Vision Sensor Chip, and Radar/LiDAR chip, who are doing it?

Automated Driving Sensor Chip Industry Report, 2020, published by ResearchInChina, analyzes market size, technologies, competitive landscape, development trend, etc of vision sensor chip, Radar and LiDAR chip for automated driving.

Vision sensor Chip: features with function integration and product diversification

Automotive vision sensor chips mainly cover CMOS image sensor (CIS) and image signal processor (ISP) chip. Currently CMOS chips are challenged by high expansion barrier, while the growth rate of CMOS demand is far higher than the expansion speed, especially under the background that automated driving ushers in rapid development in recent years, automotive camera demand skyrockets, pre-installed 960P and 1080P camera CMOS chips are in tight supply.

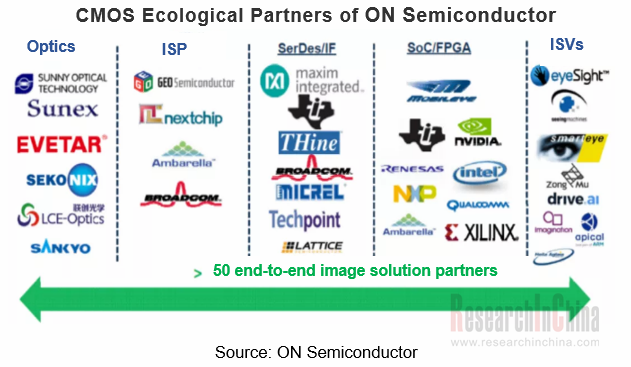

In terms of market pattern, although SONY, Samsung and other traditional mobile phone CIS vendors have successively launched several CMOS sensors for self-driving, ON Semiconductor still occupies a leading position in the market. It has more than 50 automotive ecological partners, involving businesses like optical lens, signal processors, I/O, Interface, SoC processors and software systems, etc.

In terms of image processing chip, independent ISP chips have strong performance but high cost, the main suppliers include Texas Instruments (TI), Moileye, Huawei HiSilicon, etc, among which TI outstands with the deepest accumulation of technology and the largest market share. In recent years, CIS suppliers like Aptina and OmniVision have also launched the latest CIS integration products with built-in ISP, which have low cost, small area and low power consumption, but is just capable of simple algorithms and is weak in processing power. Under the background of increased requirements for automotive intelligence, independent ISP chip in automotive camera is still the focus.

With the development of artificial intelligence (AI) and automated driving, image processing and calculation are facing more and more challenges. The integration of vision sensor chips has become a trend. In addition to ISP chips, vision processors (VP) chips with AI capabilities are gradually added.

In May 2020, Sony unveiled two models of intelligent vision sensors with AI processing functionality-- IMX500 and IMX50, which feature a stacked configuration consisting of a pixel chip (photosensitive function) and a logic chip (calculation and memory function). They are the world’s first CMOS image sensors to be equipped with AI image analysis and processing functionality on the logic chip.

In Jan. 2021, OmniVision released new sensor OAX8000, which uses a stacked-die architecture and integrates a neural processing unit (NPU) and ISP. OAX8000 ASIC samples are provided by BGA196 package now and already passed automotive AEC- Q100 2 certification.

Due to different application positions of vision camera in the car, it can be subdivided into surround view, front view, rear view, side view, drive monitoring, cockpit monitoring, etc. From the perspective of chip, there are also image sensor products dedicated to surround view, front view, rear view and driving monitoring. For example, OmniVision’s vehicle image sensor products include driver monitoring sensors (OV10652, OV2311, OV2312, OV2778, OV4690, etc), sensors for automated driving systems (OV10625, OV10640, OV10642, OV10650, OV10652, etc.), rear view and electronic mirror sensors (OV10626, OV10635, OV10640, OV10650, OV10652, etc), surround view sensors (OV10635, OV10640, OV10652, OV2312, OV2775, etc.), 8-megapixel forward camera OX08A and OX08B, and DMS sensor OAX8000, etc.

Increase in usage and industrial M&As

The number of vehicle cameras for mainstream models will increase from 1.7 in 2018 to more than 3 in 2022 per vehicle, while the number for high-end models even be more than 10. For example, Leapmotor C11 unveiled a the end of 2020 carries 10 cameras, and NIO ET7, which will be launched in 2022, carries 11 8-megapixel high-definition cameras. Also, the first model of IM (Zhiji Auto) just released in early 2021 comes standard with 15 high-definition vision cameras, 5 radars and 12 ultrasonic radars.

As the incremental application of image sensors in the next few years will be mainly in automotive market, leading players in the industry begin to deploy and a number of image sensor companies are acquired in 2020:

SmartSens Technology acquired Allchip

Goodix acquired Dreamchip

TE Connectivity acquired First Sensor

AMS acquired Osram

Nuvoton acquired Semiconductor Business from Panasonic (including image sensor)

Jenoptik acquired Trioptics(test equipment for optical components and sensors)

Sony acquired Insightness(event-based vision sensor)

Radar chip: 4D imaging radar enters mass-production and radar SoC solution arouses much concern.

Radar-used chips cover master chips (MCU, DSP, FPGA), radar chip (e.g., MMIC, ASIC) and other auxiliary ones (like PMI, ADC). The radar vendors are championing 77GHz and chip providers deliver new products, mainly 77GHz chips.

The 4D imaging radar market is already fiercely contested, and the players such as Huawei and Oculii have rolled out 4D imaging radar systems. In early 2021, Continental AG announced it would spawn the first 4D imaging radar – ARS540 within 2021, a solution based on chip cascade plus Xilinx FPGA.

Continental’s 4D imaging radar will be first available to BMW production cars; and SUV Ocean with 4D imaging radar, as an outcome of joint efforts between Magna and Fisker, made its debut in early 2021 and plans to be launched on the market at the end of 2022. Besides, there are also signs of Tesla to deploy 4D imaging radar (the 4D radar Phoenix offered by Arbe Robotics).

In addition to 4D radar, startups prefer to develop radar SoC (radar-on-a-chip) products. Vayyar, with the already raised funds of $188 million has the automotive radar chips enabling 77-81GHz imaging and radar band, incorporating a total of 48 transceivers in a SoC system able to accommodate 2,000-plus virtual channels. Vayyar’s radar SoC contains an internal DSP as well, enabling real-time signal processing. Vayyar’s sensors are enhanced through the integrated powerful DSP and large internal memory to administer complex imaging algorithms and application without a need for external tackling capability. Vayyar’s radar SoC is able to output post-processing data and original 3D images or point-cloud formats.

In December 2020, Uhnder, a start-up in the development of radar-on-a-chip secured its C-round series funding of $45 million, with a plan to unveil its first automotive-grade 4D imaging radar – Voxel within 2021, containing chips and 4D imaging software algorithms. The successful financing will serve as a stimulus to the company’s ambitious production plan in 2021.

Lidar chip: SoC solution becomes the apple of vendors’ eyes, and hopefully FMCW solution is gaining ground

Despite a varied focus of vendors on chip technologies, LiDAR on chip grows a key trend as those are beneficial to automated driving such as high reliability coming of no mechanical motion mechanisms as well as conforming to vehicle requirements, miniature and being easy to integrate, among others. Moreover, the semiconductor process (like CMOS) truly brings a cut in vehicle lidar costs, from the tens of thousands of yuan to less than ten thousand yuan in readiness for massive use.

Lidar SoC solution is the dream of many a vendor. In August 2016, Massachusetts Institute of Technology (MIT) together with Defense Advanced Research Projects Agency (DARPA) offered such a solution like this: to encapsulate lidar sensors onto a single chip with a footprint just 0.5mm×6mm, for the commercialization of which MIT set up a company named Kyber Photonic in early 2020.

In June 2020, Xilight Technology joined forces with Xidian University to develop dToF SPAD lidar sensor chip -- XHS301 on which the core photosensitive element SPAD is integrated. The solution enables the miniature and cost reduction of LiDAR and is well placed for mass production with proprietary control technologies.

In January 2021, Mobileye announced a partnership with Intel to develop silicon photonics lidar SoC system with which the lidar sensors are produced for availability onto Mobileye self-driving fleets in 2025. Such chip enjoys significant superiority in the lidar sector thanks to Intel’s professional silicon photonics workshops.

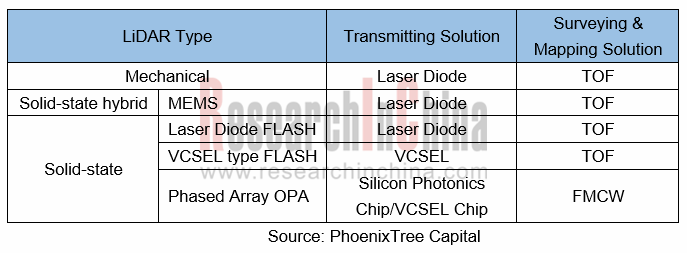

The lidar SoC developed by Mobileye and Intel employs FMCW (Frequency Modulated Continuous Wave) technology, featuring a high signal-to-noise ratio, low power consumption, irrelevance to both the distance away from objects (compared with the farther TOF lidar detects, the lower accuracy of detection will be) and the motion velocity of objects, but with the demerits including great difficulty, high costs and low yield. ToF-based pulse laser has long been dominant in the industry, and only about ten out of more than 100 lidar developers worldwide dedicate themselves to the development of FMCW lidars. It is over the recent years that FMCW technology is increasingly favored by ever more companies.

Being bullish about FMCW lidar, the optics giant Carl Zeiss AG invested and founded Bridger Photonics, an American lidar developer in November 2018 and made investments in August 2020 in Scantinel Photonics, a German FMCW lidar startup.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...