Global and China Automated Guided Vehicle (AGV) Industry Report, 2020-2026

-

Jan.2021

- Hard Copy

- USD

$3,400

-

- Pages:236

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZJF164

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

Automated Guided Vehicle (AGV), a kind of industrial robot, shares the same industry chain structure with industrial robot. Robot components, as the upstream also the core of the industry chain, occupies the most majority of costs in robot products. The medium sector is robot manufacturing & system integration enterprises, and downstream sectors covers application industries such as automobiles, 3C electronics and logistics.

As a substitute for human resources, the demand for moving AGVs has become increasingly strong. In 2019, China’s AGVs sold 40,670 units, up 37.4% yr-on-yr. In 2020, the new application value of AGVs (reducing human-to-human contact) was released due to COVID-19 epidemic, accelerating the development of entire AGV industry application scenarios. It is estimated the AGV sales volume hit 53,000 units in 2020, and forecasted to exceed 130,000 units by 2026.

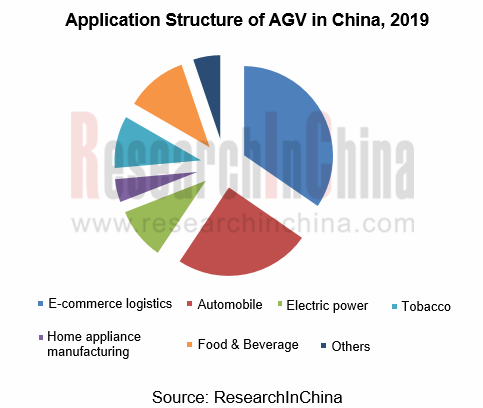

From the perspective of application scenarios, AGV are mainly used in handling scenarios, and wherever there is handling, there is the possibility of AGV application. By application fields, the automobile industry, 3C electronics, tobacco industry, and logistics industry are the most widely used and most promising industries for AGV. Among them, the largest application field is e-commerce logistics services, accounting for about 32.8% of the total AGV demand. AGVs can automatically carry according to the optimal driving route, accurately dock at the desired manual picking platform, and pick out the corresponding quantity of goods. The matching AGV intelligent management system can complete the supervision of all cargo situations and operation links, and can check the storage, delivery, transportation, etc. of goods at any time, so that customers can grasp the dynamics of their own goods in real time.

Another typical application of AGV is in the automotive industry, and mainly in the engine assembly line, or the docking of the chassis and platform. For example: ① automatic transportation of raw materials ② transportation of the assembly line ③ transportation to and from the test area ④ automatic transportation between workshop and finished products. Judging from the current data of domestic automobile manufacturers, most players have adopted domestic AGV as a circulation hardware for in-plant production logistics, with a high localization rate.

In terms of competition pattern, AGV carries relatively high localization rate but scattered market concentration, and the market steps into an era of competition. Every AGV manufacturer has its own unique advantages. Since 2015, the AGV industry has entered a period of rapid development, and there are large variables in the industry. Relatively speaking, enterprises with deeper technological accumulation and more unique functional development may benefit more from industry changes.

Formally established in 2000 and affiliated to Shenyang Institute of Automation, Shenyang Siasun Robot & Automation Co., Ltd. specializes in industrial robots, automated assembly and inspection production lines, logistics and storage automation complete sets of equipment, etc. In 2019, it realized revenue of 2.745 billion yuan, down 11.3% yr-on-yr. Among them, the logistics and storage automation complete sets of equipment business harvested operating revenue of 1.060 billion yuan, up 9.3% yr-on-yr. Its AGV mainly includes handling AGVs and assembly AGVs. Navigation technology covers a variety of navigation methods such as magnetic tape, laser, inertia, vision, GPS, natural contour, etc. Its AGV products are mainly applied in automobile and military fields, and the market share in automobile sector ranks first.

Yunnan KSEC Intelligent Equipment Co., Ltd., a subsidiary of Kunming Shipbuilding Equipment Group Co., Ltd., started to set foot in the AGV industry as an agent for Samsung AGV products in South Korea in 1996. It has been dedicated to R&D, production and sales of AGV for nearly 20 years. Its AGV products are mainly concentrated in tobacco, automobile, and household appliances industries, of which the market share in tobacco industry accounts for more than 60%, ranking first in the industry. Food & beverage industry is its next focus. In 2019, Yunnan KSEC 's AGV business revenue exceeded 100 million yuan, second only to Shenyang Siasun.

Founded in 2003, Huaxiao Precision (Suzhou) Co., Ltd. specializes in logistics containers, logistics automation equipment and related non-standard equipment products, of which logistics automation equipment is mainly AGV products widely used in automotive field, customers include Nissan, Renault, etc., and are exported to overseas markets. In January 2016, CSG Smart Science & Technology invested 60 million yuan to acquire 100% equity of Huaxiao Precision. CSG Huaxiao put forward the concept of "AGV +," that is, to connect or carry more and more creative scene applications based on AGV robots.

Global and China Automated Guided Vehicle (AGV) Industry Report, 2020-2026 highlights the following:

Definition and classification of AGV, including industry chain;

Definition and classification of AGV, including industry chain;

Global AGV market (size, demand structure, competitive pattern, development in Japan, Europe, USA, etc.);

Global AGV market (size, demand structure, competitive pattern, development in Japan, Europe, USA, etc.);

China AGV market (size, product structure by product, demand structure, price, competitive, and development trends);

China AGV market (size, product structure by product, demand structure, price, competitive, and development trends);

Core components market for AGV, including AGV system, on-board control system, drive system (motor and speed reducer, etc), navigation system (magnetic navigation sensor, laser navigation, laser scanner, etc), and charging system;

Core components market for AGV, including AGV system, on-board control system, drive system (motor and speed reducer, etc), navigation system (magnetic navigation sensor, laser navigation, laser scanner, etc), and charging system;

Major downstream sectors of AGV, including automobile, parking, power patrol, tobacco, and so on;

Major downstream sectors of AGV, including automobile, parking, power patrol, tobacco, and so on;

29 global and Chinese AGV companies (operation, AGV products, and development strategy, etc.).

29 global and Chinese AGV companies (operation, AGV products, and development strategy, etc.).

1. Overview

1.1 Definition

1.2 Classification

1.3 AMR

1.4 Industry Chain

2. Global AGV Market

2.1 Market Size

2.2 Demand Structure

2.2.1 By Application

2.2.2 By Region

2.3 Competitive Landscape

2.3.1 Corporate Competition

2.3.2 AMR VS AGVs

2.4 Regional Development

2.4.1 Japan

2.4.2 Europe

2.4.3 United Sates

2.4.4 India

3. Chinese AGV Market

3.1 Status Quo

3.1.1 Development History

3.1.2 Development Features

3.1.3 Development Mode

3.2 Market Situation

3.2.1 Market Size

3.2.2 Sales Volume

3.2.3 Ownership

3.2.4 Industry Concentration

3.3 Market Structure

3.3.1 By Navigation Technology

3.3.2 By Product

3.3.3 By Application

3.4 Price

3.5 Competitive Pattern

3.5.1 By Types of Enterprise

3.5.2 Market Shares of Enterprises

3.6 Fundraising

3.7 Development Trend

3.7.1 Market Trend

3.7.2 Technology Trend

4. Upstream and Downstream Industries of AGV

4.1 AGV Core Parts

4.1.1 Development Overview

4.1.2 Drive Device System

4.1.3 AGV On-board Control System

4.1.4 Navigation/Guidance System

4.1.5 AGV Battery/Energy System

4.1.6 AGV Master Control System

4.2 Downstream Industries of AGV

4.2.1 Automobile Manufacturing

4.2.2 Parking

4.2.3 Power Patrol Inspection

4.2.4 Tobacco Logistics

4.2.5 Heavy Load

5. Major Global AGV Players

5.1 JBT

5.1.1 Profile

5.1.2 Operation

5.1.3 AGV Business

5.1.4 Presence in China

5.2 Daifuku

5.2.1 Profile

5.2.2 Operation

5.2.3 AGV Business

5.2.4 Presence in China

5.3 Dematic

5.3.1 Profile

5.3.2 Operation

5.3.3 AGV Business

5.3.4 Presence in China

5.4 Swisslog

5.4.1 Profile

5.4.2 Operation

5.4.3 AGV Business

5.4.4 Presence in China

5.5 Meidensha

5.5.1 Profile

5.5.2 Operation

5.5.3 AGV Business

5.5.4 Presence in China

5.6 Oceaneering AGV Systems

5.6.1 Profile

5.6.2 Operation

5.6.3 AGV Business

5.7 Grenzebach Corporation

5.7.1 Operation

5.7.2 AGV Business

5.7.3 Presence in China

5.8 Elettric 80

5.8.1 Profile

5.8.2 Operation

5.9 Rocla

5.9.1 Profile

5.9.2 Operation

6. Key Chinese AGV Companies

6.1 Shenyang Siasun Robot & Automation Co., Ltd. (300024)

6.1.1 Profile

6.1.2 Operation

6.1.3 AGV Robot Business

6.1.4 Development Strategy

6.2 Yunnan KSEC Intelligent Equipment Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Typical Cases

6.3 Machinery Technology Development Co. Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 AGV Business

6.4 CSG Smart Science & Technology Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 AGV Business

6.5 Guangdong Jaten Robot & Automation Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 AGV Business

6.5.4 Main Cases

6.6 Geek+

6.6.1 Profile

6.6.2 Operation

6.6.3 AGV Business

6.6.4 Development Strategy

6.7 Quicktron Intelligent Technology

6.7.1 Profile

6.7.2 Operation

6.7.3 Application Cases

6.7.4 Development Strategy

6.8 Zhejiang Libiao Robot Co., Ltd.

6.8.1 Profile

6.8.2 Operation

6.8.3 Application Cases

6.9 Hangzhou Hikrobot Technology Co., Ltd.

6.9.1 Profile

6.9.2 Operation

6.9.3 AGV Business

6.9.4 Application Cases

6.10 Yonegy Logistics Automation Technology Co., Ltd.

6.10.1 Profile

6.10.2 Operation

6.11 Noblelift Equipment Joint Stock Co., Ltd.

6.11.1 Profile

6.11.2 Operation

6.11.3 AGV Business

6.11.4 Output and Sales Volume

6.11.5 Development Strategy

6.12 Guangzhou Jingyuan Mechano-Electric Equipment Co., Ltd.

6.12.1 Profile

6.12.2 Operation

6.13 Shanghai Triowin Automation Machinery Co., Ltd.

6.13.1 Profile

6.13.2 Operation

6.13.3 AGV Business

6.14 Shenzhen Casun Intelligent Robot Co., Ltd.

6.14.1 Profile

6.14.2 Operation

6.14.3 AGV Business

6.15 Guangzhou Sinorobot Intelligent Technology Co., Ltd.

6.16 Shenzhen OKAGV Co., Ltd.

6.17 Guozi Robotics

6.17.1 Profile

6.17.2 AGV Business

6.18 CIZON

6.19 Standard Robots

6.20 Suzhou AGV Robot

6.20.1 Profile

6.20.2 AGV Business

6.20.3 Application Cases

Architecture Diagram of AGV

Composition of AGV System

Operating Scene and Communication Mode of AGV

Classification of AGV

AMR Robots of JATEN

Schematic Diagram of Features Comparison of Magnetic Navigation AHGV, QR Code Navigation AGV and AMR

Structure of AGV Software

AGV Industry Chain

AGV Production Line VS Traditional Production Line

Global AGV Sales Volume and YoY Growth, 2016-2026E

Global AGV Market Size and YoY Growth, 2016-2026E

Global AGV Market share by Application, 2019

Global AGV Market Demand Growth, 2019-2024E

Financing and M&As of Major Global AGV Companies, 2016-2020

Competitive Landscape of Global AGV Players

Major AGV Companies and Financings in the world, 2020

Comparison Scheme between AGV and AMR

Representative Companies of AMR for Industrial Use in China

Warehousing AMR Market Size in China, 2019-2025E

AGVS/AGV Sales Volume in Japan, 2012-2019

AGVS Sales Structure in Japan by Category, 2014-2026E

AGV Market Demand Structure in Japan, 2017-2019

AGV Market Size in Europe, 2017-2026E

AGV Manufacturers in USA

AGV (by Type) Market Size in India, 2014-2025E

Development History of AGV in China

Development Model of Major AGV Producers in China, 2019

AGV Market Size and YoY Growth in China, 2016-2026E

AGV Sales Volume and YoY Growth in China, 2011-2020

AGV Ownership and YoY Growth in China, 2016-2026E

AGV Industry Concentration in China, 2019

AGV Structure in China by Navigation Mode, 2019

Major Companies in Forklift AGV Market in China, 2019

AGV Lidar Manufacturers in China

Difference between AGV and AGC

AGV Sales Structure in China by Product, 2015-2025E

Major Global and Chinese AGC Producers, 2020

AGV Demand Structure in China by Sector, 2017-2026E

Average Price of AGV in China, 2016-2026E

AGV Price of Major Global and Chinese Producers in China, 2018-2019

Market Share of AGV Companies in China by Country, 2014-2026E

Market Share of Major AGV Producers in China,2019

Financing in China AGV Industry, 2020

AGV Sales Volume and YoY Growth in China, 2019-2026E

Application of Trackless Navigation AGV in China

Development Trends of AGV

5G-based Cloud AGV High-density Cluster Deployment

Number of Motors, Drivers and Speed Reducers of Per Unit AGV Drive System by Drive Mode

New Demand for AGV Motors in China, 2016-2026E

New Demand for AGV Speed Reducers in China, 2016-2026E

Composition of Laser Guided AGV On-board Control System

New Demand for AGV On-board Controllers in China, 2016-2026E

Major Chinese Controller Producers, 2020

Classification of AGV Navigation Modes and Core Components

New Demand for AGV Laser Scanners in China, 2016-2026E

Main AGV Obstacle Avoidance Sensors in China

Major Chinese AGV Sensor Companies, 2020

Operating Principle of Magnetic Navigation Sensor for AGV System

Cycles of AGV Batteries

Contactless Power Supply AGV System

Supercapacitor Power Supply AGV System

Batteries as a Percentage of AGV Projects in Europe, 2015

Structure of AGV Batteries in China by Product, 2015

Main Charging Methods of AGV Batteries

Classification of Global AGV Software Systems

AGV Software Systems Used by Global and Chinese AGV Producers

Automobile Sales Volume and Growth in China, 2012-2026E

China’s Passenger Car Sales Volume, 2012-2020E

China’s Commercial Vehicle Sales Volume, 2012-2020E

Top 10 Passenger Car Manufacturers in China by Sales Volume, 2019

Passenger Car Production and Sales by Type in China, 2018-2019

China’s Automobile Sales Volume and Market Share (by Series), 2012-2019

Features and Configurations of AGV Systems for Car Production Lines

Density of Use of Car AGVs in Major Countries

Major Car AGV Producers in China

Car AGV Sales Volume in China, 2017-2026E

Global and Chinese AGV Products for Parking

Global and Chinese AGV for Parking Projects

Merits of Patrol Robot

Power Industry’s Demand for AGVs in China, 2017-2026E

State Grid’s Tenders for Intelligent Patrol Robot in Recent Years

Performance Comparison of Products of Key Chinese Producers of Power Patrol Robot

Development History of Tobacco Logistics in China, 2003-2019

Competitive Pattern of AGV for Tobacco Logistics

Smart Logistics System of Siasun for Tobacco Industry

Use of AGVs in Some Tobacco Factories in China

Heavy Load AGV Producers by Purpose

Businesses of JBT

Properties of JBT, 2019

Revenue and Net Income of JBT, 2013-2020

Order Backlog of JBT by Product, 2013-2020

Revenue Breakdown of JBT by Product, 2013-2020

Revenue Breakdown of JBT by Region, 2012-2019

Revenue Structure of JBT by Region, 2018

AGV Locations of JBT

JBT’s Subsidiaries in China, 2019

Global Presence of Daifuku

Business Structure of Daifuku

Net Sales and Net Income of Daifuku, FY2013-FY2020

Order Intake of Daifuku, FY2015-FY2020

Sales and Orders of Daifuku by Business, FY2018-FY2019

Sales and Orders of Daifuku by Sector, FY2018-FY2019

Orders of Daifuku by Region, FY2016-FY2019

Sales of Daifuku by Region, FY2016-FY2019

Main AGV Clients of Daifuku

AGV Systems of Daifuku

Daifuku’s Sales in China, FY2013-FY2020

M&As of Dematic, 2010-2019

Revenue of Dematic, 2014-2018

Advantages and Applications of Dematic AGV System

Dematic AGV Products

Typical Clients of Dematic in China

Milestones of Dematic’s Suzhou Plant

Businesses and Products of Swisslog

Businesses and Products of Swisslog

Operation Data of Swisslog, 2018-2019

Revenue and Orders of KUKA Group, 2018-2019

AGVs of Swisslog

Customers of AGVs of Swisslog

Branches of Swisslogin China

Business Structure of Meidensha

Net Sales and Net Income of Meidensha, FY2014-FY2020

Net Sales Structure of Meidensha by Business, FY2018-2019

FY2020 Results Forecasts of Meidensha by Business

Main Products and Clients of Meidensha’s Industrial Systems

Business Plan of Meidensha’s Industrial Systems, FY2018-2020

AGV Products and Features of Meidensha

Transport Weight and Applicable AGV Model of Meidensha

Guidance Systems of Meidensha

Truck Type AGV Application Case

Meidensha’s Subsidiaries in Mainland China, 2020

Business Segments of Oceaneering

Revenue and Net Income of Oceaneering, 2016-2020

Revenue Structure of Oceaneering by Business, 2017-2019

Revenue Structure of Oceaneering by Region, 2017-2019

AGVs of Oceaneering AGV Systems

Grenzebach’s Facts, 2018

Business Members of Grenzebach

Grenzebach’s Subsidiaries by Country/Region

AGV Products of Grenzebach

Goods-to-Person Soltions of Grenzebach

Automated Goods Transport Solutions of Grenzebach

Customized Solutions of Grenzebach

Partner and References of AGV Business of Grenzebach

Elettric 80’s Fact, 2020

AGV Products of Elettric 80

Development Course of Rocla, 1942-2020

Product Portfolio of Rocla AGV

Application Cases of Rocla AGV

Revenue and Net Income of Shenyang Siasun Robot & Automation, 2015-2020

Operating Revenue Structure of Shenyang Siasun Robot & Automation by Product, 2017-2019

Gross Margin of Shenyang Siasun Robot & Automation by Product, 2015-2019

AGVs of Shenyang Siasun Robot & Automation

Main Partners of Shenyang Siasun Robot & Automation

Development Course of AGV Business of Yunnan KSEC Intelligent Equipment

AGVs of Yunnan KSEC Intelligent Equipment

Revenue and Net Income of Machinery Technology Development, 2013-2020

Operating Revenue Structure of Machinery Technology Development by Business, 2017-2019

Major AGV Products of Machinery Technology Development

Revenue and Net Income of CSG Smart Science & Technology, 2013-2020

Revenue Structure of CSG Smart Science & Technology by Product, 2017-2020

AGVs of Huaxiao Precision (Suzhou)

Revenue and Net Income of Huaxiao Precision (Suzhou), 2016-2020

Development Course f Guangdong Jaten Robot & Automation

Operation of Guangdong Jaten Robot & Automation, 2016-2020

Self-developed AGV Products of Jaten Robot & Automation

AMR Product Family of Geek+

RaaS Cloud—Edge-Robots Fused Smart Logistics Solution of Geek+

Financing of Geek+

Decathlon Groupe/Geek + Project Extension

Development Course of Quicktron Intelligent Technology

Major Products of Quicktron Intelligent Technology

Intelligent Robot System Solution of Quicktron Intelligent Technology

Industry Chain of Quicktron Intelligent Technology

Financing of Quicktron Intelligent Technology, as of Jan.2020

Service Network of Zhejiang Libiao Robot in China

Development Course of Hangzhou Hikrobot Technology Co., Ltd.

Mobile Robot Products of Hangzhou Hikrobot Technology Co., Ltd.

Development Course of Yonegy Logistics Automation Technology

AGV Products of Yonegy Logistics Automation Technology

Main Clients of Yonegy Logistics Automation Technology

Revenue and Net Income of Noblelift Equipment, 2011-2020

Operating Revenue Breakdown of Noblelift Equipment by Product, 2013-2020

Operating Revenue Breakdown of Noblelift Equipment by Region, 2013-2019

Gross Margin of Noblelift Equipment by Product, 2013-2019

Milestones in AGV-related Business of Noblelift Equipment, 2015-2019

Capacity, Output and Sales Volume of Noblelift Equipment by Product, 2013-2019

Revenue and Net Income of Guangzhou Jingyuan Mechano-Electric Equipment, 2013-2020

Application Structure of Jingyuan Mechano-electric Equipment AGV, 2019

MAX AGV Intelligent Automated Logistics System of Jingyuan Mechano-electric Equipment

Revenue and Net Income of Shanghai Triowin Automation Machinery, 2012-2020

Revenue Structure of Shanghai Triowin Automation Machinery by Product, 2015-2019

Revenue Breakdown of Shanghai Triowin Automation Machinery by Region, 2012-2019

Applications of Shanghai Triowin Automation Machinery’s AGV Robots and Main Clients

Main AGV Products of Shanghai Triowin Automation Machinery

Revenue and Net Income of Shenzhen Casun Intelligent Robot, 2013-2020

Revenue Structure of Shenzhen Casun Intelligent Robot by Product, 2016-2018

Gross Margin of Shenzhen Casun Intelligent Robot by Product, 2013-2019

Applications of Shenzhen Casun Intelligent Robot’s AGVs and Main Clients

Main Automotive Clients of Shenzhen Casun Intelligent Robot

Main Clients of Shenzhen Casun Intelligent Robot in Electronics & Electrical Appliances Industry

Main Clients of Shenzhen Casun Intelligent Robot in Daily Chemicals Industry

AGV Business Milestones of Guangzhou SINOROBOT Intelligent Technology, 2014-2020

Main AGV Products of Sinorobot

AGV Series of Shenzhen OKAGV Robotics

Typical Application of OKAGV’s AGV

Characteristics of Zhejiang Guozi Robotics’ AGV Systems

Applied Cases of CIZON’s AGV

Major Products of Standard Robots

Development Course of Suzhou AGV Robot

Technical Strength of Suzhou AGV Robot

Non-reflector Laser Navigation Forktype AGVs of Suzhou AGV Robot

Partners of Suzhou AGV Robot

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...