BYD CASE (Connected, Autonomous, Shared, Electrified) Layout and Strategy Research Report, 2020

Research on BYD's CASE (Connected, Autonomous, Shared, Electrified): Absence of software and operating system

As we all know, BYD excels in hardware.

BYD started with rechargeable batteries and forayed into automotive sector in 2003. It established a joint venture brand "DENZA" with Daimler in 2010, and accessed to the rail transit field in 2016. BYD has four business segments to date, including automotive, mobile phone components & assembly, rechargeable batteries & photovoltaic, and Skyshuttle.

What efforts have BYD made in CASE?

Electrification: with technical knowhow about core components

BYD boasts a full-fledged industry chain concerning vertical integration of core new energy vehicle components such as power batteries and electric drive systems. It ranks second in the Chinese power battery market by share, and released in March 2020 the next-generation power battery -- "Blade Battery”. Besides, it takes the second place in the Chinese IGBT market by share as the only Chinese automaker with a complete IGBT industry chain. Its IGBT4.0 has been up to the international mainstream technology level.

BYD’s latest e-Platform is divided into 5 standard modules:

- Three-in-one drive system -- a three-in-one module comprised of drive motor, electric control and decelerator;

- Three-in-one high-voltage system -- a three-in-one module encompassing high-voltage charging and distribution system on-board charger (OBC), DC-DC converter, and power distribution box (PDU);

- A low-voltage all-in-one PCB integrating various body controllers;

- A large intelligent rotating screen with "DiLink" system;

- A power battery module.

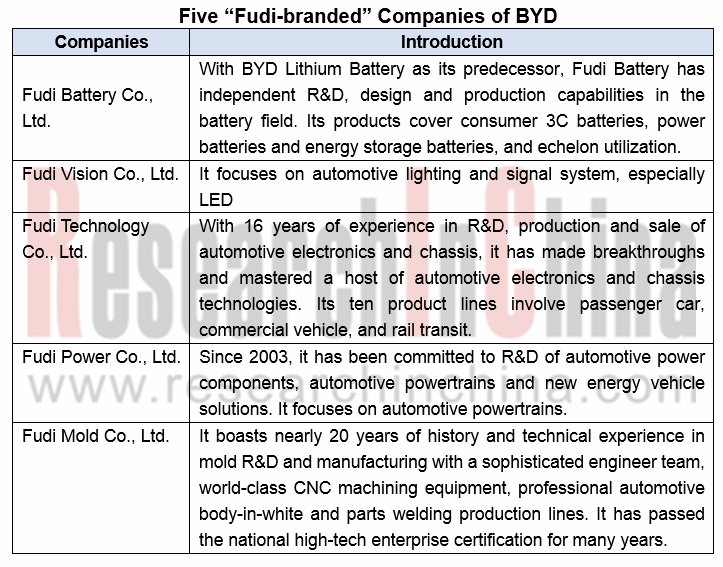

In March 2020, BYD established five “Fudi-branded” companies to spin off major new energy vehicle parts business.

BYD’s opening strategy has succeeded initially: the automakers like Changan Automobile, Changan Ford, and BAIC BJEV will adopt BYD’s ternary lithium/LiFePO4 batteries.

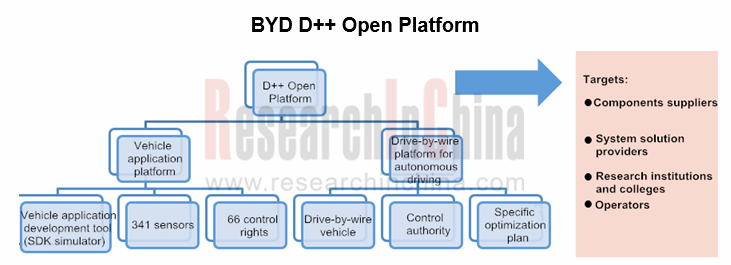

Regarding the opening strategy, BYD launched the D++ open platform covering intelligence and connectivity in 2018. By opening up 341 sensors and 66 control rights, it will create a standard platform for smart car hardware.

Intelligence: installation rate of ADAS is at the medium level in China

Among Chinese passenger car brands, BYD is positioned in the middle in terms of ADAS installation rate. In April 2020, BYD introduced DiPilot, a L2 driver assistance system (combining big data algorithms) which can learn driving habits of the driver. As concerns higher level of autonomy, BYD has yet to consider L3 development but its research and development of L4/L5 technologies is in the pipeline.

DiPilot has been installed in BYD Han, a model launched on market in July 2020. DiPilot packs 3 radars (1 in the front and 2 at the rear), 12 ultrasonic radars and 5 cameras (1 mono camera and 4 surround-view cameras). The system offers the following capabilities: automatic emergency braking, forward collision warning, adaptive cruise control, low-speed follow mode, traffic jam assist, DiTrainer self-learning, lane departure warning, lane keeping, blind spot detection and automatic parking, as well as vehicle OTA updates available for the first time.

Connectivity: installation rate of telematics remains low

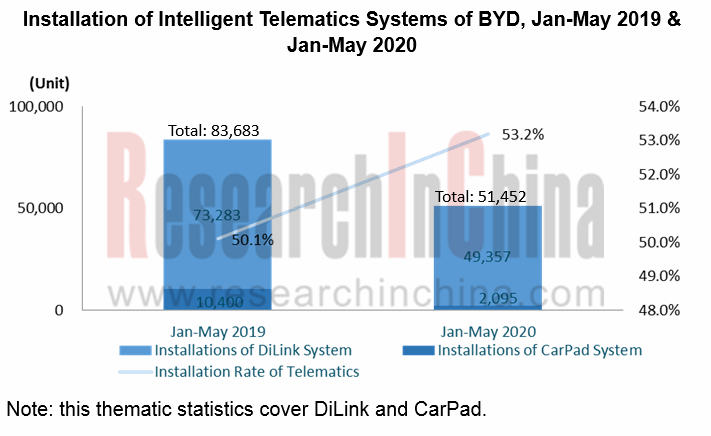

As for connectivity, BYD’s installation rate of telematics stood at 53.2% (including DiLink and CarPad) in the first five months of 2020, lower than other local auto brands such as MG, Roewe, WEY, Geely and Changan.

BYD rolled out DiLink, its new-generation intelligent center console system, in 2018. DiLink 3.0 version has become available after OTA updates and is first mounted on BYD Han. Features of DiLink include: compatibility with more than 3 million Android-based smartphone APPs, screen-split display, interaction with smart bracelet, smartphone NFC key, and in-vehicle camera. In BYD’s next step, face recognition will be added as scheduled.

Sharing: BYD is making attempts and plans to increase investment

BYD still lags well behind its domestic leading peers (e.g., Geely and SAIC) in shared mobility. At present, it not only provides new energy vehicles to local taxi companies but sets up two joint ventures with Didi.

Yadi New Energy Group (Shenzhen Didi New Energy Vehicle Technology Co., Ltd.) was co-funded by BYD (40%) and Didi (60%) in 2015, currently with the registered capital of RMB1.2 billion. The Shenzhen-based joint venture has set up over 20 wholly-owned subsidiaries in South China, Central China and East China, with most of its operations in cities like Shenzhen, Suzhou, Guangzhou, Shenzhen and Nantong. According to its announcement, the company recorded revenues of RMB128 million, RMB183 million and RMB939 million in 2016, 2017 and 2018, respectively, but made ever heavier loss during the three years, up to the loss-making RMB35 million in 2018.

In November 2019, BYD Automobile Industry Co., Ltd. and Beijing Xiaoju Intelligent Automobile Technology Co., Ltd. (“Didi Chuxing”) together invested to establish Meihao Mobility (Hangzhou) Automotive Technology Co., Ltd.. Of the registered capital of RMB1,285 million of the joint venture, BYD contributed 65% or RMB835 million, and Didi Chuxing contributed 35% or RMB450 million.

If for BYD establishment of Yadi New Energy Group is just a move to test the waters, founding Meihao Mobility shows that it pays more attention to mobility market and will seize the initiative in the market.

Predictably, BYD will invest more in shared mobility market, with Yadi New Energy Group and Meihao Mobility as a foundation.

Absence of software and operating system

BYD remains the champion by new energy vehicle sales in China for many years, selling 247,800 NEVs in 2018, a bit above Tesla’s and ranking first worldwide. However, Tesla’s electric vehicle sales posted 366,000 units in 2019, compared with BYD’s 229,500 units, indicating a widening gap between them. From product strategies of theirs it can be seen that Tesla are turning from high-priced models to the low-priced ones, while BYD are developing vehicle models from low prices to high prices.

Entering 2020 when Volkswagen AG is frustrated in its reform in vehicle software and E/E architecture, most insiders become increasingly aware of Tesla’s strong power in software and architecture, the idea of software-defined cars are deeply rooted in people’s minds and traditional big auto brands are stepping up investments into software.

SAIC established a software branch –Z.ONE Software Company at the outset of 2020 and plans to enlarge its software team to 2,200 talents till 2023. In April 2020, Great Wall Motor set up a tier-first division “digitalization center” involving intelligent driving, smart cockpit, digital marketing platform, data middle platform, user operation platform, etc.

Like Tesla, BYD upholds the independent development of core components and system, and they differ in that Tesla is adept at both software and hardware and BYD is expert only in hardware, and that Tesla accomplished vehicle OTA long ago while BYD didn’t achieve vehicle OTA until 2020 (OTA success in the model Han).

Tesla has lavished tens of billions of dollars for building revolutionary E/E architecture, operating system, AutoPilot, and FSD chip for a decade. Is there any opportunity for BYD to start from scratch and address software inadequacies? It is really a hard nut to crack.

Fortunately, BYD is aided by Huawei Technologies since they are in the same city, Shenzhen.

BYD has collaborated with Huawei for a long time, particularly in 2019 when the United States posed sanctions on Huawei and Flextronics ceased its services for Huawei, BYD as the second largest mobile phone foundry service provider in the world took the place of Flextronics and is going all out to secure OEM production of Huawei mobile phones.

In 2020, BYD’s latest Han model get access to Huawei HiCar system and is packed with Huawei’s automotive 5G communication module and new-generation NFC key.

In future, BYD and Huawei are probable to have vertical cooperation in operating system, computing chip, E/E architecture, sensors, among others.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...