Automotive OTA Research: 3.838 Million Passenger Cars Packed OTA Capability in China in 2019, Soaring by 60.6% Year on Year

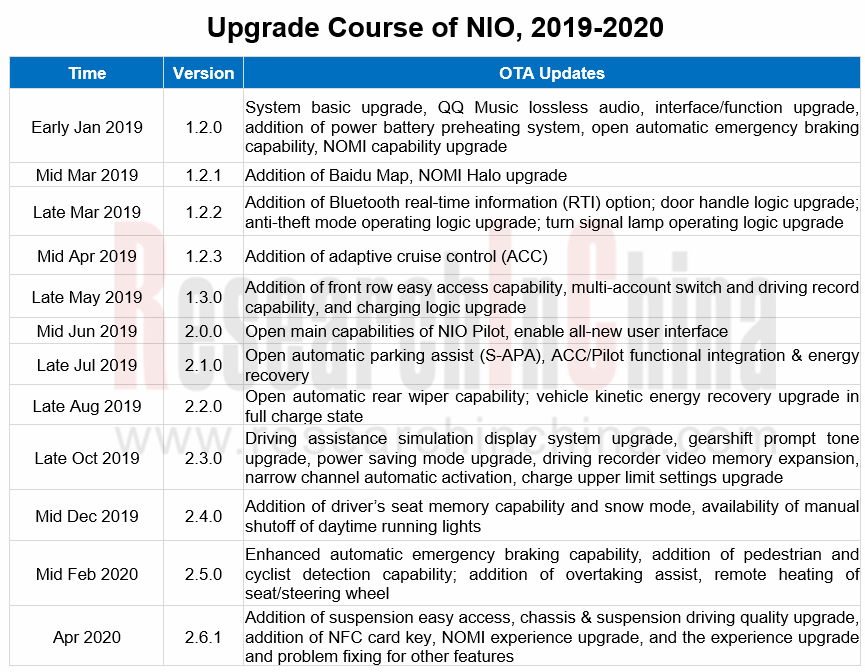

Against all odds, controversial Tesla and NIO were eventually out of the woods. What they live on is FOTA (Firmware-over-the-air). Upgrading software and hardware provides new experience for car owners, making them more satisfied and very loyal.

Even nowadays, few vehicle models enable FOTA, really a hard nut to crack.

Considering safety and FOTA challenges, traditional automakers mostly choose to tap into vehicle system SOTA (Software-over-the-air) and act prudently in FOTA promotion. Through the lens of a typical FOTA flow, realizing FOTA needs E/E architecture disruption, and the support of new technologies like automotive Ethernet, cyber security, intelligent gateway, great computing power, and large memory.

Conventional OEMs have made slow progress in FOTA development over the past several years. Yet they took a big step forward in 2019. It can be seen from the table below that there is a gap between main OEMs and Tesla. Success of Tesla Model 3 weighs so heavily on traditional automakers that they are highly endangered except sweating for rapid transformation.

VW is the most aggressive among OEMs, while its counterparts are also working hard. The race to roll out intelligent gateway chip in early 2020 is a reflection of OEM’s eager hoping to enable FOTA as early as possible just as Tesla has done.

Installation of SOTA easier to realize is soaring in both volume and rate. In 2019, 3.838 million passenger cars, or 19% of the total, were provided with SOTA, jumping by 60.6% compared with 2.39 million units, or 11.8% of the total in 2018, according to ResearchInChina.

Among typical OEMs, GM leads in OTA capability. Its new-generation electronic architecture enables FOTA updates on its ICE models, which means OTA is available to recalibrate or upgrade engine and transmission control modules, vehicle communication system, entertainment system, driving control and body control ECU at a later stage.

In 2020, Buick’s latest interconnection system, eConnect3.0 enables OTA updates of 9 major models such as OnStar module, IVI system, intelligent driving control module, body control module, and iBooster brake booster.

In 2020, the latest Cadillac CT5 model will pack GM’s new electronic architecture. CT5 allows OTA updates of more than 30 vehicle control modules including software modules (e.g., IVI and smart connectivity) and firmware electronic modules (e.g., powertrain, chassis and electrical control).

GM plans to apply its next-generation E/E architecture to most of its car lineups before 2023.

Chinese companies that excel in application layer innovation already make plenty of OTA micro-innovations. Examples include SAIC providing personalized OTA -- DOTA, and BYD and XPENG Motors both offering high temperature disinfection capability enabled by OTA updates.

In April 2020, BYD announced its new models like Tang added with “high temperature disinfection capability” enabled by OTA updates. This capability is not simple upgrade and introduction but involves a complete set of OTA-based working logic of multiple ECUs (e.g., multimedia, air-conditioner controller and PTC heater) in a safe way.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...