IGBT (Insulated Gate Bipolar Transistor) is a fully controlled and voltage-driven power semiconductor device incorporating BJT and MOSFET, superior in small drive power, fast switching speed, low saturation voltage and large current density. IGBT is critical to electrical and electronic system and deemed as the ‘CPU’ of the electrical and electronic industry.

IGBT is given full play under varied voltage class, like its exertion under 650~1200V in electric vehicle, 650V in home appliances and industrial fixing, either 650V or 1200V in new energy vehicle, and above 1700V in PV, industrial motors, high-speed railway, bullet trains, smart grid, etc.

Power semiconductors are exponentially utilized as automotive technologies are transferring to focus on new energy vehicle. Vehicle performance and costs are imposed directly by the technical level of motor control system as an essential part of the NEV industry chain. IGBT, the centerpiece of electronic control system, has the merits like high input impedance, high switching speed and low conduction loss and plays a vitally important role in the high-voltage system. IGBT module serving as high-voltage control switch component constitutes about 40% of motor controller costs. IGBT devices make up about 10% of NEV cost and share roughly 20% of charging pile costs.

In a new energy vehicle, IGBT is found in battery management system, motor control system, electric air-conditioning control system, charging system, positive temperature coefficient (PTC), etc., acting (in master inverter) to convert the direct current (DC) of high-voltage battery into the alternating current (AC) to drive three-phase motor, and (in onboard charger, or OBC) to join conversion of 220V AC into DC for charging the high-voltage battery. Also, IGBT gets widely used in DC/DC converter, PTC, electric air-conditioning compressor and other systems. In addition to its use in battery electric vehicle, IGBT is required in the high-voltage system independent of the low-voltage system in the plug-in hybrid electric vehicle (PHEV), so is the case (but used on a small scale) in the ICE cars partially packed with 48V hybrid system, such as the control module in BSG.

Concerning its use in electric vehicle, a high demanding on IGBT is asked by voltage level, power level, limiting condition, reliability, service life, costs, among others. It remains a big challenge.

IGBT packaging technologies concern chip surface interconnect, tape-up interconnect, and conductive terminals interconnect, securing high reliability and high power density, and the running of electric motor controllers under high temperature. IGBT module packaging is now studied mostly on parameter optimization of new interconnection materials and interconnection modes in a bid for better heat dissipation, smaller footprint and higher reliability.

Market Competition

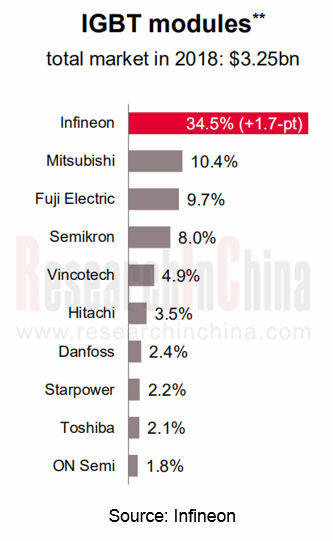

Global IGBT modules market is ruled by giants like Infineon, Mitsubishi Electric, Fuji Electric, ON Semi, and Semikron. The Chinese player Starpower is in the eighth place globally.

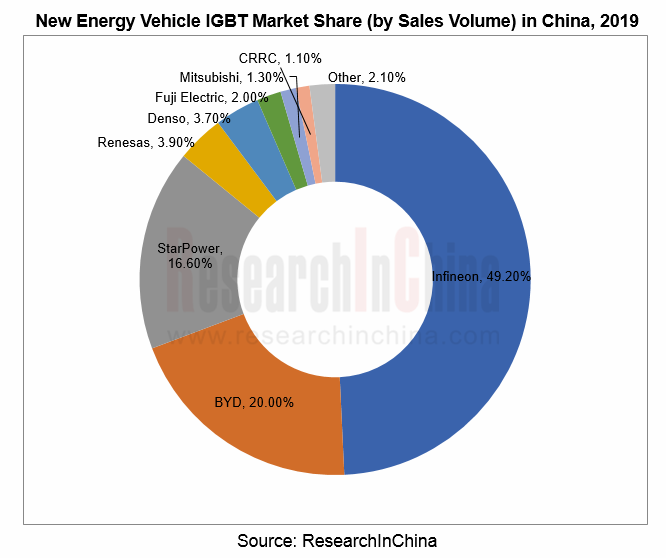

Electric vehicle (EV+PHEV) IGBT market share is learnt from those vehicle sales data, after a survey by ResearchInChina on the IGBT suppliers for EV and PHEV models on offer. Infineon stays far ahead of others, commanding 49.2%, followed by BYD 20.0% and StarPower 16.6%.

IGBT Industry Chain and Business Model

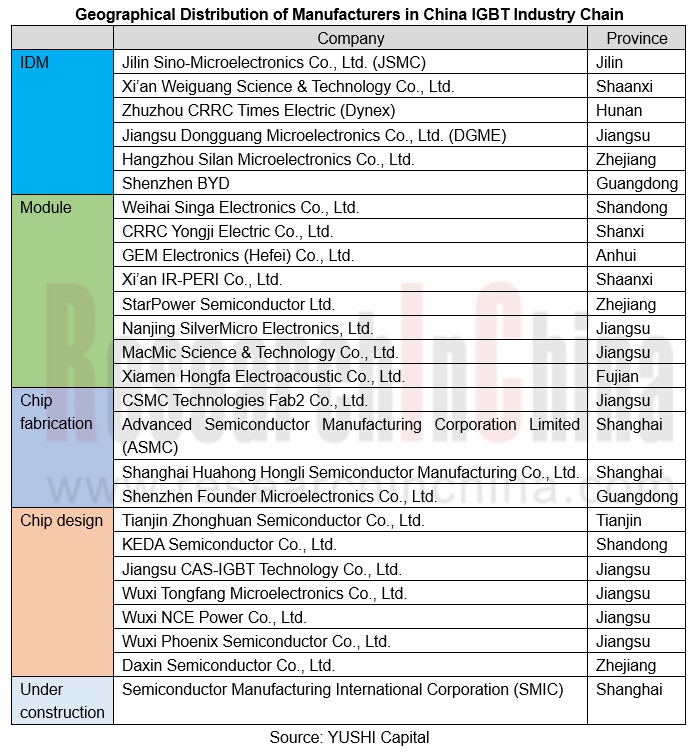

China has long been independent on importing IGBT chips and modules from abroad. It is since 2005 that a large number of overseas IGBT talents has come to China and devoted themselves to IGBT undertaking in China, where a sizable IGBT industry chain has already taken shape.

There are three IGBT business models, including Fabless, Packaging, and IDM (Integrated Device Manufacture).

·Fabless refers to the company that is only specialized in chip circuit design and sales with production outsourced, such as StarPower Semiconductor, and Jiangsu CAS-IGBT Technology.

·IDM refers to the company that involves in chip design, fabrication and packaging, such as BYD, Infineon, Mitsubishi, and Silan Microelectronics.

·Packaging model is to purchase chips and then do encapsulation independently, such as Danfoss that is engrossed in packaging technologies. Bosch, Continental and Delphi also have IGBT packaging business.

Danfoss wins support from chip vendors like Infineon and ON Semi. In June 2020, Infineon inked a multi-year deal with Danfoss and would provide the latter with IGBT and diode chipset used for power modules of electric vehicle inverter. In July 2020, ON Semi announced it would provide Danfoss with high-power IGBT and diodes for the inverter drive module of electric vehicle.

Development Status Quo and Future Trend

IGBT has been much sought after amid the trend of vehicle electrification. The IGBT vendors like Infineon, ON Semi and Microsemi now has a supply cycle from 13 weeks to 30 weeks, with a tendency of prolonged delivery, in contrast to the normal IGBT supply periodicity lasting seven weeks to eight weeks, according to Future Electronics.cn.

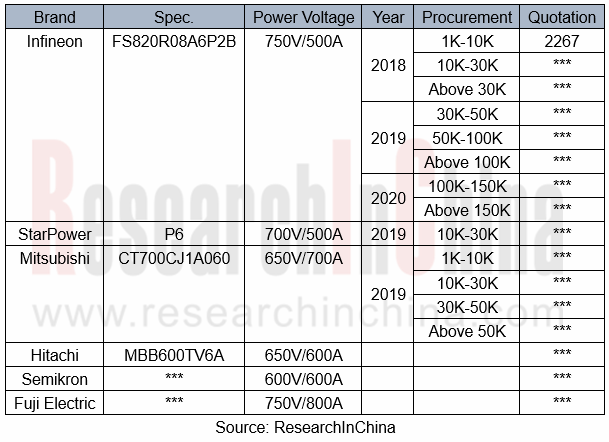

ResearchInChina studies the supply relations and prices of main automotive chips and founds it that StarPower’s IGBT product P6 is about half price of Infineon’ product of same sort.

Infineon’s automotive HybridPACK family falls into HP1-DC6 and HP-Drive packaging platforms, among which HP-Drive covers 80kW to 180kW applications. HP-Drive modules were in short supply in 2018, and the orders have a supply cycle of 39 weeks, and it will be first delivered to who first places an order. Due to supply inadequacies, NextEV paid RMB100 million in advance for ordering Infineon’s HP-Drive capacities in 2019.

Allured by robust market demand, the IGBT vendors are raising capital to ramp up production.

In April 2019, ON Semi acquired the proprietorship of Global Foundries’ 300mm wafer fab at East Fishkill, New York, to expand production of MOSFET and IGBT chips.

In April 2020, Semikron made a capital increase of more than EUR8 million to ramp up production in China and introduced the state-of-the-art MiniSKiiP manufacturing line to meet the burgeoning market demand in China.

In April 2020, Shenzhen BYD Microelectronics Co., Ltd., an exclusively funded subsidiary of BYD, was successfully reshuffled. BYD Semiconductor fulfilled the series A funding of RMB1,900 million on May 26, 2020 and A+ fundraising of RMB800 million from the investors on June 15, 2020.

StarPower went public on the A-Share market in February 2020 and a total capital of RMB510 million raised via IPO is earmarked for the performance improvement of its existing IGBT module portfolio and for the research and development of new-generation IGBT chips with lower conducting voltage drop and lower switching loss. Since it debuted with an issued price at RMB12.7 on the A-Share, StarPower has skyrocketed by 1073% in 23 days after successive twenty-one “+10%”trading limits.

Technically, it is an effective approach to improve the charging power and efficiency and reduce energy consumption during the driving of electric vehicle as concerns addressing the bottleneck of EV battery capacity and extending the mileage endurance. The general automotive silicon-based power devices are thus possibly replaced by the third-generation semiconductor power devices represented by SiC that has such merits of high voltage resistance, low loss and high efficiency that breaks through the limitations of silicon and brings better conductivity and electrical properties. All players are aggressively making deployments in SiC.

Tesla is a trailblazer in the use of SiC MOSFET (offered by ST) in Model 3 inverter module, for which Infineon also later became the supplier of SiC power semiconductors. In May 2019, CREE became the exclusive SiC partner in Volkwagen’s FAST (Future Automotive Supply Tracks) project. In September 2019, CREE and Delphi announced to collaborate on automotive SiC devices.

In 2020, BYD HAN EV motor controller was first packed with the self-developed SiC MOSFET module, significantly improving motor performance.

Bosch is developing SiC products as well and will commence production in 2020.

The global SiC industry is a tripartite pattern, i.e., USA, Europe and Japan, among which the United States takes a lion’s share since 70% to 80% of world’s SiC capacities come from American companies like CREE, ON Semi, and II-VI. In Europe, there is a complete SiC industry chain from substrates, epitaxial, devices and applications, where the typical companies are ST, Infineon, etc.

Although SiC is a long-term trend, SiC MOSFET is hard to substitute for IGBT in the short run. SiC epitaxy production encounters the inconformity of material stress, resulting in epitaxy layer bonding surface stress beyond tensile limit amid wafer size enlargement, which damages crystal grating and lowers the good yield. SiC chips now have a low yield, and wafer sizes are still mainly 4 inches or 6 inches, which makes it hard to achieve cost efficiency of large-size wafers and the production costs rather high. Of the same kind, SiC MOSFET has the cost eight to twelve folds of Si IGBT. The automotive SiC solutions has the about $300 higher cost than traditional Si IGBT.

SiC devices are costly to date owing to substrates and wafer sizes. With the technical advances in future, the cost of substrates will be ever reduced, while the wafer size will be bigger and bigger, which will undoubtedly lower the price.

SiC single crystal substrate suppliers consist of CREE, Dow Corning, SiCrystal, II-VI, Nippon Steel & Sumitomo Metal, Norstel, etc. Epitaxial companies are represented by DowCorning, II-VI, Norstel, CREE, Rohm, Mitsubishi Electric, and Infineon. Devices providers include Infineon, CREE, Rohm, ST, etc.

As for single crystal substrates, Chinese vendors focus on 4 inches. 6-inch conductive SiC substrate and high-purity semi-insulating SiC substrate have been developed in China. SICC, TankeBlue Semiconductor, Hebei Synlight Crystal, and CISRI-Zhongke Energy Conservation and Technology all succeeded in developing 6-inch substrates, and CETC Beijing Electronic Equipment already developed 6-inch semi-insulating substrate. Additionally, the competitors including EpiWorld International, Tianyu Technology (TYSiC), and Chengdu Guomin Tiancheng Semiconductor are all competent for supply of 4-inch to 6-inch epitaxial wafer.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...