Global and China Tire Mold Industry Report, 2020-2026

-

Jul.2020

- Hard Copy

- USD

$3,000

-

- Pages:123

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

ZJF154

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

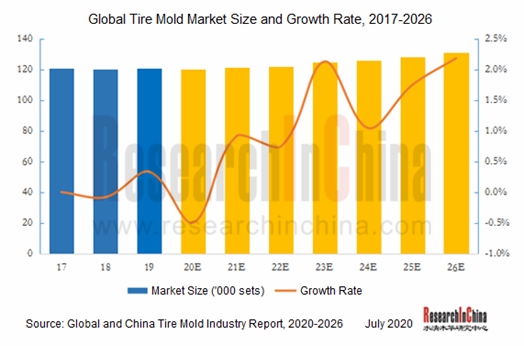

A total of 1,754 million semi-steel and all-steel radial tires were shipped worldwide in 2019, down 2.8% from a year ago. After two years of slowdown, the global tire industry will remain bearish amid the devastating COVID-19 pandemic in 2020 and will make slow headway, which undoubtedly have implications for tire mold industry. The world’s demand for tire mold reached 120,800 sets and edged up 0.33% year on year in 2019, and the figure is projected to register 131,100 sets in 2026 alongside the tire mold market expanding at a CAGR of 1.2% between 2019 and 2026.

Radial tires are used for both passenger cars and commercial vehicles. Semi-steel radial tires mainly find application in passenger cars and light-duty commercial vehicle, while all-steel ones get used in large commercial vehicle like bus and truck and are produced with different molds. In 2019, all-steel tire mold commanded 12.7% of the global market size, and semi-steel tire mold 87.3%.

Tire mold market is ruled by Asian competitors including Himile Mechanical Science & Technology (32.75%), S.Korean Saehwa (7.28%) and Shandong Wantong Mould (6.25%). Among them, Himile Mechanical Science & Technology is committed to producing and selling radial tire segmented mold, with products covering passenger car tire (PCR) mold, truck & bus tire (TBR) mold, off-the-road tire (OTR) mold, giant OTR mold, and with professional tire makers as key clients. Himile has established branches and factories in the United States, Thailand, Europe and India; 80% of Saehwa’s products are exported, with production facilities in China encompassing Tianjin Shinhan, Tianjin Saehan, and Nanjing Saehan; Shandong Wantong produces such products as all-steel and semi-steel radial tire segmented molds applicable to the production of tires for trucks, buses and sedans, possessing annual capacity of over 3,000 sets.

Global and China Tire Mold Industry Report, 2020-2026 highlights the following:

Global tire mold industry (status quo, competition and tendencies);

Global tire mold industry (status quo, competition and tendencies);

China’s tire mold industry (policy climate, development course, major producers’ capacities and profits, industry sales, and competitive pattern);

China’s tire mold industry (policy climate, development course, major producers’ capacities and profits, industry sales, and competitive pattern);

Tire mold demand in China (domestic sales, exports, tire mold upgrading & replacement);

Tire mold demand in China (domestic sales, exports, tire mold upgrading & replacement);

4 global companies (tire mold business, profitability, development in China);

4 global companies (tire mold business, profitability, development in China);

12 Chinese companies (tire mold business, operation, gross margin, revenue structure, key projects, development strategies, etc.)

12 Chinese companies (tire mold business, operation, gross margin, revenue structure, key projects, development strategies, etc.)

1. Tire Mold

1.1 Definition

1.2 Classification

1.3 Industry Chain

1.4 Production Process

1.5 Features

2. Global Tire Mold Industry

2.1 Status Quo

2.2 Market Situation

2.2.1 Market Size

2.2.2 Market Structure

2.3 Competition Pattern

2.4 Development Trend

3. China Tire Mold Industry

3.1 Development History

3.2 Industry Policy

3.3 Status Quo

3.3.1 Sales

3.3.2 Output

3.3.3 Demand

3.4 Corporate Competition

3.5 Development Trend

4. Development of Tire Industry

4.1 Global

4.1.1 Market Size

4.1.2 Key Manufacturers

4.1.3 USA

4.1.4 Europe

4.2 China

4.2.1 Industrial Size and Characteristics

4.2.2 Output and Structure

4.2.3 Export

4.2.4 Trade Friction and “Going Global”Strategy

4.2.5 Competitive Landscape

5. Development of Automobile Industry

5.1 Global

5.2 China

6. Key Global Companies

6.1 SAEHWA IMC

6.1.1 Profile

6.1.2 Business Distribution

6.1.3 Operation

6.1.4 Development History

6.1.5 Tire Mold Products

6.1.6 Development in China

6.1.7 Development Planning

6.2 HERBERT Maschinenbau GmbH & Co. KG

6.2.1 Profile

6.2.2 Tire Mold Products

6.3 Quality Mold, Inc.

6.4 A-Z Formen- und Maschinenbau GmbH

7. Key Chinese Enterprises

7.1 Himile Mechanical Science & Technology (Shandong) Co., Ltd.

7.1.1 Profile

7.1.2 Development History

7.1.3 Operation

7.1.4 Tire Mold Business

7.1.5 R&D and Projects

7.1.6 Competitive Edge

7.2 Greatoo Intelligent Equipment Inc.

7.2.1 Profile

7.2.2 Operation

7.2.3 Major Customers

7.2.4 R & D Investment and Main Projects

7.2.5 Tire Mold Business

7.3 Shandong Wantong Mould Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.4 Tianyang Mold Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.5 Anhui Wide Way Mould Co., Ltd.

7.5.1 Profile

7.5.2 Operation

7.6 Others

7.6.1 DongyingJintai Rubber Machinery Co., Ltd

7.6.2 Qingdao Yuantong Machinery Co., Ltd.

7.6.3 Shandong Hongji Mechanical Technology Co., Ltd.

7.6.4 Rongcheng Hongchang Mold Co., Ltd.

7.6.5 Anhui Varon Mould Co., Ltd.

7.6.6 Zhejiang Laifu Mould Co., Ltd.

7.6.7 MESNAC Precise Processing Industry Co., Ltd.

7.6.8 Shandong Hengyi Mould Co., Ltd.

Classification of Tire Mold

Classification of Radial Tire Segmented Mold

Upstream and Downstream of Tire Mold Industry

Comparison of Tire Mold Pattern Processing Technologies in China

Ranking of Rubber Machinery Manufacturers Worldwide, 2014-2019

Global Tire Mold Market Size, 2017-2026E

Global Demand for Tire Mold, 2017-2026E

Structure of Global Tire Mold Demand (by Product), 2019

Business Model of Major Tire Mold Manufacturers in the World

Competitive Pattern of Global Tire Mold Market, 2019

Comparison of Products between World’s Major Tire Mold Manufacturers

Development Course of China Tire Mold Industry

Policies and Laws & Regulations about China Tire Mold Industry

Sales Revenue of China Tire Mold Industry, 2015-2026E

Tire Mold Output in China, 2016-2026E

Factors Influencing Tire Mold Demand in China

Tire Mold Demand in China, 2017-2026E

Tire Mold Market Share in China, 2019

Capacity of Major Chinese Tire Mold Manufacturers in China, 2019

China’s Tire Meridianization Rate, 2008-2026E

Laws & Regulations on Environment-friendly Tire in Major Countries Worldwide

Global Tire Market Size, 2016-2026E

Regional Distribution of Global Tire Replacement Market, 2019

Regional Distribution of Global Tire OEM Market, 2019

Car Tire Market Size, 2016-2026E

Geographical Distribution of Global Tire Shipment, 2017-2019

Global Top Tire Manufacturers by Revenue, 2018-2019

Tier Distribution of Global Tire Manufacturers

Passenger Car OE and Replacement Tire Shipment in the U.S., 2013-2019

Light Truck OE and Replacement Tire Shipment in the U.S., 2013-2019

Medium/Heavy Truck OE and Replacement Tire Shipment in the U.S., 2013-2019

Passenger Car Tire Imports in US, 2018-2019

Commercial Vehicle Tire Imports in US, 2018-2019

Truck Tire Imports in US, 2018-2019

Replacement Consumer Tire Sales in Europe (ETRMA members), 2016-2019

Replacement Truck and Bus Tire Sales in Europe (ETRMA members), 2016-2019

Replacement Agricultural Tire Sales in Europe (ETRMA members), 2016-2019

China’s Automobile Tire Market Size, 2016-2026E

China’s Automobile Tire OE and Replacement Market Size, 2016-2026E

Tire Matching and Replacement Amount by Type

China’s Automobile Tire Output, 2016-2026E

China’s Automobile Tire Sales Volume, 2016-2026E

China Tire Output Structure (by Product Type), 2019

Capacity Planning of Major Tire Manufacturers in China, 2019

Output of Major Tire Manufacturers in China, 2016-2019

China’s Automotive Tire Export Volume, 2012-2019

China’s Tire Export Structure, 2019

Top 10 Export Destinations of Automobile/Light Truck Tire, 2019

Volume of Tires Exported from China to the United States, 2011-2019

Volume of Exported Tires from China to ‘One Belt, One Road’ Countries, 2011-2019

Volume of Exported Tires from China to Regions except Europe and America, 2011-2019

China’s Tire Trade Frictions with the U.S. and EU over Recent Years

Overseas Presence of Chinese Tire Manufacturers over Recent Years

Revenue from Tire of Major Tire Manufacturers in China, 2017-2019

Net Income of Major Tire Manufacturers in China, 2018-2019

Competitive Pattern of China Tire Market, 2019

Global Automobile Output, 2013-2019

Global Automotive Sales Volume by Region, 2003-2019

Automobile Output in China, 2010-2026E

Automobile Sales Volume and Growth in China, 2012-2026E

Passenger Car Production and Sales by Type in China, 2018-2019

Passenger Car Sales Volume in China, 2010-2019

Commercial Vehicle Sales Volume in China, 2010-2019

YoY Growth Rate of China’s Annual Automobile Sales Volume, 2012-2019

China’s Automobile Sales Volume and Market Share (by Series), 2012-2019

Global Business Distribution of SAEHWA IMC

Major Production Bases of SAEHWA IMC in South Korea

Global Production Bases of SAEHWA IMC (Excluding South Korea)

Operation of SAEHWA IMC, 2017-2019

Revenue Breakdown of SAEHWA IMC (by Product), 2016-2018

Product Development History of SAEHWA IMC

Development Course of SAEHWA IMC

Main Tire Mold Products of SAEHWA IMC

Profile of Major Tire Mold Companies of SAEHWA IMC in China

Medium and Long-term Business Strategies of SAEHWA IMC

Main Production Bases of HERBERT in the World

Revenue of HERBERT, 2015-2018

Main Tire Mold Products of HERBERT

Tire Mold Production Bases of Quality Mold Inc.

Major Pattern Types of Tire Mold of Quality Mold Inc

Main Tire Mold Products of A-Z

Customers of Himile Mechanical Science & Technology

Development Course of Himile Mechanical Science & Technology

Revenue and Net Income of Himile Mechanical Science & Technology, 2013-2020

Revenue Structure (by Business) of Himile Mechanical Science & Technology, 2016-2019

Revenue Structure (by Region) of Himile Mechanical Science & Technology, 2016-2019

Gross Margin of Major Products of Himile Mechanical Science & Technology, 2016-2019

Major Tire Mold Products of Himile Mechanical Science & Technology

Main Customers of Himile Mechanical Science & Technology

Tire Mold Capacity of Himile Mechanical Science & Technology, 2013-2019

Tire Mold Sales Volume of Himile Mechanical Science & Technology, 2013-2018

Tire Mold Sales Volume Structure (by Product) of Himile Mechanical Science & Technology, 2018

Operation of Mold Subsidiaries of Himile Mechanical Science & Technology, 2019

R&D Costs and % of Total Revenue of Himile Mechanical Science & Technology, 2013-2019

Global Service System of Himile Mechanical Science & Technology

Tire Mold Customers of Himile Mechanical Science & Technology

Revenue and Net Income of Greatoo Intelligent Equipment, 2013-2020

Revenue Structure (by Business) of Greatoo Intelligent Equipment, 2016-2019

Revenue Structure (by Region) of Greatoo Intelligent Equipment, 2013-2019

Gross Margin of Major Products of Greatoo Intelligent Equipment, 2013-2019

Distribution of Global Customers of Greatoo Intelligent Equipment

Key Domestic and Overseas Customers of Greatoo Intelligent Equipment

R&D Costs and % of Total Revenue of Greatoo Intelligent Equipment, 2012-2019

Key Construction Projects of Greatoo Intelligent Equipment, 2018

Major Tire Mold Products of Greatoo Intelligent Equipment

Output, Sales Volume and Inventory of Major Products of Greatoo Intelligent Equipment, 2016-2019

Tire Mold Output and Sales Volume of Greatoo Intelligent Equipment, 2016-2018

Tire Mold Products of Shandong Wantong Mould

Main Customers of Shandong Wantong Mould

Revenue of Shandong Wantong Mould, 2013-2018

Major Tire Mold Products of Tianyang Mold

Major Customers of Tianyang Mold

Revenue of Tianyang Mold, 2013-2018

Global Footprint of Anhui Wide Way Mould

Key Partners of Anhui Wide Way Mould Worldwide

Products of Anhui Wide Way Mould

Revenue of Anhui Wide Way Mould, 2013-2018

Major Products of Qingdao Yuantong Machinery

Major Customers of Qingdao Yuantong Machinery

Revenue of Qingdao Yuantong Machinery, 2013-2018

Revenue of Shandong Hongji Mechanical Technology, 2013-2018

Main Products of Rongcheng Hongchang Mold

Global Presence of Anhui Varon Mould

Main Products of Anhui Varon Mould

Revenue of Anhui Mcgill Mould, 2013-2018

Development Course of Zhejiang Laifu Mould

Marketing Network of Zhejiang Laifu Mould

Partners of Zhejiang Laifu Mould

Main Mold Products of Zhejiang Laifu Mould

Key Financials of MESNAC Precise Processing Industry, 2013-2018

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...