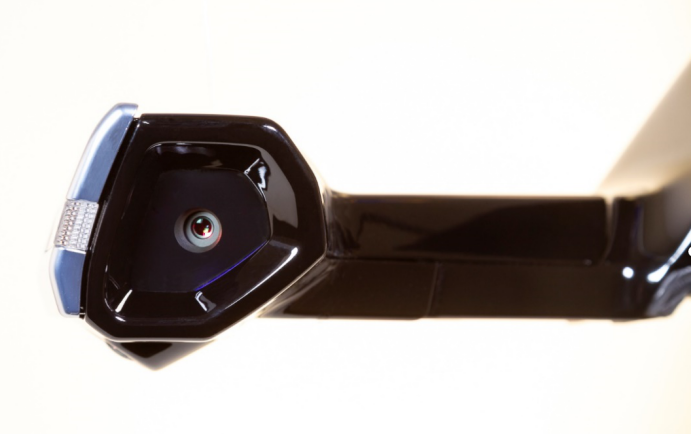

Camera Monitor System (CMS)

The spawned all-electric SUV Audi e-tron offers CMS as an option (EUR1,250). Lexus offers optional USD1,900 CMS. Honda e is the world's first model that provides CMS as a standard configuration. Tesla's first battery-electric pickup, Cyberruck, also uses CMS.

Models with CMS have much better night vision effects than the ones with traditional glass reversing mirrors.

Use in Cockpit Comfort System

Cameras are mainly used as the sensing components for ADAS. The popularity of telematics and smart cockpits help wider use of cameras in cockpit comfort systems.

For instance, Faurecia integrates smart devices such as cameras with recognition capabilities, Microsoft Connected Vehicle Platform (MCVP) and cockpit domain controllers as well as the hardware like traditional speakers, smart headrests and exciters embedded on the surface of vehicles to offer the user with personalized audio options and improve the sound conditions of the entire cockpit.

Automotive Vision Industry Chain Report 2019-2020 (I) -- Monocular Vision highlights:

Automotive vision industry chain at a glance

Automotive vision industry chain at a glance

Chinese passenger car camera market

Chinese passenger car camera market

Foreign automotive vision companies

Foreign automotive vision companies

Chinese automotive monocular vision solution providers

Chinese automotive monocular vision solution providers

Automotive Vision Industry Chain Report 2019-2020 (II) -- Binocular and Surround-view Cameras highlights:

Development trend of automotive vision industry

Development trend of automotive vision industry

Binocular vision companies

Binocular vision companies

Surround-view technologies and companies

Surround-view technologies and companies

Key automotive camera parts suppliers

Key automotive camera parts suppliers

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...