Research into Automotive Display: 10-Billion-Yuan Automotive Display Market Is Thriving.

In this report, those are analyzed and studied such as the market size, installation rate, display technology, development trends and suppliers of automotive displays (incl. cluster display, center console display, etc.).

The Center Console Display Shipments Rank First, and the Installation Rates of Rearview Mirror Displays, Rear Seat Entertainment Displays and Vehicle Control Displays Continue to Grow.

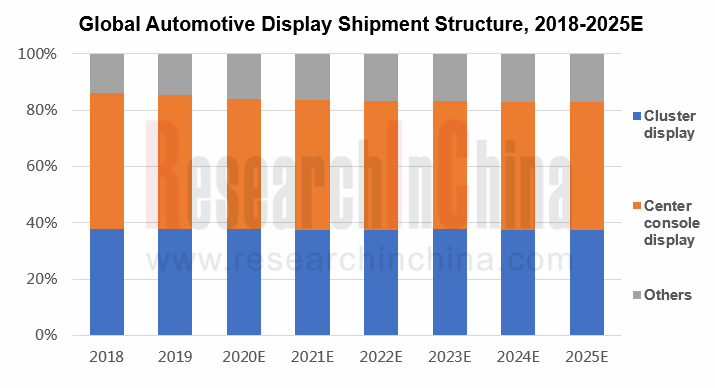

Being bound up with automobile sales, automotive display shipments worldwide edged down 1.5% year-on-year to approximately 159 million units in 2019 when auto sales continued a bearish trend. In 2020, the COVID-19 pandemic drags down global automobile sales (a like-for-like slump of 25.5% in H1 2020, and may recover a bit in H2 2020), with a projected year-on-year plunge of 20% or so. Against this, global automotive display shipments are expected to fall 12.1% year-on-year to 140 million units in 2020. In the long run, the automotive display market, however, will resume growth alongside intelligent connected vehicles at a gallop, with shipments projected to reach 180 million units by 2025.

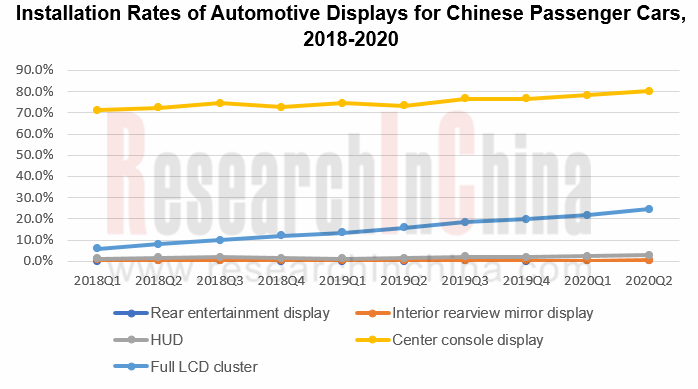

In the Chinese market, the installation rate of console displays exceeds 80%, while full LCD cluster displays see the fastest installation rate, accompanied by a marked rise in installation rates of rearview mirror displays, HUD, center console displays, among others.

In 2019, the automotive display shipments of global panel vendors grew concentrated ever, especially the top five’s rose by 4.3 percentage points. JDI led the pack in the market, while Tianma Microelectronics, the largest Chinese automotive panel supplier, took the third place in the world with its shipments growing at a far higher rate than those of JDI and LGD; however, BOE saw the quickest shipment growth rate as high as 73.2%. Chinese players are growing strong.

Automotive Display Technology: Given LCD Overcapacity, Suppliers Are Racing to Develop New Technologies such as AMOLED

LCD still prevails in the automotive display market, but Japanese and Korean panel makers led by JDI and LGD have been gearing from a-Si products to LTPS and even AMOLED to suit to the changing automotive demand.

Moreover, the rapid release of new LCD capacities will lead to a severer oversupply, ever lower prices and less meager profits, forcing vendors to cut production and seek for a transition and even a retreat from the LCD market.

BOE: it announced at the end of 2019 that it would stop investing in LCD capacity, but focus on OLED and next-generation Mini LED and Micro LED instead, with a plan to spawn Mini LED in Q4 2020.

LGD: It will stop production of LCD panels in South Korea before the end of 2021 to slash losses.

AUO: It trims LCD capacity and quickens to develop new products.

With the CASE (connected, autonomous, shared, electrified) trend in the automotive sector, automotive displays tend to be bigger, and in the form of conjugate displays and multi-displays. The rising of novel automotive displays such as vehicle control displays and curved displays has brought opportunities to Chinese vendors. Major suppliers have rolled out new technical solutions like AMOLED and Mini LED successively in 2020.

LGD: In February 2020, it provided a digital cockpit based on an OLED curved display for the new Cadillac Escalade. In June 2020, it announced that it will develop a retractable display before 2024.

Tianma Microelectronics: The ACRUS technology, debuted in January 2020, raises the contrast to over 30,000:1 by laminating LTPS double-layer panels.

Innolux: In July 2020, it launched a 29-inch free-form curved display incorporating a cluster board and a CID display, and planned to achieve mass production in 2022.

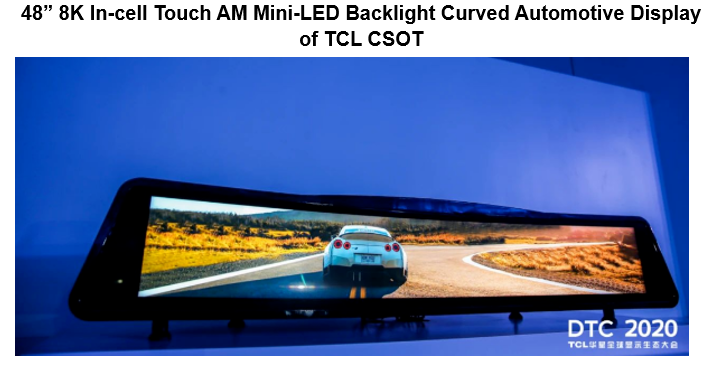

TCL CSOT: In October 2020, the 48” 8K In-cell Touch AM Mini-LED backlight curved automotive display was released, as the first 5096 partition AM Mini-LED backlight and 100% NTSC display in the automotive industry and the world’s first 6.7” AMOLED cloud scroll display.

Automotive Display Installation: Integrated Displays Grow a Standard Configuration, and OLED/AMOLED Displays Begin to Penetrate in High-end Cars.

At present, automotive dual-displays or even triple-displays represent a trend. A larger display spans the entire center console, featuring the functionality involved with the copilot. As per the center console display configuration of Chinese passenger cars in 2018-2020, the installation rate of multi-displays was up from 0.3% in 2018 to 1.3% in Q2 2020. The interiors of Mercedes-Benz, Volkswagen, Chang’an and other models in 2020 reveal that dual-displays have almost become the standard.

The multi-display layout is basically available in models priced above RMB150,000, except Chang'an Benni E-Star launched in April 2020, a mini-car priced below RMB100,000 that has full LCD cluster & center console dual-displays, signaling the penetration of dual-displays into the medium and low-end models.

With the evolvement of intelligent connectivity technology, cars are growing to be mobile smart terminals. In addition to cluster & center console dual displays, HUD, electronic rearview mirror displays, copilot recreation displays, rear seat entertainment displays, and transparent A-pillars have emerged. HOZON U, for instance, launched in 2019, is equipped with a vehicle control display and transparent A-pillars besides dual displays. ENOVATE ME7 unveiled in September 2020 carries 5 high-definition displays including a cluster display, a center console display, a copilot display and dual displays in the rear row.

According to the concept models released by OEMs, curved displays will shine in the automotive display field in future. Luxury brand cars and new energy vehicles are first making use of OLED displays.

Previously, only small displays such as transparent A-pillars, and Audi virtual rearview mirror displays applied OLED. In 2020, some production models use OLED on large displays for center consoles and the copilot. Mercedes-Benz S-class launched in August 2020 is provided with a 12.8-inch OLED curved center console display; the 2021 Cadillac Escalade will be packed with the industry’s first large-size curved OLED cluster display; Nissan’s IMQ concept uses a 33.1-inch curved display; Audi-Aicon concept adopts a surrounded display.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...