Research into autonomous delivery vehicle: Probe from single vehicle, fleet, to urban operation

Autonomous delivery is bifurcated into indoor autonomous delivery and outdoor autonomous delivery. Correspondingly, there are indoor autonomous delivery vehicles (also known as "indoor delivery robots") and outdoor ones.

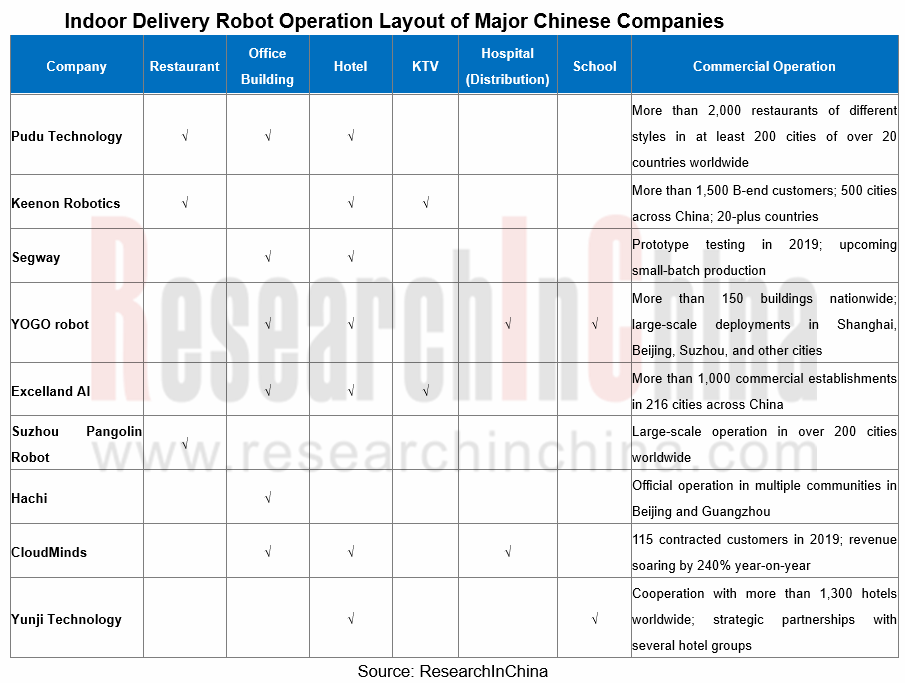

Indoor autonomous delivery market

Up to date, indoor autonomous delivery robots have been available in restaurants, hotels, office buildings, hospitals, Internet cafes, KTVs, and shopping malls, and has got vigorously promoted amid “contactless” services for the prevention and control of the COVID-19 pandemic in 2020, being quite a boon for faster deployment and operation of intelligent equipment such as indoor autonomous delivery robot. For instance, many catering companies such as Country Garden Robot Restaurant, Haidilao, De Zhuang, Xiabu Xiabu, Dadong, Hong Kong Maxim's, etc. have begun to use autonomous delivery robots to serve dishes in their stores to save labor costs and improve the security of meals.

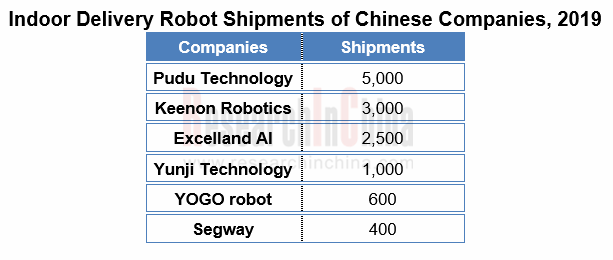

Comparatively, China stays ahead of foreign countries in the development of indoor delivery robots, where emerging players represented by Pudu Technology, Keenon Robotics, Excelland AI, YOGO, etc. have already offered basic products and been aggressively branching out into the multiple-scenario market alongside ceaseless iteration and speedy implementation of their technologies. In 2019, Pudu Technology shipped more than 5,000 units, Keenon Robotics 3,000 units, and other middle companies more than hundreds of units apiece.

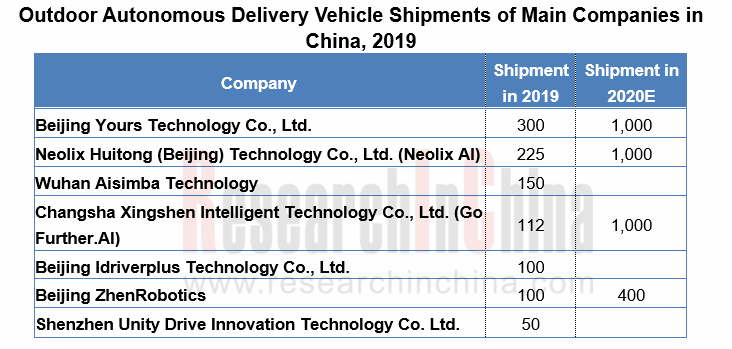

Outdoor Autonomous Delivery Market

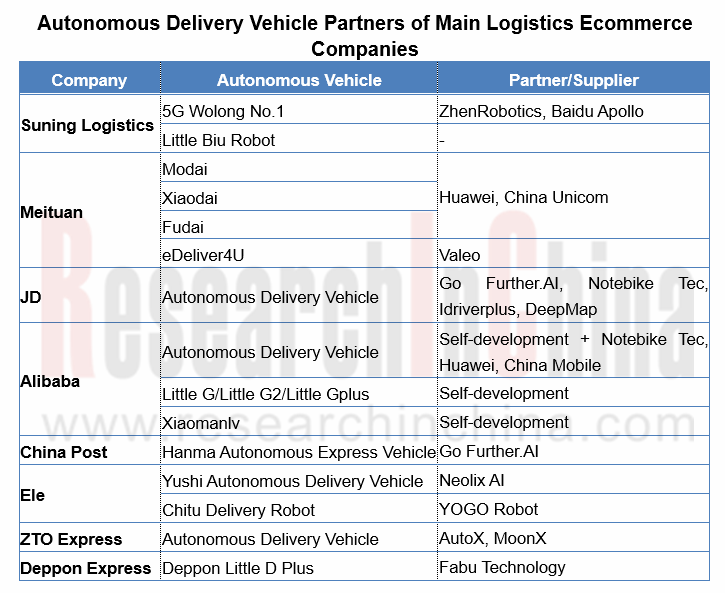

Against the huge market demand for instant delivery and express delivery as well as the decline in labor force in China, major companies are enthusiastically deploying autonomous delivery vehicles. Besides start-ups like Neolix, IdriverPlus and White Rhino, e-commerce and logistics companies such as JD.com, Meituan, Cainiao, Suning and China Post are also sparing no efforts in developing outdoor autonomous delivery business. Autonomous delivery vehicles are produced in small quantities in China and have not taken on a sizable scale yet, as is revealed by the companies concerned.

Constrained by imperfect policies and regulations, technology and scenario configurations, outdoor autonomous delivery vehicles are still undergoing pilot operation. Yet the industry gains momentum in 2020, with operations broadening from “single vehicle pilot run” to “closed scenarios/fixed route fleet operation”, and even to “city autonomous delivery operation”.

Ecommerce logistics companies thus deploy outdoor autonomous delivery vehicles in three ways: ① develop independently or partner with start-ups for deployment through logistics channels, for example, Alibaba self-develops Xiaomanlv autonomous robot and deploys it though Cainiao logistics distribution; ② work with governments, for example, Meituan and the People’s Government of Shunyi District, Beijing cooperated to deploy in the area; ③ joined hands with market players like retailors and supermarkets, for example, White Rhino Auto (Beijing) Technologies Co., Ltd. together with Yonghui Superstores introduced retail autonomous delivery.

Meituan’s autonomous delivery cars that came into service in Shunyi District of Beijing in early 2020, has been found in 15 communities of this district and surroundings and made delivery for a total of more than 10,000 orders for consecutive 270-plus days by the end of October, with support from the cooperative local government. These vehicles have become normal there. As concerns regulation, in September 2020, the People’s Government of Shunyi District, Beijing practiced a new approach to regulate: publicize the testing route and scheme of Meituan autonomous cars, allow them to run in designated places and in specific times, and define the one who is liable for safety. In its next step, Meituan plans to pilot low speed autonomous delivery on a larger scale together with Shunyi District by deploying 1,000 autonomous delivery vehicles that will run all day long throughout the area in the upcoming three years.

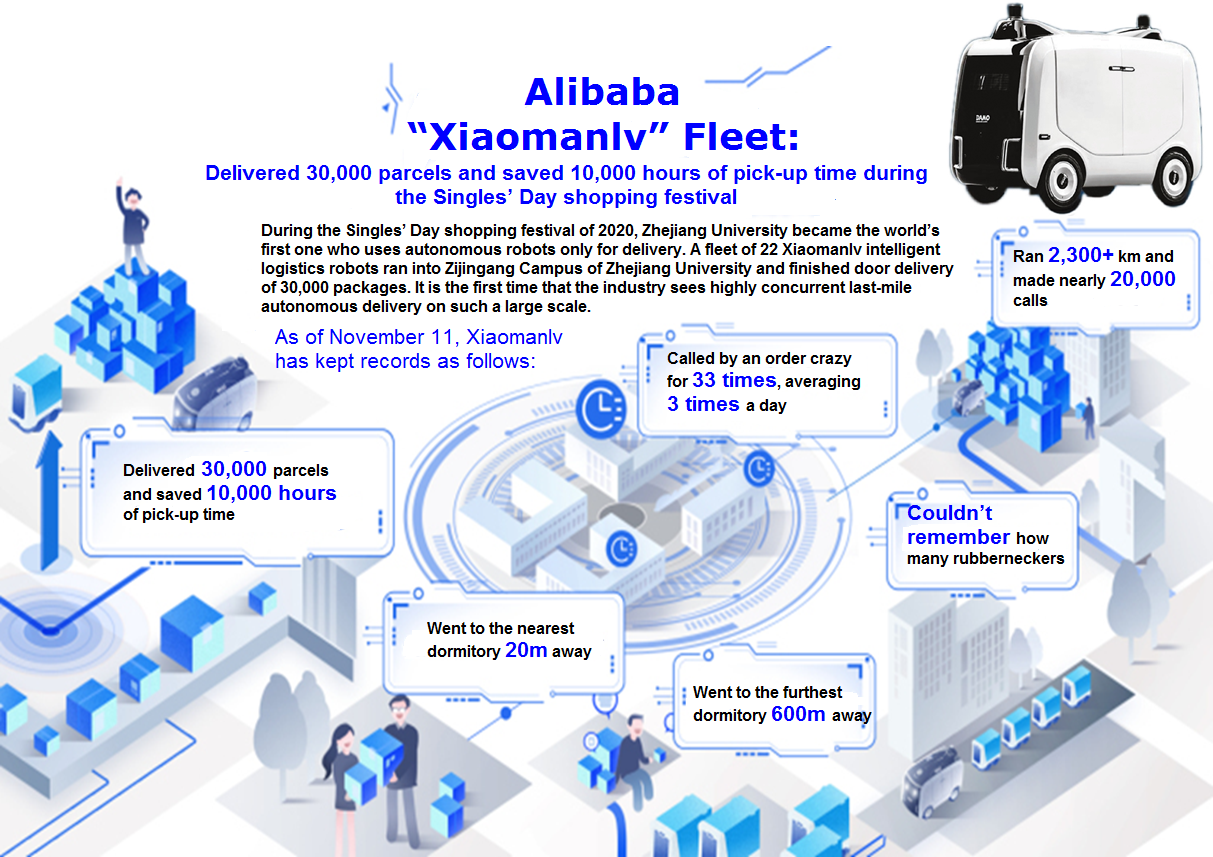

At APSARA Conference 2020 in September 2019, Alibaba’s first wheeled logistics robot called “Xiaomanlv” made a debut. Alibaba plans massive deployment of this vehicle in communities, schools and office parks. In October, Alibaba and Zijingang Campus of Zhejiang University built a fleet of 22 Xiaomanlv robots to deliver parcels from Cainiao logistics outlets to 27 dormitories. During the Singles' Day (2020.11.11) shopping festival, the fleet delivered 30,000 packages in all and saved 10,000 hours of pick-up time.

Alibaba “Xiaomanlv” Fleet

In October 2020, Jingdong Logistics (JDL) announced that it joined forces with Changshu City to construct the world’s first autonomous delivery city. JDL already deploys 5 models of 30-plus autonomous delivery vehicles available to different delivery scenarios in the downtown Changshu, and plans to put into use nearly 100 units before the end of the year. Also, JD has an “autonomous vehicle adoption” plan, that is, JDL’s couriers in the autonomous delivery area are allowed to apply for “adoption” of a set number of autonomous cars and act as the “commander” for the robot delivery task force, which means they can arrange the work for these members freely. A benign circle with links of technological innovation and service application thus takes shape to facilitate massive use of autonomous delivery vehicles and blaze a way for others to follow. JD also plans to bring at least 100,000 autonomous delivery robots into operation in the next five years.

JD Autonomous Delivery Robots Travelling on the Street of Changsha High-Tech Industrial Development Zone

In July 2018, Meituan announced to build an open autonomous delivery platform in an attempt to develop a complete autonomous delivery ecosystem in harness with governments, universities and companies. Meituan’s open autonomous delivery platform has joined hands with Nvidia (a chip vendor), Autox (an automated driving technology developer), Idriverplus, Yunji Technology (a commercial service robot developer) and Segway, as well as Chery, Valeo and other automakers and suppliers, and provides software and hardware integrated solutions together with them. In the meantime, Meituan’s partnerships with demanders using autonomous delivery vehicles in commercial scenarios, such as Joy City and China Fortune Land Development help to create a closed autonomous delivery ecosystem where demand and supply can benefit each other.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...