Automotive Cockpit SoC Technology and Application Research Report, 2020

Cockpit SoC Supports More Displays, Beefs up AI, and Improves Functional Safety

Intelligent vehicle E/E architecture ushers in a period of intra-domain integration to trans-domain convergence and to central computer from the distributed one.

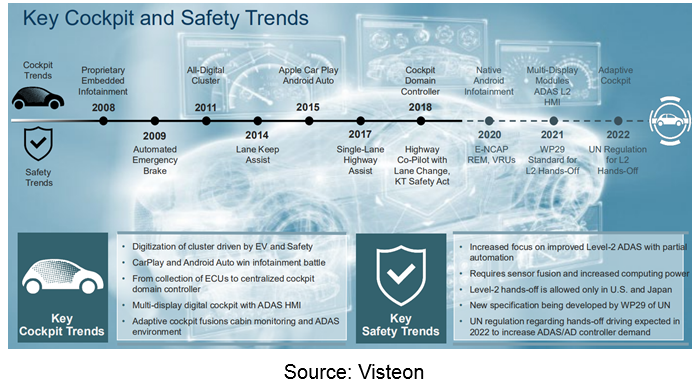

For cockpit domain, the intra-domain integration calls for powerful cockpit SoC which caters to the current cockpits’ needs to support more displays, enable more AI features and fuse with ADAS, have safer functionality, among others.

Support for More Displays

Against the trend of one core enabling multiple screens, it remains a decisive factor to being chosen by the user that how many displays a cockpit SoC can support. The third-generation Qualcomm Snapdragon cockpit SoC based on versatile CPU and GPU is an enabler for as many as six to eight displays.

Samsung Exynos Auto V9 processor is in favor of up to six in-vehicle screens and twelve cameras synchronously, which has been already found in Audi smart cockpits.

Designed for smart cockpit, SemiDrive X9 series unveiled by Nanjing Semidrive Technology Co., Ltd in 2020 support eight FHD displays and twelve cameras.

At CES2020, NXP showcased its multi-display solution supporting as many as 11 screens that are enabled by dual i.MX 8QuadMax.

Support for AI

Undoubtedly, NVIDIA stays ahead of its peers as concerns support for AI. NVIDIA rolled out CUDA in 2007 and had the idea of fostering an ecosystem via CUDA then, which is helpful to both hardware sales and its superiority in software as well as to user loyalty. Despite its cockpit SoC gets a clear edge in deep learning, NVIDIA enjoys not big a share in the cockpit processor market because of its automotive business focus on autonomous driving chips.

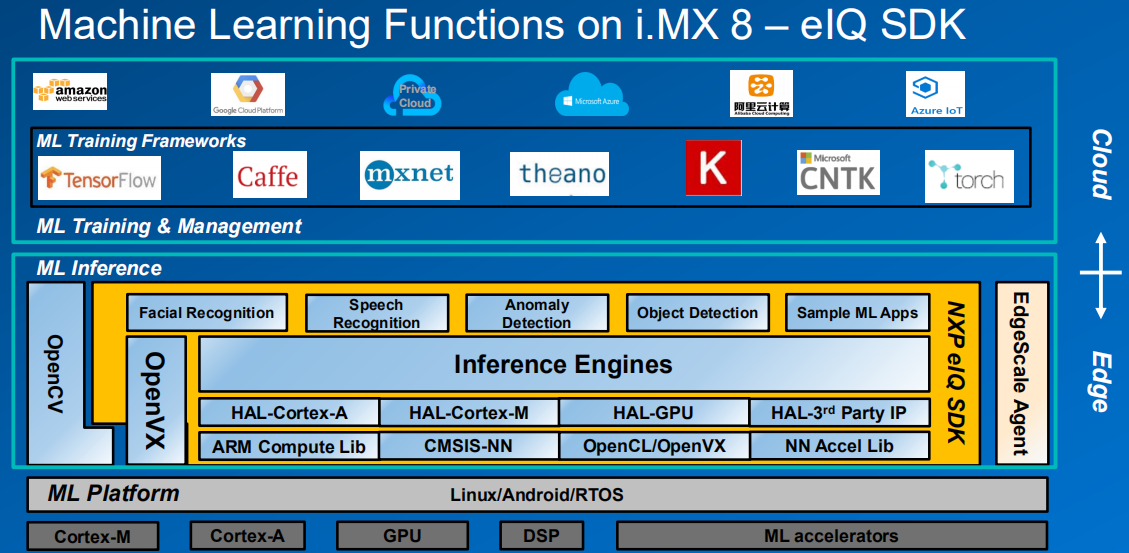

Through acquisition of Freescale, NXP is in possession of a machine learning expert team, i.e., CogniVue, an image recognition IP development team (acquired by Freescale in September 2015) based in Ottawa, Canada. NXP’s eIQ automated deep learning (DL) toolkit enables the developer to introduce DL algorithms to application programs, and meets the strict automotive standards.

Apart from its efforts in nurturing AI capabilities, NXP has been paying attention to AI defects. Deep learning employs probabilities to recognize objects and the results are inexplicable, which is disastrous to cars with a high demanding on safety. NXP has been studying a method called “explicable AI (xAI)” that extends the machine learning reasoning and probability computing capabilities through addition of more rational and humanlike decision-making methods and extra deterministic dimensions, and that combines all merits of AI with reasoning mechanism to imitate human reaction.

Fusion with ADAS for Higher Functional Safety

Some ADAS features like surround view parking, pedestrian and obstacle recognition tend to be integrated in the cockpit domain, needing the cockpit SoC to consider ADAS related capabilities.

R-Car H3, for example, gets largely utilized in cockpit and can also cope with complex functions such as obstacle detection, driver status recognition, danger prediction and avoidance.

More and more smart cockpits are added with HUD, especially the latest AR-HUD integrated with ADAS, delivering capabilities like following distance warning, line press warning, traffic lights monitoring, ahead-of-time lane change, pedestrian warning, road mark display, lane departure warning, obstacles ahead, and driver status monitoring.

There will be higher requirements on functional safety once cockpit SoC is added with some ADAS features, which will, beyond doubt, pose greater challenge to the cockpit SoC suppliers.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...