Smart Parking Industry Report, 2020 highlights the status quo and trends of the industry, policies, standards and planning, and layout in major cities, as well as development of segments like stereo garage, smart parking cloud platform, senseless payment, parking big data, and AVP smart parking service.

Smart parking, a combination of multiple technologies such as wireless communication, sensors, video capture and transmission, intelligent recognition, Internet of Things, mobile terminals, positioning, map, and senseless payment, is used for providing urban parking space services from information collection, management and inquiry to reservation and navigation, delivering maximum utilization of parking resources, the highest profits for parking lots, and the best user parking experience.

By levels of information and technologies, smart parking develops in three stages: Stage 1.0, senseless payment and unmanned operation; Stage 2.0, intelligent management of parking spots; Stage 3.0, vehicle-parking lot integrated AVP. In current stage, accompanied by the growth in automotive industry, smart parking in China is in the phase of rapid shift from Stage 1.0 to Stage 2.0, specifically as below:

Stage 1.0: hardware devices offer constant upgrades and improvements, allowing for senseless payment and unmanned operation and management of parking lots

At present, smart parking lots in China are built mainly through renovation of existing ones, for example, adding systems and devices such as license plate recognition, geomagnetic devices, high and low video piles, sensors, and senseless payment, which are used to collect data and information for single parking lots, build parking management platforms and develop parking APPs, WeChat official accounts and applets. The scattered data and information in this stage only enable basic features like online inquiry of parking lots and senseless payment for parking.

Currently, there are three common ways to realize senseless payment: scan to pay, ETC, and license plate recognition + password-free payment service provided by Alipay, QuickPass, WeChat and banks. Scan to pay is the most widely used method in China for it is easy to set up and operate. WeChat, Alipay, UnionPay and quite a few parking APPs have made this deployment.

ETC-enabled parking lots, as one of the expansion models of ETC-enabled smart city, have been deployed in a number of provinces and cities including Beijing, Shanghai, Guangdong, Nanjing, Chengdu and Taiyuan since 2020. In Beijing’s case, 300 parking lots (with around 150,000 parking spots) have realized payment via ETC system covering 24 hospitals, 23 hubs, 95 commercial complexes, 66 residential communities and 20 scenic parks, by the end of 2020. They handle more than 2 million deals each month. In 2021, Beijing plans ETC payment gradually available to all roadside parking spaces.

The downtown Zhengzhou City in Henan Province has seen nearly 300 parking lots offering ETC services as of 2020. Dengfeng, a tourist city under the jurisdiction of Zhengzhou has had 86 parking lots (with around 13,000 parking spots) completing installation and operation of ETC systems, and plans ETC deployment in all parking lots of 19 scenic spots like Shaolin Monastery in 2021.

As well as policies, besides promoting ETC payment among car users, on December 23, 2020, the General Office of the Ministry of Transport of China issued the Notice on Carrying out ETC-enabled Smart Parking Pilot Projects for Urban Construction, according to which, 27 pilot cities including Beijing and Jiangsu Province as a provincial pilot zone will be the first one to launch ETC-enabled smart parking pilot projects, expand coverage of ETC service capabilities, and widen use of ETC in parking scenario, providing better and more convenient mobility for the public. ETC-enabled parking lots are expected to usher in a boom period in 2021. The rapid growth of ETC-enabled smart parking will come with the fusing of high-level video and ETC payment technologies.

Moreover, the senseless payment method that combines parking lot license plate recognition and password-free fast payment has been deployed by quite a few companies and banks, such as WeChat, Alipay, UnionPay, ICBC and China Construction Bank. In the process, before the first use, car owners need to bind their bank card by signing a protocol on their smartphone, or their car license plate via a smartphone parking APP, and the fees will be deducted automatically from the online account with no need for scanning code or paying in cash, allowing for pass in seconds at the exit, if they drive into a contracted parking lot.

Stage 2.0: build city-level smart parking management cloud platforms and three-level parking guidance systems, and create and improve parking big data products to enable advanced capabilities such as available parking spot inquiry, dynamic update and parking spot reservation.

Based on the Stage 1.0, the city-level smart parking management cloud platform system is at the heart of the Stage 2.0, responsible for integrating static data of districts and counties of a city and many parking lots, and analyzing and controlling an array of resources, so as to provide other smart parking services for car owners in addition to senseless payment.

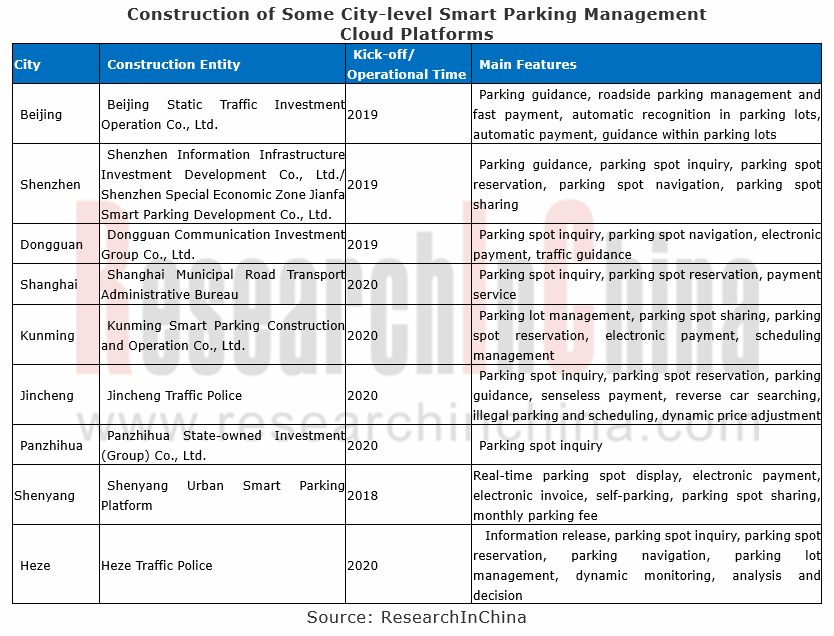

Simulated by new infrastructure, intelligent technologies and favorable policies, cities race to launch their city-level smart parking management platforms for a faster pace of deploying smart parking projects. Statistically, as of June 2020, there ae 26 provinces introducing a total of 143 such platforms, and several provinces and municipalities carrying out the projects.

For project model, city-level smart parking projects are led by local departments and built or operated in harness with companies. Besides conventional parking service providers and security firms, parking start-ups, and internet and technology firms are players as well.

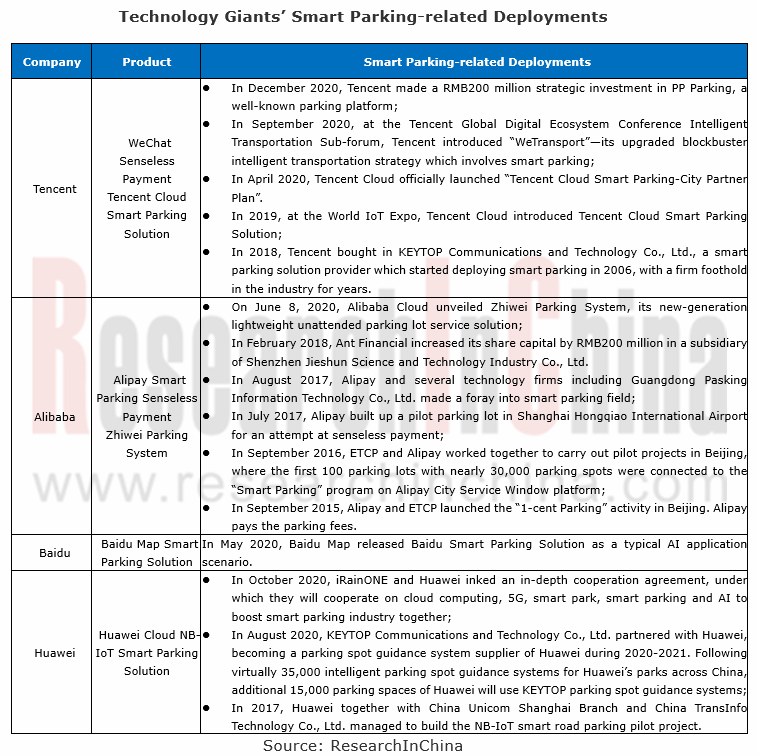

On the strength of their own edges, internet companies such as Baidu, Alibaba and Tencent rush to the fore in making deployments in smart parking market. For example, Alibaba and Tencent both deploy their own senseless parking payment systems and products via Alipay and WeChat apiece, and roll out their own smart parking solutions based on their own cloud products.

On June 8, 2020, Alibaba Cloud unveiled Zhiwei Parking System, its new-generation lightweight unattended parking lot service solution, and released its urban partner program. In 2020, Alibaba Cloud completed Jincheng smart parking management platform and parking spot renovation equipment procurement project, and Haining China Leather City digital intelligent transformation, smart parking management system & digital security passenger flow project; also undertook Fengqiao Street smart parking management system project in Suzhou National Hi-Tech District, which is scheduled to be completed in 2021; in December 2020, Alibaba Cloud won the bidding for the city-level smart parking integrated management (information system) platform, and intelligent equipment installation & construction project of Tengzhou City in Shandong Province.

Based on its map and cloud products, Baidu introduced its smart parking solution in May 2020; it also joined hands with Vanke SCPG Shanghai to build a shopping center with smart parking lots equipped with smart parking systems that integrate with smart parking and shopping mall navigation, for Shanghai Nanxiang Incity Mega.

In addition, in an upsurge of new infrastructure and smart city, several smart parking firms were in the spotlight of capital in 2020. For instance, in early 2020, Carlinkin closed an A+ funding round, raising RMB10 million; in the second half of 2020, Aipark finished four funding rounds; in January 2020, Sunsea Parking announced USD100 million raised from Goldman Sachs and Anchor Equity Partners in a Series B funding round.

Stage 3.0: automated valet parking holds the trend for the fusion of clever cars and smart parking lots

As intelligent connectivity, autonomous driving, V2X and HD map, among other technologies mature and advance, intelligent vehicles gather pace. At present, passenger cars equipped with L2 driving assistance function have gone into series production, and tend to feature L3 and L4 autonomy. How to enable L2 and L2+ intelligent vehicles to drive themselves in the closed smart parking lot scenario constitutes the megatrend and goal of smart parking development, that is, cooperation between cars and parking lots helps to realize automated valet parking (AVP).

In recent two years, players like smart parking solution providers, internet tycoons, automakers and auto parts suppliers have strained to explore and deploy in this field. Yet, AVP is still in the phase of R&D, test and demonstration due to negative factors like incomplete regulations and immature technology. Wide adoption of fully AVP is still some way off.

In October 2020, Bosch, Mercedes-Benz, and the parking garage operator Apcoa jointly deployed a set of automated valet parking (AVP) system in the P6 Parking Garage at Stuttgart Airport. The AVP system Bosch calls “INTELLIGENT PARK PILOT” is to be made ready for commercial operation. It currently supports New Mercedes-Benz S-Class sedans launched in September 2020.

APCOA FLOW, the parking garage digital platform, and newly-added devices like Bosch’s new camera and LiDAR make the S-Class with Bosch’s AVP system capable of receiving information from LiDAR and cameras, and the parking garage control center will then work out the parking route and send to the car through network. Guided by infrastructure, the car will find the parking spot automatically and park itself, without manual intervention in the whole process.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...