Research on Roadside Perception: With Greater Policy Support, the RMB10 Billion Intelligent Roadside Perception Market Takes Off

In our Smart Road: Intelligent Roadside Perception Industry Report, 2020, we analyze policies, industry chain and technologies, market size, business model and suppliers in the intelligent roadside perception industry (including RSU, roadside sensor, MEC and cloud control platform).

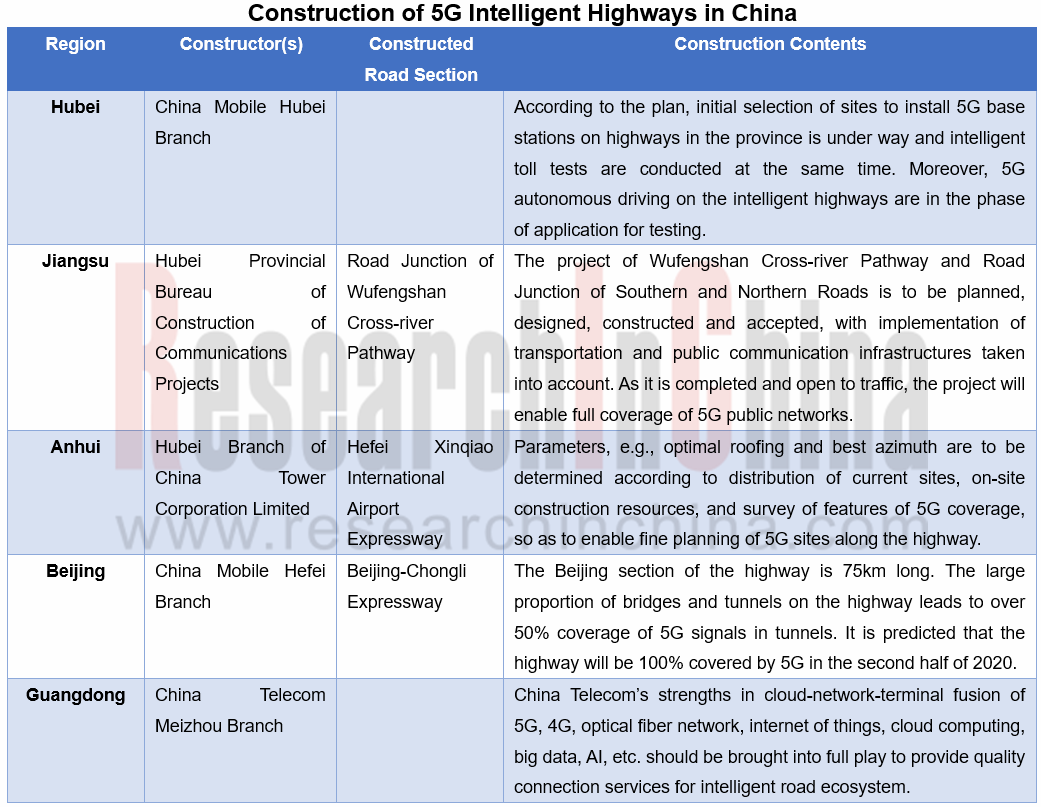

With the advancement of cooperative vehicle infrastructure system, China and the industry have come to know that the priority should be given to coordinated development between infrastructure and vehicle more than just vehicle. A plurality of policies was issued for intelligent road construction in China in 2020 alone. Wherein, the Guiding Opinions on Promoting the Construction of New Infrastructures for Transportation released in August 2020 makes it clear that ubiquitous perception facilities should be pervasive enough in the transportation industry; the Guide for Layout of Internet of Vehicles (IoV) Roadside Facilities, an association standard concerning roadside facilities published in August 2020, specifies layout of IoV roadside facilities in the C-V2X-based IoV traffic circumstance, and further promotion of roadside and cloud equipment to be unified.

With policy support, China’s intelligent roadside perception market (including radar, camera, etc.) is proliferating fast and is expected to be worth RMB40 billion by 2025. In the market, LiDAR costs the most in deployment, with a single set even priced up to tens of thousands of yuan. Yet LiDAR performs much better in roadside scenarios, notably complex intersections, for it could recognize target attributes precisely and offer far more accurate, reliable data combining with cameras. LiDAR is still at the start of application in roadside end and has yet to be used massively. If deployed on a large scale, the price of LiDAR will take a nosedive.

Intelligent roadside facilities: enormous social benefits fascinate government to invest

Core sensors of an autonomous vehicle that offer limited detection range, is far from meeting the needs for non-line-of-sight perception of surroundings, e.g., ultra long distance, intersections and blind spots. Intelligent roadside perception is thus needed to broaden the detection range around a vehicle and make autonomous driving safer and more reliable.

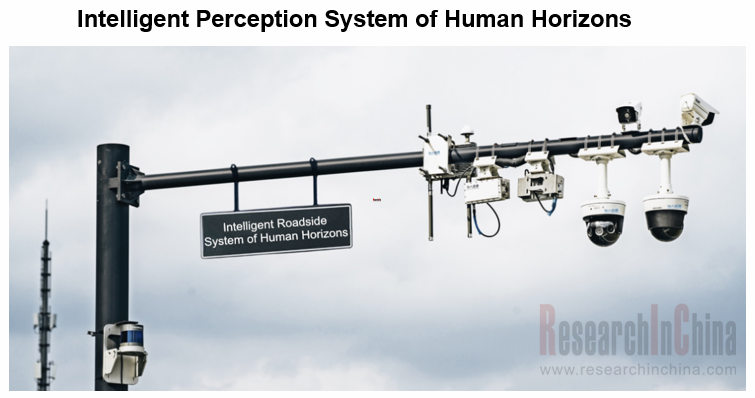

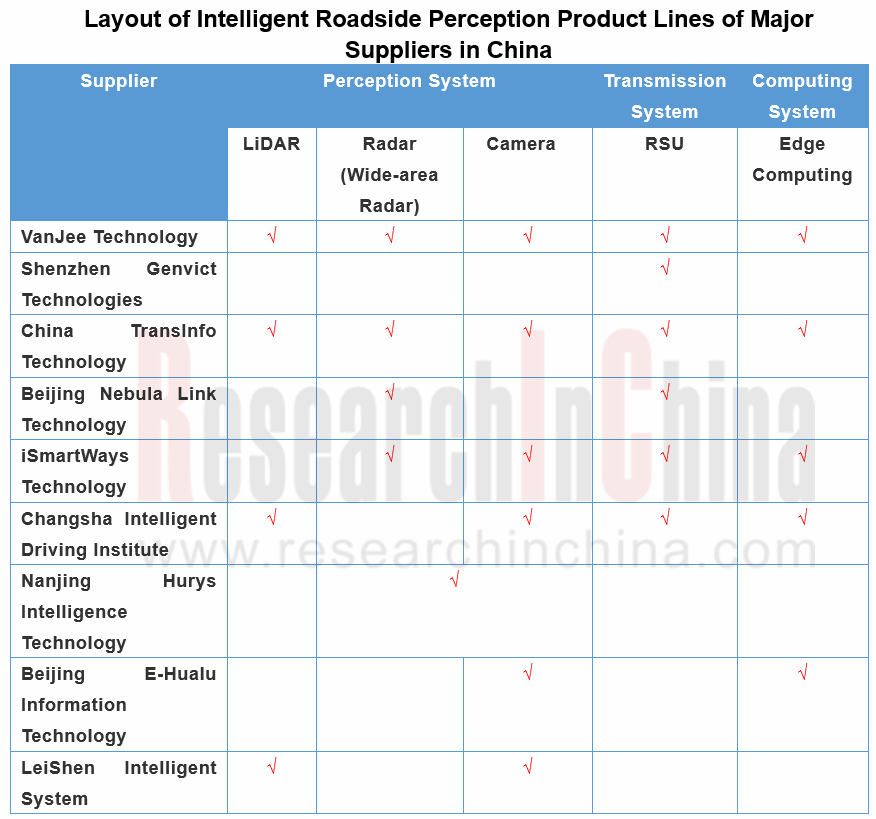

In current stage, roadside perception devices are led by camera, LiDAR and radar. Players like VanJee Technology Co., Ltd., China TransInfo Technology Co., Ltd. and Changsha Intelligent Driving Institute Ltd. have made sound deployments in roadside perception system, with product lines covering three systems (perception, transmission and computing). During the layout, roadside perception devices can be directly mounted on traffic light poles, intelligent poles and other facilities.

For single perception devices have some limitations, Chinese vendors are vigorously developing multi-sensor fusion solutions which perceive richer road environment information more accurately around the clock. Examples include VanJee Technology Co., Ltd. who already begins to work on data fusion between roadside 3D LiDARs and cameras to cover the drawbacks of LiDAR for greater ability to perceive.

Through the lens of commercial use, pilot roadside infrastructures constructed for demonstration nationwide have generated a mass of data, which is a solution to some technological problems. For example, the First Section (radars and cameras deployed every 250 meters) of Shanghai-Hangzhou-Ningbo Intelligent Expressway has made its pilot run for half a year, bringing about 8% faster average speed, a 20% increase in traffic capacity, a 10% reduction in congestion time, 90% accuracy in travel time forecast, a 10% fall in driving accidents, and a 10% cut in rescue time. It follows that intelligent roadside equipment could produce so obvious social benefits that government is more willing to construct for commercial use on large scale.

Business model: Application in specific scenarios will go first

After exploration, it is found that application in scenarios is an efficient model to develop intelligent roadside perception equipment. In the long-cycle market, pilot application first in specific commercial scenarios remains more efficient. Demonstration products such as intelligent perception and integrated smart traffic poles on intelligent highways and at city crossroads have been introduced successively.

In July 2020, Ezhou Airport Expressway, Hubei’s first intelligent highway invested and constructed by Hubei Provincial Communications Investment Group Co., Ltd., started construction, with a video detector installed every 150 meters on both sides of the road.

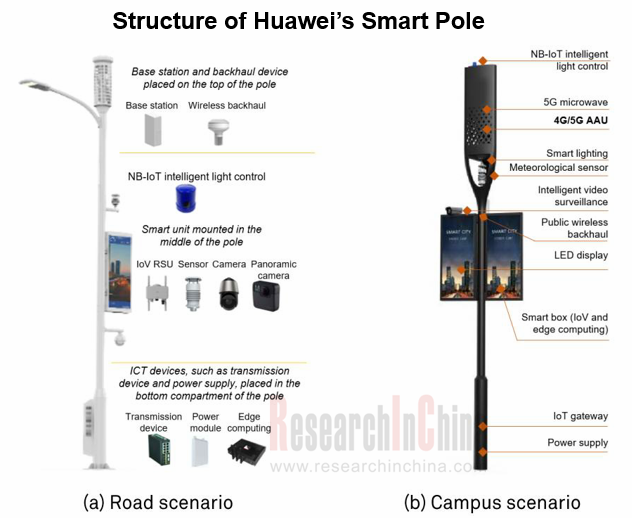

In July 2020, China’s first 5G multifunctional demonstration highway pole (Pole No.: K72+455) was installed on the Shenzhen Section of Guangshen Expressway. Every pole can carry such intelligent hardware as 5G base station, intelligent light, video surveillance system, emergency broadcaster and meteorological monitor.

IT giants race to enter

Evolvement of cooperative vehicle infrastructure system (CVIS) is decided by use of roadside equipment. Amid the rising penetration of intelligent roadside perception systems, the intelligent transportation network will be built up to further improve operational efficiency of cities and roads with technologies from edge computing to cloud control. Intelligent roadside perception system is a foundation for development of intelligent transportation.

Additionally, widespread layout of intelligent roadside equipment will drag down installation cost of vehicle V2X devices and push up their penetration. Only sound development of CVIS may make L4/L5 automated driving a reality.

IT tycoons like Huawei and BAT (Baidu, Alibaba and Tencent) who are bullish about the prospect of intelligent roadside equipment, scramble to march into the market.

Baidu focuses on research and development of roadside perception capabilities that meet needs of autonomous driving scenarios and fuse with V2X roadside perception information offered by the vehicle autonomous driving system. In the first half of 2020, Baidu has won the biddings for intelligent transportation projects in Nanjing, Hefei, Yangquan, Chongqing, to name a few.

Alibaba remains superior in infrastructure end, with Cainiao Alliance and ET City Brain. The giant will develop vehicle-infrastructure cooperation using technologies such as Alibaba Cloud Control Platform, AliOS and intelligent roadside facilities.

Tencent has a plan to expedite edge computing equipment installations and to build an open source platform for edge computing together with several partners.

Huawei makes concurrent efforts on vehicle and infrastructure ends, having rolled out products like roadside unit, EI-based Traffic Intelligent Twins, and OceanConnect intelligent transportation platform.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...