AUTOSAR Research Report: in the Era of Software Defined Vehicles (SDV), Will an OEM Acquire an AUTOSAR Software Firm?

Software defined vehicle (SDV) and architecture defined vehicle are hotly debated among insiders recently. Yet, the technical standard – AUTOSAR are essential for them.

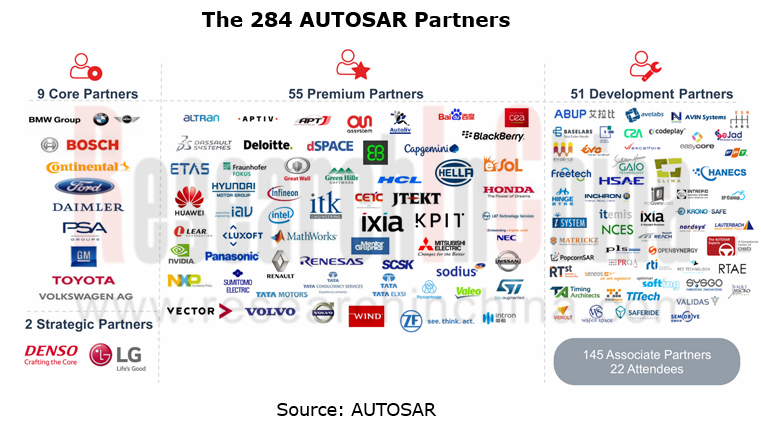

AUTomotive Open System ARchitecture (AUTOSAR) is a worldwide development partnership of vehicle manufacturers, suppliers, service providers and companies from the automotive electronics, semiconductor and software industry. Since 2003, they have been working on the development and introduction of several open, standardized software platforms for the automotive industry. The "Core Partners" of AUTOSAR are the BMW Group, Bosch, Continental, Daimler, Ford, General Motors, the PSA Group, Toyota and the Volkswagen Group.

As of May 2020, AUTOSAR has accommodated 284 members, including some Chinese companies, like Great Wall Motor, FAW, Dongfeng Motor, HiRain Technologies, iSoft Infrastructure Software, SAIC and Neusoft Reach.

It seems that not many Chinese companies are on the AUTOSAR member list. Nevertheless, the Automotive Software Ecosystem Member Organization of China (AUTOSEMO), founded in July 2020, involves 9 automakers (FAW, SAIC, GAC, NIO, Geely, Great Wall Motor, Dongfeng Motor, FAW Jiefang and Xiaopeng Motors) and 6 suppliers (Neusoft Reach, HiRain Technologies, Shanghai Nasn Automotive Electronics, Shenzhen VMAX Power, Shanghai Re-Fire Technology and Horizon Robotics). Based on AUTOSAR, AUTOSEMO is striving to develop basic software architecture standards and an industrial ecosystem that are led by Chinese companies. AUTOSEMO will temporarily not include the AUTOSAR’s application programming interface API standards (body, transmission, power, chassis, passive safety, HMI, multimedia and telematics) already under development in the business scope of its standard working groups. System software and testing standards of AUTOSEMO are consistent with AUTOSAR.

It can be seen that AUTOSEMO is basically compatible with AUTOSAR.

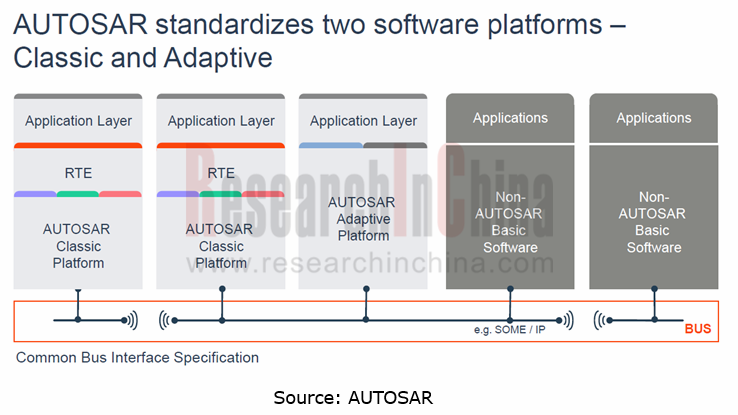

AUTOSAR standard aims to ensure standardization, reuse and interoperability of software. Currently, two complementary platforms, AUTOSAR Classic and AUTOSAR Adaptive (AP), have been introduced.

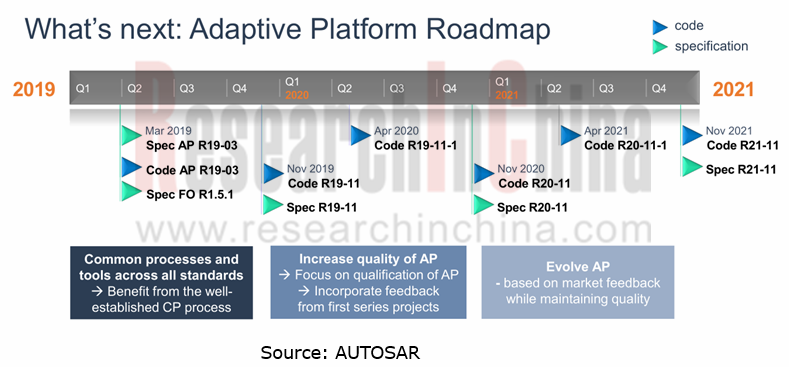

Thereof, AUTOSAR Adaptive Platform is launched to meet needs for developing new-generation autonomous, intelligent connected, electrified vehicles, with features of high flexibility, high performance, HPC support, dynamic communication, and management update. The latest version is R19-11 released in in November 2019.

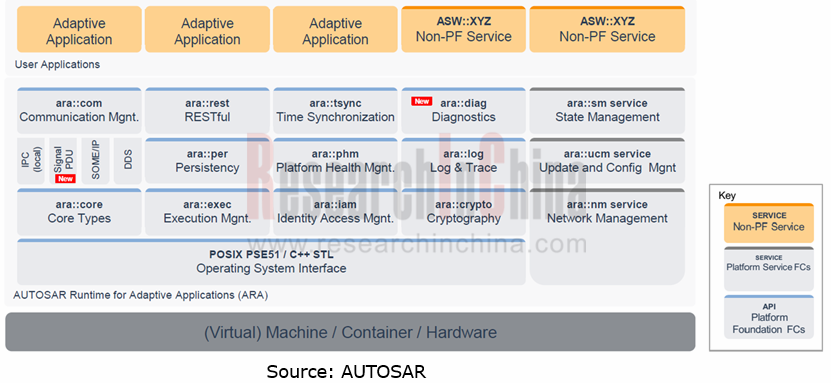

R19-11 is a layered architecture. It implements the AUTOSAR Runtime for Adaptive Applications (ARA) that consists of Foundation and Service, each of which is comprised of several modules with separate functions.

The Service is composed of three functional modules: State Management (SM), Network Management (NM) and Update & Configuration Management (UCM); the Foundation incorporates: Communication Management (COM), Cryptography (Crypto), Log & Trace (Log), Diagnostics (Diag), Persistency (Per), Execution Management (Exec), Time Synchronization (Tsync), etc.. In addition, for OS in the Foundation, the Adaptive Platform requires OS should be those subject to POSIX OS standards, e.g., Linux mcos and QNX.

The future version of AUTOSAR Adaptive Platform is expected to pack 23 new features up to multiple requirements such as better interaction between AUTOSAR Classic and AUTOSAR Adaptive, and upgrade of Security and Safety. According to the roadmap, AUTOSAR will offer a new software architecture version every year.

AUTOSAR Adaptive Platform supports all future vehicle APPs, e.g., IVI, V2X, multi-sensor fusion and autonomous driving. AUTOSAR is a standard option of next-generation automotive basic software architecture, for most automakers, components suppliers, software providers and other companies.

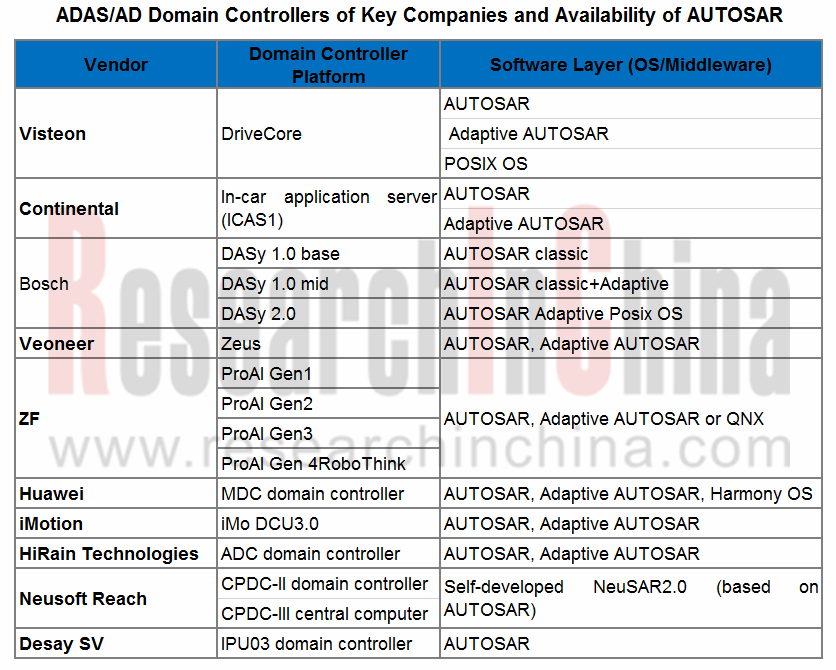

ADAS/AD is an applied field of AUTOSAR Adaptive. All autonomous driving domain controllers rolled out by Bosch, Visteon, Continental, Huawei and more, support AUTOSAR Adaptive.

Most of companies make partial use of AUTOSAR standard and few use in a full set, because AUTOSAR Adaptive came out late (the first version became available in 2017) and allows no mixed use of versions and AUTOSAR is complex and expensive with separate charge for every tool chain.

AUTOSAR has built a fairly complex technology system over a decade of development. Tool providers already develop support software to help OEMs accelerate application of AUTOSAR. Well-known AUTOSAR tool software developers include: WindRiver, EB, VECTOR, Mentor, ETAS, KPIT, Neusoft Reach, iSoft Infrastructure Software, HiRain Technologies, TaTa Elxsi and Autron. These AUTOSAR software firms also enrich product lines through mergers and acquisitions for greater competitive edges.

In 2014, Mentor Graphics announced to purchase the AUTOSAR assets, including the Mecel Picea AUTOSAR Development kit, from Mecel AB.

In September 2018, Vector acquired the Swedish embedded software specialist ARCCORE. This acquisition strengthens Vector’s portfolio of products and services in the field of AUTOSAR.

In the coming age of software defined vehicles, AUTOSAR software developers are playing an increasingly important role. It is hard for OEMs to build veteran teams shortly to develop automotive software due to lack of talent, even though they already set up their software firms or software departments in no time. Investing or purchasing AUTOSAR software firms may after all be an option.

In May 2020, Evergrande High Technology Group led the investment of tens of millions of yuan in a Series A funding round of Novauto (Beijing) Co., Ltd.. The “Basic Software Support Platform”, a product of the investee, carries the features: subject to ISO26262 ASIL D; support of AUTOSAR ADAPTIVE; compatibility with AUTOSAR Classic and ROS2; availability of middleware DDS for real-time data communication service; building of a unified, multi-QoS in-vehicle/V2V communication mechanism with high reliability, low latency and high scalability.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...