Cloud service platform (cloud platform for short) can be interpreted as a scalable platform delivering basic services, middleware, data services, and software services to users over the Internet. Cloud platform is divided into: IaaS (Infrastructure as a Service), PaaS (Platform-as-a-Service), and SaaS (Software-as-a-Service). It is also classified into public cloud, private cloud and hybrid cloud types.

The public cloud platforms incorporate AWS, Microsoft Azure, Alibaba Cloud, Tencent Cloud, Huawei Cloud and Baidu Cloud. There are a large number of private cloud platform providers such as open-source Openstack and varying Openstack-based platforms. Non-open source providers include VMware, Zstack, etc.

Vehicle, infrastructure, cloud and network are crucial elements of cooperative vehicle infrastructure system (CVIS) industry chain. This report highlights the “cloud” link, with emphasis on OEM-centric automotive cloud platform services. With supplier’s cloud platforms as a foundation, OEMs build their own cloud platforms such as marketing & after-sale cloud platform, manufacturing & supply chain cloud platform, telematics cloud platform, autonomous driving cloud platform, simulation cloud platform and HD map cloud platform.

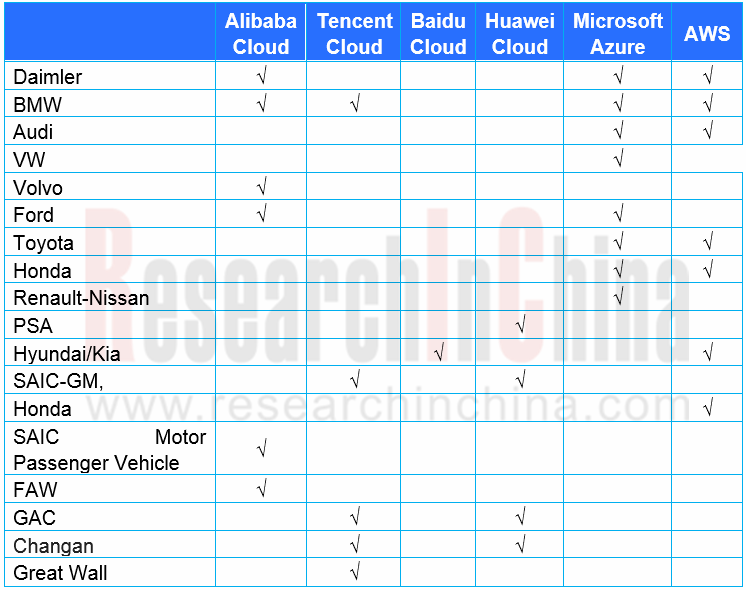

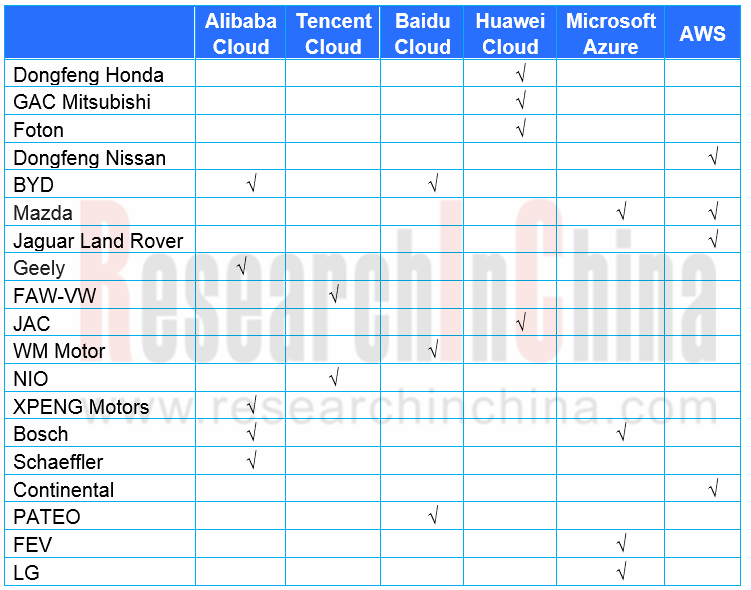

Viewed from the tables above, AWS, Microsoft Azure, Alibaba Cloud, and Tencent Cloud are the first choice of OEMs and Tier1 suppliers. Huawei Cloud and Baidu Cloud are the rising stars. Of both top ten OEMs and top ten Tier1 suppliers that once adopted Amazon Web Services (AWS), more turn to Microsoft Azure as Amazon starts developing and testing autonomous vehicles.

Quite a few OEMs stand on more than one cloud platforms. For instance, Volkswagen Automotive Cloud (vehicles, customers and services) uses Microsoft’s technology, while Volkswagen Industrial Cloud (manufacturing and supply chain management) utilizes Amazon’s.

Telematics cloud platform is among the first automotive cloud platforms already in wide use. In 2017, Microsoft released the Microsoft Connected Vehicle Platform (MCVP), an Azure-based connected automotive platform which has won support from many Tier1 suppliers. The automotive cloud service platform Huawei introduced in 2020 defines more features otherwise: autonomous driving, HD map, battery safety, OTA, V2X and “three powers” (motor, battery and ECU).

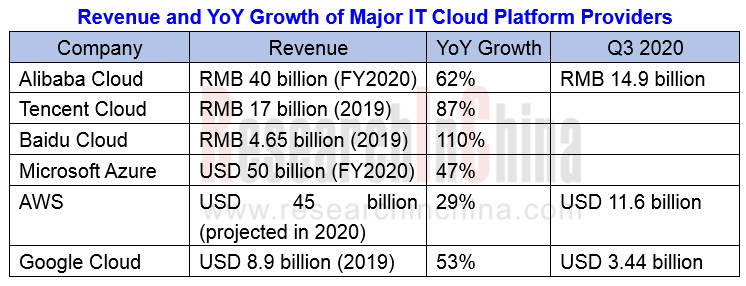

From above it can be clearly seen that IT giants post handsome cloud platform revenues at astounding growth rates, amid the booming demand from automotive sector for cloud services, which is fueled by the following:

(1) Enhancement of automaker’s production management, marketing activities and internal management, and digital revolution and synergy of related industry chains.

(2) Digitalization of the process of automakers’ development, design, test, and validation of software and hardware, and remote R&D teams’ cloud synergy and cloud-based simulation (such as cloud service for firmware simulation).

(3) Digitalization and CASE (Connected, Autonomous, Shared, and Electrified) of automotive products. This means software-defined vehicles, capabilities (e.g., connectivity, navigation, parking, entertainment and payment), and transition from a functional vehicle into an intelligent one cannot be achieved without the support of digitalized process and tools, and cloud services.

(4) Building of the telematics platform for automakers, and the connection, service and operation platform among the four -- car users, automotive products, Internet digital ecosystems, and automakers and their industry chains, providing real-time online mobile interconnected third-space services such as navigation, entertainment and payment, for better user driving experience.

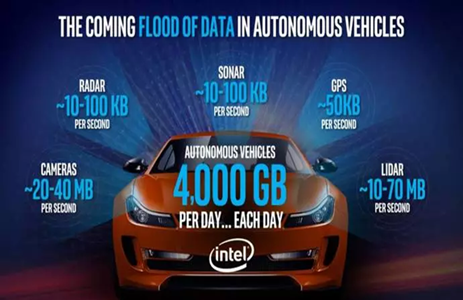

(5) As ADAS/AD gains popularity and gets updated, AVs will generate 4TB data per day, which prompts a surging demand for cloud platform space.

So BAT and Huawei lavish on automotive cloud platform involving operating system, simulation system, telematics system, autonomous driving software, and creation of software and application service ecosystem, considering it is the biggest source of their revenues after all.

OEMs always want to take hold of vehicle data. Currently, leading cloud platform solutions have reserved data ownership of OEMs. For instance, AWS platform retains full ownership of data, while providing functions like machine learning, and special solutions for connectivity and AVs to help OEMs freely create unique brand experience.

Quite a few OEMs set up their own cloud platform subsidiaries and big data centers. Take SAIC Cloud Computing Center as an example. The facility had a 6 or 7-person team, one data center and 5 or 6 cabinets at start and provided just basic cloud storage and IaaS environment. After evolution into Shanghai FinShine Technology Co., Ltd. in 2017, it now boasts a team with 150 talents, three data centers (Shanghai, Nanjing and Zhengzhou) and hundreds of cabinets, and adds software and platform services such as SaaS and PaaS. Up to now the company has owned more than 4,000 cloud hosts, over 10,000 virtual machines or containers, and 30PB storage space.

Companies like SAIC investing heavily in cloud platform still need help from IT tycoons. For example, in 2018, Alibaba Cloud and SAIC together released a hybrid cloud computing service platform for automotive R&D simulation: SSCC (SAIC Simulation Computing Cloud).

To reduce unit costs, IT giants not only build large-scale cloud platforms, but also enable AI algorithms and sundry tool chains and independently develop AI chips. Baidu Cloud, for example, has been a leader in autonomous driving cloud platform field by resorting to competitive DuerOS, Carlife, simulation platform, HD map, autonomous driving algorithms and Kunlun AI chip. OEM’s cloud platform business cannot live without the help of IT firms.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...