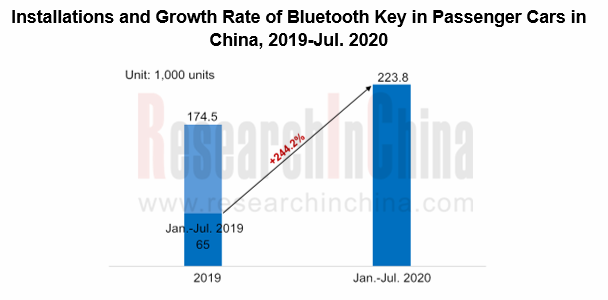

Research into Digital Vehicle Key: Bluetooth Key Installations Soared by 244% in the First Seven Months of 2020

Our Digital Vehicle Key Industry Report, 2020 sorts out current digital key solutions and development trends.

In an era of intelligent vehicles, key is a new digital trait and has been not like what it used to be. Terminals like smartphones, smart watches and smart bracelets become carriers of vehicle keys, making people’s lives more convenient and creating more room for digital car life.

1. The less than 5% installation leaves space for rapid adoption

Digital key has three technology routes: Bluetooth Low Energy (BLE), Near Field Communication (NFC) and Ultra-wideband (UWB). Yet the overall installation is below 5%. Among them Bluetooth key finds broader application.

In the first seven months of 2020, Bluetooth key was mounted on roughly 220,000 passenger cars in China, a like-for-like spurt of 244%, with an installation rate of 3.3%, 1.6 percentage points higher than that in the prior-year period. Despite low installation in both volume and rate, Bluetooth key is roaring ahead.

Apart from car lock/unlock and start-up capabilities, digital key enables personalized settings (e.g., seats, music and ID account), key sharing, vehicle trajectory record, and delivery to car. In future digital key will be an individualized element for cars and arouse much imagination.

2. Digital key is so beloved by Chinese automakers

In China, local automakers more willingly embrace digital key. In Bluetooth key’s case, there were a total of 14 passenger car brands using such a key in China between January and July in 2020, including 10 homegrown ones with a combined 70% share in installation.

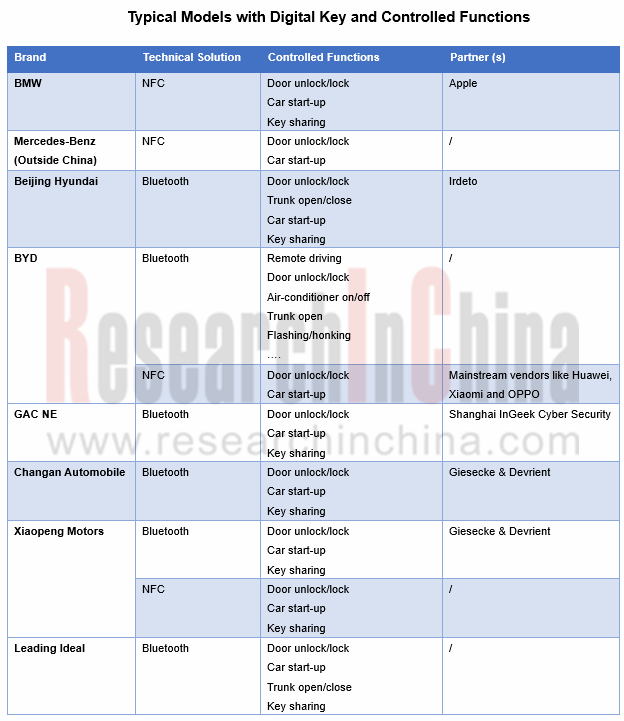

In 2014, BYD first introduced smartphone Bluetooth-based digital key which can lock and unlock cars without network. GAC NE, Xiaopeng Motors, Geely and Changan Automobile followed and rolled out Bluetooth or NFC-based key.

In April 2019, GAC NE unveiled its Bluetooth key-enabled car models -- AION.LX and AION.S. The key solution is co-developed by GAC NE and Shanghai InGeek Cyber Security Co., Ltd..

In September 2019, Xiaopeng Motors released a Bluetooth-based “financial-grade secure digital car key” (the identity authentication technology is developed with Alipay, with security performance subject to financial-grade standards of the Internet Finance Authentication Alliance (IFAA)).

In December 2019, BYD DiLink and Huawei Wallet jointly launched smartphone NFC-based car key.

Joint venture brands also followed suit. In particular, BMW and Beijing Hyundai, among others have stepped up efforts in digital key field in 2020, and plan adoption in full range of their future models.

In July 2020, BMW’s models began to be equipped with Apple CarKey, a NFC-based key solution.

In September 2020, the full family of new vehicles under Beijing Hyundai was outfitted with Irdeto Keystone, a Bluetooth key solution.

3. Established Tier1 suppliers and information security firms flock into the field

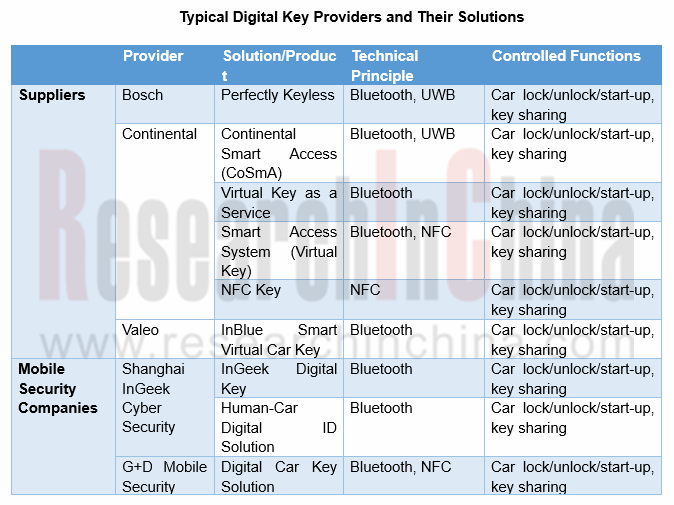

On the strength of technical expertise in common key, Tier1 suppliers like Bosch, Continental and Valeo have made a natural foray into digital key field.

In 2016, Valeo introduced InBlue, a smart virtual car key designed for shared mobility and fleet management and compatible with both Android and Apple phones.

In 2017, Bosch rolled out Perfectly Keyless, a digital key solution with which users can unlock, start or lock their cars via smartphone APP.

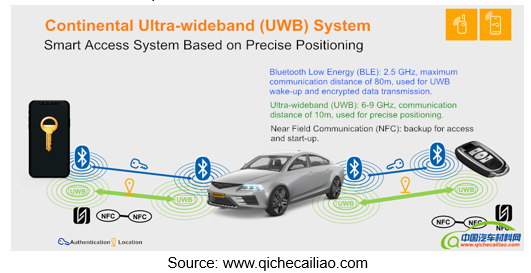

In August 2020, Continental launched new-generation CoSmA digital key based on ultra-wideband (UWB) technology. The system allows the car to be unlocked and the engine to be started without having to interact with the smartphone. It also enables remote control over the car via smartphone.

While bringing diversified and convenient experience to users, digital key poses a non-trivial security problem. Hacking at any links such as identity authentication, encryption algorithms, key storage, and data packet transmission will lead to a crash of the entire digital vehicle key security system. As a result, internet firms that are rooted in cyber security find vehicle information security a way to enter OEMs’ partnership system. Examples include foreign companies like Giesecke & Devrient (G+D) and Irdeto and Chinese peers such as Shanghai InGeek Cyber Security Co., Ltd. and Sichuan Zhongwang Safety and Environmental Protection Technology Consulting Co., Ltd..

4. BLE+NFC+UWB integrated solutions will come to the fore in future

In current stage, the three digital key solutions (BLE, NFC and UWB) can lock, unlock and start cars independently. Integrating them into one terminal (e.g., smartphone and smart wearable device) will hold the trend. In an integrated solution, BLE, NFC and UWB work together but also play their own part in different scenarios: BLE used for vehicle wake-up and transmission authorization, UWB for locating where the user is after wake-up, and NFC as an alternative solution for car unlock and start-up in the case that mobile phone runs out of power.

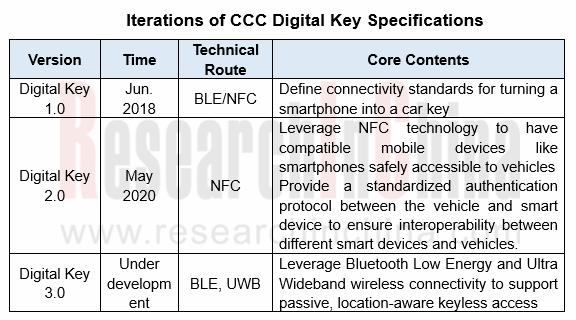

Car Connectivity Consortium (CCC) is dedicated to cross-industry collaboration in developing global standards and solutions for smartphone and in-vehicle connectivity. The Board of Directors of CCC comes from Apple, BMW, GM, Honda, Hyundai, LG, Panasonic, Samsung and Volkswagen.

In May 2020, CCC announced rollout of Digital Key Release 2.0 specification.

As below are capabilities enabled by Digital Key Release 2.0:

- Security and privacy equivalent to physical keys;

- Interoperability and user experience consistency across mobile devices and vehicles;

- Vehicle access, start, mobilization, and more;

- Owner pairing and key sharing with friends, with standard or custom entitlement profiles;

- Support for mobile devices in Battery Low Mode, where normal device operation is disabled.

The next generation of Digital Key, the Release 3.0 specification, is under development. It will leverage Bluetooth Low Energy and Ultra Wideband wireless connectivity to support passive, location-aware keyless access, providing vehicle owners with more convenience and new features.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...