Denso CASE (Connectivity, Automation, Sharing and Electrification) Research Report, 2020

As one of the top three Tier1 suppliers in the world, Denso makes adjustments and deployments during the automotive industry disruption.

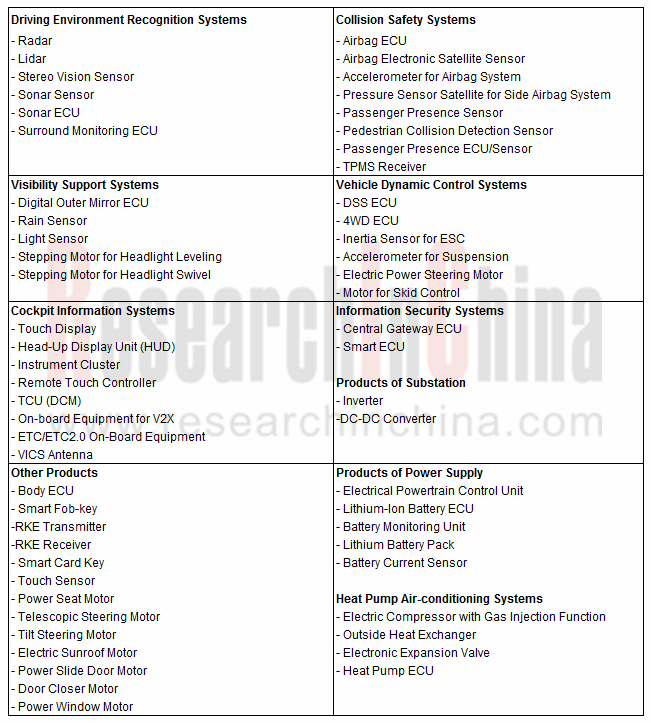

Sorting out Denso’s existing product lines, up to 200-plus varieties are found, including virtually 70 for CASE (connectivity, automation, sharing and electrification).

Denso’s CASE Products (Part)

Source: Marklines; ResearchInChina

The number of auto parts will decrease in the trend towards CASE. In a recent opinion, automotive hardware will be standardized and contribute declining revenue and profits, and future competition lies in the ability to develop software-defined vehicles. Emerging carmakers have late-mover advantages with more software talents.

Another view is that Tier1 suppliers will be marginalized by OEMs (e.g., Tesla and VW) who try to lead research and development of operating system, DCU (or vehicle central computer) and core software and hardware systems.

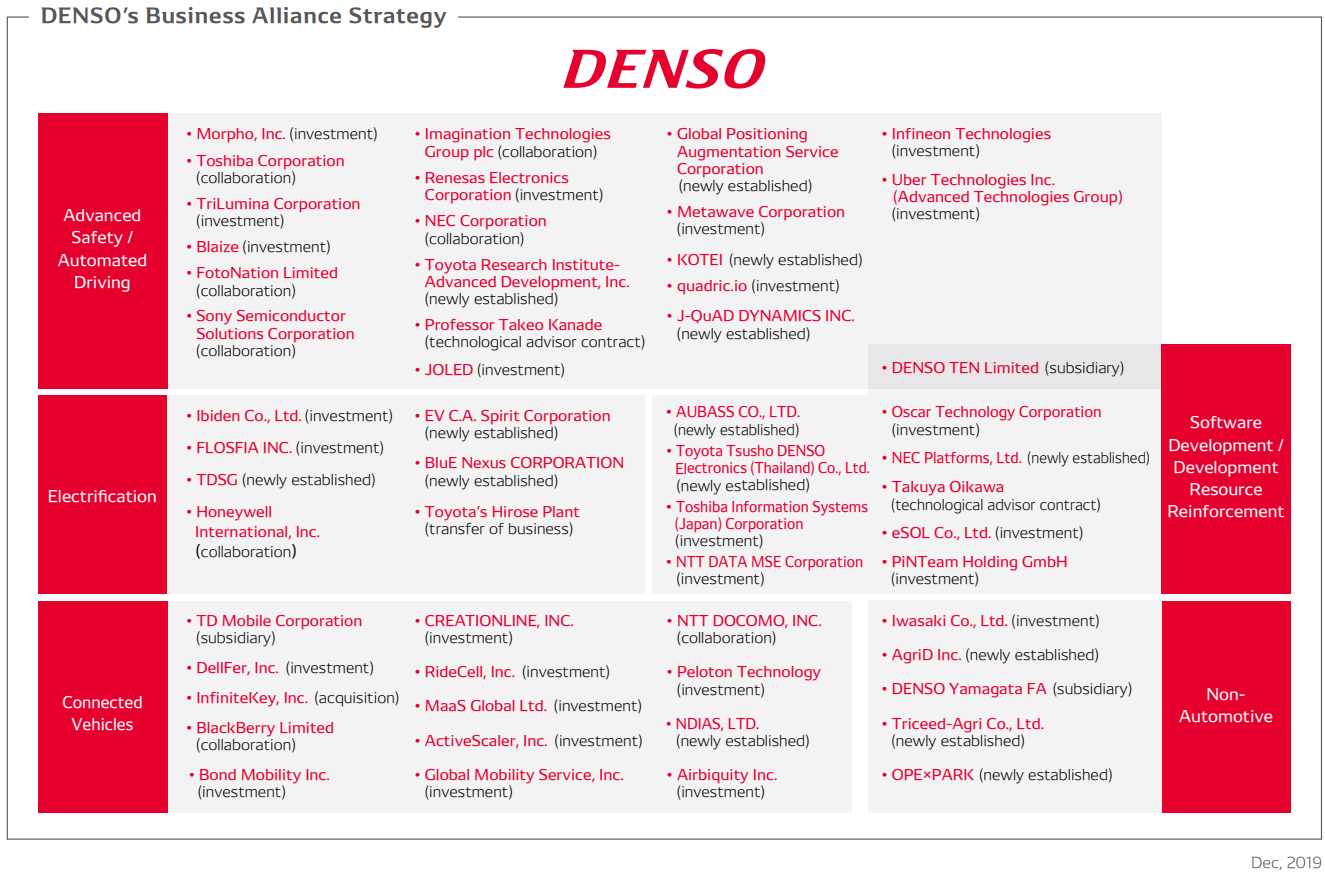

It can be seen from Denso’s CASE layout that the supplier not only makes deployments in all aspects of hardware but spends on software not less than IT-backed firms.

Denso’s Investment in Hardware

The US government’s crackdown on Chinese high-tech companies shows that just developing software and applications at the upper layer is not enough, and holding basic materials, core components and basic software is the only way to be free of others.

Denso lavishes heavily on core fundamental technologies, including magnetic materials, power semiconductors, solid-state batteries, magnetic heat pumps, human-computer interaction, AI, sensors, and quantum computing.

In 2018, Denso invested FLOSFIA and collaborated with the latter on developing a next-generation power semiconductor material (α-Ga2O3) for vehicle application. Schottky Barrier Diode (SBD), Flosfia’s α- Ga2O3 material, can work under 600V and 10A, with rated power of 100W-1kW, outperforming SiC products in both efficiency and cost. SBD is expected to be spawned in 2020. Theoretically, SBD material is seven times more efficient than GaN in low frequency and doubles GaN in high frequency or more.

Denso has been devoted to researching automotive semiconductor technology since its IC Laboratory was set up in 1968, having made improvements in ECU, sensor and other products. In September 2017, Denso founded a subsidiary -- NSITEXE, a developer of next-generation high-performance semiconductors. DFP (data flow processor) independently developed by NSITEXE, differs totally from CPU and GPU. For practical use of DFP, Denso and NSITEXE then invested Blaize and quadric.io, two semiconductor start-ups. Blaize, founded by former workers at Intel in 2012, builds software and process architectures from the underlying layer for better AI computing. NSITEXE helps to develop an autonomous driving technology which makes instant judgment in extreme scenarios, by combining DFP and EPU from quadric.io.

Leading Tier1 suppliers from Japan and Germany often adopt IDM model and have their own chip fabrication plants, compared with IC designers focusing on prevailing FABLESS model in China. Denso Hokkaido is Denso’s key manufacturing site of semiconductor sensors. To meet the robust demand from electrification and autonomous driving markets, Denso plans expansion of its Hokkaido plant. The expansion project will break ground in July 2020 and be completed in June 2021. The number of employees will expectedly rise to about 1,150 in 2025.

Denso’s Investment in Software

In 2025, Denso will boast 12,000 software talents worldwide; it will have more than 1,000 staffs and over 1,100 patents in autonomous driving field.

In addition to workforce enlargement for independent development, Denso also invests quite a few software firms.

Denso’s Big Competitive Edges in an Age of CASE

From Denso’s alliance, acquisitions and investment map as below as well as the Abstract of this report, it can be seen that Denso is sinking to research and development of core technologies and parts.

Source: Denso

Tier1 suppliers once gave an impression that they were suppliers of integrated systems for OEMs. As OEMs more set foot in system integration, Denso has turned to research and development of more basic core technologies. Weighed by new entrants from all walks of life, Denso still stays competitive on the strength of its across-the-board product matrices, economies of scale, and software and hardware synergy.

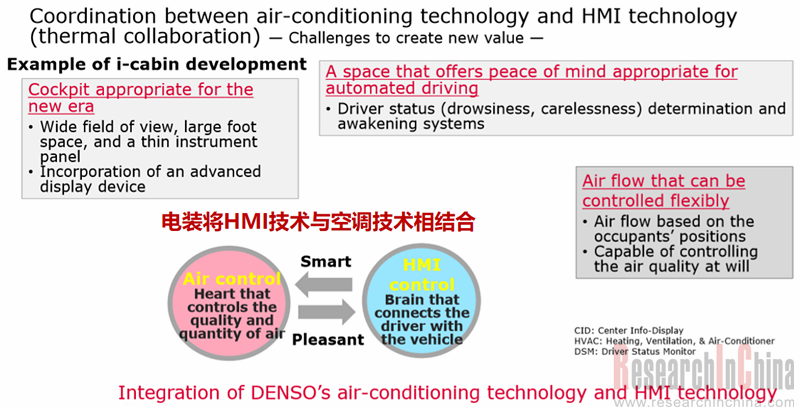

For example, Denso’s cockpit systems integrated with HMI and air-conditioning technologies will offer better user experience. This is an impossibility for the majority of companies who fail as well in high integration at the underlying layer.

Source: Denso; ResearchInChina

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...