Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2020 (I)

Leading Tier1 Suppliers’ Cockpit Business Research Report: Eight Development Trends of Intelligent Cockpit

Abstract: in the next two or three years, a range of new intelligent cockpit technologies will be in place and mounted on vehicles, according to the Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report.

High automation faces technical and regulation challenges and it takes a long period of time to build 5G network and roadside infrastructure. In this context, much enthusiasm for intelligent cockpit is being aroused before automated driving technology becomes mature enough. Intelligent cockpits featuring new design concept draw more attention from consumers than automated driving technology does.

Globally, OEMs and Tier1 suppliers are racing to explore how to launch new intelligent cockpit technologies. We expect that numerous intelligent cockpit products will be launched successively in the upcoming two years or three. Based on the picture at CES 2020, development trends for intelligent cockpit can be seen below:

(1) Cockpit domain control unit (DCU): next-generation intelligent cockpit systems are DCU-centric and enable features of cockpit electronic systems through a unified software and hardware platform, which incorporate intelligent interaction, intelligent scenarios and personalized services and serve as the foundation for human-vehicle interaction and V2X connectivity.

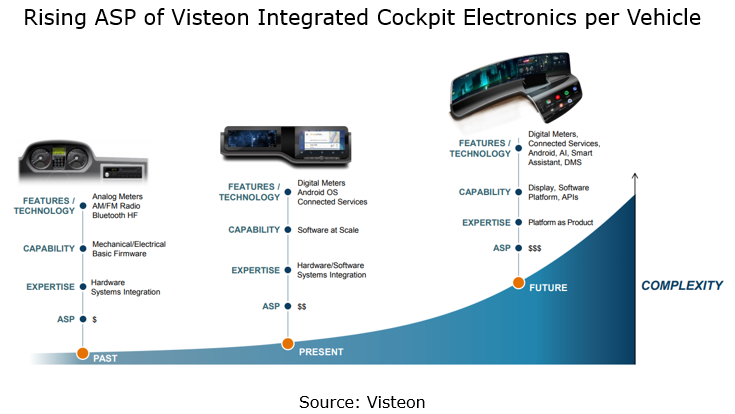

(2) Multi-display interaction: the cockpit design of dual-display interaction (center console, dashboard), four-display interaction (center console, dashboard, entertainment screen at the copilot’s seat, vehicle control display), or even five-display interaction (center console, dashboard, entertainment screen at the copilot’s seat, vehicle control display, rear seat entertainment display) is trending. Multi-display interaction needs complete cockpit domain architecture, and fusion of technologies, e.g., cockpit DCU, multi-chip (like TI automotive chips and Qualcomm entertainment chip), multiple operating systems (Linux, Android Automotive), Hypervisor virtualization technology, interaction logic, and HMI design. Tier1 suppliers are required to be more competent in product development and technology integration while seeking business growth amid the rising average selling price (ASP) of intelligent cockpit per vehicle.

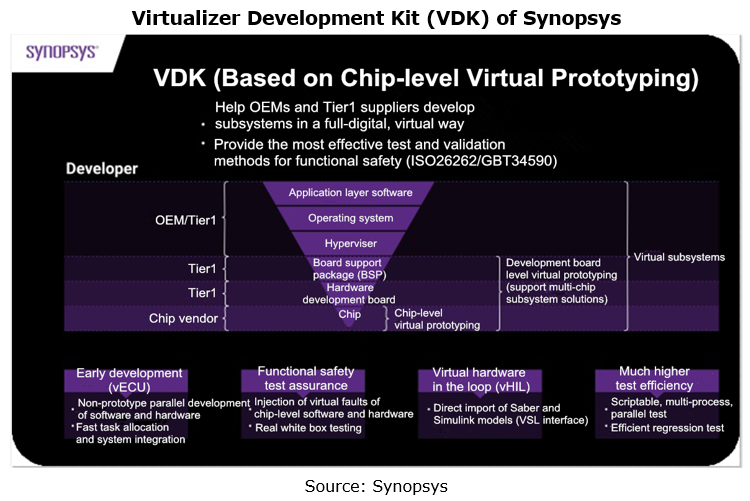

(3) Cockpit virtualization technology (separate development of software and hardware): virtual prototyping technology makes design, R&D and test of intelligent vehicles more efficient. Virtualizer Development Kit (VDK) based on virtual prototyping technology enables virtual simulation of electronic control units (ECU), e.g., chips, circuits and components. Automakers can commence development and test of software twelve months ahead of time before the availability of hardware, upgrading physical development to intelligent development in simulation environment. Also, ECUs for virtual simulation can accelerate and extend tests, and simulate various tests in extreme conditions, which is hard to achieve in real and physical circumstances and which secures faster roll-out of safer and more reliable products into market. The virtual prototyping technology is applicable to virtual development and test of all complex electronic systems such as intelligent cockpit and ADAS.

(4) Higher value of cockpit electronics software: the more complex vehicle system software means it makes up ever more of the total cost of a vehicle. OEMs and Tier1 suppliers are expanding software developers in R&D workforce. Examples include Desay SV, an intelligent cockpit bellwether in China, which boasted about 1,300 software engineers in 2019, a 70% share of its headcount; and Bosch in possession of 30,000 software talents, or 41% of the total staff in 2019 endeavoring to recruit more software developers. Between 2019 and 2020, Bosch set up Bosch China Innovation and Software R&D Center and Bosch Digital Cabin (Shanghai) R&D Center.

(5) Cockpit “terminal-cloud” integration, T-BOX and V2X as gateway of data from inside and outside vehicle, and cockpit big data as core competitive edge of products: intelligent cockpit will be a combination of terminals and cloud, in which all kinds of service contents, timely information sharing and complex computation will be offered and done over cloud, more than acts as a stand-alone terminal. In future cockpit big data will be the core competitive edge of products, making center console and dashboard, center information display (CID) navigation, T-BOX and air-conditioner controller, integrated.

(6) Evolution of vehicle display from flat rectangular screen to large curved screen: in January 2020, Corning’s high-performance Gorilla cold-rolled glass was first available to GAC Aion LX; in early 2020, Visteon and Corning joined hands to further develop ColdForm technology which will be spawned by Corning for automotive curved display systems; in July 2020, Rightware under Thundersoft, and LG Electronics partnered to develop the industry’s first curved OLED display for 2021 Cadillac Escalade.

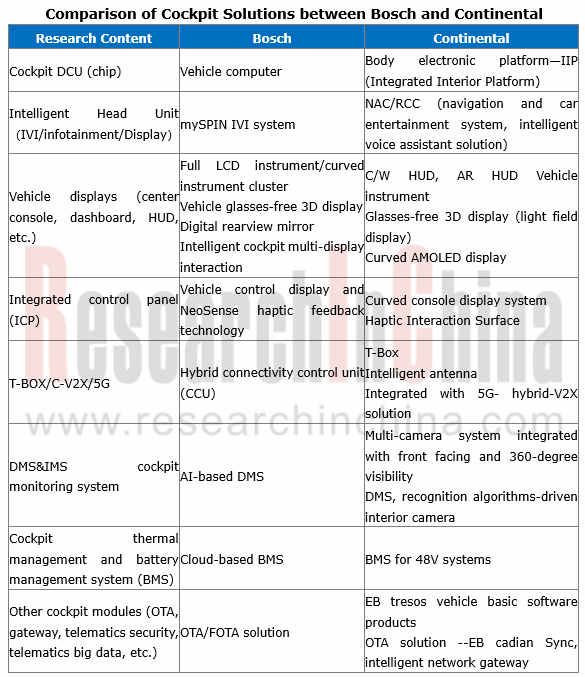

(7) Glasses-free 3D display: 3D effect makes eyes capture information more quickly. Bosch, Continental and more all focus on mass production and installation of glasses-free 3D displays in the next two year or three. At CES 2020, Continental showcased its 3D Lightfield display technology which was co-developed with Leia Inc. and mass production is arranged in 2022.

(8) Driver monitoring system (DMS) or interior monitoring system (IMS): IMS based on camera and AI is the core product of Tier1 suppliers. DMS will play a crucial role in whether a new vehicle model can be rated five stars by Euro NCAP. For example, Continental plans to mass-produce DMS in 2021 and Bosch in 2022.

The Global and China Leading Tier1 Suppliers’ Cockpit Business Research Report studies in depth strategies, technologies and products of leading Tier1 suppliers of intelligent cockpit, and highlights the following: (1) strategic plan and business layout of intelligent cockpit; (2) layout of intelligent cockpit technology centers, R&D centers and production bases; (3) intelligent cockpit product line, products and technical solutions, typical customers and vehicle models, mass production schedule, etc.; (4) intelligent cockpit product roadmap and development plan; (5) suppliers of intelligent cockpit products, technology and modules.

The Global and China Leading Tier1 Suppliers’ Cockpit Business Research Report has two parts, of which:

Part 1 with 320 pages in total covers 6 Tier1 suppliers, i.e., Bosch, Continental, Denso, Valeo, Faurecia and Panasonic.

Part 2 with 350 pages in total covers 7 Tier1 suppliers, i.e., Aptiv, Visteon, LG Electronics, Hella, Samsung Harman, Desay SV and Joyson Electronics.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...