Amid “CASE” (connected, autonomous, shared and electrified) prospering in automotive sector, Chinese and joint venture auto brands are vying for connectivity and intelligence. In China, domestic brands have gained first-mover advantages in the country’s telematics market on the strength of local resources. In January 2019, joint venture brands were left behind by Chinese OEMs, with an 11.8 percentage points lower telematics penetration. Since 2019 their deploying telematics has been expedited: they endeavor to develop underlying technologies and seek partners, with roll-outs of more secure, more intelligent in-vehicle infotainment (IVI) systems; they also focus more on user experience and exert themselves to upgrade telematics capabilities by setting up joint ventures, or cooperating with BATH (Baidu, Alibaba, Tencent and Huawei) to answer Chinese customers’ needs for services from in-vehicle entertainment to mobility. In the first ten months of 2020, joint venture brands boasted a telematics installation of up to 49.8%, closing the gap with their Chinese peers (57.7%) to 7.9 percentage points.

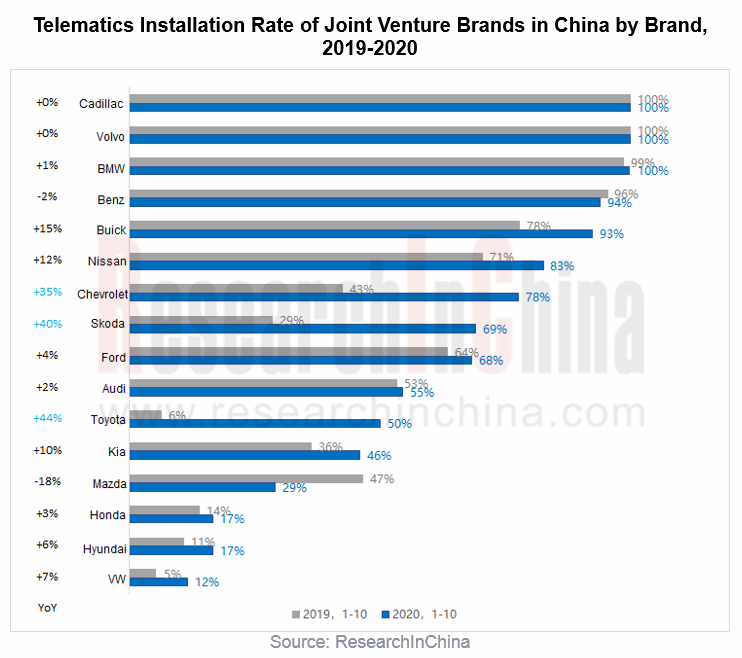

From January to October 2020, joint venture brands saw their installation of telematics jump by 14.3 percentage points from 35.6% in the prior-year period. Among them, the installation of Toyota, Chevrolet and Skoda all surged by over 30% on a like-on-like basis, because Toyota introduced Toyota Connect system into China in 2019, Chevrolet launched widely available MyLink+ system in the second half of 2018, and Skoda brought into use Skoda Connect system, a local telematics system for SAIC Volkswagen, in 2020.

In comparison, Audi and KIA post a relatively low installation, but they have set about deploying with great efforts. As an example, in December 2020 FAW Volkswagen Audi and Baidu Internet of Vehicles jointly released Audi Q2L T-Box; in October, Hyundai Kia forged a close partnership with Baidu on installation of Xiaodu In-Car OS in all future models planned to be sold in China and imported cars.

In future, joint venture automakers will head in the following directions:

1. It is estimated that their installation of telematics will outstrip 50% in 2020 and leap to around 70% in 2025.

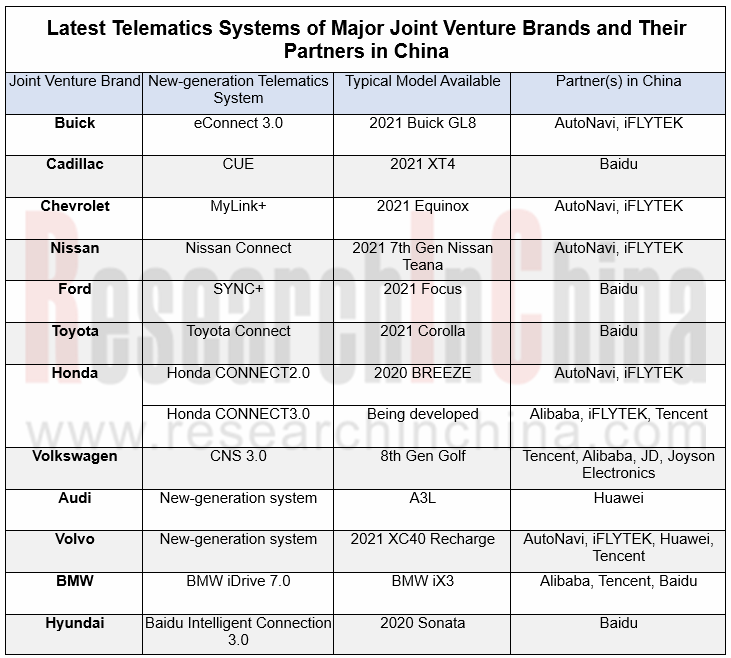

2. They will deliver better use experience to cater to Chinese clientele who has developed a unique habit of using internet, as they partner closely with Chinese companies like BATH (Baidu, Alibaba, Tencent and Huawei) to introduce new features in their IVI systems, including short video, group driving, delivery to car, biometrics, WeChat vehicle version, applets, and Huawei APP.

3. Accelerate iteration and upgrade of telematics system. IVI systems of joint venture brands like Toyota and Honda have yet to offer OTA updates, while Tesla, NIO and Xiaopeng Motors already provide full vehicle FOTA capability. In the second half of 2020, the mass-adoption of OTA updates by joint venture OEMs such as BMW and SAIC GM was enabled.

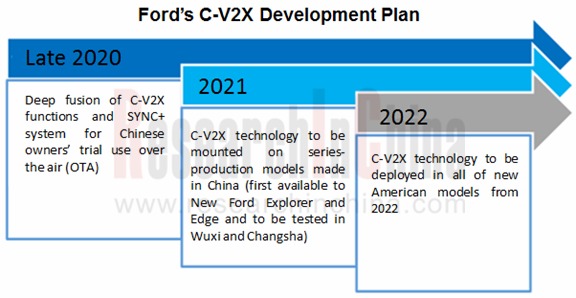

4. Apply V2X. For example, Buick has made it clear that its next-generation IVI system is to support V2X; Ford will roll out its first production model packing V2X capabilities in China in 2021.

In October 2020, BMW China released its “Customer Centric Digitalization Strategy” where China will go first in research and development, products, and user experience on the vehicle end. BMW announced the latest iDrive 7.0 OTA update for about 750,000 cars worldwide from October 19, 2020 onwards, including roughly 200,000 units in China.

BMW unveils a range of IVI system features for the Chinese market this year, including Ximalaya FM (in April 2020), Ixigua Short Video and a parking lot indoor map (in July 2020), upcoming Tencent Mini Scenario (within 2020), and WeChat vehicle version (in future). On this basis, for Chinese customers, BMW has also designed My BMW APP, an exclusive APP launched in September 2020 and offering more than 60 capabilities under three categories --“Car Selection, Service, and Social Contact”.

In future, BMW China will push on with development and launch of digital experience products for China through its Chinese R&D teams (with 1,100-plus talents including more than 400 software staffs) and its digital service outfit -- LingYue Digital Information Technology Co., Ltd. founded in 2019.

In July 2020, Dongfeng Nissan released its “Intelligent Connected Future” Program which highlights the following: 1. to launch 8 car models carrying Nissan Connect in 2020; 2. to equip 80% of its models with telematics systems in 2021; 3. to iterate Nissan Connect for four times during 2020-2024.

Nissan Connect, one of the five core technologies of Nissan Intelligent Mobility, encompasses six functional sectors (e.g., Remote Online, Online Control and Online Resources) offering 59 capabilities, of which 12 are included in the Online Resources sector, such as online payment (WeChat, Alipay and UnionPay Online Payment), account bound with third-party APPs, smart refueling (supporting online payments), and vehicle safety functions (violation query, safe arrival reminder, vehicle health monitoring and maintenance reservation). As of November 2020, Nissan Connect has been available to nine of Nissan’s models (2021) including Kicks, Tiida, Sylphy Classic, Sylphy, Qashqai, X-Trail, Murano and Teana.

In April 2019, Ford China announced “Ford China 2.0” strategy which contains “330” Product Plan, Smart Technology Plan, China Partner Plan, China Innovation Plan and China Talent Plan, among which Smart Technology Plan involves: 1. launching the new SYNC+ in-vehicle infotainment system together with Baidu; 2. Equipping most of Ford and Lincoln brand new cars made in China with SYNC+ system from 2019; 3. spawning the first C-V2X-enabled model in China in 2021.

As for telematics, Ford has built SYNC+, its new-generation in-vehicle infotainment system built on Xiaodu In-Car OS for the Chinese market. The IVI system is a fusion of capabilities such as Baidu AI Voice Assistant, Baidu Navigation and Baidu Home To Vehicle, as well as infotainment features like iQiyi, QQ Music and Himalaya FM, and is connected with FordPass APP for “IVI system-smartphone-home” interconnection.

In November 2020, Volvo’s new-generation IVI system was first seen in XC40 BEV. The system runs Google Android Automotive OS, and packs Huawei’s HMS for Car intelligent in-vehicle cloud service (that offers such application services as Huawei APP Store, Huawei Quick APP, Huawei Assistant Service, My Car, Huawei Music, and Huawei Video), iFLYTEK’s voice technology, Tmall Genie Car-Home Interconnection and Tencent Aiquting, among others.

OTA updates will bring features like WeChat vehicle version to Volvo’s new-generation IVI system. Furthermore, Volvo will team up with Huawei and China Unicom to create a next-generation 5G intelligent telematics system.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...