ADAS/AD Master Chip Research: Weaknesses and Disruption in the Integration Trend

L2 vehicles are gaining ground as penetration is over 15%. A rash of L2.5 vehicle launches is drawing near. Mass production of L3 and L4 (limited scenarios) is also around the corner.

The march toward highly automated vehicles requires installation of a large number of environmental sensors, and master chips to offer ever stronger compute and algorithms.

Single type of automotive processors, whatever FPGA/CPU/GPU or ASIC, are not competent enough to meet the needs of highly automated vehicles. SoC (master chip), a fusion of computing elements like CPU, GPU, NPU and ISP, grows a great concern of the competitive market.

In the master chip field, vendors follow different technology roadmaps, and the mainstream solution is heterogeneous fusion of chips of differing types. CPU assumes logical operation and task scheduling; GPU as a universal accelerator undertakes tasks of neural network computing (e.g., CNN) and machine learning, and will work on computing for quite a long time; FPGA as hardware accelerator that is programmable and performs well in sequential machine learning (e.g., RNN/LSTM/reinforcement learning), plays a prominent role in some mature algorithms; ASIC, as fully customized solution with optimal performance and the least power consumption, will become the final option after automated driving algorithms get mature.

Mobileye started with conventional algorithms. EyeQ5 packs 4 modules: CPU, CVP (Computer Vision Processor), DLA (Deep Learning Accelerator) and MA. By size, CPU and CVP remain large. CPU has a big footprint; CVP acts as ASIC designed for a great many conventional computer vision algorithms. Mobileye is renowned for such common algorithms which are well received for low power consumption. DLA which was not written into the initial version of EyeQ5 brochure was added in just later under the market pressure as a small part of the entire chip.

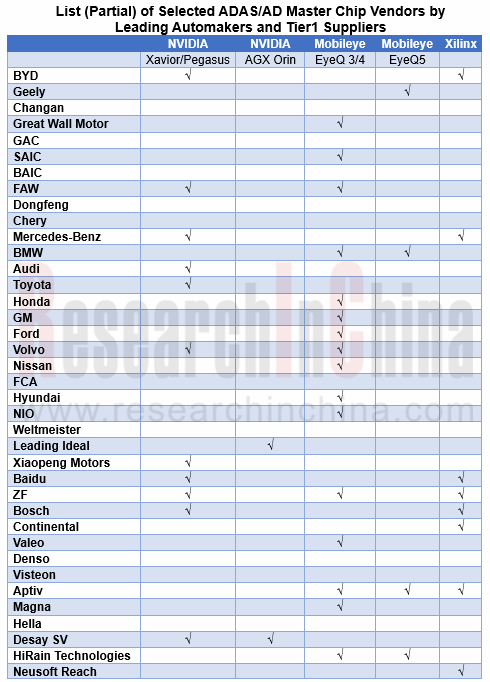

Mobileye had the foresight to sell itself to Intel early for future integration with the chip giant’s CPU and FPGA technology resources. As it is not open enough and its compute still desires to be much improved, EyeQ5 captures just few automaker users, only four (publicized), far less than NVIDIA Xavior.

We suppose that Mobileye has made arduous effort into solving the problem of openness. NXP and Renesas are also stepping up efforts to overcome weaknesses not only by improving API, tool chain and ecosystem but either buying in or acquiring related companies, for example, NXP invested Kalray and Renesas purchased IDT.

As aforementioned, Mobileye’s algorithm solutions are still led by conventional computer vision algorithms and aided by deep learning algorithms, while its largest rival Nvidia focuses on deep learning algorithms.

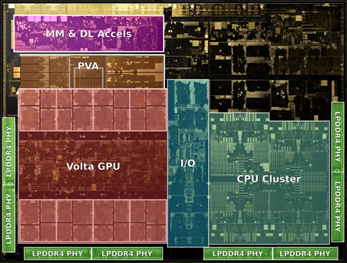

Xavier has 4 modules: CPU, GPU, DLA (Deep Learning Accelerator) and PVA. GPU has the largest size, followed by CPU; and the two special ASICs play a subsidiary role: one is DLA for reasoning and the other is PVA for accelerating conventional computer vision algorithms.

At NVIDIA GTC 2019, NVIDIA unveiled NVIDIA DRIVE AP2X, a complete Level 2 + automated driving solution encompassing DRIVE AutoPilot software, DRIVE AGX and DRIVE validation tools. To enhance mapping and localization, DRIVE AP2X software will include MapNet, a DNN that identifies lanes and landmarks.

DRIVE AutoPilot homes in on maps and plans a safe, efficient path forward. Drive Works provides an extensive set of tools, reference applications, and documentation for developers. ClearSightNet is part of NVIDIA’s camera-based obstacle perception software, which allows the vehicle to detect camera blindness in real time and performs DNN inference on a live camera feed, evaluating each frame to detect camera blindness.

Still, NVIDIA has a drawback -- high power consumption. Chips of Qualcomm and TI only need air cooling, while those of NVIDIA and Tesla need water cooling, which is a side effect of pursuing strong computing power.

It can be seen from the table above that another heavyweight is Xilinx that has won quite a few automotive clients as well on the strength of its unique FPGA (low power consumption, low latency, and excellent cost performance). Amid ADAS/AD master chips getting integrated, Xilinx does not reconcile itself to a minor role.

In 2018, Xilinx introduced Versal ACAP, a fully software-programmable, heterogeneous compute platform that combines Scalar Engines, Adaptable Engines, and Intelligent Engines. This shows Xilinx’s ambition to transform from a specialist chip vendor into a computing platform provider.

Xilinx’s products have evolved from FPGA to SoC (FPGA that has single hard-core processors on-chip) and MPSoC (FPGA that has multiple hard-core processors on-chip), then to RFSoC (RF-enabled MPSoC) and ACAP (adaptive compute acceleration platform).

In 2019, Xilinx announced Vitis, a unified software platform that makes it easier for developers to use FPGA. Vitis software platform supports heterogeneous system architectures such as Zynq SoC, MPSoC and Versal ACAP. It automatically tailors the Xilinx hardware architecture to the software or algorithmic code for developers without the need for hardware expertise.

Xilinx introducing Vitas and Versal, in a word, aims to gear from a FPGA vendor into a flexible, adaptive computing platform provider.

In the increasingly contested ADAS/AD master chip market, besides Mobileye, NVIDIA and Xilinx that have produced good results, the time-honored automotive chip vendors like NXP and Renesas are endeavoring to jump on the bandwagon. The giants Qualcomm and Huawei from the consumer electronics field make an aggressive foray into the market; Chinese start-ups Horizon Robotics, Black Sesame Technologies and SemiDrive which are availing themselves of the wave of replacing foreign products have brought in some gains.

As integration grows a trend, no one will survive without change. Anything will be possible in an unpredictable future.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...