Automotive Infrared Night Vision Research: Infrared Thermal Imaging May Handle Extreme Cases Well

Infrared radiation consists of electromagnetic waves in the wavelength region from 0.75 μm to 1,000 μm, lying between visible light and microwave light. The corresponding energy ranges from 0.1eV to 1.0eV, within which all the physicochemical effects can be used for infrared detection. A myriad of detectors have been developed, which can be divided into cooled detectors and uncooled detectors by the operating temperature.

Cadillac equipped its sedans with night vision systems early in 2000, being the world’s first to pioneer such system. Mercedes-Benz, BMW, Audi, etc. followed suit. By 2013, a dozen OEMs had installed night vision systems on their top-of-the-range models but having sold not so well to this day due to the costliness of the night vision system.

4,609 new passenger cars carrying night vision systems were sold in China in 2019, an annualized spurt of 65.6% thanks to the sales growth of Cadillac XT5, Cadillac XT6 and Hongqi H7, according to ResearchInChina.

Now, there is growing concern about safety issues amid strides in ADAS and autonomous vehicle. A controversy arises in the industry particularly after a fatality in Uber's self-driving road test, about whether infrared night vision can be used for autonomous driving to prevent accidents like Uber's incident. Infrared night vision system may be an important option for addressing the safety concern of self-driving in critical situations.

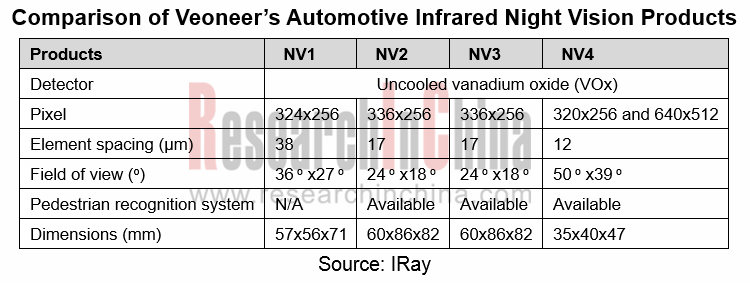

Veoneer is a typical trailblazer that has spawned infrared night vision systems in the world, and its products have experienced four generations. Its 4th-Gen night vision system, expected in June 2020, will have improved field of view and detection distances, reduction in size, weight and cost featuring enhanced algorithms for pedestrian, animal and vehicle detection as well as supporting night time automatic emergency braking (AEB) solutions.

Boson?-based thermal sensing technology from FLIR Systems has been adopted by Veoneer for its L4 autonomous vehicle production contract, planned for 2021 with a “top global automaker”. Veoneer’s system will include multiple thermal sensing cameras that provide both narrow and wide field-of-view capabilities to enhance the safety of self-driving vehicles, and that help detect and classify a broad range of common roadway objects and are especially adept at detecting people and other living things.

Hongqi H7 is provided with an advanced active night vision (ANV) system, which uses the infrared transmitter on the headlights and the camera on the front windshield to simultaneously monitor the area ahead of the vehicle, so that the driver can get clear road conditions at any time.

The near infrared (NIR) night vision system exploited by Hongqi H7 is worth thousands of yuan. Only far infrared thermal imaging technology can see the distance beyond 300 meters.

FLIR has been sparing no effort in the availability of infrared thermal imaging technology in automobiles. In August 2019, FLIR announced its next-generation thermal vision Automotive Development Kit (ADK?) featuring the high-resolution FLIR Boson? thermal camera core with a resolution of 640 × 512 for the development of self-driving cars.

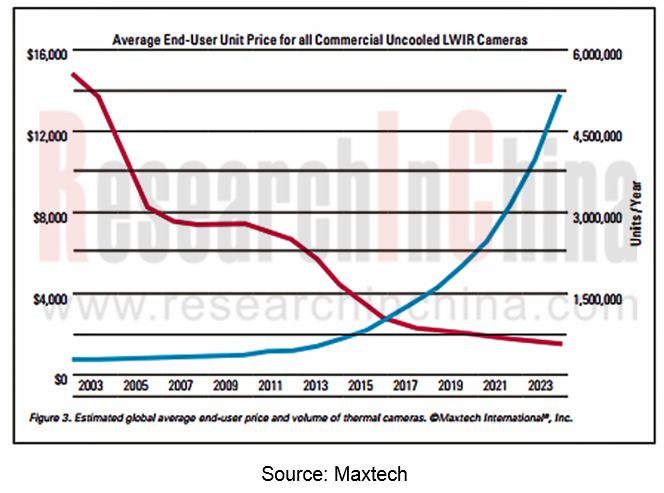

Uncooled infrared imagers and detector technology remain hot in research to date In August 2019, IRay Technology released a 10-μm 1280 × 1024 uncooled infrared focal plane detector. Maxtech predicts that the unit price of uncooled thermal imaging cameras will be below $2,000 after 2021, and the sales will outnumber 3 million units.

Still, infrared cameras are too expensive for automotive use. Israel-based ADASKY, China's Dali Technology, Guide Infrared and North Guangwei Technology are working on the development and mass production of low-cost infrared thermal imagers.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...