Dual and multi display solutions and development tendencies are analyzed in this report.

Amid the smart cockpit trend, the display incarnates intelligence as the main interface of human-computer interaction. Following the large screen, multi display and dual display grow the new trend of the cockpit display. The “one-core multi-display” solution has become the apple in the eyes of OEMs and cockpit system integrators.

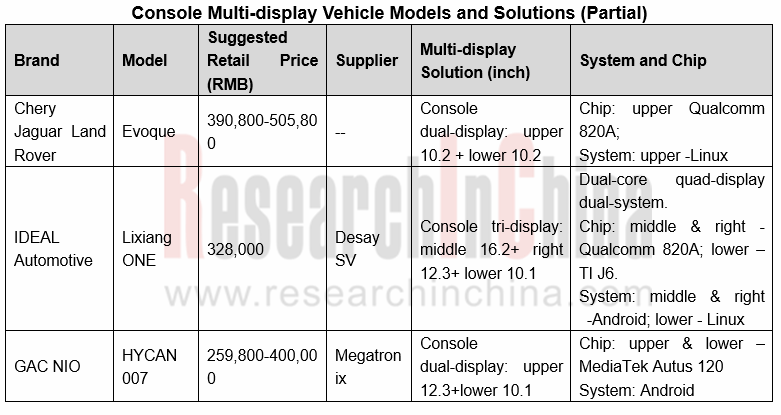

(I) Multi-display: Luxury brands adopt multi-display at first, and emerging brands follow suit.

The multi-display solution is superior in that the functions of the traditional console screen are split, so that navigation, multimedia and other information are placed on one screen or two, while vehicle information such as seats, air conditioning and ADAS are enabled on another screen. The system application menu and user’s operations are streamlined.

In 2016, Infiniti was the first to roll out a console solution with an 8.0-inch upper screen and a 7.0-inch lower screen. The Range Rover Velar unveiled in 2017 is equipped with two 10-inch console screens, featuring a sense of technology. Since then, foreign luxury brands like ACURA and Audi have followed suit.

Emerging brands such as Lixiang ONE, Nezha U, and HYCAN 007 debuted in 2019-2020 launched dual-screen consoles and even triple-screen consoles in a successive way.

In Q1 2020, the sales volume of models packed with a dual-screen console exceeded 30,000 units in China, a year-on-year spike of 165.0%; the installation rate was 1.2%, up 0.9 percentage point over the same period last year. As for terminal applications, the cost pressure confines dual-screen consoles to high-end models priced at RMB400,000-RMB500,000.

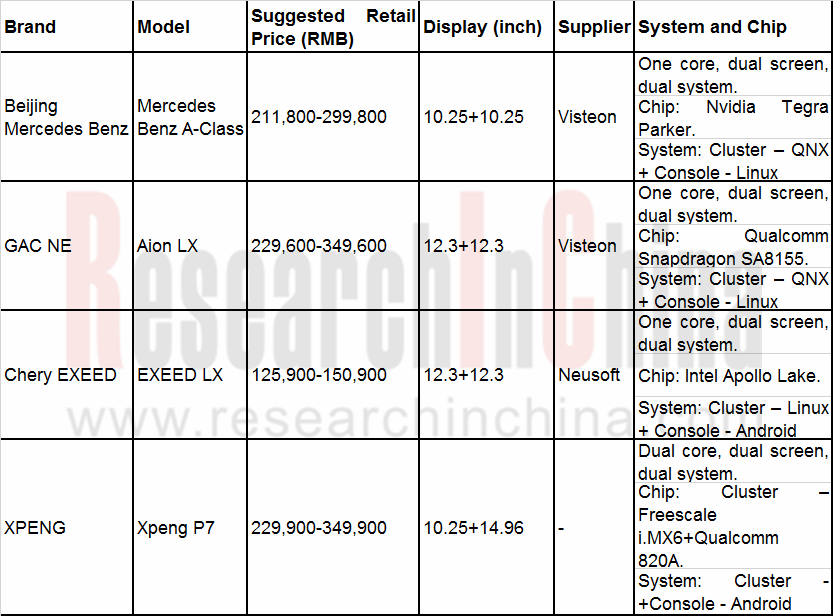

(II) Dual Display: Local Chinese Brands and Joint Venture Brands Contend for Model Launches with Dual Display during 2019-2020

The traditional console screen and the dashboard are physically separated by a large distance, so that the driver has to pay more attention to touching the console display and reading information. At the same time, console screen and LCD cluster screen interact in some content, for instance, the navigation route displayed on the console screen, music, calls and other information can be interactively showed on the LCD dashboard. In the dual-display solution, the dashboard screen and the console screen share a glass cover, being connected almost seamlessly, visually creating a sense of screen integration, making it easier for the driver to fulfil touch operations and read information.

The dual display solution first appeared in 2016. The interior of Mercedes Benz E-class mounts two 12.3-inch full HD screens housed within a single unit. In November 2018, the solution officially spread to Mercedes Benz A-class. In 2017-2018, Chinese brands such as BAIC BJEV Lite and FAW Besturn T77 began to dabble in the solution. In 2019-2020, dozens of models with dual displays, including FAW Hongqi HS5, Changan CS75 PLUS, GAC Aion LX and Chery EXEED LX, were launched successively.

In 2020Q1, China sold nearly 70,000 passenger cars equipped with the dual display solution, a year-on-year increase of 6.1%; the installation rate reached 2.4%, up 1.1 percentage points from the same period last year. The solution is mostly available in high-end models, and it has penetrated into low- and medium-end models since 2019.

(III) The “one-core multi-screen” solution: the hotspot of multi- and dual- display solutions

For chip control and system drive, the one-core multi-display is a favored solution which is seen in Benz A-Class, BUICK GL8 Avenir series, Lixiang ONE, among others, and the pioneers are in such a pre-emptive move, such as Harman, Visteon, Aptiv, Desay SV, Neusoft, etc.

In January 2020, Samsung brought its Digital Cockpit 2020 at CES. The new cockpit was developed by Samsung and its subsidiary HARMAN International, and it’s packed with technologies including an Exynos Auto V9 SoC, Android 10, a Dashboard Display which is seamlessly incorporated into the vehicle’s interior design, a Front Display, a Console Display, a Center Information Display, two physical knobs (both of which have their own displays), two 7-inch displays on each side of the dashboard as digital mirrors powered by external cameras.

Digital Cockpit 2020 by Samsung and HARMAN -- multi-display, dual-display (integrated screen), one-core multi-display system

Considering screen arrangement and chip use, Digital Cockpit 2020 jointly launched by Samsung Electronics and Harman International applies both console multi-screen and dual display solutions. The Center Information Display and the Console Display enable varied information application in the car, and the Front Display can show contents in a split-screen mode.

Digital Cockpit 2020 is packed with 4 large displays and 2 small displays:

- The 28.3-inch Front Display provides visual navigation information and is positioned to ensure that the driver keeps their eyes on the road. It is equipped with QLED Local Dimming technology and split-screen mode to allow passengers to make use of the display without distracting the driver.

- The Dashboard Display, which is seamlessly incorporated into the vehicle’s interior design, is positioned under the Front Display and delivers visual notices and alerts.

- The 12.4-inch Center Information Display can automatically rise and fall, and can provide information like driver’s schedule once the driver is authenticated via facial recognition or a connected smartphone’s fingerprint reader.

- The Console Display can be set up to control various features and the functions of other displays, as well as the vehicle itself.

- Two physical knobs, both of which have their own displays, enable users to choose music.

In a nutshell, it seems unavoidable for automakers and parts suppliers how to get perfect human-machine interaction and information display as well as full exertion of console intelligence in accompaniment with a broad range of features and applications in the car. Multi-display ‘separate governance’ and dual display ‘all in one’ are the two alternatives for the automakers. What is the most challenging now are the expensive R&D costs of the ‘one-core multi-display’ solution and a high demanding on technical strength. For the OEMs, enormous investment is necessary for chip authorization, software and operating system (OS) development, etc.; for the system integrators, software complexity remains a hard nut to crack.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...