Outperforming conventional one in intelligence and comfort, intelligent cockpit is born with the availability of more and more electronics onto vehicle and caters to the user’s needs better. It is evolving apace alongside rapid advances in new intelligence technologies and new materials.

It is analytically judged from major suppliers and their cockpits configured to new models as well as the cockpit configuration of concept cars launched in recent years that automotive intelligent cockpit design will be headed in directions below:

1. Intelligent cockpit will bear richer versatilities.

The upgrade of automotive electronics brings functional build-up of new products. Also, new features like driver monitor system (DMS), driving recorder, rear row entertainment display and co-pilot entertainment display enrich intelligent cockpit.

What’s more, the use of intelligent surface and multiple sensors in vehicle cockpit gives more scope to versatile cockpit design. For instance, window is not only a shelter from wind and rain but also an information display. HUD, sunroof and seat material can be used for displaying vehicle and entertainment information.

2. Multi-channel, fused interaction will become a mainstay in human-vehicle interaction.

Apart from button, touch and voice, human-vehicle interaction modes like voice assistant, gesture recognition, fingerprint, sound localization, face recognition and holographic image have been found in vehicle models launched. For example, BMW Natural Interaction, a new interaction system planned to be available to new iNext in 2021, seamlessly integrates with voice and gesture control and gaze recognition, which allows the driver to choose what they want in the interaction system; all-new Mercedes-Benz S-Class released in September 2020, features an upgraded gesture recognition capability that enables gesture control over center console, and recognition of face direction and body language via the in-vehicle camera to open the function as needed.

BMW Natural Interaction System

Vision BMW i Interaction EASE Cockpit BMW displayed at CES 2020

Safety should be first taken into account in design of a simpler, easy-to-use vehicle cockpit which acts as a human-vehicle interaction interface. Hopefully, multi-channel, fused interaction modes involving fabrics interaction, window interaction, intelligent headlight interaction, iris recognition and lip reading recognition are expected to be seen in intelligent vehicles, delivering an ever better user experience.

3. 3D, multiple screen, large-size display and diversified layout will hold the trends for intelligent cockpit display.

In an age of scenario-based interaction, cockpit layout no longer follows the same pattern. Center console integrated display designs from dual-screen and triple-screen to quint-screen display, for example, have been adopted by quite a few OEMs in 2020, besides usual console and cluster designs. Moreover, new displays including control screen, co-pilot entertainment screen, rear row display and transparent A-pillar have also been deployed in cars in a new way. In 2019 NeZha U added a transparent A-pillar; a virtual rearview mirror is mounted on the door of 2020 Audi e-tron Sportback at the driver’s side. These new designs are far and away new highlights for new cars.

At Auto China 2020, Audi showed an electronic rearview mirror display mounted on the door at the driver’s side

At Auto China 2020, Voyah displayed Ifree concept car which is outfitted with surround screen, control display mode and retractable steering wheel

4. “User experience”-centric cockpit scenario-based interaction modes will become pervasive.

For in-vehicle scenario-based interaction modes, new models on the market deliver simple scenario interactions with smart configurations from voice and ambient light to smart seat and in-car cameras. Take Mercedes-Benz S-Class introduced in September 2020 as an example. The model’s active ambient lighting that enshrines 263 LEDs automatically projects a bright red animation as a warning throughout the cabin when necessary, and gives real-time lighting feedback when the driver controls the air-conditioning system and “Hey Mercedes” voice assistant. As new technologies mature and come into use, vehicle interior space will vary with scenarios to meet the users’ needs. And in-vehicle scenario modes (e.g., driving, rest and office) will change to build an intelligent, connected, flexible, comfortable personal interior space.

Mercedes-Benz S-Class rolled out in September 2020 carries the active ambient lighting with 263 LEDs.

Additionally, the ever upgraded intelligent connectivity system enables availability of such features as voice-activated shopping, WeChat vehicle version and Alipay applets onto vehicles. Scenario-based interactions between the inside and outside of vehicles make vehicles a third space.

5. The maturing new materials for intelligent surfaces will likely enable every surface with interaction ability.

In the Vision BMW i International EASE cockpit, the seats covered by 3D knitted fabric interactive materials allows for touch control over functions. Yanfeng Global Automotive Interior Systems Co., Ltd.’s XiM21 smart cockpit combines digital technology, lighting and physical materials to realize touch switch and create ambience. There are several optional surface materials such as crystal, wood grain and fabric. The touch switch applies pressure sensing technology to ensure safety. The display module is composed of fabric decorative surface and ambient light, differing from common physical buttons.

Interactive surface control switch on the seat in Yanfeng XiM21 smart cockpit

6. Touch feedback will be a key technology for higher level of safety.

Automotive HMI design follows the principle of lowering the level of driver’s distraction and making input and output of vehicle data more effective. As virtual touch buttons/switches find broader application in vehicles, touch feedback technology becomes a crucial way to improve safety. As start-ups such as Tanvas, Immersion, Boréas Technologies and Aito are deploying the technology, major tier-1 suppliers like Continental, Valeo and Bosch also race to make presence.

Bosch’s proprietary “NeoSense” touchscreen gives haptic feedback to users. With buttons on the screen touch as real ones, frequent users even don’t need to see the display to complete operation.

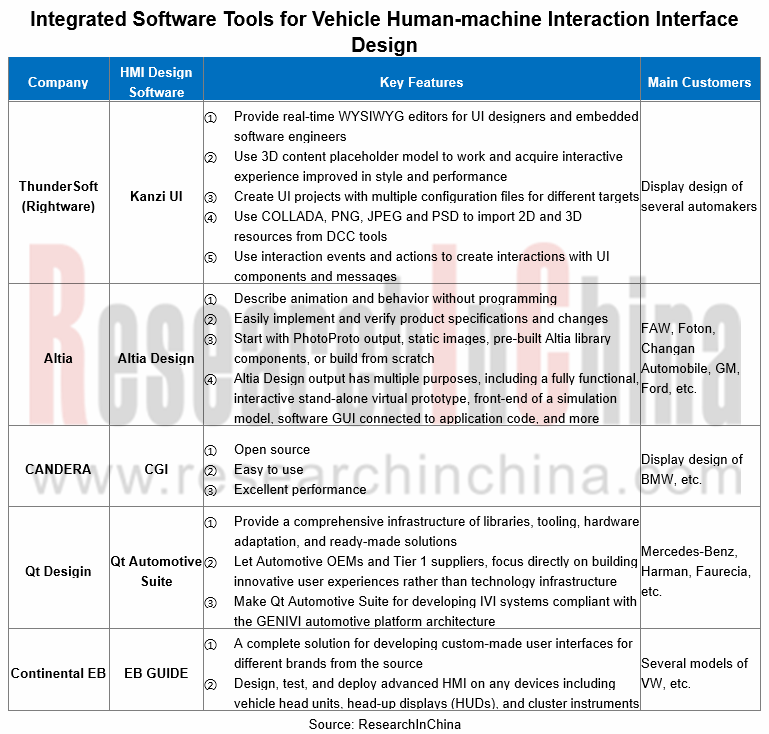

7. Software system will play as a key means to differentiate cockpits.

Android system has enriched IVI system scenarios and provides more personalized human-machine interfaces in efforts to make a rapider expansion in the automotive market, amid simultaneous iterations of software and hardware. To this end, vehicle software providers keep trying to sharpen their software tools and provide more efficient services for OEMs and suppliers. Based on useful functions, human-vehicle interaction interface design does not go into a rut. Some innovative UI designs like 3D vision, visualized, young, flat and card style designs have been found in new vehicles.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...