China Low-speed Electric Vehicle (LSEV) Industry Report, 2020-2026

-

Dec.2020

- Hard Copy

- USD

$3,400

-

- Pages:220

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZJF163

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

Low speed electric vehicle (LSEV) is passenger or freight electric vehicle driven by motor and taking lead-acid cell or lithium battery as driving power, with max speed of less than 70km/h. In a broad sense, LSEV includes electric bicycle (electric motorcycle), electric tricycle, all-terrain vehicle and low speed electric vehicle.

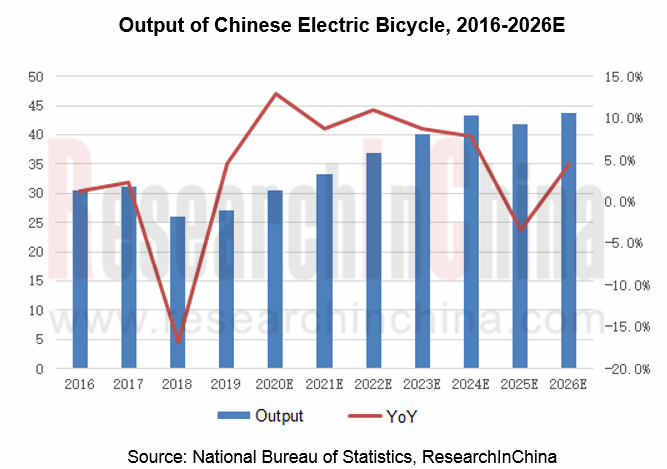

Electric bicycle

Characterized by low carbon and environmental protection, flexibility, and high performance cost ratio, electric bicycle is widely favored by people from middle and small cities, as well as rural areas. However. the electric bicycle market presented downturn due to unclear standard in the last two years. And then, the market recovers with the release of new standard, i.e. the compulsory national standard of Safety Technical Specification for Electric Bicycle (GB17761-2018), which has been formally implemented since April 15, 2019. According to National Bureau of Statistics, output of electric bicycle in China in 2019 hit 27.08 million units, up 6.1% yr-on-yr. The figure amounted to 25.48 million units from Jan 2020 to Oct. 2020, up 33.36% yr-on-yr. The figure is expected to be 30.58 million units by 2020. The market will further expand with the popularization of shared electric bikes.

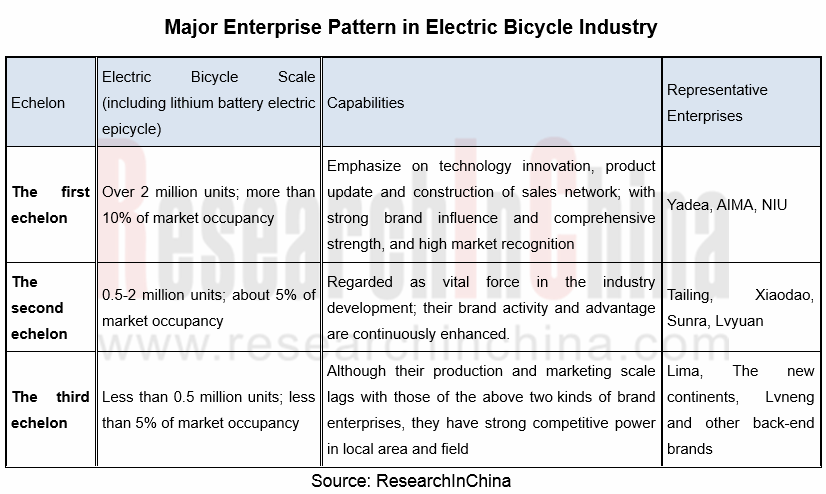

As for industry competition, the electric bicycle industry faces new round of reshuffle since the release of new national standard on electric bicycle in 2019. One the one hand, it is difficult to adapt to new national standard for over-standard manufacturers’ core indices such as technology, quality, and safety performance. Suppressed by policy, these enterprises will be squeezed by market share and even be obsoleted. On the other hand, benefiting from the new policy, industry leading brands represented by Yadea obtain new market growth space due to its advantages in technology, quality, capacity and capital.

According to annual production scale and technology ability, existing enterprises are classified into three echelons. In the future, market occupancy of enterprises from the first and second echelons will continuously grow (enterprises from the first echelon present faster growth speed), while enterprises from the third echelon will be gradually obsoleted.

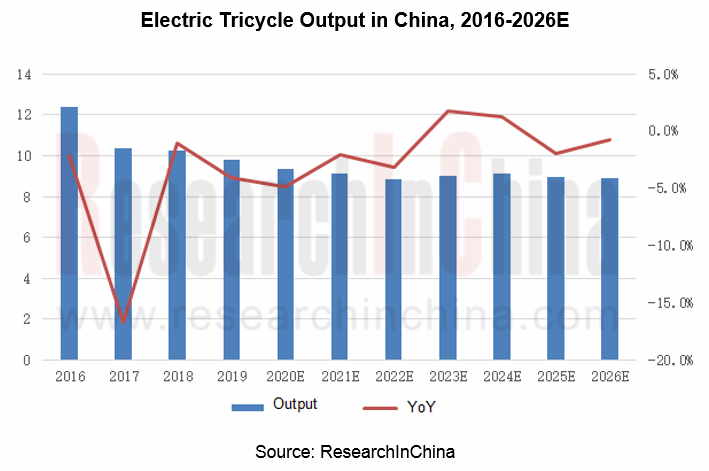

Electric tricycle

As of now, China has not made any regulations on electric tricycle yet, expect for Technical Requirement on Electric Tricycle for Delivery (Exposure Draft) released by State Post Bureau in Apr. 2016. Electric tricycle for delivery occupies large share in tricycle industry, showing great reference significance in the industry.

Boosted by fastened urbanization progress, demand on electric tricycle from second-tier and third-tier cities surged. Output of electric tricycle in 2015 approximated 12.67 million units in 2015, presenting market stagflation. From 2016 to 2019, production and sales volume of electric tricycle in China continuously declined affected by factors of environmental protection, price increase and local control, output of electric tricycle decreased to 9.82 million units. The declining trend will continue, but the market demand will not disappear soon due to price advantage.

China starts late in electric tricycle industry. Stimulated by fast industry development, number of electric tricycle enterprises surged in recent years. At present, China has over 500 electric tricycle brand enterprises. Large-scale enterprises include Huaihai, Jinpeng, Haibao, Bird, and Besway.

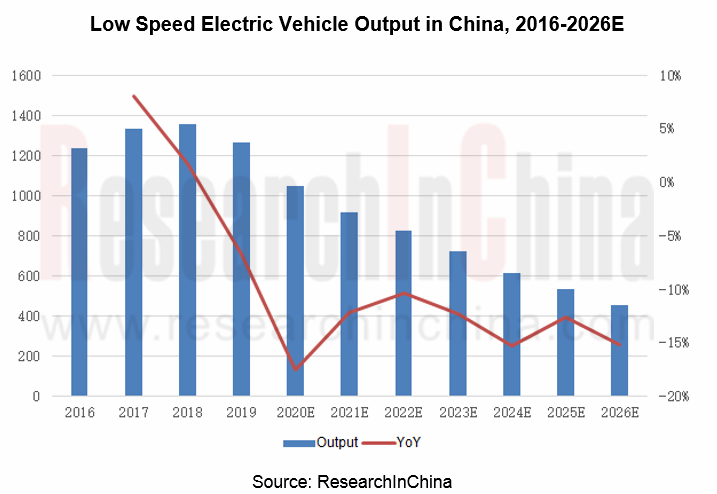

Four-wheeled low speed electric vehicle

The four-wheeled low speed electric vehicles are not built based on the prototype of traditional sedan, but developed from the prototype of golf cart. Without standard on this kind of vehicle in China, Chinese manufacturers mainly design the vehicle by referring EU and Japanese standards, namely, satisfying the requirements of small size, light weight, and low max speed.

There is no standard on four-wheeled low speed electric vehicle. In Mar. 2019, Technology Department of MIIT published nine compulsory national standard plan programs including Technical Condition of Four-wheeled Low Speed Electric Vehicle applying for project initiation. Related standard is forecasted to be released in 2021.

Since 2010, the four-wheeled low speed electric vehicle market experienced wild development due to the demand from fourth-tier and fifth-tier cities and rural areas, and the output peaked at 1.34 million units in 2018, but dropped to 1.27 million units in 2019 affected by policy adjustment from the state and main producing districts like Shandong.

The market was expected to rebound with the establishment of national low speed electric vehicle standard in 2021. However, it will continue to decline due to the impact of A00 class electric vehicles such as Wuling Hongguang MINI EV, and the transformation of many low-speed electric vehicle vendors.

On Jul. 24, 2020, Wuling Hongguang launched new A00 class new energy Hongguang MINI EV at Chengdu Auto Show. The MINI EV features 120 km to 170 km of driving mileage and 100km/h of max speed, with selling price of merely RMB 28,800 to RMB 38,800. Sales volume of the MINI EV in Jul. 2020 amounted to 7,348 units, and further to 15,000 units in Aug. 2020, making it become the first MINI EV with sales volume exceeding 10,000 units worldwide. The MINI EV will give critical strike to four-wheeled low speed electric vehicle market.

Viewed from market competition, large-scale enterprises include Hebei Yujie, BYVIN, Shandong Shifeng, Tangjun Ouling, Weifang Ruichi, Hantour, Lichi, and Baoya, which are primarily distributed in Shandong, Hebei and Jiangsu. Meanwhile, many vendors are adjusting their strategies based on market change and policy requirement, looking forward to manufacturing A00 class or above electric vehicles via qualification enhancement.

China Low Speed Electric Vehicle Industry Report, 2020-2026 highlights:

China low speed electric vehicle industry (definition, classification, and development trend);

China low speed electric vehicle industry (definition, classification, and development trend);

China low speed electric vehicle subdivision market (industry standard, related policy, market scale, competition pattern and development trend of electric bicycle, electric tricycle, low speed electric vehicle and field vehicle);

China low speed electric vehicle subdivision market (industry standard, related policy, market scale, competition pattern and development trend of electric bicycle, electric tricycle, low speed electric vehicle and field vehicle);

Related parts market (competition pattern and vendor comparison of battery, motor, motor controller, and BMS markets);

Related parts market (competition pattern and vendor comparison of battery, motor, motor controller, and BMS markets);

18 major vendors including Yadea, AIMA, Sunra, BYVIN, Jinpeng, Jiangsu Daojue, Hebei Yujie, Shandong Shifeng, Tangjun Ouling, Fulu Vehicle Industry, Letin, Hantour, Lichi, Weifang Ruichi, Shandong Deruibo and Baoya (profile, revenue, major product, R&D, manufacturing base and technology feature)

18 major vendors including Yadea, AIMA, Sunra, BYVIN, Jinpeng, Jiangsu Daojue, Hebei Yujie, Shandong Shifeng, Tangjun Ouling, Fulu Vehicle Industry, Letin, Hantour, Lichi, Weifang Ruichi, Shandong Deruibo and Baoya (profile, revenue, major product, R&D, manufacturing base and technology feature)

1. Overview of LSEV Industry

1.1 Definition and Classification of LSEV

1.2 Industry Characteristics

1.2.1 Intense Competition

1.2.2 Geographical Concentration

2. Development of Two-wheeled Electric Vehicle Industry

2.1 Standard of Two-wheeled Electric Vehicle

2.1.1 Standard of Electric Bicycle

2.2 Policies

2.3 Market Size

2.4 Regional Pattern

2.5 Competitive Landscape

2.6 Industry Forecast

3. Development of Three-wheeled Electric Vehicle Industry

3.1 Standard of Three-wheeled Electric Vehicle

3.2 Market Size

3.3 Development in Major Regions

3.4 Competitive Landscape

3.5 Industry Forecast

4. Development of LSEV Industry

4.1 Policies on Four-wheeled Electric Vehicle

4.1.1 National Policies and Standards

4.1.2 Local Policies

4.2 Market Size

4.3 Development in Major Regions

4.3.1 Shandong

4.3.2 Hebei

4.4 Competitive Landscape

4.5 Mini Electric Vehicle

5. Development of All-Terrain Vehicle Industry

5.1 Market Size

5.2 Regional Development

5.3 Markt Price

5.4 Competitive Landscape

6. Main Parts Market

6.1 Battery

6.1.1 Status Quo and Trends of LSEV Battery

6.1.2 Major Manufacturers and Competitive Landscape

6.1.3 Products of Major Manufacturers

6.1.4 Advantages and Disadvantages of Major Manufacturers

6.2 Motor

6.2.1 Major Manufacturers and Competitive Landscape

6.2.2 Products of Major Manufacturers

6.2.3 Advantages and Disadvantages of Major Manufacturers

6.3 Motor Controller

6.3.1 Major Manufacturers and Competitive Landscape

6.3.2 Products of Major Manufacturers

6.3.3 Advantages and Disadvantages of Major Manufacturers

6.4 BMS

6.4.1 Technical Analysis

6.4.2 Market Analysis

7. Chinese LSEV Manufacturers

7.1 AIMA

7.1.1 Profile

7.1.2 Operation

7.1.3 Production

7.1.4 Major Products

7.1.5 Distributors and Customers

7.1.6 Production Bases

7.1.7 Sales Network

7.2 Yadea

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Marketing Network

7.2.5 Production Bases

7.2.6 Dynamics

7.3 BYVIN

7.3.1 Profile

7.3.2 Electric Bicycle

7.3.3 Electric Tricycle

7.3.4 LSEV

7.3.5 Production Bases

7.3.6 Intelligent Electric SU—BYVIN V7

7.4 SUNRA

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Production and Marketing

7.4.5 Two-wheeled Electric Vehicle

7.4.6 Electric Tricycle

7.4.7 Electric All-terrain Vehicle

7.4.8 Marketing Network

7.4.9 Production Bases

7.4.10 Investment Projects by IPO

7.4.11 Xinri’s Partnerships with China Tower, Meituan, and AngNa Technology

7.5 Zhejiang Luyuan

7.5.1 Profile

7.5.2 Main Products

7.5.3 Main Production Bases

7.5.4 Strategic Planning

7.6 TAILG

7.6.1 Profile

7.6.2 Main Products

7.6.3 Main Production Bases

7.6.4 TAILG Joined the 2019 "UN Environment's Electric Mobility Program"

7.6.5 Strategic Planning

7.7 Jinpeng

7.7.1 Profile

7.7.2 Major Products

7.7.3 Main Production Bases, and Production and Sales

7.7.4 Full-series Lithium Battery Products were Launched

7.7.5 Jinpeng Reached Strategic Cooperation with Haier

7.7.6 Jiangsu Jemmell New Energy Vehicle Co., Ltd.

7.8 YOGOMO

7.8.1 Profile

7.8.2 Output and Sales Volume

7.8.3 Independent Operation of YOGOMO Brand

7.8.4 Major Products

7.8.5 Main Production Bases

7.8.6 YOGOMO Renamed as LinkTour

7.9 Shifeng Group

7.9.1 Profile

7.9.2 Operation

7.9.3 Production

7.9.4 Shifeng Central Research Institute

7.9.5 Strategic Planning

7.10 T-King Ouling

7.10.1 Profile

7.10.2 Major Products

7.10.3 T-King’s Strategic Cooperation with Camel Group

7.10.4 T-King’s Strategic Cooperation with Zibo Torch Energy

7.11 Fulu Vehicle

7.11.1 Profile

7.11.2 Major Products

7.11.3 Fulu Vehicle Invested RMB 160 mln to Establish Test Center

7.11.4 Fulu Vehicle Opened Li-ion Battery Era

7.11.5 Fulu Vehicle Joined Hands with BAW to Produce Beijing Branded NEVs Jointly

7.11.6 Strategic Adjustment

7.12 Dojo

7.12.1 Profile

7.12.2 Major Products

7.12.3 Production Bases and Capacity

7.12.4 Dojo’s Gaoyou Base Was Officially Put into Operation

7.12.5 Strategic Planning

7.13 LEVDEO

7.13.1 Profile

7.13.2 Major Products

7.13.3 Production Base

7.13.4 Important Technology

7.14 Lichi

7.14.1 Profile

7.14.2 Revenue

7.14.3 Major Products

7.14.4 Development Strategy

7.15 Rainchst

7.15.1 Profile

7.15.2 Major Products

7.15.3 Production Bases

7.15.4 Rainchst Signed a OEM Agreement with Italy’s XEV

7.16 Hebei Yudea New Energy Technology Group Co., Ltd.

7.16.1 Profile

7.16.2 Major Products

7.16.3 Production Base

7.16.4 Main Qualifications

7.16.5 Yudea’s 200,000 NEVs/a Project Makes Its Home in Neijiang, Sichuan

7.16.6 Shaanxi Yudea New Energy Vehicle Co., Ltd. Teamed up with Xuzhou XCMG Automobile Manufacturing Co., Ltd.

7.17 DURABLEV

7.17.1 Profile

7.17.2 Major Products

7.17.3 Main Qualifications

7.18 Han Tang Electric Vehicle

7.18.1 Profile

7.18.2 Major Products

7.18.3 Development Strategy

8. LSEV BMS Manufacturers

8.1 Shenzhen Tian-Power Technology Co., Ltd.

8.1.1 Profile

8.1.2 Major Products

8.2 Addenda Technology (Guangzhou) Co., Ltd.

8.2.1 Profile

8.2.2 Major Products

8.3 Shenzhen Guoxin Power Technology Co., Ltd.

8.3.1 Profile

8.3.2 Major Products

8.3.3 Partners

8.4 Jiangxi Keran Technology Co., Ltd.

8.4.1 Profile

8.4.2 Major Products

8.5 Hangzhou Gold Electronic Equipment INC., Ltd.

8.5.1 Profile

8.5.2 Major Products

8.6 Changsha Juli Electric Technology Co., Ltd.

8.6.1 Profile

8.6.2 Major Products

8.7 Xi’an Jindee Electrical Technology Co., Ltd.

8.7.1 Profile

8.7.2 Major Products

Main Classifications of LSEVs

Main Types of Tricycles on the Market

Economic Benefits Comparison between LSEV and Other Types of Vehicles

Main Applications of LSEV

Comparison between Main Technical Specifications for Electric Bicycles (GB17761-1999 VS GB17761-2018)

Policies on Electric Bicycle in China in Recent Years

Electric Bicycle Forbidding Policies Promulgated by Some Cities in China

Laws and Regulations for Electric Motorcycle Industry Issued in Recent Years

Output of Electric Bicycles in China, 2016-2026E

Ownership of Electric Bicycles in China, 2016-2026E

Competitive Pattern of Main Enterprises in Electric Bicycle Industry

Market Structure of Electric Bicycles (by Battery Type) in China, 2013-2019

Key Reference Indicators in Technical Requirements on Electric Tricycle for Express Delivery

China’s Electric Tricycle Output, 2016-2026E

China’s Electric Tricycle Output by Market Segment, 2019

China’s Electric Tricycle Ownership, 2016-2026E

Major Electric Tricycle Production Bases and Sales Regions in China

Competitive Pattern of Electric Tricycle Industry in China, 2019

Partial Contents of Three Meetings of Work Team for Low Speed Electric Vehicle Standard Formulation, 2016

Contents of Technical Specifications for Four-wheeled Low-speed Electric Vehicle Circulated Online

Distribution of Main Regions Issuing Local LSEV Policies

Interpretation of Local Policies and Regulations on LSEV in Recent Years

Regulations of Shandong Province on Administration of LSEV (Trial) (Part)

Overview of Regulations on Administration of LSEV in Some Cities in Shandong

Provisions on Relevant Technical Indicators in Regulations on Administration of LSEV in Xingtai City (Trial)

China’s Low-speed Electric Vehicle Output, 2016-2026E

China’s Low-speed Electric Vehicle Ownership, 2016-2026E

Geographical Distribution of China LSEV Industry

Shandong’s Low-speed Electric Vehicle Output, 2016-2026E

National Share of Shandong’s Low-speed Electric Vehicle Output, 2019

Major LSEV Manufacturers in China

Ranking of Major Chinese LSEV Manufacturers by Sales Volume, 2019

Subsidies for New Energy Passenger Vehicles by Type, 2020

Main Technical Indicators of Some Best-selling Minicars

Main Approaches of LSEV Manufacturers to Obtain Electric Vehicle Production Qualification

Specifications of Wuling Hongguang MINI EV

ATV (All-Terrain Vehicle) Output in China, 2016-2026E

ATV Sales Volume in China, 2016-2026E

Export Volume of All-Terrain Golf Cart in China, 2013-2020

ATV Sales Structure by Region in China, 2019

Comparison of ATV Prices between China and Overseas Countries

Most-Applied ATVs in China

ATV Manufacturers in North America

Ranking of Sightseeing Vehicle Manufacturers in China by Sales Volume, 2018-2019

Sales Volume of Forklift in China by Market Segment, 2015-2019

Performance Comparison of EV Batteries

Comparison between Typical Lead-acid and Lithium Battery Vehicles

Major Battery Supplier’s Share in Two-wheeled and Three-wheeled Electric Vehicle Market, 2019

Major Battery Suppliers’ Share in Low-speed Electric Vehicle Market, 2019

Chaowei Power’s Main Batteries for LSEV

Tianneng Power’s Main Batteries for LSEV

Sacred Sun’s Sealed Lead-acid Batteries for Electric On-road Vehicle

Comparison between Chaowei Power and Tianneng Power

Comparison of Economical Efficiency between LSEVs

Capacity of Major Motor Manufacturers in Two-wheeled and Three-wheeled Electric Vehicle Industries in China

Motor Supply Relationship for LSEV in China

Shandong Xindayang’s Main Motors for Two-wheeled and Three-wheeled Electric Vehicles

Ananda’s Main Motors

Boyu’s Main Motors of LSEV

Yucheng Futong Motor’s Main Motors

Shandong Depuda Electric Motor’s Main Products

Motor Controller Scheme for LSEV

Capacity of Major Manufacturers of Motor Controller for Electric Bicycle in China

Capacity of Major Manufacturers of Motor Controller for Electric Vehicle in China

Deyang Electronic Technology’s Main Motor Controllers

Ananda’s Main Controllers

Wuxi Jinghui Electronics’ Main EV Controllers

Tianneng Power’s Main Motor Controllers

Shanghai Edrive’s Motor Control Systems for LSEV

Tianjin Santroll Electric Automobile Technology’s Main Motor Controllers for LSEV

V&T’s Main EV Controllers

LSEV Motor Controller Products of Zhuhai Enpower Electric

Major LSEV BMS Suppliers in China

Equity Structure (Top 10 Shareholders) of AIMA

Subsidiaries under AIMA

Revenue and Net Income of AIMA, 2015-2019

Revenue Structure of AIMA by Product, 2016-2019

Operating Revenue Structure of AIMA by Region, 2016-2019

AIMA’s Electric Vehicle Output, Sales and Capacity, 2010-2019

Performance Parameters of MINE and Snow Leopard, AIMA’s Two Featured Brands

AIMA’s Main Electric Vehicles and Their Performance

AIMA’s Revenue from Top 5 Distributers, 2018-2019

AIMA’s Revenue from Top 5 Clients, 2016-2019

Capacity of AIMA’s Main Production Bases and Investment

EV Distribution Network of AIMA

Number of AIMA’s Distributers, 2016-2019

AIMA’s Revenue from Electric Bicycles (in Guangzhou, Dongguan & Zhuhai), 2016-2019

Revenue and Net Income of Yadea, 2013-2020

Yadea’s Revenue by Product, 2013-2020

Yadea’s Revenue Structure by Product, 2018-2019

Yadea’s Sales Volume of Major Products, 2013-2020

Distribution of Yadea’s Distributors Nationwide

Profile of Yadea’s Wuxi Headquarters

Profile of Yadea’s Zhejiang Base

BYVIN’s Main Two-Wheeled Electric Vehicles

Specifications of BYVIN’s Main Electric Bicycles

BYVIN’s Main Three-wheeled Electric Vehicles

Main Parameters of BYVIN Spring Breeze Electric Tricycles

Main Parameters of BYVIN M8 Electric Vehicle

Main Parameters of BYVIN M7 Electric Vehicle

Main Parameters of BYVIN M6 Electric Vehicle

Major New Energy Power Technologies of BYVIN

Main Two-wheeled Electric Vehicle Products Bases of BYVIN

Distribution of BYVIN’s Production Bases

BYVIN’s Electric Vehicle Production Bases and Capacity Expansion Plans

Key Performance Indicators of BYVIN V7

Xinri’s Revenue and Net Income, 2014-2020

Xinri’s Revenue by Product, 2014-2019

Xinri’s Revenue by Region, 2014-2019

Xinri’s Electric Bicycle Capacity, Output and Sales Volume, 2014-2019

SUNRA’s Major Two-wheeled Electric Vehicles

Environmental Effect Assessment of SUNRA’s Electric Bicycle Projects

SUNRA’s Major Three-wheeled Electric Vehicles

SUNRA’s Major AVTs

Distribution of Xinri’s Dealers

Basic Information of Tianjin Xinri

Basic Information of Hubei Xinri (e.g., Revenue)

Basic Information of Guangdong Xinri

Overview of Zhejiang Luyuan Electric Vehicle

Major Three-wheeled Electric Vehicles of Zhejiang Luyuan Electric Vehicle

Specifications of Luyuan FBA2

Specifications of Luyuan MH5

Distribution of Main Production Bases of Zhejiang Luyuan Electric Vehicle

Overview of TAILG Group

Main Products of TAILG Group

Specifications of Lion Electric Vehicle Made in Wuxi Base

Specifications of Lion Electric Vehicle Made in Dongguan Base

Distribution of Main Production Bases of TAILG Group

Jinpeng’s Main Electric Vehicles

Capacity of Some Production Bases of Jinpeng

YOGOMO’s Sales Volume of LSEV, 2011-2019

Three Electric Vehicle Brands and Market Segmentation of YOGOMO

Specifications of YOGOMO 330

Specifications of YOGOMO Q EV

Specifications of YOGOMO A260 EV

Specifications of YOGOMO S325 EV

Specifications of YOGOMO X260 EV

Specifications of YOGOMO X6320 Cargo Van

Specifications of YOGOMO M6320

YOGOMO’s Main Production Bases and Products

Capacity and Products of YOGOMO's Main Production Bases

Marketing Network of Shifeng Group

Operating Revenue and Profits & Taxes of Shifeng Group, 2010-2019

Vehicle and Electric Vehicle Output of Shifeng Group, 2010-2019

Distribution of T-King’s Dealers

Specifications of T-King Ouling T1 EV

Specifications of T-King Ouling A6 EV

Specifications of T-King Tianshi EV

Specifications of Fulu Letu

Specifications of Fulu Lechi

Specifications of Fulu Meike

Specifications of Fulu FLE360-F

Specifications of Fulu Q7

Specifications of Dojo Pilot

Specifications of Dojo CooYes

Specifications of Dojo Dream Achiever

Parameters of Dojo Pioneer S

Main Production Bases of Dojo

Specifications of D80 LSEV

Specifications of D50 LSEV

Specifications of D70 LSEV

Specifications of LEVDEO V60 LSEV

Specifications of LEVDEO S50 LSEV

Specifications of LEVDEO LOTTO

LEVDEO i-Life Battery Management System Technology

LEVDEO i-Control Motor Control Technology

Revenue and Net Income of Lichi, 2014-2020

Mini (Low Speed) Electric Car Sales Volume of Lichi, 2014-2020

Parameter Comparison of Lichi’s Main Electric Vehicles

Main Parameters of Rainchst A00 EV

Main Parameters of Rainchst A0 EV

Main Parameters of Rainchst A EV

Main Parameters of Rainchst MMPV EV

Main Parameters of Rainchst Electric Mini-truck

Main Parameters of Rainchst Electric Sports Car

Main Parameters of Rainchst Sightseeing Electric Vehicle

Main Parameters of Revey

Main Technologies Adopted by Rainchst’s Production Bases

Main Technical Parameters of Xinyuzhou Yudea’s Electric Police Car

Main Technical Parameters of XinyuzhouYudea’s Sightseeing Electric Vehicle

Main Parameters of Yudea T80

Main Parameters of Yudea T60

Main Parameters of Yudea T70

Distribution of Main Production Bases of Yudea Group

Lithium Battery-powered Electric Vehicles of DURABLEV

History of Weifang Han Tang New Energy Vehicle Technology

Specifications of Han Tang A1

Specifications of Han Tang A3

Specifications of Han Tang A6

Specifications of Han Tang Q3

Specifications of Han Tang Lingka

R&D Teams of Shenzhen Tian-Power Technology

Tian-Power’s BMS Products

Main Technical Parameters of Tian-Power’s LSEV BMS Products

Addenda’s Integrated BMS Series

Addenda’s Distributed BMS Series

Guoxin Power’s Integrated BMS Series

Guoxin Power’s Distributed BMS Series

Guoxin Power’s Major Partners

BMS Products of Gold Electronic

BMS AIO Legend of Gold Electronic

Technical Parameters of Gold Electronic’s BMS AIO

Gold Electronic’s 10S BMS Module - EVBMM-1022

LSEV Lithium Battery Management System - EViBMM-2412/3212

BMS Products of Changsha Juli Electric Technology

Changsha Juli Electric Technology’s LSEV BMS Products

Battery Monitoring Modules and Systems of Xi’an Jindee Electrical Technology

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...