Global and China Automotive Seat Motor Industry Report, 2020-2026

-

Dec.2020

- Hard Copy

- USD

$3,200

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZJF162

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

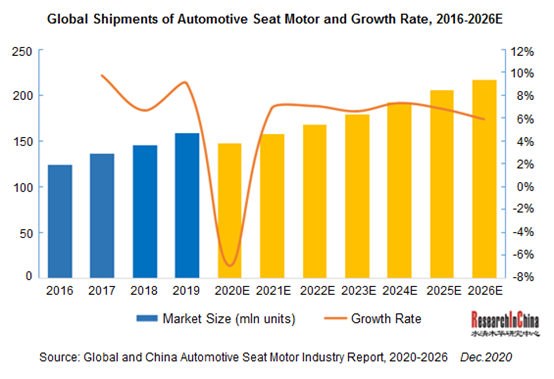

Automotive seat as a key integral of a car concerns ride comfort and safety, and it is growing ever versatile with technological advances. Power seat or electric seat has come to the fore in the market, possessing height regulating motor, sliding motor, electronic control module, heater, massager, memory among others. Power seat was first available onto some luxury cars and then equipped progressively to the medium and high-grade models whose sales boom in turn helps a rise in the installation rate of electric seats, which is naturally a boon for the burgeoning demand for automotive seat motors. In 2019, global shipments of power seat motor reached 157 million units, a figure projected to be approximately 147 million units in 2020 due to the still devastating COVID-19 worldwide, to hopefully recover as the pandemic eases and draw close to 217 million units in 2026.

The production and sales of upscale cars is on a steady rise annually in China, the largest producer and consumer of automobiles in the world, calling for more and more automotive seat motors whose shipments in the country in 2019 posted 30.9 million units and enjoyed a global share of more than 24.3%. The faster growing Chinese seat motor market than the global market arises from a transfer of the market demand to the medium- and high-end products and a spurt in sales growth of medium- and high-grade passenger cars, invigorating the seat motor sector measurably.

In the global market of automotive seat motors, Japanese players lead the pack and four out of the world’s top eight seat motor tycoons are from Japan (Denso, Nidec, Mitsuba, and Mabuchi), holding market shares 45% together. Besides, German-based Bosch, Brose and Chinese peers Johnson Electric and Shenghuabo Group are the competitive suppliers.

Boasting at least 300 branches and operations in over 40 countries, Nidec Corporation dedicates itself to the R&D, production and sale of precision small motors to ultra-large electric motors. Also is Nidec second to none in vehicle motor field, sweeping roughly 16.5% shares in 2019 in the automotive seat motor market and ranking first. Nidec entered China in 1989 and is now in possession of 36 plants, 54 marketing companies and offices with a workforce of virtually 40,000 there. In June 2020, Nidec announced to lavish about JPY100 billion or RMB6.5 billion for building a factory (where a R&D base settles) in Dalian city, China, and the base is to produce the driving motors for both battery electric vehicle and home appliances.

As one of the largest suppliers of auto parts and systems in the world, Denso Corporation has 179 associated companies in more than 30 countries and regions. With its automotive motor business mainly from ASMO, Denso is aggressively seeking innovations in its state-of-the-art technologies and electromechanical products and had a business reshuffle with ASMO in 2017 (incorporating the latter’ motor business inclusive of automotive seat motor to Denso). In 2019, Denso held a global share of 13.1% or so in the automotive seat motor market. Denso (Tianjin) Motor Co., Ltd is the largest manufacturing base for automotive seat motors of Denso in China, with annual capacity outnumbering 3 million units.

Established in 1959, Johnson Electric is a large multi-national corporation from Hong Kong (China) and has a strong market leadership in the design, R&D and production of micro motors and integrated motor systems. With about 35,000 contract workers in 23 countries, Johnson Electric is a global leading provider delivering total seat driving solutions for front/rear seat, seat tilt, height regulation, seat reclining, headrest regulation, lumbar support and seat haptic feedback. It seized a global market share of 10.1% in 2019.

Global and China Automotive Seat Motor Industry Report, 2020-2026 highlights:

Automotive seat motor (definition, classification, technical standards, etc.);

Automotive seat motor (definition, classification, technical standards, etc.);

Global automotive seat motor market (status quo, market size, competitive landscape, etc.);

Global automotive seat motor market (status quo, market size, competitive landscape, etc.);

China automotive seat motor market (development environment, market size, competition pattern, tendencies, etc.);

China automotive seat motor market (development environment, market size, competition pattern, tendencies, etc.);

Downstream sectors including automobile and automotive seating (market size, competition pattern, etc.);

Downstream sectors including automobile and automotive seating (market size, competition pattern, etc.);

Six foreign companies (Nidec, Denso, Mitsuba, Mabuchi, Bosch, Brose) and nine Chinese counterparts like Johnson Electric, Shenghuabo Group, Zhejiang Founder Motor and Ningbo Shuanglin Auto Parts (operation, automotive seat motor business, etc.)

Six foreign companies (Nidec, Denso, Mitsuba, Mabuchi, Bosch, Brose) and nine Chinese counterparts like Johnson Electric, Shenghuabo Group, Zhejiang Founder Motor and Ningbo Shuanglin Auto Parts (operation, automotive seat motor business, etc.)

1. Overview of Automotive Seat Motor

1.1 Automotive Power Seat

1.2 Definition and Classification

1.3 Technical Standards

2. Global Automotive Seat Motor Industry

2.1 Status Quo

2.2 Market Situation

2.2.1 Market Size

2.2.2 Competitive Landscape

3. China Automotive Seat Motor Industry

3.1 Development Environment

3.2 Market Situation

3.2.1 Market Size

3.2.2 Competitive Landscape

3.3 Development Trend

4. Downstream Automotive Seat Industry

4.1 Automobile

4.1.1 Global

4.1.2 China

4.2 Automotive Seat

4.2.1 Market Size

4.2.2 Competitive Landscape

5. Foreign Automotive Seat Motor Manufacturers

5.1 Nidec

5.1.1 Profile

5.1.2 Operation

5.1.3 Automotive Seat Motor Business

5.2 Mabuchi

5.2.1 Profile

5.2.2 Operation

5.2.3 Automotive Seat Motor Business

5.3 Brose

5.3.1 Profile

5.3.2 Operation

5.3.3 Automotive Seat Motor Business

5.3.4 Shanghai Brose Electric Motors Co., Ltd.

5.4 Denso

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 R&D and Acquisitions

5.4.5 Automotive Seat Motor Business

5.4.6 Development in China

5.5 Bosch

5.5.1 Profile

5.5.2 Operation

5.5.3 Automotive Seat Motor Business

5.5.4 Bosch Automotive Products (Changsha) Co., Ltd.

5.6 Mitsuba

5.6.1 Profile

5.6.2 Operation

5.6.3 Automotive Seat Motor Business

5.6.4 Guangzhou Mitsuba Electric (Wuhan) Co., Ltd.

6. Chinese Automotive Seat Motor Manufacturers

6.1 Johnson Electric

6.1.1 Profile

6.1.2 Operation

6.1.3 Automotive Seat Motor Business

6.2 Shenghuabo Group

6.2.1 Profile

6.2.2 Automotive Seat Motor Business

6.2.3 Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd.

6.2.4 Zhejiang SHB Automotive Appliance, Anhui Co., Ltd.

6.3 Founder Motor

6.3.1 Profile

6.3.2 Operation

6.3.3 Automotive Seat Motor Business

6.4 Ningbo Shuanglin Auto Parts Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 Automotive Seat Motor Business

6.5 Others

6.5.1 Zhejiang Kefon Auto-Electric Co., Ltd.

6.5.2 Jiangsu Yidong Aviation Machinery Co., Ltd.

6.5.3 Zhangjiagang Heli Motor Co., Ltd.

6.5.4 Shenzhen Puda Motor Co., Ltd.

6.5.5 Shanghai Mansda Industrial Co., Ltd.

Composition of Automotive Seat

Typical 8-way Adjustable Power Seat Buttons

Typical 10-way Adjustable Power Seat

30-way Adjustable Power Seat of Lincoln CONTINENTAL

Schematic Diagram for Motor Distribution of Automotive Seating

Automotive Seat Regulating System and Motors Used

Global Automotive Power Seat Motor Shipment, 2016-2026E

Global Automotive Seat Motor Revenue, 2016-2026E

Competitive Landscape of Global Seat Motor Market, 2019

Supply Relationship between Global Major Seat Motor Manufacturers and Automakers

China’s Automotive Seat Motor Shipment, 2016-2026E

China’s Automotive Seat Motor Revenue, 2016-2026E

Global Share of China’s Automotive Seat Motor Sales Volume, 2016-2026E

Plants of Global Major Seat Motor Enterprises in China

Output of Major Seat Motor Manufacturers in China, 2019

Passenger Car Fuel Consumption Standards in Major Countries

Lightweight Trend of Automotive Seat Mechanical Parts

Lightweight Trend of Automotive Seat Adjustment Motors

Lightweight Trend of Automotive Seat Lumbar Support

Global Automobile Output, 2016-2026E

Global Automobile Output Structure, 2013-2019

Global Automobile Output (by Region), 2014-2019

Top 20 Countries by Automobile Output, 2019

Global Automobile Sales Volume, 2016-2026E

Global Automobile Sales Volume (by Region), 2014-2019

Top 10 Countries by Automobile Sales Volume, 2014-2019

Automobile Sales Volume and Growth in China, 2012-2026E

China’s Passenger Car Sales Volume, 2012-2020E

China’s Commercial Vehicle Sales Volume, 2012-2020E

Top 10 Passenger Car Manufacturers in China by Sales Volume, 2019

Passenger Car Production and Sales by Type in China, 2018-2019

China’s Automobile Sales Volume and Market Share (by Series), 2012-2019

Global Top 10 Power Seats for Midsize Cars by Sales Volume, 2017

Global Automotive Seat Market Size, 2016-2026E

China’s Automotive Seat Market Size, 2016-2026E

Market Share of Major Automotive Seat Manufacturers Worldwide, 2019

Competitive Landscape of Passenger Car Seating Market in North America, 2019

Competitive Landscape of Passenger Car Seating Market in Europe, 2019

Competitive Landscape of Passenger Car Seating Market in Japan, 2019

Distribution of Toyota’s Automotive Seat Suppliers, 2019

Distribution of Honda’s Automotive Seat Suppliers, 2019

Distribution of Nissan’s Automotive Seat Suppliers, 2019

Distribution of VW’s Automotive Seat Suppliers, 2019

Distribution of BMW’s Automotive Seat Suppliers, 2019

Distribution of BENZ’s Automotive Seat Suppliers, 2019

Distribution of GM’s Automotive Seat Suppliers, 2019

Distribution of Ford’s Automotive Seat Suppliers, 2019

Distribution of HYUNDAI’s Automotive Seat Suppliers, 2019

Relationship between Chinese Major Automotive Seat Manufacturers and Automakers

Competitive Landscape of Chinese Passenger Car Seating Market, 2019

Distribution of SAIC’s Automotive Seat Suppliers, 2019

Distribution of FAW’s Automotive Seat Suppliers, 2019

Distribution of Changan’s Automotive Seat Suppliers, 2019

Distribution of Dongfeng’s Automotive Seat Suppliers, 2019

Distribution of BAIC’s Automotive Seat Suppliers, 2019

Nidec’s Business Structure, FY2020Q1

Nidec’s Net Revenue, FY2011-FY2020

Nidec’s Net Revenue (by Product), FY2008-FY2020

Nidec’s Revenue and Structure (by Region), FY2016-FY2020

Application of Nidec’s Motors in Automobiles

Nidec’s Major Automotive Motor R & D Bases

Revenue and Operating Income of Nidec’s Automobile and Industrial Application Division, FY2016-FY2020

Shipments (by Automotive Motors) of Nidec, FY2016-FY2020

Seat Motors Produced by Nidec

Parameters of Seat Motors Produced by Nidec

Seat Motors Produced by Nidec’s Dalian Factory

Mabuchi’s Major Motor Products

Mabuchi’s Global Footprint

Mabuchi’s Revenue and Operating Income, 2012-2020

Mabuchi’s Development Plan, 2020E

Mabuchi’s Revenue Structure (by Product), 2015-2020

Mabuchi’s Revenue Structure (by Region), 2015-2020

Application of Mabuchi’s Micro-motors in Automotive Electrical Equipment Field

Application of Mabuchi’s Micro-motors in Automotive AV Field

Revenue Structure of Mabuchi’s Automotive Micro-motors (by Product), 2016-2020

Revenue Structure of Mabuchi’s Automotive Medium Motors (by Product), 2016-2020

Revenue of Mabuchi’s Medium Automotive Motors, 2016-2019

Output of Mabuchi’s Major Motor Production Bases in China, 2019

Mabuchi’s Seat Adjustment Motors

Parameters of Mabuchi’s Seat Adjustment Motors

Mabuchi’s Seat Motor Revenue, 2011-2020

Brose’s Revenue, 2006-2019

Brose’s Revenue Structure (by Business), 2013-2019

Brose’s Revenue Structure (by Business), 2019

Brose’s Revenue in China, 2009-2017

Brose’s Major Branches in China

Brose’s Seat Motors and Parameters

Revenue and Net Income of Denso, FY2014-FY2020

Revenue Breakdown (by Business) of Denso, FY2019-FY2020

Revenue Breakdown (by Country/Region) of Denso, FY2016-FY2020

Revenue Breakdown (by Customer) of Denso, FY2019-FY2020

R&D Costs and % of Total Revenue of Denso, FY2014-FY2020

Application of ASMO’s Motors in Automobiles

Seat Motors Displayed by ASMO

Profile of Denso (Tianjin) Motor Co., Ltd.

Capacity of Main Products of Tianjin ASMO Automotive Small Motor Co., Ltd., 2019

Profile of Denso (Hangzhou) Co., Ltd.

Bosch’s Revenue and Growth Rate, 2009-2019

Bosch’s Revenue and Growth Rate in China, 2009-2019

Bosch’s Net Income, 2009-2019

Bosch’s Revenue (by Division), 2019

Bosch’s Revenue Structure (by Region), 2011-2019

MITSUBA’s Operation, FY2015-FY2020

MITSUBA’s Revenue Structure (by Business), FY2020

MITSUBA’s Revenue (by Region), FY2018-FY2020

MITSUBA’s Revenue in China and Global Share, FY2012-FY2020

Application of MITSUBA’s Automotive Motors

MITSUBA’s Main Automotive Motors

MITSUBA’s Seat Motor Factories / Subsidiaries

Global Distribution of Johnson Electric’s Production Bases

History and Development of Johnson Electric

Revenue and Gross Profit of Johnson Electric, FY2011-FY2021

Revenue of Johnson Electric (by Business), FY2011-FY2020

APG Revenue of Johnson Electric (by Geography), FY2019-FY2020

Revenue Structure of Johnson Electric (by Region), FY2020

Seat Adjustment Motors of Johnson Electric

Lightweight Seat Motors of Johnson Electric

Automotive Seat Motor Weight of Johnson Electric

Compact Seat Motors of Johnson Electric

Lumbar Support Adjustment Motors of Johnson Electric

Seat Belt Pretensioner Drive Motors of Johnson Electric

Key Business of Shenghuabo Group

Seat Motor Development Course of Shenghuabo Group

Main Vehicle Models Supported by Seat Motors of Shenghuabo Group

Parameters and Appearance of Seat Motors of Shenghuabo Group

Seating Motor Products of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd.

Major Clients of Zhejiang SHB Automotive Appliance, Shanghai Co., Ltd. by Region

Revenue and Net Income of Founder Motor, 2010-2020

Revenue of Founder Motor (by Product), 2010-2020

Revenue Structure of Founder Motor (by Region), 2010-2020

Revenue from Top 5 Customers of Founder Motor, 2019

Gross Margin of Founder Motor, 2011-2020

Revenue and Net Income of Shuanglin, 2010-2020

Revenue Structure of Shuanglin (by Segment), 2015-2020

Revenue Structure of Shuanglin (by Region), 2015-2020

Gross Margin of Shuanglin, 2014-2020

Seat Motor Diagram of Shuanglin

Parameters and Appearance of Automotive Seat Motors of Kefon Auto-Electric

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...