High-precision Positioning Research: Competition from Chips, Terminals to Ground-based Augmentation Stations

Autonomous driving prompts the use of high-precision positioning technology in the realm of automobile where L3 autonomous driving requires decimeter-level accuracy and L4 or above centimeter precision.

Apart from the vehicle's own sensors for precise positioning, a high-precision positioning system outside the vehicle is also indispensable. For ground roads, a high-precision positioning system centering on 5G + BeiDou (or GPS) satellite + ground-based augmentation system is beginning to take shape; for parking lots, there may arise a V2X-centric (or UWB) high-precision positioning system.

The high-precision positioning infrastructure is not in place yet, the user base is still small, and the equipment is priced at least RMB10,000. Beijing Xilang Technology, for example, provides the products with a price range from thousands of yuan to more than RMB30,000, for autonomous buses, AGVs, smart agricultural machinery, inspection robots, etc.

The high-precision positioning solution launched by Qianxun SI in 2019 for low-speed autonomous driving integrates "services, hardware, and algorithms", reducing the cost of high-precision positioning equipment to thousands of yuan. The solution has been found in the products of low-speed autonomous driving companies like Neolix, Trunk, Cainiao, etc.

The cost reduction of high-precision positioning terminal also hinges on mass production. OEMs hope that positioning infrastructure will be built as soon as possible, which is facilitated by the new infrastructure projects under way in China.

Competition in Ground-based Augmentation Stations

China will launch in June 2020 the last satellite for Beidou-3 Navigation Satellite System, an array of 30 satellites that will provide services to global users, which will offer development opportunities for the high-precision positioning market based on BeiDou.

Since its inception in August 2015, Qianxun SI has deployed more than 2,500 ground-based augmentation stations across China. Its FindAUTO spatio-temporal engines can be spawned for automotive use and in readiness for L2.5 autopilot on expressways and L3 high-speed autonomous driving. In 2020, there will be six production models of carmakers with FindAUTO in the market.

In October 2019, China Mobile purchased 4,400 sets of base station equipment for HAP (high-precision satellite positioning base station), with a total budget of RMB336.11 million or so.

Sixents Technology, backed by China Telecom, Tencent and NavInfo, plans to build 2,000+ ground-based augmentation stations nationwide with China Telecom’s base station resources, core network resources and all-weather operation and maintenance systems.

In addition to Qianxun SI, Sixents Technology and China Mobile, GeeSpace invested by Geely, Starcart in the communications industry, Hi-Target, Huace, UniStrong and State Grid Shenwang LBS (Beijing) from the traditional surveying and mapping field also deploy ground-based augmentation systems.

State Grid Corporation of China is also striving to construct a nationwide electric power BeiDou ground-based augmentation system which is undertaken by State Grid Shenwang LBS (Beijing). As scheduled, State Grid will build 1,200 BeiDou (high-precision satellite positioning) base stations in its 27 provincial subsidiaries by leveraging its infrastructure nationwide.

For parking lot positioning, UWB technology provider Kunchen has successively signed contracts with Huawei, Desay SV, Qianxun SI, etc., targeting to cover more parking lots with UWB base stations.

Competition in Positioning Chips and Modules

In May 2019, Beijing BDStar Navigation developed Nebulas-IV, a 22nm positioning chip for automotive use.

In September 2019, Quectel, Qianxun SI and STMicroelectronics jointly released LG69T, a dual-frequency high-precision satellite and inertial navigation fusion positioning module for automotive use.

At the end of 2019, Jingwei Technology, a UWB positioning chip maker announced it raised tens of millions of yuan in Series A financing.

In February 2020, Qorvo announced the acquisition of Decawave, a UWB chip maker.

The BY682 board developed by BYNAV provides high-precision RTK services under good satellite signals and enables GNSS/INS integrated navigation through working together with Analog Devices Inc.'s ADIS16465 MEMS IMU.

High-precision Positioning Is Increasingly Used in Vehicles

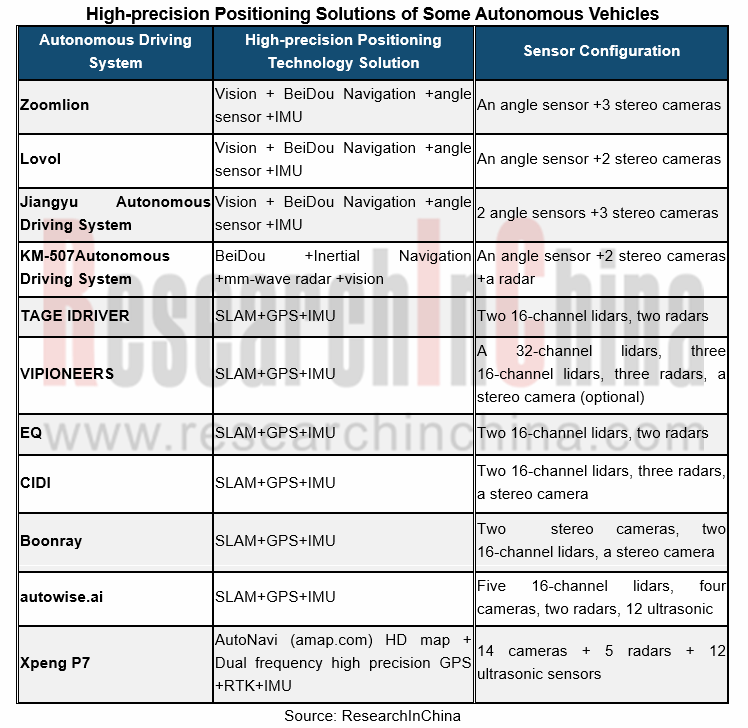

With the maturity of technology, high-precision positioning finds more application in vehicles. Besides the vertical industries such as autonomous agricultural machinery, autonomous mining, driverless sweeping vehicle, etc., high-precision positioning systems are pre-installed in passenger cars like Cadillac CT6, SAIC Roewe Marvel X, and Xpeng P7.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...